Back

SPVs

SPV for Late-Stage and Secondary Investments

SPV for Late-Stage and Secondary Investments

SPV for Late-Stage and Secondary Investments

As private companies remain private for longer, late-stage and secondary investments have become a defining feature of modern private markets. Investors seeking exposure to mature, high-growth companies increasingly rely on Special Purpose Vehicles, or SPVs, to access these opportunities efficiently and at scale.

SPVs play a particularly important role in late-stage and secondary transactions because these deals introduce unique structural, legal, and operational challenges. This article explains how SPVs are used in these contexts, why they are often preferred over direct investments, and what investors should understand before participating.

Why Late-Stage and Secondary Deals Are Different

Late-stage and secondary investments differ fundamentally from early-stage venture rounds. In late-stage rounds, companies are often well-capitalized, highly selective about investors, and sensitive to cap table complexity. In secondary transactions, shares are acquired from existing shareholders rather than directly from the company, introducing additional legal and contractual considerations.

In both cases, companies typically want:

Minimal disruption to governance

Limited changes to shareholder composition

Clean cap tables with predictable ownership

SPVs help meet these requirements by consolidating many investors into a single investing entity.

What Is a Late-Stage SPV?

A late-stage SPV is a single-purpose investment vehicle created to invest in a mature private company, often at Series C or later. These SPVs are commonly used to participate in large funding rounds, pre-IPO financings, or structured growth investments.

Instead of admitting dozens of new shareholders, the company accepts the SPV as a single investor. The SPV aggregates capital from multiple investors and holds the shares on their behalf.

This approach benefits both sides. Investors gain access to late-stage opportunities that may otherwise be unavailable, while companies preserve cap table simplicity and governance control.

SPVs in Secondary Transactions

Secondary investments involve the purchase of existing shares from early employees, founders, or early investors. These transactions allow sellers to achieve liquidity without waiting for an IPO or acquisition.

SPVs are especially well-suited for secondaries because they can:

Aggregate buyer demand

Negotiate a single purchase agreement

Handle complex transfer mechanics

Manage post-transaction ownership cleanly

In many cases, secondary sellers prefer SPVs because they reduce administrative burden and ensure compliance with transfer restrictions.

How Capital Flows in Late-Stage and Secondary SPVs

The capital flow in a late-stage or secondary SPV follows a structured process.

Investors first commit capital to the SPV and execute subscription agreements. Once onboarding and compliance checks are complete, capital is wired into a dedicated SPV bank account. The SPV then deploys capital either directly into the company, in the case of a primary round, or to the selling shareholders in a secondary transaction.

In secondary deals, funds typically flow through escrow or controlled settlement mechanisms to ensure that shares and cash are exchanged simultaneously and in compliance with company transfer rules.

Governance and Control Considerations

Late-stage companies often impose stricter governance requirements than early-stage startups. Shareholder agreements may include information rights, transfer restrictions, and consent provisions that apply to SPVs.

SPV agreements must align with these requirements. The SPV manager typically exercises voting rights and represents the SPV in communications with the company. Investors usually do not interact directly with the company, which helps maintain a clean governance structure.

This centralized representation is one of the primary reasons companies prefer SPVs for late-stage participation.

Valuation and Pricing Dynamics

Late-stage and secondary investments are often priced differently from early-stage rounds. Valuations may be influenced by recent financings, internal company metrics, or negotiated discounts for lack of liquidity.

In secondary transactions, pricing reflects both company performance and seller-specific factors such as urgency, vesting schedules, and contractual restrictions. SPVs allow investors to participate in these opportunities without negotiating individual purchase agreements, which can be operationally complex.

Regulatory and Compliance Considerations

Late-stage and secondary SPVs must comply with securities regulations, including exemptions for private offerings and restrictions on resale. In the United States, most SPVs rely on Regulation D exemptions and are limited to accredited investors.

Secondary transactions also require careful handling of company consent rights, rights of first refusal, and co-sale provisions. Failure to comply with these requirements can invalidate transfers or create legal exposure.

Professional SPV management ensures that these compliance obligations are met throughout the transaction lifecycle.

Risk Profile of Late-Stage and Secondary SPVs

While late-stage investments are often perceived as lower risk than early-stage bets, they introduce their own complexities. Valuations are higher, upside may be more limited, and liquidity timing is still uncertain.

Secondary investments may also involve additional risks related to information asymmetry, transfer restrictions, and changes in company strategy after the transaction.

SPVs help manage these risks by standardizing documentation, centralizing decision-making, and maintaining clean records, but they do not eliminate investment risk entirely.

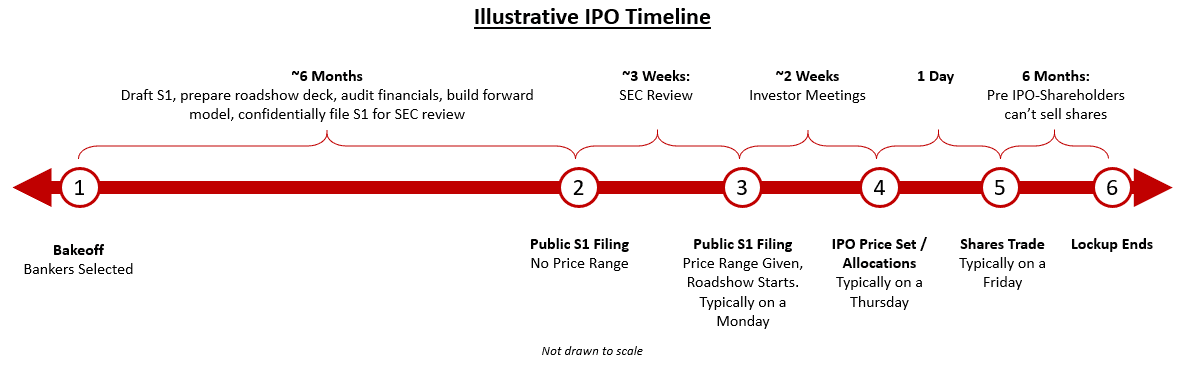

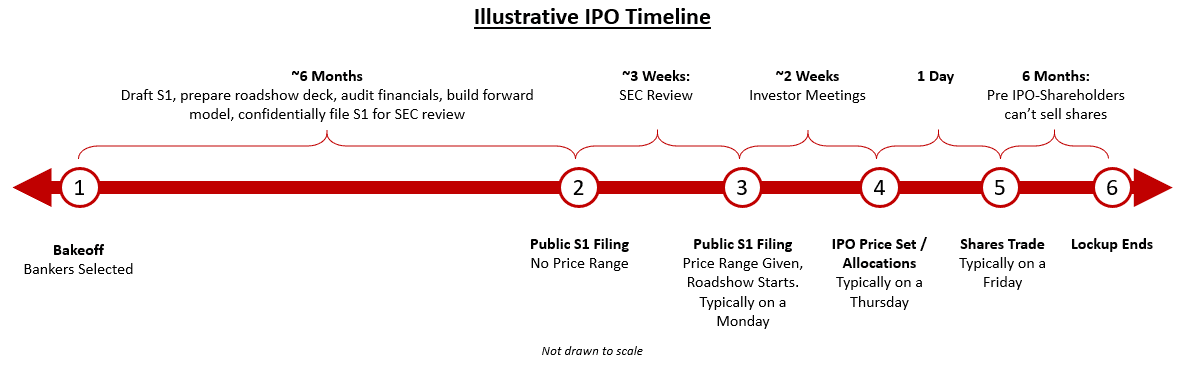

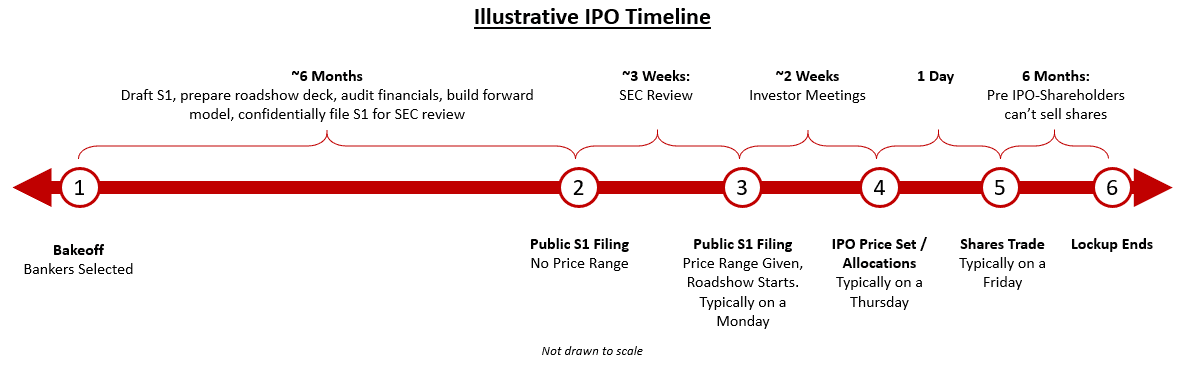

Exit Scenarios and Liquidity

Exits for late-stage and secondary SPVs typically occur through acquisitions, IPOs, or further secondary sales. When a liquidity event occurs, proceeds flow from the company or buyer to the SPV.

The SPV then distributes proceeds to investors according to the terms defined in its governing documents. Because late-stage companies are closer to liquidity, SPVs in this category may have shorter lifecycles than early-stage vehicles, although timelines are never guaranteed.

Why SPVs Are the Preferred Structure for Late-Stage Access

Late-stage companies are often oversubscribed and selective. They want sophisticated capital without operational friction. SPVs provide a solution that aligns investor access with company preferences.

For investors, SPVs offer:

Access to high-quality private companies

Controlled exposure to specific opportunities

Professional administration and reporting

Platforms like Allocations enable sponsors to structure and manage these SPVs efficiently while maintaining institutional standards.

The Growing Role of SPVs in Secondary Markets

As private markets mature, secondary liquidity is becoming a permanent feature rather than an exception. SPVs are emerging as the default infrastructure layer that supports this evolution.

They allow capital to move efficiently between buyers and sellers while preserving compliance, transparency, and governance. For late-stage and secondary investing, SPVs are no longer optional tools. They are foundational.

As private companies remain private for longer, late-stage and secondary investments have become a defining feature of modern private markets. Investors seeking exposure to mature, high-growth companies increasingly rely on Special Purpose Vehicles, or SPVs, to access these opportunities efficiently and at scale.

SPVs play a particularly important role in late-stage and secondary transactions because these deals introduce unique structural, legal, and operational challenges. This article explains how SPVs are used in these contexts, why they are often preferred over direct investments, and what investors should understand before participating.

Why Late-Stage and Secondary Deals Are Different

Late-stage and secondary investments differ fundamentally from early-stage venture rounds. In late-stage rounds, companies are often well-capitalized, highly selective about investors, and sensitive to cap table complexity. In secondary transactions, shares are acquired from existing shareholders rather than directly from the company, introducing additional legal and contractual considerations.

In both cases, companies typically want:

Minimal disruption to governance

Limited changes to shareholder composition

Clean cap tables with predictable ownership

SPVs help meet these requirements by consolidating many investors into a single investing entity.

What Is a Late-Stage SPV?

A late-stage SPV is a single-purpose investment vehicle created to invest in a mature private company, often at Series C or later. These SPVs are commonly used to participate in large funding rounds, pre-IPO financings, or structured growth investments.

Instead of admitting dozens of new shareholders, the company accepts the SPV as a single investor. The SPV aggregates capital from multiple investors and holds the shares on their behalf.

This approach benefits both sides. Investors gain access to late-stage opportunities that may otherwise be unavailable, while companies preserve cap table simplicity and governance control.

SPVs in Secondary Transactions

Secondary investments involve the purchase of existing shares from early employees, founders, or early investors. These transactions allow sellers to achieve liquidity without waiting for an IPO or acquisition.

SPVs are especially well-suited for secondaries because they can:

Aggregate buyer demand

Negotiate a single purchase agreement

Handle complex transfer mechanics

Manage post-transaction ownership cleanly

In many cases, secondary sellers prefer SPVs because they reduce administrative burden and ensure compliance with transfer restrictions.

How Capital Flows in Late-Stage and Secondary SPVs

The capital flow in a late-stage or secondary SPV follows a structured process.

Investors first commit capital to the SPV and execute subscription agreements. Once onboarding and compliance checks are complete, capital is wired into a dedicated SPV bank account. The SPV then deploys capital either directly into the company, in the case of a primary round, or to the selling shareholders in a secondary transaction.

In secondary deals, funds typically flow through escrow or controlled settlement mechanisms to ensure that shares and cash are exchanged simultaneously and in compliance with company transfer rules.

Governance and Control Considerations

Late-stage companies often impose stricter governance requirements than early-stage startups. Shareholder agreements may include information rights, transfer restrictions, and consent provisions that apply to SPVs.

SPV agreements must align with these requirements. The SPV manager typically exercises voting rights and represents the SPV in communications with the company. Investors usually do not interact directly with the company, which helps maintain a clean governance structure.

This centralized representation is one of the primary reasons companies prefer SPVs for late-stage participation.

Valuation and Pricing Dynamics

Late-stage and secondary investments are often priced differently from early-stage rounds. Valuations may be influenced by recent financings, internal company metrics, or negotiated discounts for lack of liquidity.

In secondary transactions, pricing reflects both company performance and seller-specific factors such as urgency, vesting schedules, and contractual restrictions. SPVs allow investors to participate in these opportunities without negotiating individual purchase agreements, which can be operationally complex.

Regulatory and Compliance Considerations

Late-stage and secondary SPVs must comply with securities regulations, including exemptions for private offerings and restrictions on resale. In the United States, most SPVs rely on Regulation D exemptions and are limited to accredited investors.

Secondary transactions also require careful handling of company consent rights, rights of first refusal, and co-sale provisions. Failure to comply with these requirements can invalidate transfers or create legal exposure.

Professional SPV management ensures that these compliance obligations are met throughout the transaction lifecycle.

Risk Profile of Late-Stage and Secondary SPVs

While late-stage investments are often perceived as lower risk than early-stage bets, they introduce their own complexities. Valuations are higher, upside may be more limited, and liquidity timing is still uncertain.

Secondary investments may also involve additional risks related to information asymmetry, transfer restrictions, and changes in company strategy after the transaction.

SPVs help manage these risks by standardizing documentation, centralizing decision-making, and maintaining clean records, but they do not eliminate investment risk entirely.

Exit Scenarios and Liquidity

Exits for late-stage and secondary SPVs typically occur through acquisitions, IPOs, or further secondary sales. When a liquidity event occurs, proceeds flow from the company or buyer to the SPV.

The SPV then distributes proceeds to investors according to the terms defined in its governing documents. Because late-stage companies are closer to liquidity, SPVs in this category may have shorter lifecycles than early-stage vehicles, although timelines are never guaranteed.

Why SPVs Are the Preferred Structure for Late-Stage Access

Late-stage companies are often oversubscribed and selective. They want sophisticated capital without operational friction. SPVs provide a solution that aligns investor access with company preferences.

For investors, SPVs offer:

Access to high-quality private companies

Controlled exposure to specific opportunities

Professional administration and reporting

Platforms like Allocations enable sponsors to structure and manage these SPVs efficiently while maintaining institutional standards.

The Growing Role of SPVs in Secondary Markets

As private markets mature, secondary liquidity is becoming a permanent feature rather than an exception. SPVs are emerging as the default infrastructure layer that supports this evolution.

They allow capital to move efficiently between buyers and sellers while preserving compliance, transparency, and governance. For late-stage and secondary investing, SPVs are no longer optional tools. They are foundational.

As private companies remain private for longer, late-stage and secondary investments have become a defining feature of modern private markets. Investors seeking exposure to mature, high-growth companies increasingly rely on Special Purpose Vehicles, or SPVs, to access these opportunities efficiently and at scale.

SPVs play a particularly important role in late-stage and secondary transactions because these deals introduce unique structural, legal, and operational challenges. This article explains how SPVs are used in these contexts, why they are often preferred over direct investments, and what investors should understand before participating.

Why Late-Stage and Secondary Deals Are Different

Late-stage and secondary investments differ fundamentally from early-stage venture rounds. In late-stage rounds, companies are often well-capitalized, highly selective about investors, and sensitive to cap table complexity. In secondary transactions, shares are acquired from existing shareholders rather than directly from the company, introducing additional legal and contractual considerations.

In both cases, companies typically want:

Minimal disruption to governance

Limited changes to shareholder composition

Clean cap tables with predictable ownership

SPVs help meet these requirements by consolidating many investors into a single investing entity.

What Is a Late-Stage SPV?

A late-stage SPV is a single-purpose investment vehicle created to invest in a mature private company, often at Series C or later. These SPVs are commonly used to participate in large funding rounds, pre-IPO financings, or structured growth investments.

Instead of admitting dozens of new shareholders, the company accepts the SPV as a single investor. The SPV aggregates capital from multiple investors and holds the shares on their behalf.

This approach benefits both sides. Investors gain access to late-stage opportunities that may otherwise be unavailable, while companies preserve cap table simplicity and governance control.

SPVs in Secondary Transactions

Secondary investments involve the purchase of existing shares from early employees, founders, or early investors. These transactions allow sellers to achieve liquidity without waiting for an IPO or acquisition.

SPVs are especially well-suited for secondaries because they can:

Aggregate buyer demand

Negotiate a single purchase agreement

Handle complex transfer mechanics

Manage post-transaction ownership cleanly

In many cases, secondary sellers prefer SPVs because they reduce administrative burden and ensure compliance with transfer restrictions.

How Capital Flows in Late-Stage and Secondary SPVs

The capital flow in a late-stage or secondary SPV follows a structured process.

Investors first commit capital to the SPV and execute subscription agreements. Once onboarding and compliance checks are complete, capital is wired into a dedicated SPV bank account. The SPV then deploys capital either directly into the company, in the case of a primary round, or to the selling shareholders in a secondary transaction.

In secondary deals, funds typically flow through escrow or controlled settlement mechanisms to ensure that shares and cash are exchanged simultaneously and in compliance with company transfer rules.

Governance and Control Considerations

Late-stage companies often impose stricter governance requirements than early-stage startups. Shareholder agreements may include information rights, transfer restrictions, and consent provisions that apply to SPVs.

SPV agreements must align with these requirements. The SPV manager typically exercises voting rights and represents the SPV in communications with the company. Investors usually do not interact directly with the company, which helps maintain a clean governance structure.

This centralized representation is one of the primary reasons companies prefer SPVs for late-stage participation.

Valuation and Pricing Dynamics

Late-stage and secondary investments are often priced differently from early-stage rounds. Valuations may be influenced by recent financings, internal company metrics, or negotiated discounts for lack of liquidity.

In secondary transactions, pricing reflects both company performance and seller-specific factors such as urgency, vesting schedules, and contractual restrictions. SPVs allow investors to participate in these opportunities without negotiating individual purchase agreements, which can be operationally complex.

Regulatory and Compliance Considerations

Late-stage and secondary SPVs must comply with securities regulations, including exemptions for private offerings and restrictions on resale. In the United States, most SPVs rely on Regulation D exemptions and are limited to accredited investors.

Secondary transactions also require careful handling of company consent rights, rights of first refusal, and co-sale provisions. Failure to comply with these requirements can invalidate transfers or create legal exposure.

Professional SPV management ensures that these compliance obligations are met throughout the transaction lifecycle.

Risk Profile of Late-Stage and Secondary SPVs

While late-stage investments are often perceived as lower risk than early-stage bets, they introduce their own complexities. Valuations are higher, upside may be more limited, and liquidity timing is still uncertain.

Secondary investments may also involve additional risks related to information asymmetry, transfer restrictions, and changes in company strategy after the transaction.

SPVs help manage these risks by standardizing documentation, centralizing decision-making, and maintaining clean records, but they do not eliminate investment risk entirely.

Exit Scenarios and Liquidity

Exits for late-stage and secondary SPVs typically occur through acquisitions, IPOs, or further secondary sales. When a liquidity event occurs, proceeds flow from the company or buyer to the SPV.

The SPV then distributes proceeds to investors according to the terms defined in its governing documents. Because late-stage companies are closer to liquidity, SPVs in this category may have shorter lifecycles than early-stage vehicles, although timelines are never guaranteed.

Why SPVs Are the Preferred Structure for Late-Stage Access

Late-stage companies are often oversubscribed and selective. They want sophisticated capital without operational friction. SPVs provide a solution that aligns investor access with company preferences.

For investors, SPVs offer:

Access to high-quality private companies

Controlled exposure to specific opportunities

Professional administration and reporting

Platforms like Allocations enable sponsors to structure and manage these SPVs efficiently while maintaining institutional standards.

The Growing Role of SPVs in Secondary Markets

As private markets mature, secondary liquidity is becoming a permanent feature rather than an exception. SPVs are emerging as the default infrastructure layer that supports this evolution.

They allow capital to move efficiently between buyers and sellers while preserving compliance, transparency, and governance. For late-stage and secondary investing, SPVs are no longer optional tools. They are foundational.

Take the next step with Allocations

Take the next step with Allocations

Take the next step with Allocations

SPVs

Top Upcoming IPOs in 2026 : Allocations Research

Top Upcoming IPOs in 2026 : Allocations Research

Read more

SPVs

Why Digital Asset Treasury Companies (DATCOs) Will Lead 2026

Why Digital Asset Treasury Companies (DATCOs) Will Lead 2026

Read more

Company

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Read more

SPVs

How do you structure an SPV into another SPV?

How do you structure an SPV into another SPV?

Read more

SPVs

What are secondary SPVs?

What are secondary SPVs?

Read more

Fund Manager

Watch out school VC: the podcasters are coming

Watch out school VC: the podcasters are coming

Read more

Fund Manager

Fast, hassle-free SPVs mean more time for due diligence

Fast, hassle-free SPVs mean more time for due diligence

Read more

Analytics

The rise of opportunity funds and why fund managers might need to start using them

The rise of opportunity funds and why fund managers might need to start using them

Read more

Analytics

Move as fast as founders do with instant SPVs

Move as fast as founders do with instant SPVs

Read more

Fund Manager

4 practical things LPs and fund managers need to know for tax season

4 practical things LPs and fund managers need to know for tax season

Read more

Fund Manager

Keep up with these 4 VC firms focused on crypto and blockchain

Keep up with these 4 VC firms focused on crypto and blockchain

Read more

Fund Manager

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Read more

Company

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Read more

SPVs

SPV in Venture Capital: How SPVs Are Used to Invest in Startups

SPV in Venture Capital: How SPVs Are Used to Invest in Startups

Read more

SPVs

Types of SPV: Allocations Research 2026

Types of SPV: Allocations Research 2026

Read more

SPVs

Setup your next entity in GIFT City with Allocations

Setup your next entity in GIFT City with Allocations

Read more

SPVs

What Is an SPV in Business? Real-World Examples and the Role of SPVs in Private Equity

What Is an SPV in Business? Real-World Examples and the Role of SPVs in Private Equity

Read more

SPVs

Why Allocations Is the Best Fund Admin?

Why Allocations Is the Best Fund Admin?

Read more

SPVs

SPV Syndicate Fundraising: How Syndicates Use Special Purpose Vehicles to Raise Capital Efficiently

SPV Syndicate Fundraising: How Syndicates Use Special Purpose Vehicles to Raise Capital Efficiently

Read more

SPVs

SPV Fundraising: How Special Purpose Vehicles Are Transforming Deal-Based Capital Formation

SPV Fundraising: How Special Purpose Vehicles Are Transforming Deal-Based Capital Formation

Read more

SPVs

SPV Capital Raising: How SPVs Enable Efficient Deal-Based Funding

SPV Capital Raising: How SPVs Enable Efficient Deal-Based Funding

Read more

SPVs

SPV vs Fund Structure: Choosing the Right Investment Vehicle in Private Markets

SPV vs Fund Structure: Choosing the Right Investment Vehicle in Private Markets

Read more

SPVs

SPV Investment Structure: How Special Purpose Vehicles Are Designed for Modern Investing

SPV Investment Structure: How Special Purpose Vehicles Are Designed for Modern Investing

Read more

SPVs

SPV Financing: A Complete Guide to Structure, Use Cases, and Investment Strategy

SPV Financing: A Complete Guide to Structure, Use Cases, and Investment Strategy

Read more

SPVs

Real Estate SPVs: A Modern Framework for Structured Property Investing

Real Estate SPVs: A Modern Framework for Structured Property Investing

Read more

SPVs

ADGM Private Company Limited by Shares: Allocations Research

ADGM Private Company Limited by Shares: Allocations Research

Read more

SPVs

Offshore Company vs Onshore Company: Key Differences Explained

Offshore Company vs Onshore Company: Key Differences Explained

Read more

SPVs

What Is Offshore? Meaning, Uses, and How Offshore Structures Work in 2026

What Is Offshore? Meaning, Uses, and How Offshore Structures Work in 2026

Read more

SPVs

The Best Fund Admins for Emerging VCs (2026)

The Best Fund Admins for Emerging VCs (2026)

Read more

SPVs

How to Choose the Right Jurisdiction for an Offshore Company

How to Choose the Right Jurisdiction for an Offshore Company

Read more

SPVs

How to Start an Offshore Company: Allocations Guide 2026

How to Start an Offshore Company: Allocations Guide 2026

Read more

SPVs

Types of Special Purpose Vehicles (SPVs) and How Allocations Powers Them

Types of Special Purpose Vehicles (SPVs) and How Allocations Powers Them

Read more

SPVs

SPV vs Fund: Choose better with Allocation

SPV vs Fund: Choose better with Allocation

Read more

SPVs

AngelList SPV vs Allocations SPV: Best SPV Platform for Fund Managers

AngelList SPV vs Allocations SPV: Best SPV Platform for Fund Managers

Read more

SPVs

Sydecar SPV vs Allocations SPV: What to chose in 2026

Sydecar SPV vs Allocations SPV: What to chose in 2026

Read more

SPVs

Best SPV Platform in the United States (USA) in 2026

Best SPV Platform in the United States (USA) in 2026

Read more

SPVs

Best SPV Platform in the United Arab Emirates (UAE) in 2026

Best SPV Platform in the United Arab Emirates (UAE) in 2026

Read more

SPVs

Carta Pricing vs Allocations Pricing (2026)

Carta Pricing vs Allocations Pricing (2026)

Read more

SPVs

AngelList Pricing vs Allocations Pricing (2026)

AngelList Pricing vs Allocations Pricing (2026)

Read more

SPVs

How to Invest into Real Estate with Allocations: A Beginner's Guide to SPV Funds

How to Invest into Real Estate with Allocations: A Beginner's Guide to SPV Funds

Read more

SPVs

Best Fund Admin & Reporting Tools for VC Investors in 2026: Allocations

Best Fund Admin & Reporting Tools for VC Investors in 2026: Allocations

Read more

SPVs

Convertible Notes: Early Stage Investing with Allocations

Convertible Notes: Early Stage Investing with Allocations

Read more

SPVs

Top 5 Value for Money SPV Platforms

Top 5 Value for Money SPV Platforms

Read more

SPVs

How SPV Pricing Works on Allocations

How SPV Pricing Works on Allocations

Read more

SPVs

Best Fund Admin in 2026: Why Allocations Leads

Best Fund Admin in 2026: Why Allocations Leads

Read more

SPVs

How Allocations Is Changing SPV & Fund Formation

How Allocations Is Changing SPV & Fund Formation

Read more

SPVs

What Makes Allocations the First Choice for Fund Administrators

What Makes Allocations the First Choice for Fund Administrators

Read more

SPVs

Why Choose Allocations for SPVs and Funds in 2026

Why Choose Allocations for SPVs and Funds in 2026

Read more

SPVs

Best SPV Platforms in 2026: Why Allocations

Best SPV Platforms in 2026: Why Allocations

Read more

SPVs

SPV & Fund Pricing in 2026: Allocations

SPV & Fund Pricing in 2026: Allocations

Read more

SPVs

Can I Have Non-U.S. Investors? A Practical Guide for SPVs and Fund Managers

Can I Have Non-U.S. Investors? A Practical Guide for SPVs and Fund Managers

Read more

SPVs

What Do I Need to Do Every Year as a Fund Manager?

What Do I Need to Do Every Year as a Fund Manager?

Read more

SPVs

Do I Need an ERA? A Practical Guide for Fund Managers

Do I Need an ERA? A Practical Guide for Fund Managers

Read more

SPVs

How Much Does It Cost to Create an SPV in 2026?

How Much Does It Cost to Create an SPV in 2026?

Read more

SPVs

Special Purpose Vehicle (SPV): Meaning in Finance, Banking and Real-World Examples

Special Purpose Vehicle (SPV): Meaning in Finance, Banking and Real-World Examples

Read more

SPVs

Top Fund Administration Platforms in 2026

Top Fund Administration Platforms in 2026

Read more

SPVs

Migrate Your Fund to Allocations: A Complete Guide for Fund Managers

Migrate Your Fund to Allocations: A Complete Guide for Fund Managers

Read more

SPVs

What Does “Offshore” Means?

What Does “Offshore” Means?

Read more

SPVs

Comparing 506b vs 506c for Private Fundraising

Comparing 506b vs 506c for Private Fundraising

Read more

SPVs

LLP vs LLC | Choose business structure with Allocations

LLP vs LLC | Choose business structure with Allocations

Read more

SPVs

SPV Meaning in Finance: Complete Guide to Special Purpose Vehicles (2026)

SPV Meaning in Finance: Complete Guide to Special Purpose Vehicles (2026)

Read more

SPVs

The Best AngelList Alternatives in 2026 (Detailed Comparison)

The Best AngelList Alternatives in 2026 (Detailed Comparison)

Read more

SPVs

Understanding Special Purpose Vehicles (SPVs)

Understanding Special Purpose Vehicles (SPVs)

Read more

SPVs

Special Purpose Vehicle (SPV): What It Is and Why Investors Use It

Special Purpose Vehicle (SPV): What It Is and Why Investors Use It

Read more

SPVs

Who Typically Uses SPVs?

Who Typically Uses SPVs?

Read more

SPVs

Understanding SPVs in the Context of Private Equity

Understanding SPVs in the Context of Private Equity

Read more

SPVs

Why Use an SPV for Investment?

Why Use an SPV for Investment?

Read more

SPVs

SPV for Late-Stage and Secondary Investments

SPV for Late-Stage and Secondary Investments

Read more

SPVs

SPV Investment Structures: How Money Flows from Investors to Startups

SPV Investment Structures: How Money Flows from Investors to Startups

Read more

SPVs

SPV Management 101: What Happens After the Deal Closes

SPV Management 101: What Happens After the Deal Closes

Read more

SPVs

SPV in Venture Capital vs Traditional VC Funds: What Investors Need to Know

SPV in Venture Capital vs Traditional VC Funds: What Investors Need to Know

Read more

SPVs

SPV Structures in 2026: How Special Purpose Vehicles Are Evolving in Private Markets

SPV Structures in 2026: How Special Purpose Vehicles Are Evolving in Private Markets

Read more

SPVs

Real Estate SPV: A Complete Guide to Structuring Property Investments with Allocations

Real Estate SPV: A Complete Guide to Structuring Property Investments with Allocations

Read more

SPVs

Best SPV Platform in 2026: Features, Pricing, Compliance & How to Choose

Best SPV Platform in 2026: Features, Pricing, Compliance & How to Choose

Read more

SPVs

Top SPV Platforms in 2026: A Complete Comparison

Top SPV Platforms in 2026: A Complete Comparison

Read more

SPVs

SPV Structure and Governance: Who Controls What?

SPV Structure and Governance: Who Controls What?

Read more

SPVs

SPV Structure Explained: How SPVs Work for Private Investments

SPV Structure Explained: How SPVs Work for Private Investments

Read more

SPVs

Why Special Purpose Vehicles (SPVs) Are Becoming Essential in Modern Investing

Why Special Purpose Vehicles (SPVs) Are Becoming Essential in Modern Investing

Read more

SPVs

Understanding SPV Structures

Understanding SPV Structures

Read more

SPVs

Inside DATCOs: The Rise of Digital Asset Treasury Companies | Allocations

Inside DATCOs: The Rise of Digital Asset Treasury Companies | Allocations

Read more

SPVs

DATCO Stock Performance vs Bitcoin Price: Where to Invest in 2026

DATCO Stock Performance vs Bitcoin Price: Where to Invest in 2026

Read more

SPVs

Private Markets Aren’t Broken, They’re Just Waiting for Better Tools

Private Markets Aren’t Broken, They’re Just Waiting for Better Tools

Read more

SPVs

Digital Asset Treasury Companies: The DATCO Era Begins | Allocations

Digital Asset Treasury Companies: The DATCO Era Begins | Allocations

Read more

SPVs

How Allocations Redefines SPVs, Fund Formation, and Fund Management Software for Today’s Investment Managers

How Allocations Redefines SPVs, Fund Formation, and Fund Management Software for Today’s Investment Managers

Read more

SPVs

How VCs Are Scaling Trust, Not Just Capital

How VCs Are Scaling Trust, Not Just Capital

Read more

SPVs

Digital Asset Treasury Companies (DATCOs) vs Bitcoin ETFs: What’s the Difference?

Digital Asset Treasury Companies (DATCOs) vs Bitcoin ETFs: What’s the Difference?

Read more

SPVs

The 10-Minute Fund: What Instant Fund Formation Really Means

The 10-Minute Fund: What Instant Fund Formation Really Means

Read more

SPVs

Allocation IRR: Measuring Returns in Private Market Deals

Allocation IRR: Measuring Returns in Private Market Deals

Read more

SPVs

How Much Does It Cost to Start an SPV in 2025?

How Much Does It Cost to Start an SPV in 2025?

Read more

SPVs

Allocations Pricing Explained: Transparent, Flat-Fee Fund Administration for SPVs and Funds

Allocations Pricing Explained: Transparent, Flat-Fee Fund Administration for SPVs and Funds

Read more

SPVs

Private Equity SPVs: How Allocations Automates Fund Formation for Modern Investors

Private Equity SPVs: How Allocations Automates Fund Formation for Modern Investors

Read more

SPVs

From Term Sheet to Close: How Automated Deal Execution Platforms Speed Up Venture Investing

From Term Sheet to Close: How Automated Deal Execution Platforms Speed Up Venture Investing

Read more

SPVs

Why Modern Fund Managers Need Better Infrastructure

Why Modern Fund Managers Need Better Infrastructure

Read more

SPVs

AngelList vs Sydecar vs Allocations: The 2025 SPV Platform Showdown

AngelList vs Sydecar vs Allocations: The 2025 SPV Platform Showdown

Read more

SPVs

Fund Setup Software: Building Your First Fund With Allocations

Fund Setup Software: Building Your First Fund With Allocations

Read more

SPVs

Understanding 506(b) Funds: How Private Offerings Stay Compliant

Understanding 506(b) Funds: How Private Offerings Stay Compliant

Read more

SPVs

Allocations: The Complete Guide to Modern Fund Management

Allocations: The Complete Guide to Modern Fund Management

Read more

SPVs

Emerging Managers 101: Why SPVs Are the Easiest Way to Start Raising Capital

Emerging Managers 101: Why SPVs Are the Easiest Way to Start Raising Capital

Read more

SPVs

Asset Allocation Strategies for Modern Portfolios in 2025 ft. Allocations

Asset Allocation Strategies for Modern Portfolios in 2025 ft. Allocations

Read more

SPVs

Deal Allocation Tools: How to Streamline Investor Access to Opportunities

Deal Allocation Tools: How to Streamline Investor Access to Opportunities

Read more

SPVs

SPV Fees Explained: What Sponsors and Investors Should Know

SPV Fees Explained: What Sponsors and Investors Should Know

Read more

SPVs

How to Set Up an SPV: Step-by-Step Guide for Sponsors and Investors

How to Set Up an SPV: Step-by-Step Guide for Sponsors and Investors

Read more

SPVs

Why Delaware for SPVs? Investor Trust, Legal Clarity, Faster Closes

Why Delaware for SPVs? Investor Trust, Legal Clarity, Faster Closes

Read more

SPVs

Best SPV Platform in 2025? Features, Pricing, and How to Choose

Best SPV Platform in 2025? Features, Pricing, and How to Choose

Read more

SPVs

SPV Exit Strategies: What Happens When the Deal Closes

SPV Exit Strategies: What Happens When the Deal Closes

Read more

SPVs

Side Letters in SPVs: What You Need to Know

Side Letters in SPVs: What You Need to Know

Read more

SPVs

SPV K-1 Tax Reporting: What Sponsors and Investors Need to Know (2025 Guide)

SPV K-1 Tax Reporting: What Sponsors and Investors Need to Know (2025 Guide)

Read more

SPVs

What Does an SPV Company Do? (2025 Guide)

What Does an SPV Company Do? (2025 Guide)

Read more

SPVs

Real Estate SPV vs LLC: Which Is Better for Property Investment?

Real Estate SPV vs LLC: Which Is Better for Property Investment?

Read more

SPVs

SPV Tax Reporting: A Complete Guide for Sponsors and Investors

SPV Tax Reporting: A Complete Guide for Sponsors and Investors

Read more

SPVs

The Role of Allocations in Modern Asset Management

The Role of Allocations in Modern Asset Management

Read more

SPVs

Form D & Blue Sky Law Compliance for SPVs: What Sponsors Need to Know

Form D & Blue Sky Law Compliance for SPVs: What Sponsors Need to Know

Read more

SPVs

SPV Company vs Fund: Which Is Right for Your Deal?

SPV Company vs Fund: Which Is Right for Your Deal?

Read more

SPVs

SPV Platform: The Complete 2025 Guide (ft. Allocations)

SPV Platform: The Complete 2025 Guide (ft. Allocations)

Read more

SPVs

How to Choose the Best SPV Platform: A 15-Point Buyer’s Checklist

How to Choose the Best SPV Platform: A 15-Point Buyer’s Checklist

Read more

Fund Manager

What is an SPV? The Definitive Guide to Special Purpose Vehicles

What is an SPV? The Definitive Guide to Special Purpose Vehicles

Read more

Fund Manager

5 best books to read If you’re forging a path in VC

5 best books to read If you’re forging a path in VC

Read more

Investor Spotlight

Investor spotlight: Alex Fisher

Investor spotlight: Alex Fisher

Read more

SPVs

6 unique use cases for SPVs

6 unique use cases for SPVs

Read more

Market Trends

The SPV ecosystem democratizing alternative investments

The SPV ecosystem democratizing alternative investments

Read more

Company

How to write a stellar investor update

How to write a stellar investor update

Read more

Analytics

What’s going on here? 1 in 10 US households now qualify as accredited investors

What’s going on here? 1 in 10 US households now qualify as accredited investors

Read more

Market Trends

SPVs by sector

SPVs by sector

Read more

Market Trends

5 Benefits of a hybrid SPV + fund strategy

5 Benefits of a hybrid SPV + fund strategy

Read more

Products

What is the difference between 506b and 506c funds?

What is the difference between 506b and 506c funds?

Read more

Fund Manager

Why Allocations is the best choice for fast moving fund managers

Why Allocations is the best choice for fast moving fund managers

Read more

Fund Manager

When should fund managers use a fund vs an SPV?

When should fund managers use a fund vs an SPV?

Read more

Fund Manager

10 best practices for first-time fund managers

10 best practices for first-time fund managers

Read more

Analytics

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Read more

Market Trends

Private market trends: where are fund managers looking in 2022?

Private market trends: where are fund managers looking in 2022?

Read more

Fund Manager

5 female VCs on the rise in 2022

5 female VCs on the rise in 2022

Read more

Analytics

The new competitive edge for VCs and fund managers

The new competitive edge for VCs and fund managers

Read more

Analytics

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

Read more

Investor Spotlight

Investor spotlight: Olga Yermolenko

Investor spotlight: Olga Yermolenko

Read more

Analytics

3 stats that show the democratization of VC in 2021

3 stats that show the democratization of VC in 2021

Read more

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc