In the world of modern finance, complex investments and large capital transactions rarely happen directly. Instead, they are structured through carefully designed legal entities that protect investors, isolate risk, and simplify execution. One of the most widely used structures for this purpose is the Special Purpose Vehicle (SPV).

From venture capital and private equity to banking, real estate, and structured finance, SPVs have become a foundational tool. Understanding SPV meaning in finance, what is SPV in banking, how an SPV company works, and the different types of SPVs is essential for fund managers, investors, and financial professionals operating in private markets today.

This guide by Allocations breaks down SPVs in a practical, easy-to-understand way—without legal jargon.

SPV Meaning in Finance: What Is a Special Purpose Vehicle?

A Special Purpose Vehicle (SPV) is a legally separate entity created for a specific and limited objective. Unlike operating companies, an SPV exists to hold a particular asset, execute a single transaction, or manage a defined financial risk.

In finance, the core idea behind an SPV is risk isolation. Because the SPV is legally independent from its parent or sponsor, any liabilities or financial distress remain contained within the SPV itself. This makes SPVs especially valuable in high-value investments where investors want clarity, transparency, and protection.

An SPV may be structured as:

A private limited company

A limited partnership

An LLP or trust, depending on jurisdiction

Once its purpose is fulfilled, the SPV is often dissolved.

What Is an SPV Company and Why Is It Created?

An SPV company is formed just like a normal business entity, but with restricted activities written into its governing documents. This ensures the SPV cannot take on unrelated business risks.

For example, if a group of investors wants to invest in a single startup or acquire one property, creating an SPV company allows them to:

Pool capital efficiently

Hold the asset under one legal entity

Simplify ownership and reporting

Protect investors from external liabilities

The SPV company becomes the only entity exposed to the risks of that investment, not the investors individually and not the sponsoring firm.

In private markets, platforms like Allocations are increasingly used to create and manage SPV companies digitally, reducing legal friction and administrative overhead.

Special Purpose Vehicle Example: How SPVs Work in Practice

To fully understand SPVs, it helps to look at real-world special purpose vehicle examples.

Consider a venture capital scenario. A lead investor wants to invest in a promising startup but also wants to bring along several angel investors. Instead of having each investor invest directly, an SPV is formed. All investors invest into the SPV, and the SPV makes a single investment into the startup. The startup sees only one name on its cap table, while investors hold proportional ownership in the SPV.

In real estate, developers often create a separate SPV for each property. Rental income flows into the SPV, expenses and debt are handled within it, and investors receive returns without exposure to the developer’s other projects.

In private equity, acquisition SPVs are created to purchase companies, allowing debt and operational risk to remain isolated at the transaction level.

What Is SPV in Banking?

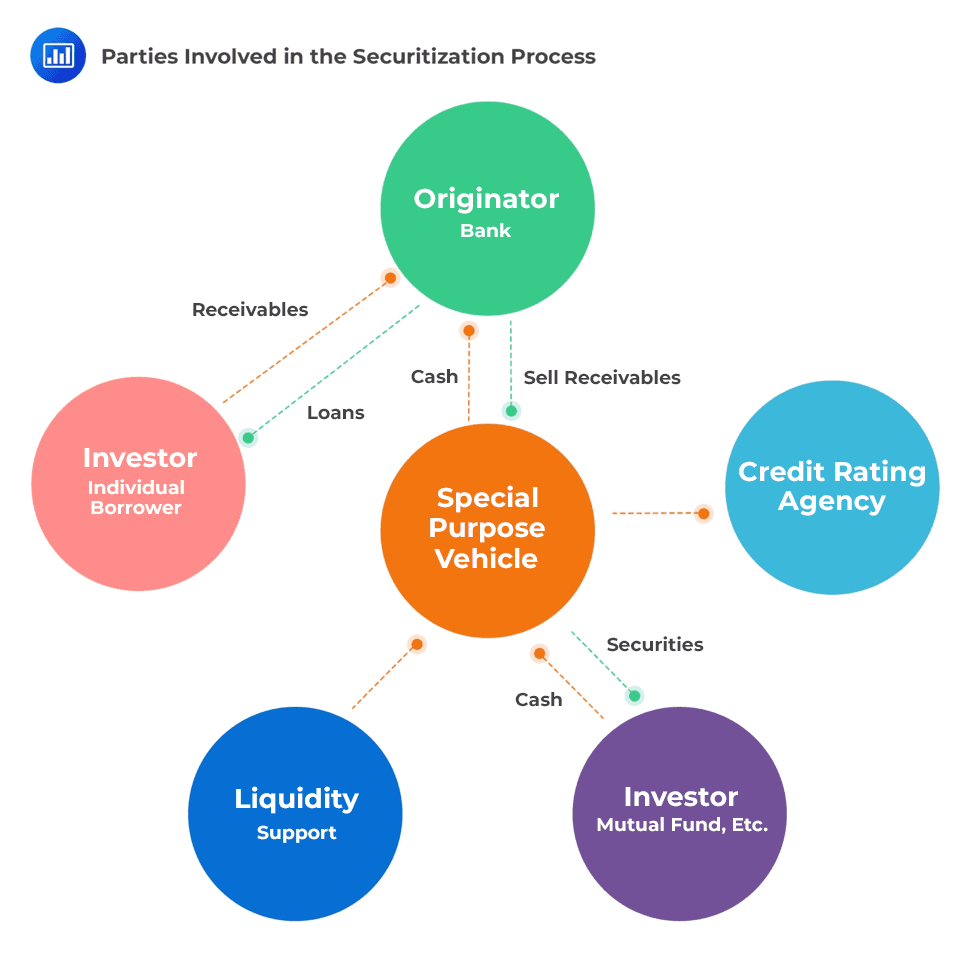

The use of SPVs in banking is significantly different from their use in venture capital or private equity. To understand what is SPV in banking, we need to look at securitization and risk transfer.

Banks regularly hold large volumes of loans such as home loans, auto loans, or credit card receivables. Holding these loans on the balance sheet ties up capital and increases regulatory requirements. To solve this, banks transfer these assets to an SPV.

The SPV then issues securities backed by the cash flows of those loans. Investors buy these securities, and the bank receives immediate liquidity. This structure allows banks to:

Improve capital efficiency

Reduce balance sheet risk

Increase lending capacity

This is how asset-backed securities (ABS) and mortgage-backed securities (MBS) are created.

Understanding SPV Loans

An SPV loan refers to debt raised directly by the SPV, rather than by its sponsor or parent company. These loans are typically non-recourse or limited-recourse, meaning lenders rely primarily on the SPV’s assets and cash flows for repayment.

SPV loans are common in:

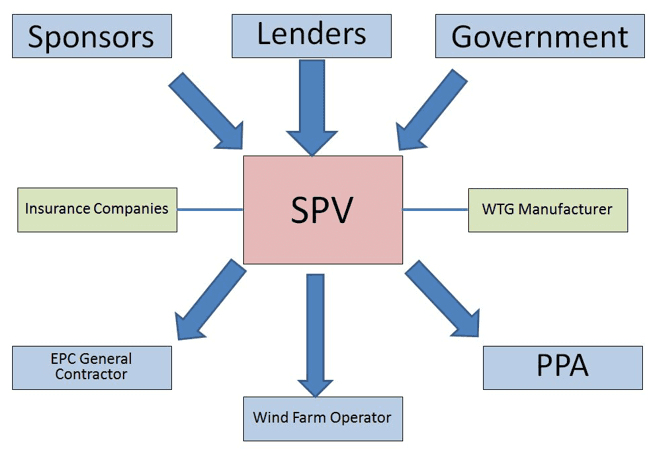

Infrastructure projects

Renewable energy projects

Real estate developments

Large acquisitions

For example, a solar power plant may be owned by an SPV that takes a loan to finance construction. The loan is repaid using revenue generated from selling electricity, not from the parent company’s balance sheet.

This structure protects sponsors while giving lenders clear visibility into repayment sources.

Types of SPV Explained in Detail

There are several types of SPVs, each designed for a specific financial use case.

Investment SPVs are widely used in venture capital and angel syndicates to invest in a single company or asset.

Securitization SPVs are common in banking and structured finance, holding receivables and issuing tradable securities.

Project finance SPVs are created to own and operate infrastructure projects such as roads, power plants, or airports.

Real estate SPVs hold individual properties or portfolios, making ownership, taxation, and financing more efficient.

Synthetic SPVs are used in advanced financial engineering to transfer risk using derivatives rather than physical asset transfers.

Why SPVs Are Essential in Modern Finance

SPVs exist because they solve real problems. They create clarity between ownership and risk, simplify investment structures, and provide confidence to investors and regulators.

For fund managers and syndicates, SPVs enable faster deal execution without launching a full fund. For banks, they improve capital efficiency. For investors, they offer transparency and protection.

Today, SPVs are no longer reserved for large institutions. With modern fund infrastructure platforms like Allocations, setting up and operating SPVs has become faster, more compliant, and globally scalable.

Final Thoughts

Understanding SPV meaning in finance, what is SPV in banking, SPV loans, SPV companies, and the various types of SPVs is critical for anyone participating in private capital markets. SPVs are not loopholes or accounting tricks—they are essential tools that enable capital formation while managing risk responsibly.

As private markets continue to grow, SPVs will remain the backbone of structured finance, investment syndication, and asset ownership worldwide.

Frequently Asked Questions (FAQs) About Special Purpose Vehicles (SPVs)

1. What is a Special Purpose Vehicle (SPV)?

A Special Purpose Vehicle (SPV) is a legally separate entity created to carry out a specific financial or business objective. It is commonly used to hold a single asset, execute one investment, or isolate financial risk from a parent company or investors.

In finance, SPVs are designed to be bankruptcy-remote, meaning if the parent company faces financial trouble, the SPV’s assets and obligations remain protected. This makes SPVs a preferred structure in venture capital, private equity, banking, real estate, and structured finance.

2. What is the meaning of SPV in finance?

The SPV meaning in finance refers to an entity created to ring-fence risk and assets for a defined purpose. Financial institutions, investors, and fund managers use SPVs to:

Pool investor capital

Hold investments or receivables

Raise debt independently

Improve transparency and governance

SPVs allow financial transactions to be structured efficiently while protecting stakeholders from unrelated liabilities.

3. What is an SPV company?

An SPV company is a corporate entity incorporated solely to serve the SPV’s purpose. While it looks like a regular company on paper, its activities are strictly limited by legal agreements.

An SPV company typically:

Holds one asset or investment

Has predefined operating restrictions

Exists for a limited duration

Is dissolved after completing its objective

SPV companies are widely used in private investments because they simplify ownership, compliance, and reporting.

4. What is SPV in banking?

SPV in banking refers to the use of special purpose vehicles to manage risk, liquidity, and regulatory capital. Banks commonly use SPVs in securitization transactions.

In this structure:

A bank transfers loans or receivables to an SPV

The SPV issues securities backed by those assets

Investors purchase these securities

The bank receives liquidity and reduces balance-sheet exposure

This allows banks to lend more efficiently while maintaining regulatory compliance.

5. Why do banks use SPVs instead of holding assets directly?

Banks use SPVs because holding large volumes of loans directly increases:

Capital requirements

Balance-sheet risk

Regulatory scrutiny

By transferring assets to an SPV, banks can:

Free up capital

Improve liquidity ratios

Reduce concentration risk

Continue originating new loans

SPVs play a critical role in modern banking systems worldwide.

6. What is an SPV loan?

An SPV loan is debt raised directly by the SPV rather than by its parent company or sponsors. These loans are typically non-recourse or limited-recourse, meaning lenders rely on the SPV’s assets and cash flows for repayment.

SPV loans are commonly used in:

Infrastructure projects

Renewable energy

Real estate developments

Project finance

This structure protects sponsors while giving lenders clarity on repayment sources.

7. What are the different types of SPVs?

There are several types of SPVs, each serving a specific purpose:

Investment SPVs – Used for single-company or single-asset investments

Securitization SPVs – Used by banks to issue asset-backed securities

Project finance SPVs – Used for infrastructure and energy projects

Real estate SPVs – Used to own individual properties or portfolios

Synthetic SPVs – Used to transfer financial risk using derivatives

Each type is designed to isolate risk and improve financial efficiency.

8. Can individuals invest through an SPV?

Yes, individuals frequently invest through SPVs, especially in:

Angel syndicates

Startup investments

Private equity deals

Real estate opportunities

Investing through an SPV allows individuals to participate in private deals while benefiting from professional structuring, simplified documentation, and better risk management.

9. How is an SPV different from a fund?

An SPV and a fund serve different purposes:

An SPV is created for one specific investment or transaction, while a fund is designed to make multiple investments over time. SPVs are usually cheaper, faster to set up, and easier to manage, making them ideal for deal-by-deal investing.

Funds, on the other hand, involve ongoing compliance, portfolio management, and regulatory obligations.

10. Are SPVs legal and regulated?

Yes, SPVs are fully legal and widely regulated across jurisdictions. They are commonly used by banks, investment firms, and governments.

However, SPVs must comply with:

Corporate laws

Securities regulations

Tax requirements

Anti-money laundering (AML) rules

Modern platforms like Allocations help ensure SPVs are structured and managed in a compliant manner.

11. What are the advantages of using an SPV?

The key advantages of SPVs include:

Risk isolation

Investor protection

Cleaner accounting

Simplified ownership

Easier fundraising

Transaction-level transparency

These benefits make SPVs a preferred structure in private markets.

12. Are there any risks associated with SPVs?

While SPVs are powerful tools, they do carry risks if not structured correctly. Poor governance, lack of transparency, or regulatory non-compliance can create issues.

This is why professional administration, proper documentation, and ongoing compliance are essential when setting up and managing SPVs.

13. How long does an SPV typically exist?

Most SPVs are temporary and exist only for the duration of the investment or project. Once the asset is sold or the objective is completed, the SPV is liquidated or dissolved.

Some SPVs, such as real estate holding vehicles, may exist for longer periods depending on the investment horizon.

14. How does Allocations help with SPVs?

Allocations provides end-to-end infrastructure to:

Create SPVs quickly

Onboard investors digitally

Manage capital calls and distributions

Handle compliance and reporting

Scale from SPVs to full funds

This allows fund managers and syndicates to focus on investing rather than operations.

15. Who should consider using an SPV?

SPVs are ideal for:

Angel investors

Syndicate leads

Venture capital managers

Private equity firms

Real estate investors

Infrastructure sponsors

Anyone looking to structure a single investment efficiently and professionally should consider using an SPV.

SPVs

Read more

SPVs

Read more

Company

Read more

SPVs

Read more

SPVs

Read more

Fund Manager

Read more

Fund Manager

Read more

Analytics

Read more

Analytics

Read more

Fund Manager

Read more

Fund Manager

Read more

Fund Manager

Read more

Company

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

Fund Manager

Read more

Fund Manager

Read more

Investor Spotlight

Read more

SPVs

Read more

Market Trends

Read more

Company

Read more

Analytics

Read more

Market Trends

Read more

Market Trends

Read more

Products

Read more

Fund Manager

Read more

Fund Manager

Read more

Fund Manager

Read more

Analytics

Read more

Market Trends

Read more

Fund Manager

Read more

Analytics

Read more

Analytics

Read more

Investor Spotlight

Read more

Analytics

Read more