Back

SPVs

SPV Investment Structure: How Special Purpose Vehicles Are Designed for Modern Investing

SPV Investment Structure: How Special Purpose Vehicles Are Designed for Modern Investing

SPV Investment Structure: How Special Purpose Vehicles Are Designed for Modern Investing

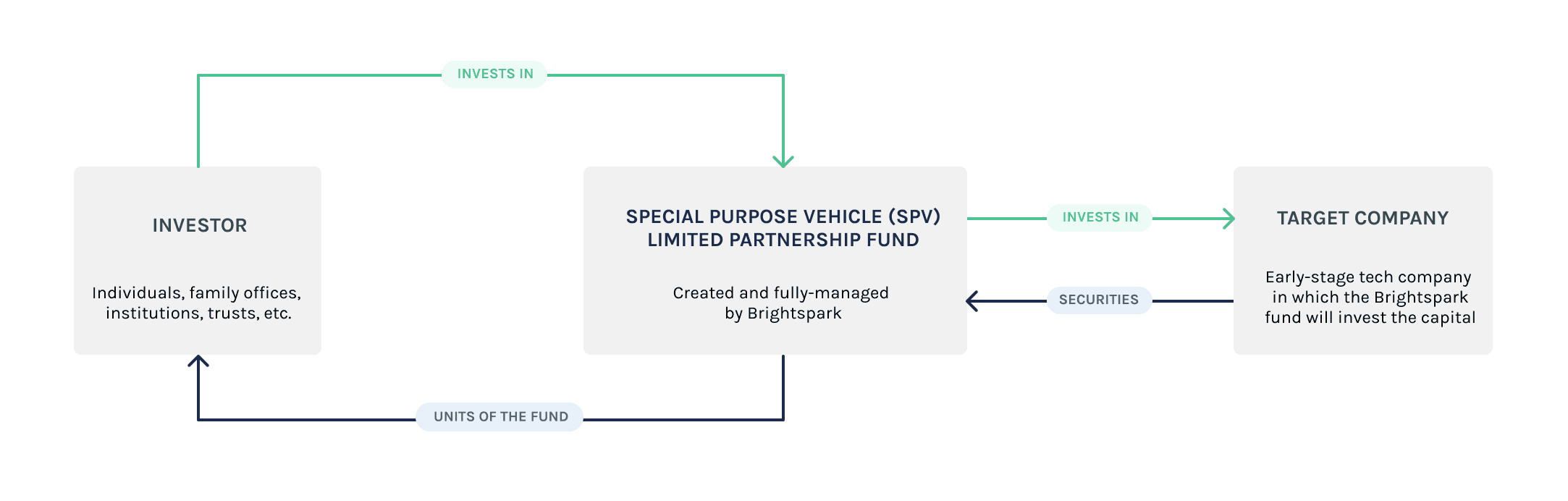

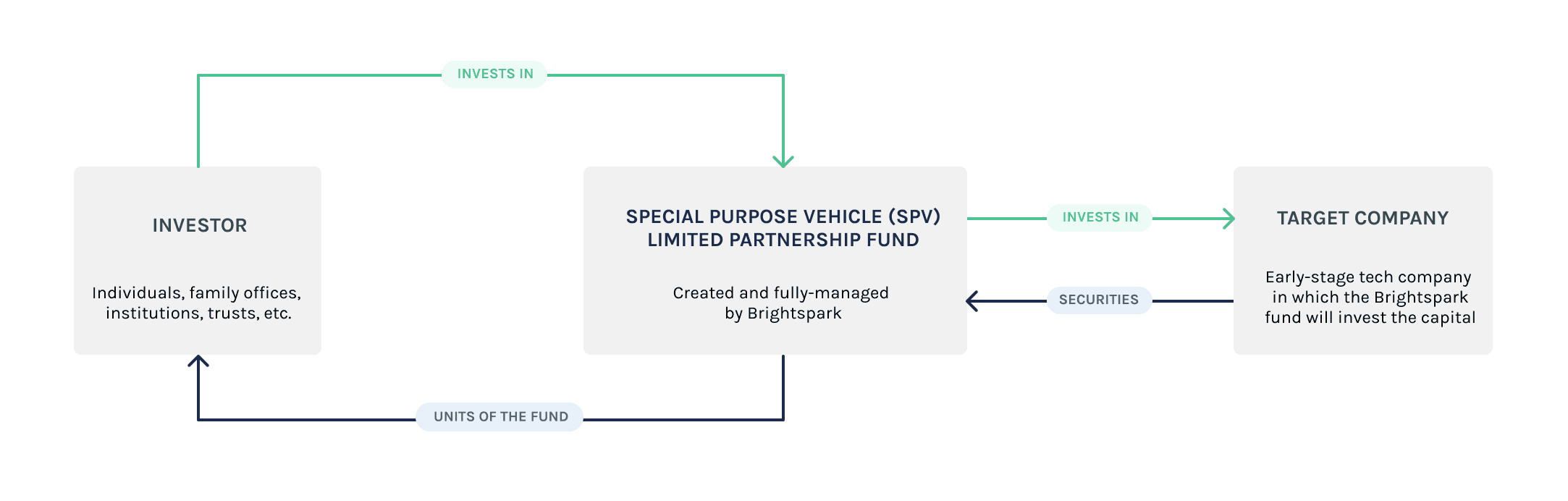

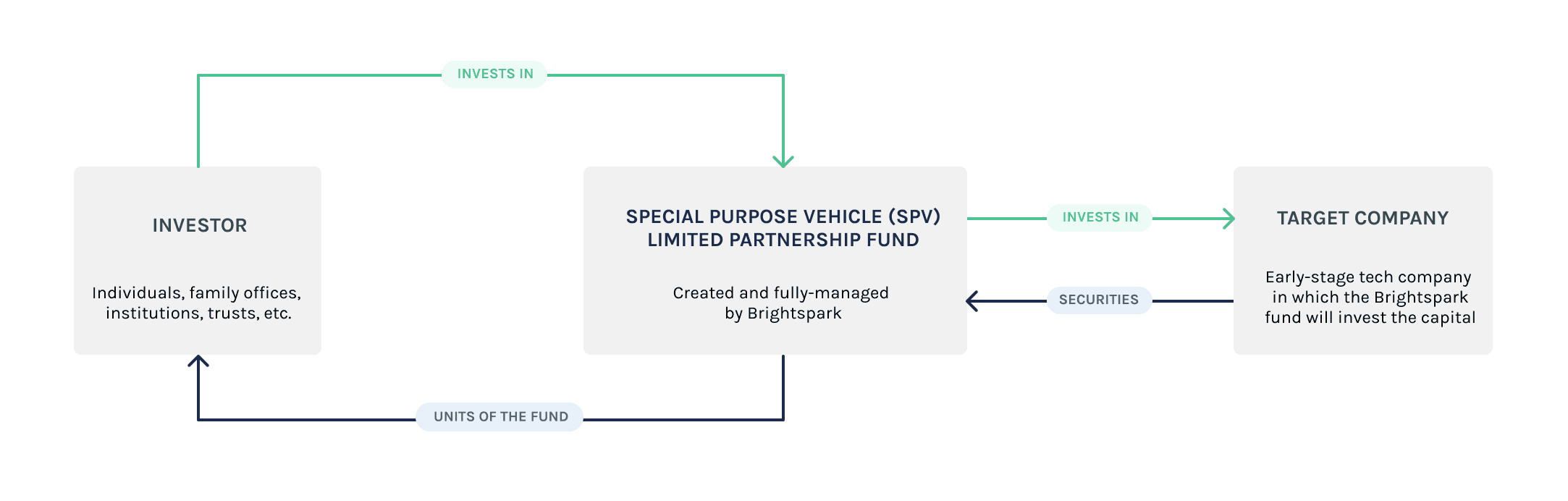

The SPV investment structure has become one of the most widely used frameworks in private markets, enabling investors to participate in focused opportunities while maintaining legal, financial, and operational clarity. As private equity, venture capital, real estate, and alternative assets continue to grow outside public markets, SPVs have evolved into a preferred mechanism for structuring deal-specific investments.

At a high level, an SPV investment structure creates a dedicated legal entity whose sole purpose is to hold a specific investment or execute a defined transaction. This structural separation is not accidental—it is a deliberate design choice that allows investors to isolate risk, streamline ownership, and precisely control how capital is deployed and returned.

Understanding the Core Concept of an SPV Investment Structure

An SPV investment structure revolves around the creation of a standalone entity—commonly a limited liability company (LLC) or limited partnership (LP)—that exists solely to own a specific asset or stake in a transaction. The SPV has no operational business of its own. Its balance sheet, cash flows, and liabilities are entirely tied to the underlying investment.

This structure allows investors to gain economic exposure without directly appearing on the cap table of the operating company or owning the asset individually. Instead, they own interests in the SPV, which in turn owns the investment.

The separation created by the SPV is fundamental. From a legal and financial standpoint, the SPV acts as a firewall. Any obligations, debts, or risks associated with the investment remain confined within the SPV, protecting both investors and sponsors from cross-contamination with other ventures.

Key Components of an SPV Investment Structure

Every SPV investment structure is built from a set of core components that work together to ensure clarity, compliance, and efficient capital flow.

The first component is the legal entity itself. Jurisdiction and entity type are chosen based on regulatory environment, tax considerations, and investor base. This decision influences reporting obligations, investor eligibility, and withholding tax treatment.

The second component is the investor participation layer. Investors subscribe to the SPV through legally binding agreements that define ownership percentages, capital commitments, and economic rights.

The third component is the underlying investment asset, which may include equity in a startup, shares in a private company, a real estate property, or a structured credit instrument.

Finally, the governance and economics framework ties everything together, outlining how decisions are made, how information is shared, and how returns are distributed.

Capital Flow in an SPV Investment Structure

Capital flow is one of the most important aspects of SPV structuring. Unlike operating companies, SPVs are designed to move capital in a clean, predictable manner.

Capital enters the SPV through investor subscriptions. Once capital is fully funded, the SPV deploys it into the target investment according to predefined terms. From that point onward, all cash flows—dividends, interest payments, or exit proceeds—flow back into the SPV before being distributed to investors.

This layered flow provides transparency and simplifies accounting. Investors can clearly see how much capital was deployed, how returns were generated, and how fees or carried interest were applied.

Typically, distributions follow a waterfall structure, which ensures that capital is returned in a logical sequence:

Return of invested capital to investors

Payment of preferred returns, if applicable

Allocation of profits between investors and sponsors

This structured approach reduces ambiguity and minimizes disputes.

Governance and Control Within an SPV

Governance is one of the most nuanced aspects of an SPV investment structure. While SPVs are passive entities, decisions still need to be made regarding voting rights, exit timing, and extraordinary events.

Most SPVs appoint a manager or general partner responsible for executing the investment and handling administrative duties. Investors typically have limited voting rights, reserved for major decisions such as amendments to governing documents or early liquidation.

The governance framework is intentionally lighter than that of traditional funds, but it is still critical. Poorly defined governance can lead to misalignment, especially when SPVs are used for high-growth or long-duration investments.

A well-structured SPV clearly defines:

Decision-making authority

Information and reporting rights

Conflict-of-interest safeguards

These elements protect both investors and sponsors while maintaining operational efficiency.

SPV Investment Structure vs Direct Investing

One of the primary reasons SPVs are used is to avoid the complications of direct investing.

Direct investment often leads to fragmented ownership, administrative overhead, and regulatory complexity—especially when multiple investors participate in a single deal. From the perspective of the underlying company or asset owner, managing dozens or hundreds of individual investors is inefficient.

An SPV consolidates all investors into a single economic entity, appearing as one line item on the cap table or ownership register. This simplifies governance, communication, and future transactions such as follow-on funding or exits.

For investors, the SPV structure also provides standardized documentation, centralized reporting, and clearer exit mechanics, all of which are difficult to achieve through direct ownership.

Use of SPV Investment Structures Across Asset Classes

SPV investment structures are highly adaptable and used across a wide range of asset classes.

In venture capital, SPVs are commonly used to syndicate angel investors into early-stage deals. This allows startups to accept capital from a broad investor base without complicating their cap table.

In private equity, SPVs are often used for co-investments, enabling limited partners to invest additional capital into specific portfolio companies alongside a lead fund.

In real estate, each property or development project is typically held in its own SPV. This allows investors to evaluate performance on an asset-by-asset basis while isolating liabilities.

In private credit and structured finance, SPVs are used to hold loan portfolios, receivables, or asset-backed securities, ensuring clean separation between assets and issuers.

Risk Isolation and Legal Protection

Risk isolation is arguably the most important benefit of an SPV investment structure.

By housing a single investment within a standalone entity, investors limit their exposure strictly to the capital committed. If the investment fails, creditors have recourse only to the SPV’s assets, not to investors’ other holdings or the sponsor’s broader portfolio.

This principle is especially important in leveraged transactions, real estate developments, and structured credit deals, where liabilities can be significant.

Legal isolation also simplifies exit scenarios. Buyers can acquire the SPV directly rather than renegotiating individual ownership stakes, reducing friction and transaction costs.

Tax and Regulatory Considerations in SPV Structures

Tax efficiency is often a major driver in SPV structuring decisions. Depending on jurisdiction, SPVs may be designed as pass-through entities, allowing income and losses to flow directly to investors.

Regulatory considerations also play a critical role. Many SPVs rely on private placement exemptions, restricting participation to accredited or professional investors. This reduces compliance burden while maintaining investor protection.

As global regulations evolve, SPV structures must be carefully designed to balance flexibility with compliance, especially for cross-border investments.

Operational Complexity and Administration

While SPVs simplify investing at a strategic level, they introduce operational requirements that cannot be ignored.

Each SPV requires:

Legal formation and documentation

Ongoing accounting and financial reporting

Tax filings and regulatory compliance

Investor communications and distributions

Historically, this complexity limited SPVs to institutional players. Today, modern SPV platforms and fund administration tools are reducing friction, making SPV investment structures accessible at scale.

The Role of Technology in Modern SPV Investment Structures

Technology is reshaping how SPVs are created, managed, and scaled.

Digital onboarding, automated capital calls, real-time reporting dashboards, and standardized documentation are turning SPVs into repeatable financial products rather than bespoke legal projects.

This shift is particularly important as private markets expand into new areas such as real-world assets, tokenized securities, and decentralized finance, where precision and transparency are critical.

Final Perspective on SPV Investment Structure

The SPV investment structure is no longer a niche legal construct—it is a foundational tool of modern private investing. Its ability to combine risk isolation, transparency, and capital efficiency makes it ideal for today’s deal-driven investment landscape.

For investors seeking targeted exposure, and for sponsors aiming to structure capital efficiently, SPVs offer a balance of control and simplicity that traditional structures often lack.

Understanding how SPV investment structures work is essential for anyone operating in private markets, whether as an investor, founder, or fund manager.

The SPV investment structure has become one of the most widely used frameworks in private markets, enabling investors to participate in focused opportunities while maintaining legal, financial, and operational clarity. As private equity, venture capital, real estate, and alternative assets continue to grow outside public markets, SPVs have evolved into a preferred mechanism for structuring deal-specific investments.

At a high level, an SPV investment structure creates a dedicated legal entity whose sole purpose is to hold a specific investment or execute a defined transaction. This structural separation is not accidental—it is a deliberate design choice that allows investors to isolate risk, streamline ownership, and precisely control how capital is deployed and returned.

Understanding the Core Concept of an SPV Investment Structure

An SPV investment structure revolves around the creation of a standalone entity—commonly a limited liability company (LLC) or limited partnership (LP)—that exists solely to own a specific asset or stake in a transaction. The SPV has no operational business of its own. Its balance sheet, cash flows, and liabilities are entirely tied to the underlying investment.

This structure allows investors to gain economic exposure without directly appearing on the cap table of the operating company or owning the asset individually. Instead, they own interests in the SPV, which in turn owns the investment.

The separation created by the SPV is fundamental. From a legal and financial standpoint, the SPV acts as a firewall. Any obligations, debts, or risks associated with the investment remain confined within the SPV, protecting both investors and sponsors from cross-contamination with other ventures.

Key Components of an SPV Investment Structure

Every SPV investment structure is built from a set of core components that work together to ensure clarity, compliance, and efficient capital flow.

The first component is the legal entity itself. Jurisdiction and entity type are chosen based on regulatory environment, tax considerations, and investor base. This decision influences reporting obligations, investor eligibility, and withholding tax treatment.

The second component is the investor participation layer. Investors subscribe to the SPV through legally binding agreements that define ownership percentages, capital commitments, and economic rights.

The third component is the underlying investment asset, which may include equity in a startup, shares in a private company, a real estate property, or a structured credit instrument.

Finally, the governance and economics framework ties everything together, outlining how decisions are made, how information is shared, and how returns are distributed.

Capital Flow in an SPV Investment Structure

Capital flow is one of the most important aspects of SPV structuring. Unlike operating companies, SPVs are designed to move capital in a clean, predictable manner.

Capital enters the SPV through investor subscriptions. Once capital is fully funded, the SPV deploys it into the target investment according to predefined terms. From that point onward, all cash flows—dividends, interest payments, or exit proceeds—flow back into the SPV before being distributed to investors.

This layered flow provides transparency and simplifies accounting. Investors can clearly see how much capital was deployed, how returns were generated, and how fees or carried interest were applied.

Typically, distributions follow a waterfall structure, which ensures that capital is returned in a logical sequence:

Return of invested capital to investors

Payment of preferred returns, if applicable

Allocation of profits between investors and sponsors

This structured approach reduces ambiguity and minimizes disputes.

Governance and Control Within an SPV

Governance is one of the most nuanced aspects of an SPV investment structure. While SPVs are passive entities, decisions still need to be made regarding voting rights, exit timing, and extraordinary events.

Most SPVs appoint a manager or general partner responsible for executing the investment and handling administrative duties. Investors typically have limited voting rights, reserved for major decisions such as amendments to governing documents or early liquidation.

The governance framework is intentionally lighter than that of traditional funds, but it is still critical. Poorly defined governance can lead to misalignment, especially when SPVs are used for high-growth or long-duration investments.

A well-structured SPV clearly defines:

Decision-making authority

Information and reporting rights

Conflict-of-interest safeguards

These elements protect both investors and sponsors while maintaining operational efficiency.

SPV Investment Structure vs Direct Investing

One of the primary reasons SPVs are used is to avoid the complications of direct investing.

Direct investment often leads to fragmented ownership, administrative overhead, and regulatory complexity—especially when multiple investors participate in a single deal. From the perspective of the underlying company or asset owner, managing dozens or hundreds of individual investors is inefficient.

An SPV consolidates all investors into a single economic entity, appearing as one line item on the cap table or ownership register. This simplifies governance, communication, and future transactions such as follow-on funding or exits.

For investors, the SPV structure also provides standardized documentation, centralized reporting, and clearer exit mechanics, all of which are difficult to achieve through direct ownership.

Use of SPV Investment Structures Across Asset Classes

SPV investment structures are highly adaptable and used across a wide range of asset classes.

In venture capital, SPVs are commonly used to syndicate angel investors into early-stage deals. This allows startups to accept capital from a broad investor base without complicating their cap table.

In private equity, SPVs are often used for co-investments, enabling limited partners to invest additional capital into specific portfolio companies alongside a lead fund.

In real estate, each property or development project is typically held in its own SPV. This allows investors to evaluate performance on an asset-by-asset basis while isolating liabilities.

In private credit and structured finance, SPVs are used to hold loan portfolios, receivables, or asset-backed securities, ensuring clean separation between assets and issuers.

Risk Isolation and Legal Protection

Risk isolation is arguably the most important benefit of an SPV investment structure.

By housing a single investment within a standalone entity, investors limit their exposure strictly to the capital committed. If the investment fails, creditors have recourse only to the SPV’s assets, not to investors’ other holdings or the sponsor’s broader portfolio.

This principle is especially important in leveraged transactions, real estate developments, and structured credit deals, where liabilities can be significant.

Legal isolation also simplifies exit scenarios. Buyers can acquire the SPV directly rather than renegotiating individual ownership stakes, reducing friction and transaction costs.

Tax and Regulatory Considerations in SPV Structures

Tax efficiency is often a major driver in SPV structuring decisions. Depending on jurisdiction, SPVs may be designed as pass-through entities, allowing income and losses to flow directly to investors.

Regulatory considerations also play a critical role. Many SPVs rely on private placement exemptions, restricting participation to accredited or professional investors. This reduces compliance burden while maintaining investor protection.

As global regulations evolve, SPV structures must be carefully designed to balance flexibility with compliance, especially for cross-border investments.

Operational Complexity and Administration

While SPVs simplify investing at a strategic level, they introduce operational requirements that cannot be ignored.

Each SPV requires:

Legal formation and documentation

Ongoing accounting and financial reporting

Tax filings and regulatory compliance

Investor communications and distributions

Historically, this complexity limited SPVs to institutional players. Today, modern SPV platforms and fund administration tools are reducing friction, making SPV investment structures accessible at scale.

The Role of Technology in Modern SPV Investment Structures

Technology is reshaping how SPVs are created, managed, and scaled.

Digital onboarding, automated capital calls, real-time reporting dashboards, and standardized documentation are turning SPVs into repeatable financial products rather than bespoke legal projects.

This shift is particularly important as private markets expand into new areas such as real-world assets, tokenized securities, and decentralized finance, where precision and transparency are critical.

Final Perspective on SPV Investment Structure

The SPV investment structure is no longer a niche legal construct—it is a foundational tool of modern private investing. Its ability to combine risk isolation, transparency, and capital efficiency makes it ideal for today’s deal-driven investment landscape.

For investors seeking targeted exposure, and for sponsors aiming to structure capital efficiently, SPVs offer a balance of control and simplicity that traditional structures often lack.

Understanding how SPV investment structures work is essential for anyone operating in private markets, whether as an investor, founder, or fund manager.

The SPV investment structure has become one of the most widely used frameworks in private markets, enabling investors to participate in focused opportunities while maintaining legal, financial, and operational clarity. As private equity, venture capital, real estate, and alternative assets continue to grow outside public markets, SPVs have evolved into a preferred mechanism for structuring deal-specific investments.

At a high level, an SPV investment structure creates a dedicated legal entity whose sole purpose is to hold a specific investment or execute a defined transaction. This structural separation is not accidental—it is a deliberate design choice that allows investors to isolate risk, streamline ownership, and precisely control how capital is deployed and returned.

Understanding the Core Concept of an SPV Investment Structure

An SPV investment structure revolves around the creation of a standalone entity—commonly a limited liability company (LLC) or limited partnership (LP)—that exists solely to own a specific asset or stake in a transaction. The SPV has no operational business of its own. Its balance sheet, cash flows, and liabilities are entirely tied to the underlying investment.

This structure allows investors to gain economic exposure without directly appearing on the cap table of the operating company or owning the asset individually. Instead, they own interests in the SPV, which in turn owns the investment.

The separation created by the SPV is fundamental. From a legal and financial standpoint, the SPV acts as a firewall. Any obligations, debts, or risks associated with the investment remain confined within the SPV, protecting both investors and sponsors from cross-contamination with other ventures.

Key Components of an SPV Investment Structure

Every SPV investment structure is built from a set of core components that work together to ensure clarity, compliance, and efficient capital flow.

The first component is the legal entity itself. Jurisdiction and entity type are chosen based on regulatory environment, tax considerations, and investor base. This decision influences reporting obligations, investor eligibility, and withholding tax treatment.

The second component is the investor participation layer. Investors subscribe to the SPV through legally binding agreements that define ownership percentages, capital commitments, and economic rights.

The third component is the underlying investment asset, which may include equity in a startup, shares in a private company, a real estate property, or a structured credit instrument.

Finally, the governance and economics framework ties everything together, outlining how decisions are made, how information is shared, and how returns are distributed.

Capital Flow in an SPV Investment Structure

Capital flow is one of the most important aspects of SPV structuring. Unlike operating companies, SPVs are designed to move capital in a clean, predictable manner.

Capital enters the SPV through investor subscriptions. Once capital is fully funded, the SPV deploys it into the target investment according to predefined terms. From that point onward, all cash flows—dividends, interest payments, or exit proceeds—flow back into the SPV before being distributed to investors.

This layered flow provides transparency and simplifies accounting. Investors can clearly see how much capital was deployed, how returns were generated, and how fees or carried interest were applied.

Typically, distributions follow a waterfall structure, which ensures that capital is returned in a logical sequence:

Return of invested capital to investors

Payment of preferred returns, if applicable

Allocation of profits between investors and sponsors

This structured approach reduces ambiguity and minimizes disputes.

Governance and Control Within an SPV

Governance is one of the most nuanced aspects of an SPV investment structure. While SPVs are passive entities, decisions still need to be made regarding voting rights, exit timing, and extraordinary events.

Most SPVs appoint a manager or general partner responsible for executing the investment and handling administrative duties. Investors typically have limited voting rights, reserved for major decisions such as amendments to governing documents or early liquidation.

The governance framework is intentionally lighter than that of traditional funds, but it is still critical. Poorly defined governance can lead to misalignment, especially when SPVs are used for high-growth or long-duration investments.

A well-structured SPV clearly defines:

Decision-making authority

Information and reporting rights

Conflict-of-interest safeguards

These elements protect both investors and sponsors while maintaining operational efficiency.

SPV Investment Structure vs Direct Investing

One of the primary reasons SPVs are used is to avoid the complications of direct investing.

Direct investment often leads to fragmented ownership, administrative overhead, and regulatory complexity—especially when multiple investors participate in a single deal. From the perspective of the underlying company or asset owner, managing dozens or hundreds of individual investors is inefficient.

An SPV consolidates all investors into a single economic entity, appearing as one line item on the cap table or ownership register. This simplifies governance, communication, and future transactions such as follow-on funding or exits.

For investors, the SPV structure also provides standardized documentation, centralized reporting, and clearer exit mechanics, all of which are difficult to achieve through direct ownership.

Use of SPV Investment Structures Across Asset Classes

SPV investment structures are highly adaptable and used across a wide range of asset classes.

In venture capital, SPVs are commonly used to syndicate angel investors into early-stage deals. This allows startups to accept capital from a broad investor base without complicating their cap table.

In private equity, SPVs are often used for co-investments, enabling limited partners to invest additional capital into specific portfolio companies alongside a lead fund.

In real estate, each property or development project is typically held in its own SPV. This allows investors to evaluate performance on an asset-by-asset basis while isolating liabilities.

In private credit and structured finance, SPVs are used to hold loan portfolios, receivables, or asset-backed securities, ensuring clean separation between assets and issuers.

Risk Isolation and Legal Protection

Risk isolation is arguably the most important benefit of an SPV investment structure.

By housing a single investment within a standalone entity, investors limit their exposure strictly to the capital committed. If the investment fails, creditors have recourse only to the SPV’s assets, not to investors’ other holdings or the sponsor’s broader portfolio.

This principle is especially important in leveraged transactions, real estate developments, and structured credit deals, where liabilities can be significant.

Legal isolation also simplifies exit scenarios. Buyers can acquire the SPV directly rather than renegotiating individual ownership stakes, reducing friction and transaction costs.

Tax and Regulatory Considerations in SPV Structures

Tax efficiency is often a major driver in SPV structuring decisions. Depending on jurisdiction, SPVs may be designed as pass-through entities, allowing income and losses to flow directly to investors.

Regulatory considerations also play a critical role. Many SPVs rely on private placement exemptions, restricting participation to accredited or professional investors. This reduces compliance burden while maintaining investor protection.

As global regulations evolve, SPV structures must be carefully designed to balance flexibility with compliance, especially for cross-border investments.

Operational Complexity and Administration

While SPVs simplify investing at a strategic level, they introduce operational requirements that cannot be ignored.

Each SPV requires:

Legal formation and documentation

Ongoing accounting and financial reporting

Tax filings and regulatory compliance

Investor communications and distributions

Historically, this complexity limited SPVs to institutional players. Today, modern SPV platforms and fund administration tools are reducing friction, making SPV investment structures accessible at scale.

The Role of Technology in Modern SPV Investment Structures

Technology is reshaping how SPVs are created, managed, and scaled.

Digital onboarding, automated capital calls, real-time reporting dashboards, and standardized documentation are turning SPVs into repeatable financial products rather than bespoke legal projects.

This shift is particularly important as private markets expand into new areas such as real-world assets, tokenized securities, and decentralized finance, where precision and transparency are critical.

Final Perspective on SPV Investment Structure

The SPV investment structure is no longer a niche legal construct—it is a foundational tool of modern private investing. Its ability to combine risk isolation, transparency, and capital efficiency makes it ideal for today’s deal-driven investment landscape.

For investors seeking targeted exposure, and for sponsors aiming to structure capital efficiently, SPVs offer a balance of control and simplicity that traditional structures often lack.

Understanding how SPV investment structures work is essential for anyone operating in private markets, whether as an investor, founder, or fund manager.

Take the next step with Allocations

Take the next step with Allocations

Take the next step with Allocations

SPVs

Top Upcoming IPOs in 2026 : Allocations Research

Top Upcoming IPOs in 2026 : Allocations Research

Read more

SPVs

Why Digital Asset Treasury Companies (DATCOs) Will Lead 2026

Why Digital Asset Treasury Companies (DATCOs) Will Lead 2026

Read more

Company

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Read more

SPVs

How do you structure an SPV into another SPV?

How do you structure an SPV into another SPV?

Read more

SPVs

What are secondary SPVs?

What are secondary SPVs?

Read more

Fund Manager

Watch out school VC: the podcasters are coming

Watch out school VC: the podcasters are coming

Read more

Fund Manager

Fast, hassle-free SPVs mean more time for due diligence

Fast, hassle-free SPVs mean more time for due diligence

Read more

Analytics

The rise of opportunity funds and why fund managers might need to start using them

The rise of opportunity funds and why fund managers might need to start using them

Read more

Analytics

Move as fast as founders do with instant SPVs

Move as fast as founders do with instant SPVs

Read more

Fund Manager

4 practical things LPs and fund managers need to know for tax season

4 practical things LPs and fund managers need to know for tax season

Read more

Fund Manager

Keep up with these 4 VC firms focused on crypto and blockchain

Keep up with these 4 VC firms focused on crypto and blockchain

Read more

Fund Manager

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Read more

Company

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Read more

SPVs

SPV in Venture Capital: How SPVs Are Used to Invest in Startups

SPV in Venture Capital: How SPVs Are Used to Invest in Startups

Read more

SPVs

Why Allocations Is the Best Fund Admin?

Why Allocations Is the Best Fund Admin?

Read more

SPVs

SPV Syndicate Fundraising: How Syndicates Use Special Purpose Vehicles to Raise Capital Efficiently

SPV Syndicate Fundraising: How Syndicates Use Special Purpose Vehicles to Raise Capital Efficiently

Read more

SPVs

SPV Fundraising: How Special Purpose Vehicles Are Transforming Deal-Based Capital Formation

SPV Fundraising: How Special Purpose Vehicles Are Transforming Deal-Based Capital Formation

Read more

SPVs

SPV Capital Raising: How SPVs Enable Efficient Deal-Based Funding

SPV Capital Raising: How SPVs Enable Efficient Deal-Based Funding

Read more

SPVs

SPV vs Fund Structure: Choosing the Right Investment Vehicle in Private Markets

SPV vs Fund Structure: Choosing the Right Investment Vehicle in Private Markets

Read more

SPVs

SPV Investment Structure: How Special Purpose Vehicles Are Designed for Modern Investing

SPV Investment Structure: How Special Purpose Vehicles Are Designed for Modern Investing

Read more

SPVs

SPV Financing: A Complete Guide to Structure, Use Cases, and Investment Strategy

SPV Financing: A Complete Guide to Structure, Use Cases, and Investment Strategy

Read more

SPVs

Real Estate SPVs: A Modern Framework for Structured Property Investing

Real Estate SPVs: A Modern Framework for Structured Property Investing

Read more

SPVs

ADGM Private Company Limited by Shares: Allocations Research

ADGM Private Company Limited by Shares: Allocations Research

Read more

SPVs

Offshore Company vs Onshore Company: Key Differences Explained

Offshore Company vs Onshore Company: Key Differences Explained

Read more

SPVs

What Is Offshore? Meaning, Uses, and How Offshore Structures Work in 2026

What Is Offshore? Meaning, Uses, and How Offshore Structures Work in 2026

Read more

SPVs

The Best Fund Admins for Emerging VCs (2026)

The Best Fund Admins for Emerging VCs (2026)

Read more

SPVs

How to Choose the Right Jurisdiction for an Offshore Company

How to Choose the Right Jurisdiction for an Offshore Company

Read more

SPVs

How to Start an Offshore Company: Allocations Guide 2026

How to Start an Offshore Company: Allocations Guide 2026

Read more

SPVs

Types of Special Purpose Vehicles (SPVs) and How Allocations Powers Them

Types of Special Purpose Vehicles (SPVs) and How Allocations Powers Them

Read more

SPVs

SPV vs Fund: Choose better with Allocation

SPV vs Fund: Choose better with Allocation

Read more

SPVs

AngelList SPV vs Allocations SPV: Best SPV Platform for Fund Managers

AngelList SPV vs Allocations SPV: Best SPV Platform for Fund Managers

Read more

SPVs

Sydecar SPV vs Allocations SPV: What to chose in 2026

Sydecar SPV vs Allocations SPV: What to chose in 2026

Read more

SPVs

Best SPV Platform in the United States (USA) in 2026

Best SPV Platform in the United States (USA) in 2026

Read more

SPVs

Best SPV Platform in the United Arab Emirates (UAE) in 2026

Best SPV Platform in the United Arab Emirates (UAE) in 2026

Read more

SPVs

Carta Pricing vs Allocations Pricing (2026)

Carta Pricing vs Allocations Pricing (2026)

Read more

SPVs

AngelList Pricing vs Allocations Pricing (2026)

AngelList Pricing vs Allocations Pricing (2026)

Read more

SPVs

How to Invest into Real Estate with Allocations: A Beginner's Guide to SPV Funds

How to Invest into Real Estate with Allocations: A Beginner's Guide to SPV Funds

Read more

SPVs

Best Fund Admin & Reporting Tools for VC Investors in 2026: Allocations

Best Fund Admin & Reporting Tools for VC Investors in 2026: Allocations

Read more

SPVs

Convertible Notes: Early Stage Investing with Allocations

Convertible Notes: Early Stage Investing with Allocations

Read more

SPVs

Top 5 Value for Money SPV Platforms

Top 5 Value for Money SPV Platforms

Read more

SPVs

How SPV Pricing Works on Allocations

How SPV Pricing Works on Allocations

Read more

SPVs

Best Fund Admin in 2026: Why Allocations Leads

Best Fund Admin in 2026: Why Allocations Leads

Read more

SPVs

How Allocations Is Changing SPV & Fund Formation

How Allocations Is Changing SPV & Fund Formation

Read more

SPVs

What Makes Allocations the First Choice for Fund Administrators

What Makes Allocations the First Choice for Fund Administrators

Read more

SPVs

Why Choose Allocations for SPVs and Funds in 2026

Why Choose Allocations for SPVs and Funds in 2026

Read more

SPVs

Best SPV Platforms in 2026: Why Allocations

Best SPV Platforms in 2026: Why Allocations

Read more

SPVs

SPV & Fund Pricing in 2026: Allocations

SPV & Fund Pricing in 2026: Allocations

Read more

SPVs

Can I Have Non-U.S. Investors? A Practical Guide for SPVs and Fund Managers

Can I Have Non-U.S. Investors? A Practical Guide for SPVs and Fund Managers

Read more

SPVs

What Do I Need to Do Every Year as a Fund Manager?

What Do I Need to Do Every Year as a Fund Manager?

Read more

SPVs

Do I Need an ERA? A Practical Guide for Fund Managers

Do I Need an ERA? A Practical Guide for Fund Managers

Read more

SPVs

How Much Does It Cost to Create an SPV in 2026?

How Much Does It Cost to Create an SPV in 2026?

Read more

SPVs

Special Purpose Vehicle (SPV): Meaning in Finance, Banking and Real-World Examples

Special Purpose Vehicle (SPV): Meaning in Finance, Banking and Real-World Examples

Read more

SPVs

Top Fund Administration Platforms in 2026

Top Fund Administration Platforms in 2026

Read more

SPVs

Migrate Your Fund to Allocations: A Complete Guide for Fund Managers

Migrate Your Fund to Allocations: A Complete Guide for Fund Managers

Read more

SPVs

What Does “Offshore” Means?

What Does “Offshore” Means?

Read more

SPVs

Comparing 506b vs 506c for Private Fundraising

Comparing 506b vs 506c for Private Fundraising

Read more

SPVs

LLP vs LLC | Choose business structure with Allocations

LLP vs LLC | Choose business structure with Allocations

Read more

SPVs

SPV Meaning in Finance: Complete Guide to Special Purpose Vehicles (2026)

SPV Meaning in Finance: Complete Guide to Special Purpose Vehicles (2026)

Read more

SPVs

The Best AngelList Alternatives in 2026 (Detailed Comparison)

The Best AngelList Alternatives in 2026 (Detailed Comparison)

Read more

SPVs

Understanding Special Purpose Vehicles (SPVs)

Understanding Special Purpose Vehicles (SPVs)

Read more

SPVs

Special Purpose Vehicle (SPV): What It Is and Why Investors Use It

Special Purpose Vehicle (SPV): What It Is and Why Investors Use It

Read more

SPVs

Who Typically Uses SPVs?

Who Typically Uses SPVs?

Read more

SPVs

Understanding SPVs in the Context of Private Equity

Understanding SPVs in the Context of Private Equity

Read more

SPVs

Why Use an SPV for Investment?

Why Use an SPV for Investment?

Read more

SPVs

SPV for Late-Stage and Secondary Investments

SPV for Late-Stage and Secondary Investments

Read more

SPVs

SPV Investment Structures: How Money Flows from Investors to Startups

SPV Investment Structures: How Money Flows from Investors to Startups

Read more

SPVs

SPV Management 101: What Happens After the Deal Closes

SPV Management 101: What Happens After the Deal Closes

Read more

SPVs

SPV in Venture Capital vs Traditional VC Funds: What Investors Need to Know

SPV in Venture Capital vs Traditional VC Funds: What Investors Need to Know

Read more

SPVs

SPV Structures in 2026: How Special Purpose Vehicles Are Evolving in Private Markets

SPV Structures in 2026: How Special Purpose Vehicles Are Evolving in Private Markets

Read more

SPVs

Real Estate SPV: A Complete Guide to Structuring Property Investments with Allocations

Real Estate SPV: A Complete Guide to Structuring Property Investments with Allocations

Read more

SPVs

Best SPV Platform in 2026: Features, Pricing, Compliance & How to Choose

Best SPV Platform in 2026: Features, Pricing, Compliance & How to Choose

Read more

SPVs

Top SPV Platforms in 2026: A Complete Comparison

Top SPV Platforms in 2026: A Complete Comparison

Read more

SPVs

SPV Structure and Governance: Who Controls What?

SPV Structure and Governance: Who Controls What?

Read more

SPVs

SPV Structure Explained: How SPVs Work for Private Investments

SPV Structure Explained: How SPVs Work for Private Investments

Read more

SPVs

Why Special Purpose Vehicles (SPVs) Are Becoming Essential in Modern Investing

Why Special Purpose Vehicles (SPVs) Are Becoming Essential in Modern Investing

Read more

SPVs

Understanding SPV Structures

Understanding SPV Structures

Read more

SPVs

Inside DATCOs: The Rise of Digital Asset Treasury Companies | Allocations

Inside DATCOs: The Rise of Digital Asset Treasury Companies | Allocations

Read more

SPVs

DATCO Stock Performance vs Bitcoin Price: Where to Invest in 2026

DATCO Stock Performance vs Bitcoin Price: Where to Invest in 2026

Read more

SPVs

Private Markets Aren’t Broken, They’re Just Waiting for Better Tools

Private Markets Aren’t Broken, They’re Just Waiting for Better Tools

Read more

SPVs

Digital Asset Treasury Companies: The DATCO Era Begins | Allocations

Digital Asset Treasury Companies: The DATCO Era Begins | Allocations

Read more

SPVs

How Allocations Redefines SPVs, Fund Formation, and Fund Management Software for Today’s Investment Managers

How Allocations Redefines SPVs, Fund Formation, and Fund Management Software for Today’s Investment Managers

Read more

SPVs

How VCs Are Scaling Trust, Not Just Capital

How VCs Are Scaling Trust, Not Just Capital

Read more

SPVs

Digital Asset Treasury Companies (DATCOs) vs Bitcoin ETFs: What’s the Difference?

Digital Asset Treasury Companies (DATCOs) vs Bitcoin ETFs: What’s the Difference?

Read more

SPVs

The 10-Minute Fund: What Instant Fund Formation Really Means

The 10-Minute Fund: What Instant Fund Formation Really Means

Read more

SPVs

Allocation IRR: Measuring Returns in Private Market Deals

Allocation IRR: Measuring Returns in Private Market Deals

Read more

SPVs

How Much Does It Cost to Start an SPV in 2025?

How Much Does It Cost to Start an SPV in 2025?

Read more

SPVs

Allocations Pricing Explained: Transparent, Flat-Fee Fund Administration for SPVs and Funds

Allocations Pricing Explained: Transparent, Flat-Fee Fund Administration for SPVs and Funds

Read more

SPVs

Private Equity SPVs: How Allocations Automates Fund Formation for Modern Investors

Private Equity SPVs: How Allocations Automates Fund Formation for Modern Investors

Read more

SPVs

From Term Sheet to Close: How Automated Deal Execution Platforms Speed Up Venture Investing

From Term Sheet to Close: How Automated Deal Execution Platforms Speed Up Venture Investing

Read more

SPVs

Why Modern Fund Managers Need Better Infrastructure

Why Modern Fund Managers Need Better Infrastructure

Read more

SPVs

AngelList vs Sydecar vs Allocations: The 2025 SPV Platform Showdown

AngelList vs Sydecar vs Allocations: The 2025 SPV Platform Showdown

Read more

SPVs

Fund Setup Software: Building Your First Fund With Allocations

Fund Setup Software: Building Your First Fund With Allocations

Read more

SPVs

Understanding 506(b) Funds: How Private Offerings Stay Compliant

Understanding 506(b) Funds: How Private Offerings Stay Compliant

Read more

SPVs

Allocations: The Complete Guide to Modern Fund Management

Allocations: The Complete Guide to Modern Fund Management

Read more

SPVs

Emerging Managers 101: Why SPVs Are the Easiest Way to Start Raising Capital

Emerging Managers 101: Why SPVs Are the Easiest Way to Start Raising Capital

Read more

SPVs

Asset Allocation Strategies for Modern Portfolios in 2025 ft. Allocations

Asset Allocation Strategies for Modern Portfolios in 2025 ft. Allocations

Read more

SPVs

Deal Allocation Tools: How to Streamline Investor Access to Opportunities

Deal Allocation Tools: How to Streamline Investor Access to Opportunities

Read more

SPVs

SPV Fees Explained: What Sponsors and Investors Should Know

SPV Fees Explained: What Sponsors and Investors Should Know

Read more

SPVs

How to Set Up an SPV: Step-by-Step Guide for Sponsors and Investors

How to Set Up an SPV: Step-by-Step Guide for Sponsors and Investors

Read more

SPVs

Why Delaware for SPVs? Investor Trust, Legal Clarity, Faster Closes

Why Delaware for SPVs? Investor Trust, Legal Clarity, Faster Closes

Read more

SPVs

Best SPV Platform in 2025? Features, Pricing, and How to Choose

Best SPV Platform in 2025? Features, Pricing, and How to Choose

Read more

SPVs

SPV Exit Strategies: What Happens When the Deal Closes

SPV Exit Strategies: What Happens When the Deal Closes

Read more

SPVs

Side Letters in SPVs: What You Need to Know

Side Letters in SPVs: What You Need to Know

Read more

SPVs

SPV K-1 Tax Reporting: What Sponsors and Investors Need to Know (2025 Guide)

SPV K-1 Tax Reporting: What Sponsors and Investors Need to Know (2025 Guide)

Read more

SPVs

What Does an SPV Company Do? (2025 Guide)

What Does an SPV Company Do? (2025 Guide)

Read more

SPVs

Real Estate SPV vs LLC: Which Is Better for Property Investment?

Real Estate SPV vs LLC: Which Is Better for Property Investment?

Read more

SPVs

SPV Tax Reporting: A Complete Guide for Sponsors and Investors

SPV Tax Reporting: A Complete Guide for Sponsors and Investors

Read more

SPVs

The Role of Allocations in Modern Asset Management

The Role of Allocations in Modern Asset Management

Read more

SPVs

Form D & Blue Sky Law Compliance for SPVs: What Sponsors Need to Know

Form D & Blue Sky Law Compliance for SPVs: What Sponsors Need to Know

Read more

SPVs

SPV Company vs Fund: Which Is Right for Your Deal?

SPV Company vs Fund: Which Is Right for Your Deal?

Read more

SPVs

SPV Platform: The Complete 2025 Guide (ft. Allocations)

SPV Platform: The Complete 2025 Guide (ft. Allocations)

Read more

SPVs

How to Choose the Best SPV Platform: A 15-Point Buyer’s Checklist

How to Choose the Best SPV Platform: A 15-Point Buyer’s Checklist

Read more

Fund Manager

What is an SPV? The Definitive Guide to Special Purpose Vehicles

What is an SPV? The Definitive Guide to Special Purpose Vehicles

Read more

Fund Manager

5 best books to read If you’re forging a path in VC

5 best books to read If you’re forging a path in VC

Read more

Investor Spotlight

Investor spotlight: Alex Fisher

Investor spotlight: Alex Fisher

Read more

SPVs

6 unique use cases for SPVs

6 unique use cases for SPVs

Read more

Market Trends

The SPV ecosystem democratizing alternative investments

The SPV ecosystem democratizing alternative investments

Read more

Company

How to write a stellar investor update

How to write a stellar investor update

Read more

Analytics

What’s going on here? 1 in 10 US households now qualify as accredited investors

What’s going on here? 1 in 10 US households now qualify as accredited investors

Read more

Market Trends

SPVs by sector

SPVs by sector

Read more

Market Trends

5 Benefits of a hybrid SPV + fund strategy

5 Benefits of a hybrid SPV + fund strategy

Read more

Products

What is the difference between 506b and 506c funds?

What is the difference between 506b and 506c funds?

Read more

Fund Manager

Why Allocations is the best choice for fast moving fund managers

Why Allocations is the best choice for fast moving fund managers

Read more

Fund Manager

When should fund managers use a fund vs an SPV?

When should fund managers use a fund vs an SPV?

Read more

Fund Manager

10 best practices for first-time fund managers

10 best practices for first-time fund managers

Read more

Analytics

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Read more

Market Trends

Private market trends: where are fund managers looking in 2022?

Private market trends: where are fund managers looking in 2022?

Read more

Fund Manager

5 female VCs on the rise in 2022

5 female VCs on the rise in 2022

Read more

Analytics

The new competitive edge for VCs and fund managers

The new competitive edge for VCs and fund managers

Read more

Analytics

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

Read more

Investor Spotlight

Investor spotlight: Olga Yermolenko

Investor spotlight: Olga Yermolenko

Read more

Analytics

3 stats that show the democratization of VC in 2021

3 stats that show the democratization of VC in 2021

Read more

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc