As private markets mature and deal access becomes more competitive, investors and fund managers are increasingly turning to Special Purpose Vehicles (SPVs) as a flexible, efficient way to structure investments. From angel syndicates and venture capital to private credit and secondaries, SPVs have become a core building block of modern private investing.

In this article, we’ll break down why SPVs are used, how they work in practice, and why platforms like Allocations are making SPVs faster, safer, and easier to manage at scale.

What Is an SPV?

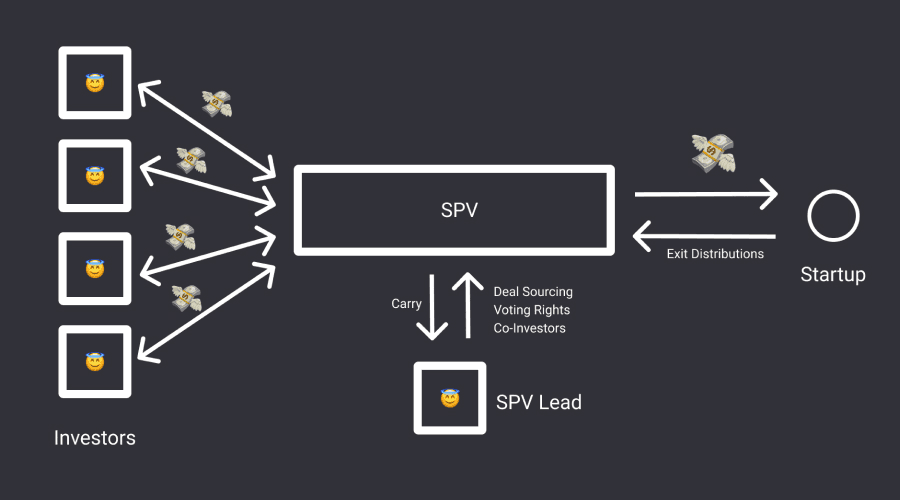

A Special Purpose Vehicle (SPV) is a standalone legal entity—typically an LLC or LP—created to hold a single investment or a narrowly defined set of assets.

Instead of multiple investors investing directly into a startup or asset, they pool their capital into the SPV. The SPV then makes the investment as one line item on the cap table.

At a high level:

Investors → invest into the SPV

SPV → invests into the company or asset

Returns → flow back to investors through the SPV

This structure may seem simple, but it unlocks several powerful advantages.

1. Cap Table Simplification for Founders

One of the most common reasons SPVs exist is to simplify cap tables.

Without an SPV, a startup raising capital from 20–100 angel investors would have:

Dozens of names on the cap table

Complex voting and consent mechanics

Higher legal overhead for future rounds

With an SPV:

The company sees one investor (the SPV)

Governance is cleaner and easier to manage

Future institutional investors are more comfortable

From a founder’s perspective, SPVs are often a non-negotiable requirement for accepting angel or syndicate capital.

2. Access to Deals Without Running a Full Fund

Traditional venture capital and private equity funds are powerful structures—but they are not always practical. Launching a fund typically requires multi-year investor commitments, extensive legal and regulatory setup, and fund-level economics that may not suit every opportunity. According to industry estimates, setting up a traditional VC fund can take 6–12 months and cost six figures in legal and compliance expenses before a single dollar is invested.

SPVs offer a significantly lighter alternative.

Rather than committing to a blind pool of capital, SPVs allow deal leads and syndicate managers to raise capital one transaction at a time. This structure is particularly valuable in competitive private markets, where high-quality opportunities often arise unpredictably and require fast execution. Instead of waiting for fund approval cycles or reserving capital across dozens of potential investments, managers can form an SPV only when a deal meets their conviction threshold.

This model has fueled the rise of angel syndicates and solo capital allocators. Over the last decade, deal-by-deal investing has grown rapidly, especially in early-stage venture, where many of today’s most active investors operate without a formal fund. SPVs allow these investors to remain flexible, opportunistic, and aligned with their networks—without taking on the operational burden of becoming a regulated fund manager.

In short, SPVs lower the barrier to entry for accessing private deals while preserving institutional-grade structure.

3. Better Alignment Between Investors and Deals

One of the fundamental drawbacks of traditional fund structures is information asymmetry at the time of commitment. Investors commit capital first and learn the specifics of portfolio construction later. While this model works well for diversified exposure, it can dilute alignment for investors who prefer precision and transparency.

SPVs reverse this dynamic.

Each SPV is created for a single, clearly defined investment—a specific company, asset, or transaction. Investors know exactly what they are backing, at what valuation, under which terms, and with what risk profile. This clarity enables informed decision-making and attracts investors who want intentional exposure rather than broad, pooled risk.

From a performance perspective, SPVs also change how success is measured. Instead of evaluating outcomes across a blended fund portfolio, returns are assessed deal by deal. This creates stronger accountability for deal leads and clearer attribution for investors. In practice, this transparency often leads to higher trust, stronger long-term relationships, and more repeat participation in future SPVs.

As private markets mature, sophisticated investors increasingly favor this level of granularity—and SPVs are the structure that enables it.

4. Risk Isolation and Liability Protection

Risk management is a core reason SPVs exist.

Because each SPV is a standalone legal entity, it creates structural isolation between investments. If an individual deal underperforms or encounters legal, regulatory, or operational issues, those risks are contained within that specific vehicle. Other SPVs—and other investments—remain unaffected.

This isolation is particularly important in asset classes where downside risk is asymmetric. Early-stage startups, private credit, international transactions, and regulated industries all carry unique exposure profiles. By separating each investment into its own entity, investors limit their liability strictly to the capital committed to that SPV.

From a legal standpoint, this separation acts as a firewall. Investors are shielded from cross-claim exposure, and managers reduce the risk that a single problematic deal could jeopardize an entire investment program. For this reason, SPVs have become standard practice in professional private investing, even among large institutions.

5. Flexible Economics and Custom Deal Terms

Another key advantage of SPVs is economic flexibility.

Unlike funds, which typically apply uniform management fees and carry across all investments, SPVs allow economics to be tailored on a deal-by-deal basis. This is essential in real-world private markets, where not all opportunities are created equal.

For example, a highly competitive secondary transaction may justify lower fees in exchange for speed and access, while a proprietary early-stage deal may include higher carry to reflect sourcing and value-add. SPVs can also accommodate side letters, strategic investor terms, or bespoke waterfalls that would be cumbersome—or impossible—to implement at the fund level.

This flexibility is especially important for lead investors who bring more than capital. Operators, domain experts, and strategic angels often contribute sourcing, diligence, or post-investment support. SPVs allow these contributions to be reflected economically, aligning incentives without overcomplicating the structure.

Modern platforms like Allocations standardize these mechanics, ensuring that custom terms remain clean, auditable, and easy to administer.

6. Efficient Tax and Reporting Structure

From a tax perspective, most SPVs are structured as pass-through entities, meaning profits and losses flow directly to investors rather than being taxed at the entity level. This avoids double taxation and aligns with how most private market investors expect returns to be treated.

However, while the tax treatment is straightforward in theory, execution has historically been complex. Managing individual K-1s, capital accounts, distributions, and ongoing reporting across dozens—or hundreds—of investors is operationally demanding.

This is where modern SPV infrastructure has changed the equation.

Instead of manual spreadsheets and fragmented service providers, today’s SPV platforms automate allocations, generate tax-ready reporting, and provide investors with centralized dashboards. As a result, SPVs are no longer reserved only for large checks. They are now viable for repeat, smaller investments, enabling broader participation without increasing administrative burden.

7. Enabling Secondary and Late-Stage Transactions

SPVs play a critical role in unlocking access to secondary and late-stage private deals.

These transactions often involve time-sensitive opportunities, multiple buyers pooling capital, and sellers who demand clean execution. Founders, early employees, and early investors increasingly seek liquidity before IPO or acquisition, driving rapid growth in the private secondary market—now estimated to exceed $100 billion annually.

SPVs are uniquely suited to this environment. They allow capital to be aggregated quickly, shares to be acquired efficiently, and ownership to be consolidated under a single entity. Without SPVs, many of these deals would be inaccessible to smaller investors or impractical to execute within tight timelines.

In effect, SPVs democratize access to late-stage private market liquidity while preserving institutional standards.

8. Operational Simplicity at Scale

Historically, SPVs were viewed as cumbersome. Formation was slow, banking was fragmented, and investor onboarding was manual. These frictions limited SPVs to niche use cases.

That reality has changed.

Today, platforms like Allocations provide end-to-end SPV infrastructure: entity formation, digital KYC/AML onboarding, integrated banking, compliance workflows, and automated distributions—all within a single system.

This operational simplicity has transformed SPVs from a workaround into core private-market infrastructure. Managers can now launch and manage multiple SPVs in parallel without scaling operational overhead, making the structure suitable not just for one-off deals, but for repeatable investment programs.

Final Thoughts

SPVs are no longer a tactical shortcut—they are a strategic investment tool.

They offer precision where funds offer scale, flexibility where funds impose uniformity, and transparency where traditional structures rely on trust over visibility. By simplifying access, aligning incentives, isolating risk, and reducing operational friction, SPVs have become the preferred structure for modern private investing.

As private markets continue to expand and specialize, SPVs—powered by platforms like Allocations, are increasingly the default way sophisticated investors participate in high-quality private opportunities.

As private markets mature and deal access becomes more competitive, investors and fund managers are increasingly turning to Special Purpose Vehicles (SPVs) as a flexible, efficient way to structure investments. From angel syndicates and venture capital to private credit and secondaries, SPVs have become a core building block of modern private investing.

In this article, we’ll break down why SPVs are used, how they work in practice, and why platforms like Allocations are making SPVs faster, safer, and easier to manage at scale.

What Is an SPV?

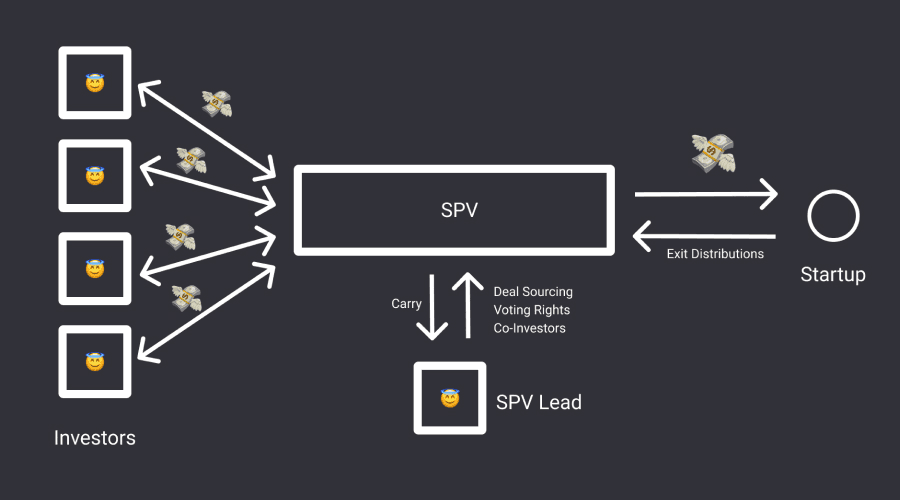

A Special Purpose Vehicle (SPV) is a standalone legal entity—typically an LLC or LP—created to hold a single investment or a narrowly defined set of assets.

Instead of multiple investors investing directly into a startup or asset, they pool their capital into the SPV. The SPV then makes the investment as one line item on the cap table.

At a high level:

Investors → invest into the SPV

SPV → invests into the company or asset

Returns → flow back to investors through the SPV

This structure may seem simple, but it unlocks several powerful advantages.

1. Cap Table Simplification for Founders

One of the most common reasons SPVs exist is to simplify cap tables.

Without an SPV, a startup raising capital from 20–100 angel investors would have:

Dozens of names on the cap table

Complex voting and consent mechanics

Higher legal overhead for future rounds

With an SPV:

The company sees one investor (the SPV)

Governance is cleaner and easier to manage

Future institutional investors are more comfortable

From a founder’s perspective, SPVs are often a non-negotiable requirement for accepting angel or syndicate capital.

2. Access to Deals Without Running a Full Fund

Traditional venture capital and private equity funds are powerful structures—but they are not always practical. Launching a fund typically requires multi-year investor commitments, extensive legal and regulatory setup, and fund-level economics that may not suit every opportunity. According to industry estimates, setting up a traditional VC fund can take 6–12 months and cost six figures in legal and compliance expenses before a single dollar is invested.

SPVs offer a significantly lighter alternative.

Rather than committing to a blind pool of capital, SPVs allow deal leads and syndicate managers to raise capital one transaction at a time. This structure is particularly valuable in competitive private markets, where high-quality opportunities often arise unpredictably and require fast execution. Instead of waiting for fund approval cycles or reserving capital across dozens of potential investments, managers can form an SPV only when a deal meets their conviction threshold.

This model has fueled the rise of angel syndicates and solo capital allocators. Over the last decade, deal-by-deal investing has grown rapidly, especially in early-stage venture, where many of today’s most active investors operate without a formal fund. SPVs allow these investors to remain flexible, opportunistic, and aligned with their networks—without taking on the operational burden of becoming a regulated fund manager.

In short, SPVs lower the barrier to entry for accessing private deals while preserving institutional-grade structure.

3. Better Alignment Between Investors and Deals

One of the fundamental drawbacks of traditional fund structures is information asymmetry at the time of commitment. Investors commit capital first and learn the specifics of portfolio construction later. While this model works well for diversified exposure, it can dilute alignment for investors who prefer precision and transparency.

SPVs reverse this dynamic.

Each SPV is created for a single, clearly defined investment—a specific company, asset, or transaction. Investors know exactly what they are backing, at what valuation, under which terms, and with what risk profile. This clarity enables informed decision-making and attracts investors who want intentional exposure rather than broad, pooled risk.

From a performance perspective, SPVs also change how success is measured. Instead of evaluating outcomes across a blended fund portfolio, returns are assessed deal by deal. This creates stronger accountability for deal leads and clearer attribution for investors. In practice, this transparency often leads to higher trust, stronger long-term relationships, and more repeat participation in future SPVs.

As private markets mature, sophisticated investors increasingly favor this level of granularity—and SPVs are the structure that enables it.

4. Risk Isolation and Liability Protection

Risk management is a core reason SPVs exist.

Because each SPV is a standalone legal entity, it creates structural isolation between investments. If an individual deal underperforms or encounters legal, regulatory, or operational issues, those risks are contained within that specific vehicle. Other SPVs—and other investments—remain unaffected.

This isolation is particularly important in asset classes where downside risk is asymmetric. Early-stage startups, private credit, international transactions, and regulated industries all carry unique exposure profiles. By separating each investment into its own entity, investors limit their liability strictly to the capital committed to that SPV.

From a legal standpoint, this separation acts as a firewall. Investors are shielded from cross-claim exposure, and managers reduce the risk that a single problematic deal could jeopardize an entire investment program. For this reason, SPVs have become standard practice in professional private investing, even among large institutions.

5. Flexible Economics and Custom Deal Terms

Another key advantage of SPVs is economic flexibility.

Unlike funds, which typically apply uniform management fees and carry across all investments, SPVs allow economics to be tailored on a deal-by-deal basis. This is essential in real-world private markets, where not all opportunities are created equal.

For example, a highly competitive secondary transaction may justify lower fees in exchange for speed and access, while a proprietary early-stage deal may include higher carry to reflect sourcing and value-add. SPVs can also accommodate side letters, strategic investor terms, or bespoke waterfalls that would be cumbersome—or impossible—to implement at the fund level.

This flexibility is especially important for lead investors who bring more than capital. Operators, domain experts, and strategic angels often contribute sourcing, diligence, or post-investment support. SPVs allow these contributions to be reflected economically, aligning incentives without overcomplicating the structure.

Modern platforms like Allocations standardize these mechanics, ensuring that custom terms remain clean, auditable, and easy to administer.

6. Efficient Tax and Reporting Structure

From a tax perspective, most SPVs are structured as pass-through entities, meaning profits and losses flow directly to investors rather than being taxed at the entity level. This avoids double taxation and aligns with how most private market investors expect returns to be treated.

However, while the tax treatment is straightforward in theory, execution has historically been complex. Managing individual K-1s, capital accounts, distributions, and ongoing reporting across dozens—or hundreds—of investors is operationally demanding.

This is where modern SPV infrastructure has changed the equation.

Instead of manual spreadsheets and fragmented service providers, today’s SPV platforms automate allocations, generate tax-ready reporting, and provide investors with centralized dashboards. As a result, SPVs are no longer reserved only for large checks. They are now viable for repeat, smaller investments, enabling broader participation without increasing administrative burden.

7. Enabling Secondary and Late-Stage Transactions

SPVs play a critical role in unlocking access to secondary and late-stage private deals.

These transactions often involve time-sensitive opportunities, multiple buyers pooling capital, and sellers who demand clean execution. Founders, early employees, and early investors increasingly seek liquidity before IPO or acquisition, driving rapid growth in the private secondary market—now estimated to exceed $100 billion annually.

SPVs are uniquely suited to this environment. They allow capital to be aggregated quickly, shares to be acquired efficiently, and ownership to be consolidated under a single entity. Without SPVs, many of these deals would be inaccessible to smaller investors or impractical to execute within tight timelines.

In effect, SPVs democratize access to late-stage private market liquidity while preserving institutional standards.

8. Operational Simplicity at Scale

Historically, SPVs were viewed as cumbersome. Formation was slow, banking was fragmented, and investor onboarding was manual. These frictions limited SPVs to niche use cases.

That reality has changed.

Today, platforms like Allocations provide end-to-end SPV infrastructure: entity formation, digital KYC/AML onboarding, integrated banking, compliance workflows, and automated distributions—all within a single system.

This operational simplicity has transformed SPVs from a workaround into core private-market infrastructure. Managers can now launch and manage multiple SPVs in parallel without scaling operational overhead, making the structure suitable not just for one-off deals, but for repeatable investment programs.

Final Thoughts

SPVs are no longer a tactical shortcut—they are a strategic investment tool.

They offer precision where funds offer scale, flexibility where funds impose uniformity, and transparency where traditional structures rely on trust over visibility. By simplifying access, aligning incentives, isolating risk, and reducing operational friction, SPVs have become the preferred structure for modern private investing.

As private markets continue to expand and specialize, SPVs—powered by platforms like Allocations, are increasingly the default way sophisticated investors participate in high-quality private opportunities.

As private markets mature and deal access becomes more competitive, investors and fund managers are increasingly turning to Special Purpose Vehicles (SPVs) as a flexible, efficient way to structure investments. From angel syndicates and venture capital to private credit and secondaries, SPVs have become a core building block of modern private investing.

In this article, we’ll break down why SPVs are used, how they work in practice, and why platforms like Allocations are making SPVs faster, safer, and easier to manage at scale.

What Is an SPV?

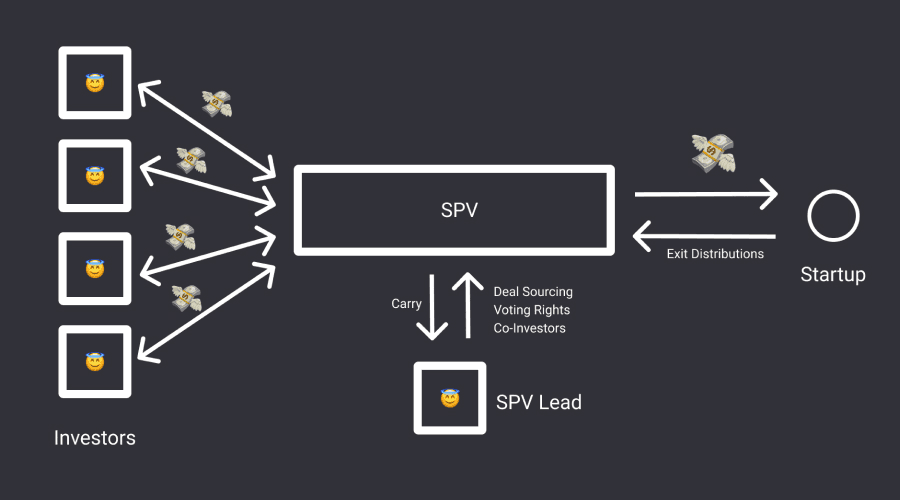

A Special Purpose Vehicle (SPV) is a standalone legal entity—typically an LLC or LP—created to hold a single investment or a narrowly defined set of assets.

Instead of multiple investors investing directly into a startup or asset, they pool their capital into the SPV. The SPV then makes the investment as one line item on the cap table.

At a high level:

Investors → invest into the SPV

SPV → invests into the company or asset

Returns → flow back to investors through the SPV

This structure may seem simple, but it unlocks several powerful advantages.

1. Cap Table Simplification for Founders

One of the most common reasons SPVs exist is to simplify cap tables.

Without an SPV, a startup raising capital from 20–100 angel investors would have:

Dozens of names on the cap table

Complex voting and consent mechanics

Higher legal overhead for future rounds

With an SPV:

The company sees one investor (the SPV)

Governance is cleaner and easier to manage

Future institutional investors are more comfortable

From a founder’s perspective, SPVs are often a non-negotiable requirement for accepting angel or syndicate capital.

2. Access to Deals Without Running a Full Fund

Traditional venture capital and private equity funds are powerful structures—but they are not always practical. Launching a fund typically requires multi-year investor commitments, extensive legal and regulatory setup, and fund-level economics that may not suit every opportunity. According to industry estimates, setting up a traditional VC fund can take 6–12 months and cost six figures in legal and compliance expenses before a single dollar is invested.

SPVs offer a significantly lighter alternative.

Rather than committing to a blind pool of capital, SPVs allow deal leads and syndicate managers to raise capital one transaction at a time. This structure is particularly valuable in competitive private markets, where high-quality opportunities often arise unpredictably and require fast execution. Instead of waiting for fund approval cycles or reserving capital across dozens of potential investments, managers can form an SPV only when a deal meets their conviction threshold.

This model has fueled the rise of angel syndicates and solo capital allocators. Over the last decade, deal-by-deal investing has grown rapidly, especially in early-stage venture, where many of today’s most active investors operate without a formal fund. SPVs allow these investors to remain flexible, opportunistic, and aligned with their networks—without taking on the operational burden of becoming a regulated fund manager.

In short, SPVs lower the barrier to entry for accessing private deals while preserving institutional-grade structure.

3. Better Alignment Between Investors and Deals

One of the fundamental drawbacks of traditional fund structures is information asymmetry at the time of commitment. Investors commit capital first and learn the specifics of portfolio construction later. While this model works well for diversified exposure, it can dilute alignment for investors who prefer precision and transparency.

SPVs reverse this dynamic.

Each SPV is created for a single, clearly defined investment—a specific company, asset, or transaction. Investors know exactly what they are backing, at what valuation, under which terms, and with what risk profile. This clarity enables informed decision-making and attracts investors who want intentional exposure rather than broad, pooled risk.

From a performance perspective, SPVs also change how success is measured. Instead of evaluating outcomes across a blended fund portfolio, returns are assessed deal by deal. This creates stronger accountability for deal leads and clearer attribution for investors. In practice, this transparency often leads to higher trust, stronger long-term relationships, and more repeat participation in future SPVs.

As private markets mature, sophisticated investors increasingly favor this level of granularity—and SPVs are the structure that enables it.

4. Risk Isolation and Liability Protection

Risk management is a core reason SPVs exist.

Because each SPV is a standalone legal entity, it creates structural isolation between investments. If an individual deal underperforms or encounters legal, regulatory, or operational issues, those risks are contained within that specific vehicle. Other SPVs—and other investments—remain unaffected.

This isolation is particularly important in asset classes where downside risk is asymmetric. Early-stage startups, private credit, international transactions, and regulated industries all carry unique exposure profiles. By separating each investment into its own entity, investors limit their liability strictly to the capital committed to that SPV.

From a legal standpoint, this separation acts as a firewall. Investors are shielded from cross-claim exposure, and managers reduce the risk that a single problematic deal could jeopardize an entire investment program. For this reason, SPVs have become standard practice in professional private investing, even among large institutions.

5. Flexible Economics and Custom Deal Terms

Another key advantage of SPVs is economic flexibility.

Unlike funds, which typically apply uniform management fees and carry across all investments, SPVs allow economics to be tailored on a deal-by-deal basis. This is essential in real-world private markets, where not all opportunities are created equal.

For example, a highly competitive secondary transaction may justify lower fees in exchange for speed and access, while a proprietary early-stage deal may include higher carry to reflect sourcing and value-add. SPVs can also accommodate side letters, strategic investor terms, or bespoke waterfalls that would be cumbersome—or impossible—to implement at the fund level.

This flexibility is especially important for lead investors who bring more than capital. Operators, domain experts, and strategic angels often contribute sourcing, diligence, or post-investment support. SPVs allow these contributions to be reflected economically, aligning incentives without overcomplicating the structure.

Modern platforms like Allocations standardize these mechanics, ensuring that custom terms remain clean, auditable, and easy to administer.

6. Efficient Tax and Reporting Structure

From a tax perspective, most SPVs are structured as pass-through entities, meaning profits and losses flow directly to investors rather than being taxed at the entity level. This avoids double taxation and aligns with how most private market investors expect returns to be treated.

However, while the tax treatment is straightforward in theory, execution has historically been complex. Managing individual K-1s, capital accounts, distributions, and ongoing reporting across dozens—or hundreds—of investors is operationally demanding.

This is where modern SPV infrastructure has changed the equation.

Instead of manual spreadsheets and fragmented service providers, today’s SPV platforms automate allocations, generate tax-ready reporting, and provide investors with centralized dashboards. As a result, SPVs are no longer reserved only for large checks. They are now viable for repeat, smaller investments, enabling broader participation without increasing administrative burden.

7. Enabling Secondary and Late-Stage Transactions

SPVs play a critical role in unlocking access to secondary and late-stage private deals.

These transactions often involve time-sensitive opportunities, multiple buyers pooling capital, and sellers who demand clean execution. Founders, early employees, and early investors increasingly seek liquidity before IPO or acquisition, driving rapid growth in the private secondary market—now estimated to exceed $100 billion annually.

SPVs are uniquely suited to this environment. They allow capital to be aggregated quickly, shares to be acquired efficiently, and ownership to be consolidated under a single entity. Without SPVs, many of these deals would be inaccessible to smaller investors or impractical to execute within tight timelines.

In effect, SPVs democratize access to late-stage private market liquidity while preserving institutional standards.

8. Operational Simplicity at Scale

Historically, SPVs were viewed as cumbersome. Formation was slow, banking was fragmented, and investor onboarding was manual. These frictions limited SPVs to niche use cases.

That reality has changed.

Today, platforms like Allocations provide end-to-end SPV infrastructure: entity formation, digital KYC/AML onboarding, integrated banking, compliance workflows, and automated distributions—all within a single system.

This operational simplicity has transformed SPVs from a workaround into core private-market infrastructure. Managers can now launch and manage multiple SPVs in parallel without scaling operational overhead, making the structure suitable not just for one-off deals, but for repeatable investment programs.

Final Thoughts

SPVs are no longer a tactical shortcut—they are a strategic investment tool.

They offer precision where funds offer scale, flexibility where funds impose uniformity, and transparency where traditional structures rely on trust over visibility. By simplifying access, aligning incentives, isolating risk, and reducing operational friction, SPVs have become the preferred structure for modern private investing.

As private markets continue to expand and specialize, SPVs—powered by platforms like Allocations, are increasingly the default way sophisticated investors participate in high-quality private opportunities.

Take the next step with Allocations

Take the next step with Allocations

Take the next step with Allocations

SPVs

Top Upcoming IPOs in 2026 : Allocations Research

Top Upcoming IPOs in 2026 : Allocations Research

Read more

SPVs

Why Digital Asset Treasury Companies (DATCOs) Will Lead 2026

Why Digital Asset Treasury Companies (DATCOs) Will Lead 2026

Read more

Company

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Read more

SPVs

How do you structure an SPV into another SPV?

How do you structure an SPV into another SPV?

Read more

SPVs

What are secondary SPVs?

What are secondary SPVs?

Read more

Fund Manager

Watch out school VC: the podcasters are coming

Watch out school VC: the podcasters are coming

Read more

Fund Manager

Fast, hassle-free SPVs mean more time for due diligence

Fast, hassle-free SPVs mean more time for due diligence

Read more

Analytics

The rise of opportunity funds and why fund managers might need to start using them

The rise of opportunity funds and why fund managers might need to start using them

Read more

Analytics

Move as fast as founders do with instant SPVs

Move as fast as founders do with instant SPVs

Read more

Fund Manager

4 practical things LPs and fund managers need to know for tax season

4 practical things LPs and fund managers need to know for tax season

Read more

Fund Manager

Keep up with these 4 VC firms focused on crypto and blockchain

Keep up with these 4 VC firms focused on crypto and blockchain

Read more

Fund Manager

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Read more

Company

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Read more

SPVs

SPV in Venture Capital: How SPVs Are Used to Invest in Startups

SPV in Venture Capital: How SPVs Are Used to Invest in Startups

Read more

SPVs

Best Fund Admin in 2026: Why Allocations Leads the Market

Best Fund Admin in 2026: Why Allocations Leads the Market

Read more

SPVs

How to migrate fund from Sydecar to Allocations?

How to migrate fund from Sydecar to Allocations?

Read more

SPVs

Book a Demo with Allocations: Understand SPV & Fund Pricing Before You Launch

Book a Demo with Allocations: Understand SPV & Fund Pricing Before You Launch

Read more

SPVs

What Is Meant by SPV? A Complete Guide to Special Purpose Vehicles in Business and Finance

What Is Meant by SPV? A Complete Guide to Special Purpose Vehicles in Business and Finance

Read more

SPVs

What Is a SPV in Business? A Complete Guide for Founders, Investors, and Fund Managers

What Is a SPV in Business? A Complete Guide for Founders, Investors, and Fund Managers

Read more

SPVs

What Is an Example of a SPV Company? A Deep Dive into Real-World SPVs

What Is an Example of a SPV Company? A Deep Dive into Real-World SPVs

Read more

SPVs

How Does SPVs Work? A Complete Guide to Understanding SPVs

How Does SPVs Work? A Complete Guide to Understanding SPVs

Read more

SPVs

Is SPV Legal in India? A Complete Guide to Special Purpose Vehicles Under Indian Law

Is SPV Legal in India? A Complete Guide to Special Purpose Vehicles Under Indian Law

Read more

SPVs

What Are the Benefits of SPV? A Complete Guide to the Advantages of SPVs

What Are the Benefits of SPV? A Complete Guide to the Advantages of SPVs

Read more

SPVs

Fastest SPV Platform: Allocations vs Other Platforms

Fastest SPV Platform: Allocations vs Other Platforms

Read more

SPVs

Types of SPV: Allocations Research 2026

Types of SPV: Allocations Research 2026

Read more

SPVs

Setup your next entity in GIFT City with Allocations

Setup your next entity in GIFT City with Allocations

Read more

SPVs

What Is an SPV in Business? Real-World Examples and the Role of SPVs in Private Equity

What Is an SPV in Business? Real-World Examples and the Role of SPVs in Private Equity

Read more

SPVs

Why Allocations Is the Best Fund Admin?

Why Allocations Is the Best Fund Admin?

Read more

SPVs

SPV Syndicate Fundraising: How Syndicates Use Special Purpose Vehicles to Raise Capital Efficiently

SPV Syndicate Fundraising: How Syndicates Use Special Purpose Vehicles to Raise Capital Efficiently

Read more

SPVs

SPV Fundraising: How Special Purpose Vehicles Are Transforming Deal-Based Capital Formation

SPV Fundraising: How Special Purpose Vehicles Are Transforming Deal-Based Capital Formation

Read more

SPVs

SPV Capital Raising: How SPVs Enable Efficient Deal-Based Funding

SPV Capital Raising: How SPVs Enable Efficient Deal-Based Funding

Read more

SPVs

SPV vs Fund Structure: Choosing the Right Investment Vehicle in Private Markets

SPV vs Fund Structure: Choosing the Right Investment Vehicle in Private Markets

Read more

SPVs

SPV Investment Structure: How Special Purpose Vehicles Are Designed for Modern Investing

SPV Investment Structure: How Special Purpose Vehicles Are Designed for Modern Investing

Read more

SPVs

SPV Financing: A Complete Guide to Structure, Use Cases, and Investment Strategy

SPV Financing: A Complete Guide to Structure, Use Cases, and Investment Strategy

Read more

SPVs

Real Estate SPVs: A Modern Framework for Structured Property Investing

Real Estate SPVs: A Modern Framework for Structured Property Investing

Read more

SPVs

ADGM Private Company Limited by Shares: Allocations Research

ADGM Private Company Limited by Shares: Allocations Research

Read more

SPVs

Offshore Company vs Onshore Company: Key Differences Explained

Offshore Company vs Onshore Company: Key Differences Explained

Read more

SPVs

What Is Offshore? Meaning, Uses, and How Offshore Structures Work in 2026

What Is Offshore? Meaning, Uses, and How Offshore Structures Work in 2026

Read more

SPVs

The Best Fund Admins for Emerging VCs (2026)

The Best Fund Admins for Emerging VCs (2026)

Read more

SPVs

How to Choose the Right Jurisdiction for an Offshore Company

How to Choose the Right Jurisdiction for an Offshore Company

Read more

SPVs

How to Start an Offshore Company: Allocations Guide 2026

How to Start an Offshore Company: Allocations Guide 2026

Read more

SPVs

Types of Special Purpose Vehicles (SPVs) and How Allocations Powers Them

Types of Special Purpose Vehicles (SPVs) and How Allocations Powers Them

Read more

SPVs

SPV vs Fund: Choose better with Allocation

SPV vs Fund: Choose better with Allocation

Read more

SPVs

AngelList SPV vs Allocations SPV: Best SPV Platform for Fund Managers

AngelList SPV vs Allocations SPV: Best SPV Platform for Fund Managers

Read more

SPVs

Sydecar SPV vs Allocations SPV: What to chose in 2026

Sydecar SPV vs Allocations SPV: What to chose in 2026

Read more

SPVs

Best SPV Platform in the United States (USA) in 2026

Best SPV Platform in the United States (USA) in 2026

Read more

SPVs

Best SPV Platform in the United Arab Emirates (UAE) in 2026

Best SPV Platform in the United Arab Emirates (UAE) in 2026

Read more

SPVs

Carta Pricing vs Allocations Pricing (2026)

Carta Pricing vs Allocations Pricing (2026)

Read more

SPVs

AngelList Pricing vs Allocations Pricing (2026)

AngelList Pricing vs Allocations Pricing (2026)

Read more

SPVs

How to Invest into Real Estate with Allocations: A Beginner's Guide to SPV Funds

How to Invest into Real Estate with Allocations: A Beginner's Guide to SPV Funds

Read more

SPVs

Best Fund Admin & Reporting Tools for VC Investors in 2026: Allocations

Best Fund Admin & Reporting Tools for VC Investors in 2026: Allocations

Read more

SPVs

Convertible Notes: Early Stage Investing with Allocations

Convertible Notes: Early Stage Investing with Allocations

Read more

SPVs

Top 5 Value for Money SPV Platforms

Top 5 Value for Money SPV Platforms

Read more

SPVs

How SPV Pricing Works on Allocations

How SPV Pricing Works on Allocations

Read more

SPVs

Best Fund Admin in 2026: Why Allocations Leads

Best Fund Admin in 2026: Why Allocations Leads

Read more

SPVs

How Allocations Is Changing SPV & Fund Formation

How Allocations Is Changing SPV & Fund Formation

Read more

SPVs

What Makes Allocations the First Choice for Fund Administrators

What Makes Allocations the First Choice for Fund Administrators

Read more

SPVs

Why Choose Allocations for SPVs and Funds in 2026

Why Choose Allocations for SPVs and Funds in 2026

Read more

SPVs

Best SPV Platforms in 2026: Why Allocations

Best SPV Platforms in 2026: Why Allocations

Read more

SPVs

SPV & Fund Pricing in 2026: Allocations

SPV & Fund Pricing in 2026: Allocations

Read more

SPVs

Can I Have Non-U.S. Investors? A Practical Guide for SPVs and Fund Managers

Can I Have Non-U.S. Investors? A Practical Guide for SPVs and Fund Managers

Read more

SPVs

What Do I Need to Do Every Year as a Fund Manager?

What Do I Need to Do Every Year as a Fund Manager?

Read more

SPVs

Do I Need an ERA? A Practical Guide for Fund Managers

Do I Need an ERA? A Practical Guide for Fund Managers

Read more

SPVs

How Much Does It Cost to Create an SPV in 2026?

How Much Does It Cost to Create an SPV in 2026?

Read more

SPVs

Special Purpose Vehicle (SPV): Meaning in Finance, Banking and Real-World Examples

Special Purpose Vehicle (SPV): Meaning in Finance, Banking and Real-World Examples

Read more

SPVs

Top Fund Administration Platforms in 2026

Top Fund Administration Platforms in 2026

Read more

SPVs

Migrate Your Fund to Allocations: A Complete Guide for Fund Managers

Migrate Your Fund to Allocations: A Complete Guide for Fund Managers

Read more

SPVs

What Does “Offshore” Means?

What Does “Offshore” Means?

Read more

SPVs

Comparing 506b vs 506c for Private Fundraising

Comparing 506b vs 506c for Private Fundraising

Read more

SPVs

LLP vs LLC | Choose business structure with Allocations

LLP vs LLC | Choose business structure with Allocations

Read more

SPVs

SPV Meaning in Finance: Complete Guide to Special Purpose Vehicles (2026)

SPV Meaning in Finance: Complete Guide to Special Purpose Vehicles (2026)

Read more

SPVs

The Best AngelList Alternatives in 2026 (Detailed Comparison)

The Best AngelList Alternatives in 2026 (Detailed Comparison)

Read more

SPVs

Understanding Special Purpose Vehicles (SPVs)

Understanding Special Purpose Vehicles (SPVs)

Read more

SPVs

Special Purpose Vehicle (SPV): What It Is and Why Investors Use It

Special Purpose Vehicle (SPV): What It Is and Why Investors Use It

Read more

SPVs

Who Typically Uses SPVs?

Who Typically Uses SPVs?

Read more

SPVs

Understanding SPVs in the Context of Private Equity

Understanding SPVs in the Context of Private Equity

Read more

SPVs

Why Use an SPV for Investment?

Why Use an SPV for Investment?

Read more

SPVs

SPV for Late-Stage and Secondary Investments

SPV for Late-Stage and Secondary Investments

Read more

SPVs

SPV Investment Structures: How Money Flows from Investors to Startups

SPV Investment Structures: How Money Flows from Investors to Startups

Read more

SPVs

SPV Management 101: What Happens After the Deal Closes

SPV Management 101: What Happens After the Deal Closes

Read more

SPVs

SPV in Venture Capital vs Traditional VC Funds: What Investors Need to Know

SPV in Venture Capital vs Traditional VC Funds: What Investors Need to Know

Read more

SPVs

SPV Structures in 2026: How Special Purpose Vehicles Are Evolving in Private Markets

SPV Structures in 2026: How Special Purpose Vehicles Are Evolving in Private Markets

Read more

SPVs

Real Estate SPV: A Complete Guide to Structuring Property Investments with Allocations

Real Estate SPV: A Complete Guide to Structuring Property Investments with Allocations

Read more

SPVs

Best SPV Platform in 2026: Features, Pricing, Compliance & How to Choose

Best SPV Platform in 2026: Features, Pricing, Compliance & How to Choose

Read more

SPVs

Top SPV Platforms in 2026: A Complete Comparison

Top SPV Platforms in 2026: A Complete Comparison

Read more

SPVs

SPV Structure and Governance: Who Controls What?

SPV Structure and Governance: Who Controls What?

Read more

SPVs

SPV Structure Explained: How SPVs Work for Private Investments

SPV Structure Explained: How SPVs Work for Private Investments

Read more

SPVs

Why Special Purpose Vehicles (SPVs) Are Becoming Essential in Modern Investing

Why Special Purpose Vehicles (SPVs) Are Becoming Essential in Modern Investing

Read more

SPVs

Understanding SPV Structures

Understanding SPV Structures

Read more

SPVs

Inside DATCOs: The Rise of Digital Asset Treasury Companies | Allocations

Inside DATCOs: The Rise of Digital Asset Treasury Companies | Allocations

Read more

SPVs

DATCO Stock Performance vs Bitcoin Price: Where to Invest in 2026

DATCO Stock Performance vs Bitcoin Price: Where to Invest in 2026

Read more

SPVs

Private Markets Aren’t Broken, They’re Just Waiting for Better Tools

Private Markets Aren’t Broken, They’re Just Waiting for Better Tools

Read more

SPVs

Digital Asset Treasury Companies: The DATCO Era Begins | Allocations

Digital Asset Treasury Companies: The DATCO Era Begins | Allocations

Read more

SPVs

How Allocations Redefines SPVs, Fund Formation, and Fund Management Software for Today’s Investment Managers

How Allocations Redefines SPVs, Fund Formation, and Fund Management Software for Today’s Investment Managers

Read more

SPVs

How VCs Are Scaling Trust, Not Just Capital

How VCs Are Scaling Trust, Not Just Capital

Read more

SPVs

Digital Asset Treasury Companies (DATCOs) vs Bitcoin ETFs: What’s the Difference?

Digital Asset Treasury Companies (DATCOs) vs Bitcoin ETFs: What’s the Difference?

Read more

SPVs

The 10-Minute Fund: What Instant Fund Formation Really Means

The 10-Minute Fund: What Instant Fund Formation Really Means

Read more

SPVs

Allocation IRR: Measuring Returns in Private Market Deals

Allocation IRR: Measuring Returns in Private Market Deals

Read more

SPVs

How Much Does It Cost to Start an SPV in 2025?

How Much Does It Cost to Start an SPV in 2025?

Read more

SPVs

Allocations Pricing Explained: Transparent, Flat-Fee Fund Administration for SPVs and Funds

Allocations Pricing Explained: Transparent, Flat-Fee Fund Administration for SPVs and Funds

Read more

SPVs

Private Equity SPVs: How Allocations Automates Fund Formation for Modern Investors

Private Equity SPVs: How Allocations Automates Fund Formation for Modern Investors

Read more

SPVs

From Term Sheet to Close: How Automated Deal Execution Platforms Speed Up Venture Investing

From Term Sheet to Close: How Automated Deal Execution Platforms Speed Up Venture Investing

Read more

SPVs

Why Modern Fund Managers Need Better Infrastructure

Why Modern Fund Managers Need Better Infrastructure

Read more

SPVs

AngelList vs Sydecar vs Allocations: The 2025 SPV Platform Showdown

AngelList vs Sydecar vs Allocations: The 2025 SPV Platform Showdown

Read more

SPVs

Fund Setup Software: Building Your First Fund With Allocations

Fund Setup Software: Building Your First Fund With Allocations

Read more

SPVs

Understanding 506(b) Funds: How Private Offerings Stay Compliant

Understanding 506(b) Funds: How Private Offerings Stay Compliant

Read more

SPVs

Allocations: The Complete Guide to Modern Fund Management

Allocations: The Complete Guide to Modern Fund Management

Read more

SPVs

Emerging Managers 101: Why SPVs Are the Easiest Way to Start Raising Capital

Emerging Managers 101: Why SPVs Are the Easiest Way to Start Raising Capital

Read more

SPVs

Asset Allocation Strategies for Modern Portfolios in 2025 ft. Allocations

Asset Allocation Strategies for Modern Portfolios in 2025 ft. Allocations

Read more

SPVs

Deal Allocation Tools: How to Streamline Investor Access to Opportunities

Deal Allocation Tools: How to Streamline Investor Access to Opportunities

Read more

SPVs

SPV Fees Explained: What Sponsors and Investors Should Know

SPV Fees Explained: What Sponsors and Investors Should Know

Read more

SPVs

How to Set Up an SPV: Step-by-Step Guide for Sponsors and Investors

How to Set Up an SPV: Step-by-Step Guide for Sponsors and Investors

Read more

SPVs

Why Delaware for SPVs? Investor Trust, Legal Clarity, Faster Closes

Why Delaware for SPVs? Investor Trust, Legal Clarity, Faster Closes

Read more

SPVs

Best SPV Platform in 2025? Features, Pricing, and How to Choose

Best SPV Platform in 2025? Features, Pricing, and How to Choose

Read more

SPVs

SPV Exit Strategies: What Happens When the Deal Closes

SPV Exit Strategies: What Happens When the Deal Closes

Read more

SPVs

Side Letters in SPVs: What You Need to Know

Side Letters in SPVs: What You Need to Know

Read more

SPVs

SPV K-1 Tax Reporting: What Sponsors and Investors Need to Know (2025 Guide)

SPV K-1 Tax Reporting: What Sponsors and Investors Need to Know (2025 Guide)

Read more

SPVs

What Does an SPV Company Do? (2025 Guide)

What Does an SPV Company Do? (2025 Guide)

Read more

SPVs

Real Estate SPV vs LLC: Which Is Better for Property Investment?

Real Estate SPV vs LLC: Which Is Better for Property Investment?

Read more

SPVs

SPV Tax Reporting: A Complete Guide for Sponsors and Investors

SPV Tax Reporting: A Complete Guide for Sponsors and Investors

Read more

SPVs

The Role of Allocations in Modern Asset Management

The Role of Allocations in Modern Asset Management

Read more

SPVs

Form D & Blue Sky Law Compliance for SPVs: What Sponsors Need to Know

Form D & Blue Sky Law Compliance for SPVs: What Sponsors Need to Know

Read more

SPVs

SPV Company vs Fund: Which Is Right for Your Deal?

SPV Company vs Fund: Which Is Right for Your Deal?

Read more

SPVs

SPV Platform: The Complete 2025 Guide (ft. Allocations)

SPV Platform: The Complete 2025 Guide (ft. Allocations)

Read more

SPVs

How to Choose the Best SPV Platform: A 15-Point Buyer’s Checklist

How to Choose the Best SPV Platform: A 15-Point Buyer’s Checklist

Read more

Fund Manager

What is an SPV? The Definitive Guide to Special Purpose Vehicles

What is an SPV? The Definitive Guide to Special Purpose Vehicles

Read more

Fund Manager

5 best books to read If you’re forging a path in VC

5 best books to read If you’re forging a path in VC

Read more

Investor Spotlight

Investor spotlight: Alex Fisher

Investor spotlight: Alex Fisher

Read more

SPVs

6 unique use cases for SPVs

6 unique use cases for SPVs

Read more

Market Trends

The SPV ecosystem democratizing alternative investments

The SPV ecosystem democratizing alternative investments

Read more

Company

How to write a stellar investor update

How to write a stellar investor update

Read more

Analytics

What’s going on here? 1 in 10 US households now qualify as accredited investors

What’s going on here? 1 in 10 US households now qualify as accredited investors

Read more

Market Trends

SPVs by sector

SPVs by sector

Read more

Market Trends

5 Benefits of a hybrid SPV + fund strategy

5 Benefits of a hybrid SPV + fund strategy

Read more

Products

What is the difference between 506b and 506c funds?

What is the difference between 506b and 506c funds?

Read more

Fund Manager

Why Allocations is the best choice for fast moving fund managers

Why Allocations is the best choice for fast moving fund managers

Read more

Fund Manager

When should fund managers use a fund vs an SPV?

When should fund managers use a fund vs an SPV?

Read more

Fund Manager

10 best practices for first-time fund managers

10 best practices for first-time fund managers

Read more

Analytics

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Read more

Market Trends

Private market trends: where are fund managers looking in 2022?

Private market trends: where are fund managers looking in 2022?

Read more

Fund Manager

5 female VCs on the rise in 2022

5 female VCs on the rise in 2022

Read more

Analytics

The new competitive edge for VCs and fund managers

The new competitive edge for VCs and fund managers

Read more

Analytics

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

Read more

Investor Spotlight

Investor spotlight: Olga Yermolenko

Investor spotlight: Olga Yermolenko

Read more

Analytics

3 stats that show the democratization of VC in 2021

3 stats that show the democratization of VC in 2021

Read more

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc