Back

SPVs

SPV vs Fund: Choose better with Allocation

SPV vs Fund: Choose better with Allocation

SPV vs Fund: Choose better with Allocation

As private markets mature, the decision between launching a Special Purpose Vehicle (SPV) or forming a fund has become a strategic choice rather than a procedural one. In 2026, this decision impacts not just legal structure, but speed of execution, operational complexity, investor experience, regulatory exposure, and long-term scalability.

For fund managers, syndicate leads, family offices, and emerging GPs, choosing the wrong structure can slow capital deployment, inflate costs, and create friction with investors. Choosing the right one can unlock efficiency, flexibility, and institutional credibility from day one.

This article takes a deep, practical look at SPVs vs funds, explaining how they differ in real-world operation—and how modern infrastructure platforms like Allocations are changing how managers use both.

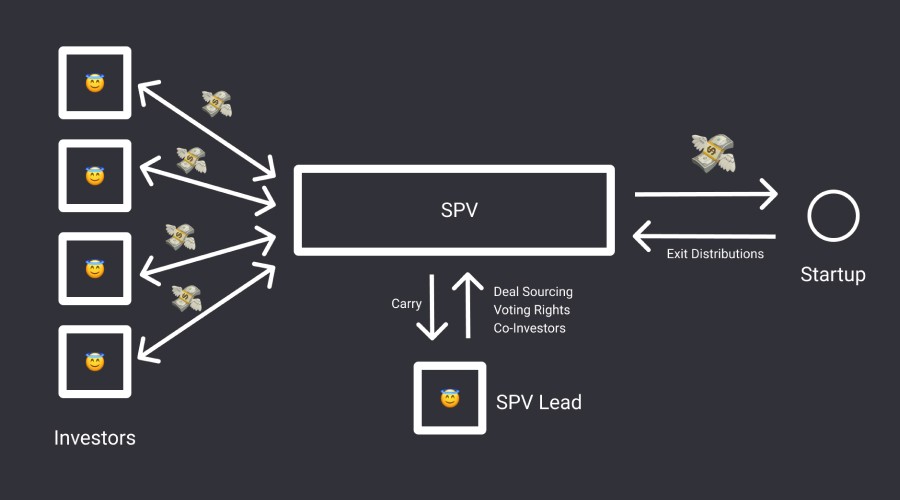

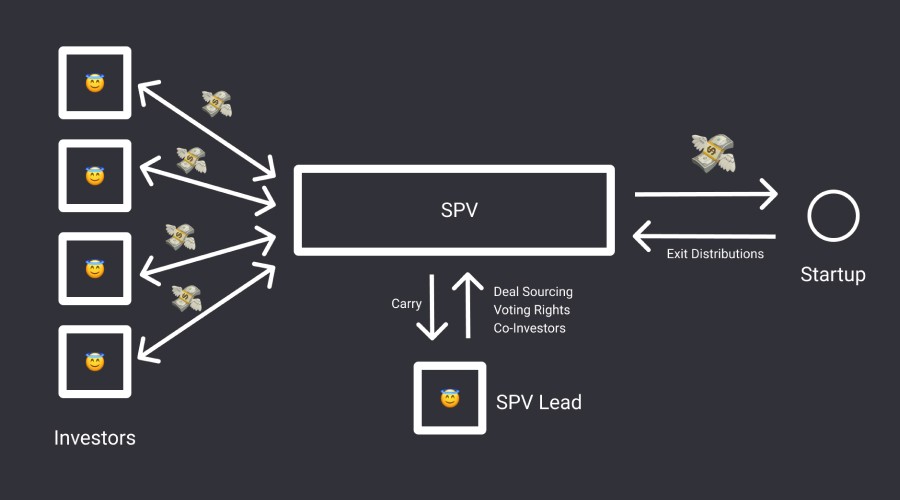

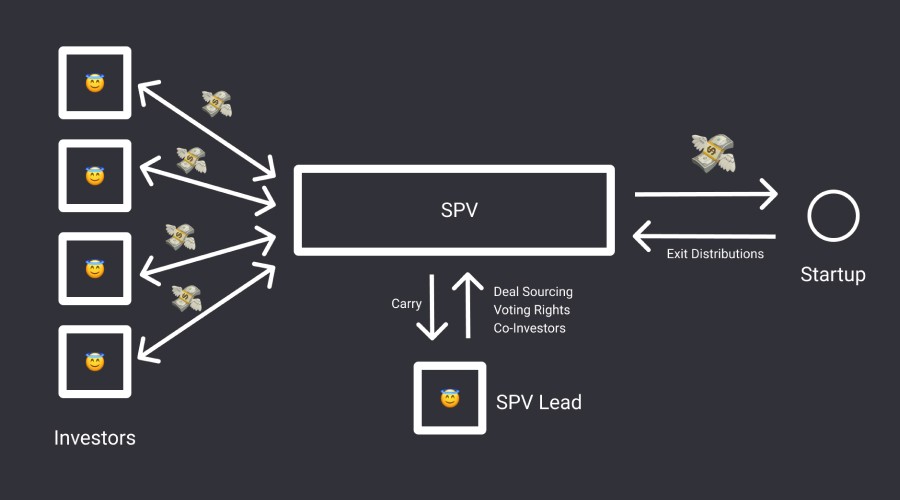

Understanding the Core Purpose of an SPV

An SPV is a single-purpose legal entity created to hold one investment or execute one transaction. It exists to pool capital efficiently, isolate risk, and simplify ownership for a specific deal.

In practice, SPVs are used when precision and speed matter more than long-term continuity. Each SPV is formed, funded, deployed, and eventually wound down independently.

Because of this design, SPVs are particularly effective for:

Deal-by-deal angel syndicates

Co-investments alongside lead funds

Secondary transactions

Opportunistic or time-sensitive allocations

Experimental or thesis-testing investments

From an investor’s perspective, SPVs offer maximum clarity: capital goes into a known asset, under known terms, with no cross-contamination from other deals.

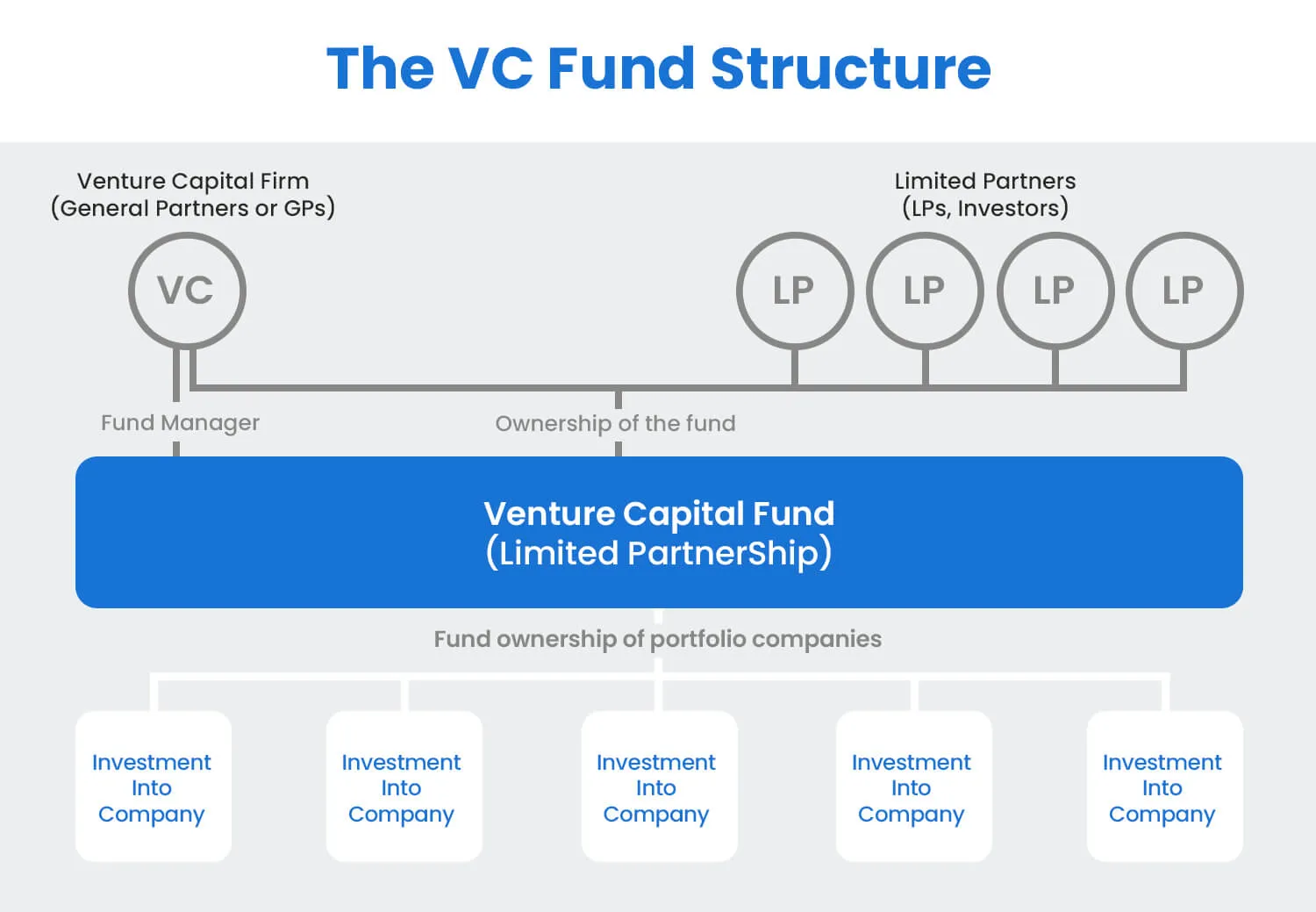

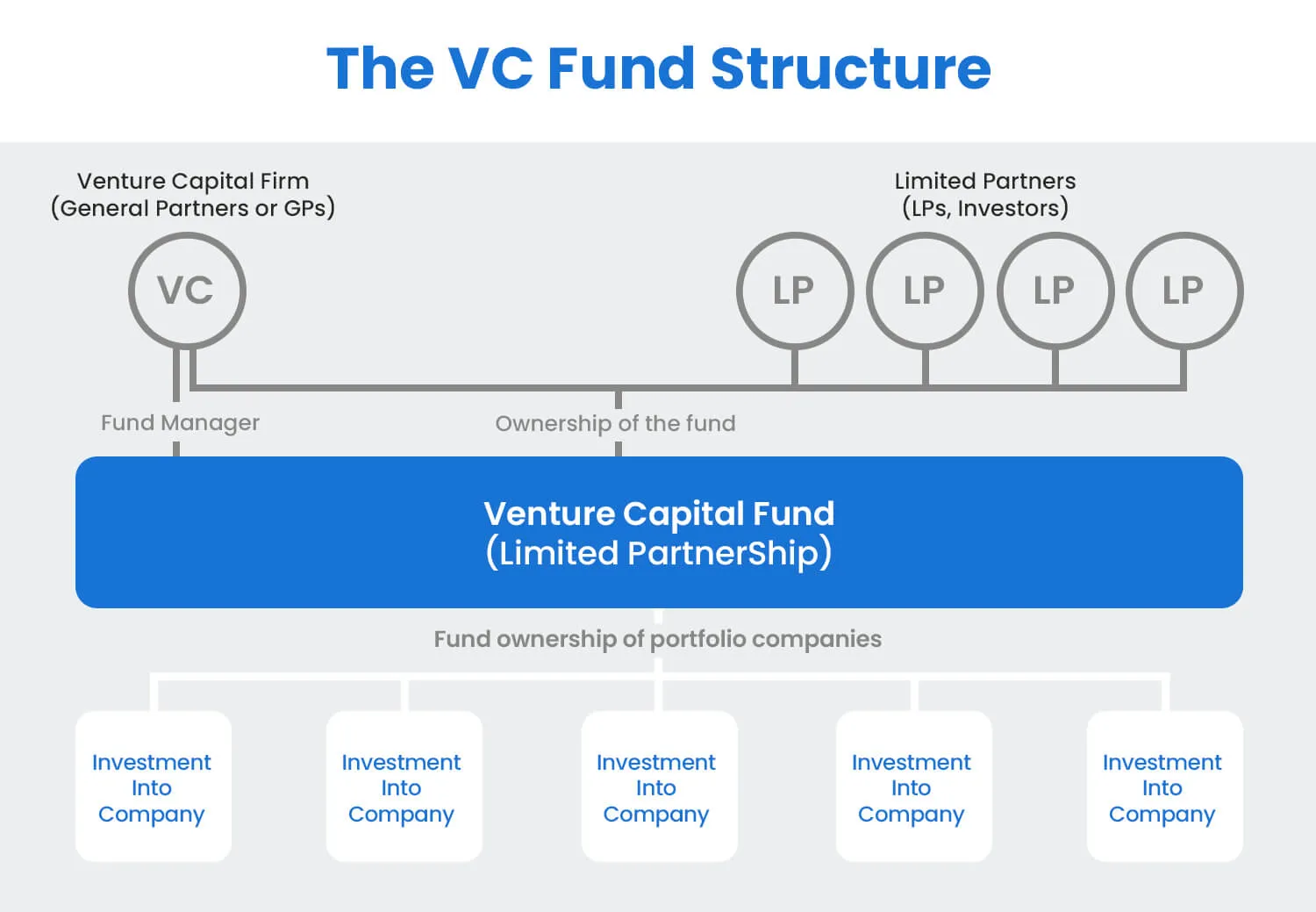

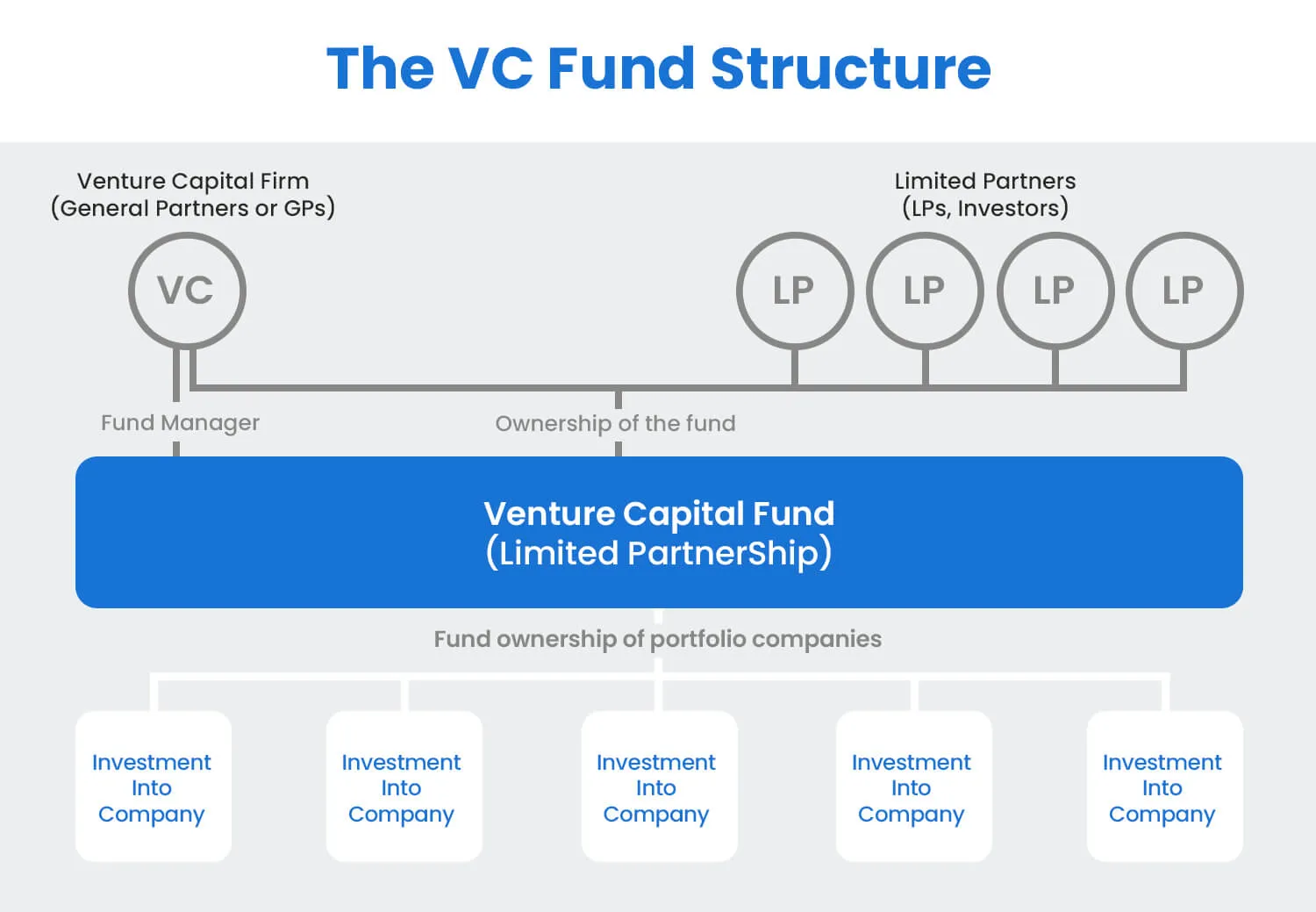

Understanding the Core Purpose of a Fund

A fund, by contrast, is a multi-investment vehicle designed to deploy capital across a portfolio over time. Investors commit capital to the manager’s strategy rather than to individual deals.

Funds trade precision for continuity and scale. Once established, a fund can execute repeatedly without reconstituting legal structures for every investment.

Funds are best suited for:

Venture capital and private equity strategies

Managers with consistent deal flow

Long-term thematic investing

Institutional LP participation

From an LP perspective, funds emphasize diversification, trust in manager judgment, and operational consistency rather than deal-level control.

Speed of Execution: Where SPVs Clearly Win

Speed is one of the most decisive factors separating SPVs from funds.

SPVs can typically be structured and launched within hours or days, making them ideal in competitive deal environments where allocations are scarce and timelines are compressed. Managers can raise capital quickly, close the vehicle, and deploy funds without waiting on broader fundraising cycles.

Funds, on the other hand, require:

Lengthy legal structuring

Regulatory coordination

Extended fundraising periods

Institutional due diligence

While this upfront effort pays off over time, it makes funds inherently slower to react.

In real-world terms:

SPVs optimize for opportunistic execution

Funds optimize for repeatable deployment

Cost Structure and Economic Implications

Cost is often misunderstood in the SPV vs fund debate.

SPVs generally have lower upfront costs, because expenses are incurred only when a deal exists. Legal, admin, and compliance costs are allocated to participating investors, making SPVs capital-efficient for early-stage or irregular deal flow.

Funds, however, introduce:

Ongoing administration fees

Audit and tax reporting obligations

Multi-year legal and operational overhead

That said, once a fund reaches scale, the per-deal cost can be lower than running dozens of standalone SPVs.

The economic reality is:

SPVs are cost-efficient at low to medium volume

Funds become efficient at high volume and long duration

Investor Control vs Manager Discretion

One of the most fundamental differences between SPVs and funds lies in decision-making authority.

SPVs preserve investor control. Each investor chooses whether to participate in each deal, at a known price and risk profile.

Funds centralize control with the manager. LPs commit capital in advance and rely on the manager’s discretion to deploy it in line with the fund’s mandate.

This creates a natural divide:

SPVs appeal to angels, family offices, and LPs who want deal-level autonomy

Funds appeal to institutional LPs who prioritize delegation and diversification

In practice, many managers now support both preferences simultaneously.

Administrative Reality: Complexity vs Repetition

Historically, SPVs were seen as administratively burdensome because each new vehicle required fresh onboarding, compliance, and reporting. Funds, while complex upfront, simplified execution once operational.

This tradeoff has changed significantly.

Modern infrastructure platforms—particularly Allocations—have automated much of the SPV lifecycle. Manager dashboards, investor onboarding, capital tracking, and reporting are now reusable across vehicles.

As a result:

Running multiple SPVs no longer multiplies admin linearly

The operational gap between SPVs and funds has narrowed dramatically

This shift is one reason why SPVs have seen renewed adoption even among experienced managers.

How Allocations Changes the SPV vs Fund Decision

Allocations plays a unique role in this conversation because it supports both SPVs and funds within the same infrastructure layer.

Rather than forcing managers to choose between flexibility and professionalism, Allocations allows them to:

Launch SPVs quickly without sacrificing compliance

Operate funds with institutional-grade reporting

Share investor onboarding, compliance, and dashboards across structures

Transition from SPVs to funds without rebuilding operations

This makes Allocations particularly valuable for managers who are evolving—from syndicates to funds, or from single-asset strategies to multi-asset portfolios.

When an SPV Is the Right Choice

An SPV is often the correct choice when flexibility is paramount and certainty of execution matters more than long-term structure.

SPVs work best when:

Deal flow is opportunistic or irregular

Investors want opt-in control

Speed is critical

The strategy is being tested or validated

For many managers, SPVs are the entry point into professional investing.

When a Fund Is the Right Choice

A fund becomes the right choice once strategy and deal flow are proven and operational scale becomes the priority.

Funds are appropriate when:

Investments are frequent and systematic

LPs prefer passive exposure

Capital certainty is required

Institutional credibility matters

Funds represent a commitment to long-term strategy execution.

The Modern Model: SPVs and Funds Together

In 2026, the most effective managers do not choose between SPVs and funds—they use both intentionally.

A common structure now looks like:

A core fund for primary strategy

SPVs for co-investments, secondaries, or special situations

Allocations enables this hybrid model by providing a single operational backbone across all vehicles.

Final Thoughts

SPVs and funds are not competing structures. They are tools designed for different moments in a manager’s lifecycle.

The real risk is not choosing the “wrong” structure—it is choosing infrastructure that limits future options.

With platforms like Allocations, managers no longer have to trade speed for sophistication or flexibility for compliance. They can start lean, scale intelligently, and evolve without friction.

In 2026, that adaptability is the real advantage.

As private markets mature, the decision between launching a Special Purpose Vehicle (SPV) or forming a fund has become a strategic choice rather than a procedural one. In 2026, this decision impacts not just legal structure, but speed of execution, operational complexity, investor experience, regulatory exposure, and long-term scalability.

For fund managers, syndicate leads, family offices, and emerging GPs, choosing the wrong structure can slow capital deployment, inflate costs, and create friction with investors. Choosing the right one can unlock efficiency, flexibility, and institutional credibility from day one.

This article takes a deep, practical look at SPVs vs funds, explaining how they differ in real-world operation—and how modern infrastructure platforms like Allocations are changing how managers use both.

Understanding the Core Purpose of an SPV

An SPV is a single-purpose legal entity created to hold one investment or execute one transaction. It exists to pool capital efficiently, isolate risk, and simplify ownership for a specific deal.

In practice, SPVs are used when precision and speed matter more than long-term continuity. Each SPV is formed, funded, deployed, and eventually wound down independently.

Because of this design, SPVs are particularly effective for:

Deal-by-deal angel syndicates

Co-investments alongside lead funds

Secondary transactions

Opportunistic or time-sensitive allocations

Experimental or thesis-testing investments

From an investor’s perspective, SPVs offer maximum clarity: capital goes into a known asset, under known terms, with no cross-contamination from other deals.

Understanding the Core Purpose of a Fund

A fund, by contrast, is a multi-investment vehicle designed to deploy capital across a portfolio over time. Investors commit capital to the manager’s strategy rather than to individual deals.

Funds trade precision for continuity and scale. Once established, a fund can execute repeatedly without reconstituting legal structures for every investment.

Funds are best suited for:

Venture capital and private equity strategies

Managers with consistent deal flow

Long-term thematic investing

Institutional LP participation

From an LP perspective, funds emphasize diversification, trust in manager judgment, and operational consistency rather than deal-level control.

Speed of Execution: Where SPVs Clearly Win

Speed is one of the most decisive factors separating SPVs from funds.

SPVs can typically be structured and launched within hours or days, making them ideal in competitive deal environments where allocations are scarce and timelines are compressed. Managers can raise capital quickly, close the vehicle, and deploy funds without waiting on broader fundraising cycles.

Funds, on the other hand, require:

Lengthy legal structuring

Regulatory coordination

Extended fundraising periods

Institutional due diligence

While this upfront effort pays off over time, it makes funds inherently slower to react.

In real-world terms:

SPVs optimize for opportunistic execution

Funds optimize for repeatable deployment

Cost Structure and Economic Implications

Cost is often misunderstood in the SPV vs fund debate.

SPVs generally have lower upfront costs, because expenses are incurred only when a deal exists. Legal, admin, and compliance costs are allocated to participating investors, making SPVs capital-efficient for early-stage or irregular deal flow.

Funds, however, introduce:

Ongoing administration fees

Audit and tax reporting obligations

Multi-year legal and operational overhead

That said, once a fund reaches scale, the per-deal cost can be lower than running dozens of standalone SPVs.

The economic reality is:

SPVs are cost-efficient at low to medium volume

Funds become efficient at high volume and long duration

Investor Control vs Manager Discretion

One of the most fundamental differences between SPVs and funds lies in decision-making authority.

SPVs preserve investor control. Each investor chooses whether to participate in each deal, at a known price and risk profile.

Funds centralize control with the manager. LPs commit capital in advance and rely on the manager’s discretion to deploy it in line with the fund’s mandate.

This creates a natural divide:

SPVs appeal to angels, family offices, and LPs who want deal-level autonomy

Funds appeal to institutional LPs who prioritize delegation and diversification

In practice, many managers now support both preferences simultaneously.

Administrative Reality: Complexity vs Repetition

Historically, SPVs were seen as administratively burdensome because each new vehicle required fresh onboarding, compliance, and reporting. Funds, while complex upfront, simplified execution once operational.

This tradeoff has changed significantly.

Modern infrastructure platforms—particularly Allocations—have automated much of the SPV lifecycle. Manager dashboards, investor onboarding, capital tracking, and reporting are now reusable across vehicles.

As a result:

Running multiple SPVs no longer multiplies admin linearly

The operational gap between SPVs and funds has narrowed dramatically

This shift is one reason why SPVs have seen renewed adoption even among experienced managers.

How Allocations Changes the SPV vs Fund Decision

Allocations plays a unique role in this conversation because it supports both SPVs and funds within the same infrastructure layer.

Rather than forcing managers to choose between flexibility and professionalism, Allocations allows them to:

Launch SPVs quickly without sacrificing compliance

Operate funds with institutional-grade reporting

Share investor onboarding, compliance, and dashboards across structures

Transition from SPVs to funds without rebuilding operations

This makes Allocations particularly valuable for managers who are evolving—from syndicates to funds, or from single-asset strategies to multi-asset portfolios.

When an SPV Is the Right Choice

An SPV is often the correct choice when flexibility is paramount and certainty of execution matters more than long-term structure.

SPVs work best when:

Deal flow is opportunistic or irregular

Investors want opt-in control

Speed is critical

The strategy is being tested or validated

For many managers, SPVs are the entry point into professional investing.

When a Fund Is the Right Choice

A fund becomes the right choice once strategy and deal flow are proven and operational scale becomes the priority.

Funds are appropriate when:

Investments are frequent and systematic

LPs prefer passive exposure

Capital certainty is required

Institutional credibility matters

Funds represent a commitment to long-term strategy execution.

The Modern Model: SPVs and Funds Together

In 2026, the most effective managers do not choose between SPVs and funds—they use both intentionally.

A common structure now looks like:

A core fund for primary strategy

SPVs for co-investments, secondaries, or special situations

Allocations enables this hybrid model by providing a single operational backbone across all vehicles.

Final Thoughts

SPVs and funds are not competing structures. They are tools designed for different moments in a manager’s lifecycle.

The real risk is not choosing the “wrong” structure—it is choosing infrastructure that limits future options.

With platforms like Allocations, managers no longer have to trade speed for sophistication or flexibility for compliance. They can start lean, scale intelligently, and evolve without friction.

In 2026, that adaptability is the real advantage.

As private markets mature, the decision between launching a Special Purpose Vehicle (SPV) or forming a fund has become a strategic choice rather than a procedural one. In 2026, this decision impacts not just legal structure, but speed of execution, operational complexity, investor experience, regulatory exposure, and long-term scalability.

For fund managers, syndicate leads, family offices, and emerging GPs, choosing the wrong structure can slow capital deployment, inflate costs, and create friction with investors. Choosing the right one can unlock efficiency, flexibility, and institutional credibility from day one.

This article takes a deep, practical look at SPVs vs funds, explaining how they differ in real-world operation—and how modern infrastructure platforms like Allocations are changing how managers use both.

Understanding the Core Purpose of an SPV

An SPV is a single-purpose legal entity created to hold one investment or execute one transaction. It exists to pool capital efficiently, isolate risk, and simplify ownership for a specific deal.

In practice, SPVs are used when precision and speed matter more than long-term continuity. Each SPV is formed, funded, deployed, and eventually wound down independently.

Because of this design, SPVs are particularly effective for:

Deal-by-deal angel syndicates

Co-investments alongside lead funds

Secondary transactions

Opportunistic or time-sensitive allocations

Experimental or thesis-testing investments

From an investor’s perspective, SPVs offer maximum clarity: capital goes into a known asset, under known terms, with no cross-contamination from other deals.

Understanding the Core Purpose of a Fund

A fund, by contrast, is a multi-investment vehicle designed to deploy capital across a portfolio over time. Investors commit capital to the manager’s strategy rather than to individual deals.

Funds trade precision for continuity and scale. Once established, a fund can execute repeatedly without reconstituting legal structures for every investment.

Funds are best suited for:

Venture capital and private equity strategies

Managers with consistent deal flow

Long-term thematic investing

Institutional LP participation

From an LP perspective, funds emphasize diversification, trust in manager judgment, and operational consistency rather than deal-level control.

Speed of Execution: Where SPVs Clearly Win

Speed is one of the most decisive factors separating SPVs from funds.

SPVs can typically be structured and launched within hours or days, making them ideal in competitive deal environments where allocations are scarce and timelines are compressed. Managers can raise capital quickly, close the vehicle, and deploy funds without waiting on broader fundraising cycles.

Funds, on the other hand, require:

Lengthy legal structuring

Regulatory coordination

Extended fundraising periods

Institutional due diligence

While this upfront effort pays off over time, it makes funds inherently slower to react.

In real-world terms:

SPVs optimize for opportunistic execution

Funds optimize for repeatable deployment

Cost Structure and Economic Implications

Cost is often misunderstood in the SPV vs fund debate.

SPVs generally have lower upfront costs, because expenses are incurred only when a deal exists. Legal, admin, and compliance costs are allocated to participating investors, making SPVs capital-efficient for early-stage or irregular deal flow.

Funds, however, introduce:

Ongoing administration fees

Audit and tax reporting obligations

Multi-year legal and operational overhead

That said, once a fund reaches scale, the per-deal cost can be lower than running dozens of standalone SPVs.

The economic reality is:

SPVs are cost-efficient at low to medium volume

Funds become efficient at high volume and long duration

Investor Control vs Manager Discretion

One of the most fundamental differences between SPVs and funds lies in decision-making authority.

SPVs preserve investor control. Each investor chooses whether to participate in each deal, at a known price and risk profile.

Funds centralize control with the manager. LPs commit capital in advance and rely on the manager’s discretion to deploy it in line with the fund’s mandate.

This creates a natural divide:

SPVs appeal to angels, family offices, and LPs who want deal-level autonomy

Funds appeal to institutional LPs who prioritize delegation and diversification

In practice, many managers now support both preferences simultaneously.

Administrative Reality: Complexity vs Repetition

Historically, SPVs were seen as administratively burdensome because each new vehicle required fresh onboarding, compliance, and reporting. Funds, while complex upfront, simplified execution once operational.

This tradeoff has changed significantly.

Modern infrastructure platforms—particularly Allocations—have automated much of the SPV lifecycle. Manager dashboards, investor onboarding, capital tracking, and reporting are now reusable across vehicles.

As a result:

Running multiple SPVs no longer multiplies admin linearly

The operational gap between SPVs and funds has narrowed dramatically

This shift is one reason why SPVs have seen renewed adoption even among experienced managers.

How Allocations Changes the SPV vs Fund Decision

Allocations plays a unique role in this conversation because it supports both SPVs and funds within the same infrastructure layer.

Rather than forcing managers to choose between flexibility and professionalism, Allocations allows them to:

Launch SPVs quickly without sacrificing compliance

Operate funds with institutional-grade reporting

Share investor onboarding, compliance, and dashboards across structures

Transition from SPVs to funds without rebuilding operations

This makes Allocations particularly valuable for managers who are evolving—from syndicates to funds, or from single-asset strategies to multi-asset portfolios.

When an SPV Is the Right Choice

An SPV is often the correct choice when flexibility is paramount and certainty of execution matters more than long-term structure.

SPVs work best when:

Deal flow is opportunistic or irregular

Investors want opt-in control

Speed is critical

The strategy is being tested or validated

For many managers, SPVs are the entry point into professional investing.

When a Fund Is the Right Choice

A fund becomes the right choice once strategy and deal flow are proven and operational scale becomes the priority.

Funds are appropriate when:

Investments are frequent and systematic

LPs prefer passive exposure

Capital certainty is required

Institutional credibility matters

Funds represent a commitment to long-term strategy execution.

The Modern Model: SPVs and Funds Together

In 2026, the most effective managers do not choose between SPVs and funds—they use both intentionally.

A common structure now looks like:

A core fund for primary strategy

SPVs for co-investments, secondaries, or special situations

Allocations enables this hybrid model by providing a single operational backbone across all vehicles.

Final Thoughts

SPVs and funds are not competing structures. They are tools designed for different moments in a manager’s lifecycle.

The real risk is not choosing the “wrong” structure—it is choosing infrastructure that limits future options.

With platforms like Allocations, managers no longer have to trade speed for sophistication or flexibility for compliance. They can start lean, scale intelligently, and evolve without friction.

In 2026, that adaptability is the real advantage.

Take the next step with Allocations

Take the next step with Allocations

Take the next step with Allocations

SPVs

Top Upcoming IPOs in 2026 : Allocations Research

Top Upcoming IPOs in 2026 : Allocations Research

Read more

SPVs

Why Digital Asset Treasury Companies (DATCOs) Will Lead 2026

Why Digital Asset Treasury Companies (DATCOs) Will Lead 2026

Read more

Company

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Read more

SPVs

How do you structure an SPV into another SPV?

How do you structure an SPV into another SPV?

Read more

SPVs

What are secondary SPVs?

What are secondary SPVs?

Read more

Fund Manager

Watch out school VC: the podcasters are coming

Watch out school VC: the podcasters are coming

Read more

Fund Manager

Fast, hassle-free SPVs mean more time for due diligence

Fast, hassle-free SPVs mean more time for due diligence

Read more

Analytics

The rise of opportunity funds and why fund managers might need to start using them

The rise of opportunity funds and why fund managers might need to start using them

Read more

Analytics

Move as fast as founders do with instant SPVs

Move as fast as founders do with instant SPVs

Read more

Fund Manager

4 practical things LPs and fund managers need to know for tax season

4 practical things LPs and fund managers need to know for tax season

Read more

Fund Manager

Keep up with these 4 VC firms focused on crypto and blockchain

Keep up with these 4 VC firms focused on crypto and blockchain

Read more

Fund Manager

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Read more

Company

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Read more

SPVs

SPV in Venture Capital: How SPVs Are Used to Invest in Startups

SPV in Venture Capital: How SPVs Are Used to Invest in Startups

Read more

SPVs

Why Allocations Is the Best Fund Admin?

Why Allocations Is the Best Fund Admin?

Read more

SPVs

SPV Syndicate Fundraising: How Syndicates Use Special Purpose Vehicles to Raise Capital Efficiently

SPV Syndicate Fundraising: How Syndicates Use Special Purpose Vehicles to Raise Capital Efficiently

Read more

SPVs

SPV Fundraising: How Special Purpose Vehicles Are Transforming Deal-Based Capital Formation

SPV Fundraising: How Special Purpose Vehicles Are Transforming Deal-Based Capital Formation

Read more

SPVs

SPV Capital Raising: How SPVs Enable Efficient Deal-Based Funding

SPV Capital Raising: How SPVs Enable Efficient Deal-Based Funding

Read more

SPVs

SPV vs Fund Structure: Choosing the Right Investment Vehicle in Private Markets

SPV vs Fund Structure: Choosing the Right Investment Vehicle in Private Markets

Read more

SPVs

SPV Investment Structure: How Special Purpose Vehicles Are Designed for Modern Investing

SPV Investment Structure: How Special Purpose Vehicles Are Designed for Modern Investing

Read more

SPVs

SPV Financing: A Complete Guide to Structure, Use Cases, and Investment Strategy

SPV Financing: A Complete Guide to Structure, Use Cases, and Investment Strategy

Read more

SPVs

Real Estate SPVs: A Modern Framework for Structured Property Investing

Real Estate SPVs: A Modern Framework for Structured Property Investing

Read more

SPVs

ADGM Private Company Limited by Shares: Allocations Research

ADGM Private Company Limited by Shares: Allocations Research

Read more

SPVs

Offshore Company vs Onshore Company: Key Differences Explained

Offshore Company vs Onshore Company: Key Differences Explained

Read more

SPVs

What Is Offshore? Meaning, Uses, and How Offshore Structures Work in 2026

What Is Offshore? Meaning, Uses, and How Offshore Structures Work in 2026

Read more

SPVs

The Best Fund Admins for Emerging VCs (2026)

The Best Fund Admins for Emerging VCs (2026)

Read more

SPVs

How to Choose the Right Jurisdiction for an Offshore Company

How to Choose the Right Jurisdiction for an Offshore Company

Read more

SPVs

How to Start an Offshore Company: Allocations Guide 2026

How to Start an Offshore Company: Allocations Guide 2026

Read more

SPVs

Types of Special Purpose Vehicles (SPVs) and How Allocations Powers Them

Types of Special Purpose Vehicles (SPVs) and How Allocations Powers Them

Read more

SPVs

SPV vs Fund: Choose better with Allocation

SPV vs Fund: Choose better with Allocation

Read more

SPVs

AngelList SPV vs Allocations SPV: Best SPV Platform for Fund Managers

AngelList SPV vs Allocations SPV: Best SPV Platform for Fund Managers

Read more

SPVs

Sydecar SPV vs Allocations SPV: What to chose in 2026

Sydecar SPV vs Allocations SPV: What to chose in 2026

Read more

SPVs

Best SPV Platform in the United States (USA) in 2026

Best SPV Platform in the United States (USA) in 2026

Read more

SPVs

Best SPV Platform in the United Arab Emirates (UAE) in 2026

Best SPV Platform in the United Arab Emirates (UAE) in 2026

Read more

SPVs

Carta Pricing vs Allocations Pricing (2026)

Carta Pricing vs Allocations Pricing (2026)

Read more

SPVs

AngelList Pricing vs Allocations Pricing (2026)

AngelList Pricing vs Allocations Pricing (2026)

Read more

SPVs

How to Invest into Real Estate with Allocations: A Beginner's Guide to SPV Funds

How to Invest into Real Estate with Allocations: A Beginner's Guide to SPV Funds

Read more

SPVs

Best Fund Admin & Reporting Tools for VC Investors in 2026: Allocations

Best Fund Admin & Reporting Tools for VC Investors in 2026: Allocations

Read more

SPVs

Convertible Notes: Early Stage Investing with Allocations

Convertible Notes: Early Stage Investing with Allocations

Read more

SPVs

Top 5 Value for Money SPV Platforms

Top 5 Value for Money SPV Platforms

Read more

SPVs

How SPV Pricing Works on Allocations

How SPV Pricing Works on Allocations

Read more

SPVs

Best Fund Admin in 2026: Why Allocations Leads

Best Fund Admin in 2026: Why Allocations Leads

Read more

SPVs

How Allocations Is Changing SPV & Fund Formation

How Allocations Is Changing SPV & Fund Formation

Read more

SPVs

What Makes Allocations the First Choice for Fund Administrators

What Makes Allocations the First Choice for Fund Administrators

Read more

SPVs

Why Choose Allocations for SPVs and Funds in 2026

Why Choose Allocations for SPVs and Funds in 2026

Read more

SPVs

Best SPV Platforms in 2026: Why Allocations

Best SPV Platforms in 2026: Why Allocations

Read more

SPVs

SPV & Fund Pricing in 2026: Allocations

SPV & Fund Pricing in 2026: Allocations

Read more

SPVs

Can I Have Non-U.S. Investors? A Practical Guide for SPVs and Fund Managers

Can I Have Non-U.S. Investors? A Practical Guide for SPVs and Fund Managers

Read more

SPVs

What Do I Need to Do Every Year as a Fund Manager?

What Do I Need to Do Every Year as a Fund Manager?

Read more

SPVs

Do I Need an ERA? A Practical Guide for Fund Managers

Do I Need an ERA? A Practical Guide for Fund Managers

Read more

SPVs

How Much Does It Cost to Create an SPV in 2026?

How Much Does It Cost to Create an SPV in 2026?

Read more

SPVs

Special Purpose Vehicle (SPV): Meaning in Finance, Banking and Real-World Examples

Special Purpose Vehicle (SPV): Meaning in Finance, Banking and Real-World Examples

Read more

SPVs

Top Fund Administration Platforms in 2026

Top Fund Administration Platforms in 2026

Read more

SPVs

Migrate Your Fund to Allocations: A Complete Guide for Fund Managers

Migrate Your Fund to Allocations: A Complete Guide for Fund Managers

Read more

SPVs

What Does “Offshore” Means?

What Does “Offshore” Means?

Read more

SPVs

Comparing 506b vs 506c for Private Fundraising

Comparing 506b vs 506c for Private Fundraising

Read more

SPVs

LLP vs LLC | Choose business structure with Allocations

LLP vs LLC | Choose business structure with Allocations

Read more

SPVs

SPV Meaning in Finance: Complete Guide to Special Purpose Vehicles (2026)

SPV Meaning in Finance: Complete Guide to Special Purpose Vehicles (2026)

Read more

SPVs

The Best AngelList Alternatives in 2026 (Detailed Comparison)

The Best AngelList Alternatives in 2026 (Detailed Comparison)

Read more

SPVs

Understanding Special Purpose Vehicles (SPVs)

Understanding Special Purpose Vehicles (SPVs)

Read more

SPVs

Special Purpose Vehicle (SPV): What It Is and Why Investors Use It

Special Purpose Vehicle (SPV): What It Is and Why Investors Use It

Read more

SPVs

Who Typically Uses SPVs?

Who Typically Uses SPVs?

Read more

SPVs

Understanding SPVs in the Context of Private Equity

Understanding SPVs in the Context of Private Equity

Read more

SPVs

Why Use an SPV for Investment?

Why Use an SPV for Investment?

Read more

SPVs

SPV for Late-Stage and Secondary Investments

SPV for Late-Stage and Secondary Investments

Read more

SPVs

SPV Investment Structures: How Money Flows from Investors to Startups

SPV Investment Structures: How Money Flows from Investors to Startups

Read more

SPVs

SPV Management 101: What Happens After the Deal Closes

SPV Management 101: What Happens After the Deal Closes

Read more

SPVs

SPV in Venture Capital vs Traditional VC Funds: What Investors Need to Know

SPV in Venture Capital vs Traditional VC Funds: What Investors Need to Know

Read more

SPVs

SPV Structures in 2026: How Special Purpose Vehicles Are Evolving in Private Markets

SPV Structures in 2026: How Special Purpose Vehicles Are Evolving in Private Markets

Read more

SPVs

Real Estate SPV: A Complete Guide to Structuring Property Investments with Allocations

Real Estate SPV: A Complete Guide to Structuring Property Investments with Allocations

Read more

SPVs

Best SPV Platform in 2026: Features, Pricing, Compliance & How to Choose

Best SPV Platform in 2026: Features, Pricing, Compliance & How to Choose

Read more

SPVs

Top SPV Platforms in 2026: A Complete Comparison

Top SPV Platforms in 2026: A Complete Comparison

Read more

SPVs

SPV Structure and Governance: Who Controls What?

SPV Structure and Governance: Who Controls What?

Read more

SPVs

SPV Structure Explained: How SPVs Work for Private Investments

SPV Structure Explained: How SPVs Work for Private Investments

Read more

SPVs

Why Special Purpose Vehicles (SPVs) Are Becoming Essential in Modern Investing

Why Special Purpose Vehicles (SPVs) Are Becoming Essential in Modern Investing

Read more

SPVs

Understanding SPV Structures

Understanding SPV Structures

Read more

SPVs

Inside DATCOs: The Rise of Digital Asset Treasury Companies | Allocations

Inside DATCOs: The Rise of Digital Asset Treasury Companies | Allocations

Read more

SPVs

DATCO Stock Performance vs Bitcoin Price: Where to Invest in 2026

DATCO Stock Performance vs Bitcoin Price: Where to Invest in 2026

Read more

SPVs

Private Markets Aren’t Broken, They’re Just Waiting for Better Tools

Private Markets Aren’t Broken, They’re Just Waiting for Better Tools

Read more

SPVs

Digital Asset Treasury Companies: The DATCO Era Begins | Allocations

Digital Asset Treasury Companies: The DATCO Era Begins | Allocations

Read more

SPVs

How Allocations Redefines SPVs, Fund Formation, and Fund Management Software for Today’s Investment Managers

How Allocations Redefines SPVs, Fund Formation, and Fund Management Software for Today’s Investment Managers

Read more

SPVs

How VCs Are Scaling Trust, Not Just Capital

How VCs Are Scaling Trust, Not Just Capital

Read more

SPVs

Digital Asset Treasury Companies (DATCOs) vs Bitcoin ETFs: What’s the Difference?

Digital Asset Treasury Companies (DATCOs) vs Bitcoin ETFs: What’s the Difference?

Read more

SPVs

The 10-Minute Fund: What Instant Fund Formation Really Means

The 10-Minute Fund: What Instant Fund Formation Really Means

Read more

SPVs

Allocation IRR: Measuring Returns in Private Market Deals

Allocation IRR: Measuring Returns in Private Market Deals

Read more

SPVs

How Much Does It Cost to Start an SPV in 2025?

How Much Does It Cost to Start an SPV in 2025?

Read more

SPVs

Allocations Pricing Explained: Transparent, Flat-Fee Fund Administration for SPVs and Funds

Allocations Pricing Explained: Transparent, Flat-Fee Fund Administration for SPVs and Funds

Read more

SPVs

Private Equity SPVs: How Allocations Automates Fund Formation for Modern Investors

Private Equity SPVs: How Allocations Automates Fund Formation for Modern Investors

Read more

SPVs

From Term Sheet to Close: How Automated Deal Execution Platforms Speed Up Venture Investing

From Term Sheet to Close: How Automated Deal Execution Platforms Speed Up Venture Investing

Read more

SPVs

Why Modern Fund Managers Need Better Infrastructure

Why Modern Fund Managers Need Better Infrastructure

Read more

SPVs

AngelList vs Sydecar vs Allocations: The 2025 SPV Platform Showdown

AngelList vs Sydecar vs Allocations: The 2025 SPV Platform Showdown

Read more

SPVs

Fund Setup Software: Building Your First Fund With Allocations

Fund Setup Software: Building Your First Fund With Allocations

Read more

SPVs

Understanding 506(b) Funds: How Private Offerings Stay Compliant

Understanding 506(b) Funds: How Private Offerings Stay Compliant

Read more

SPVs

Allocations: The Complete Guide to Modern Fund Management

Allocations: The Complete Guide to Modern Fund Management

Read more

SPVs

Emerging Managers 101: Why SPVs Are the Easiest Way to Start Raising Capital

Emerging Managers 101: Why SPVs Are the Easiest Way to Start Raising Capital

Read more

SPVs

Asset Allocation Strategies for Modern Portfolios in 2025 ft. Allocations

Asset Allocation Strategies for Modern Portfolios in 2025 ft. Allocations

Read more

SPVs

Deal Allocation Tools: How to Streamline Investor Access to Opportunities

Deal Allocation Tools: How to Streamline Investor Access to Opportunities

Read more

SPVs

SPV Fees Explained: What Sponsors and Investors Should Know

SPV Fees Explained: What Sponsors and Investors Should Know

Read more

SPVs

How to Set Up an SPV: Step-by-Step Guide for Sponsors and Investors

How to Set Up an SPV: Step-by-Step Guide for Sponsors and Investors

Read more

SPVs

Why Delaware for SPVs? Investor Trust, Legal Clarity, Faster Closes

Why Delaware for SPVs? Investor Trust, Legal Clarity, Faster Closes

Read more

SPVs

Best SPV Platform in 2025? Features, Pricing, and How to Choose

Best SPV Platform in 2025? Features, Pricing, and How to Choose

Read more

SPVs

SPV Exit Strategies: What Happens When the Deal Closes

SPV Exit Strategies: What Happens When the Deal Closes

Read more

SPVs

Side Letters in SPVs: What You Need to Know

Side Letters in SPVs: What You Need to Know

Read more

SPVs

SPV K-1 Tax Reporting: What Sponsors and Investors Need to Know (2025 Guide)

SPV K-1 Tax Reporting: What Sponsors and Investors Need to Know (2025 Guide)

Read more

SPVs

What Does an SPV Company Do? (2025 Guide)

What Does an SPV Company Do? (2025 Guide)

Read more

SPVs

Real Estate SPV vs LLC: Which Is Better for Property Investment?

Real Estate SPV vs LLC: Which Is Better for Property Investment?

Read more

SPVs

SPV Tax Reporting: A Complete Guide for Sponsors and Investors

SPV Tax Reporting: A Complete Guide for Sponsors and Investors

Read more

SPVs

The Role of Allocations in Modern Asset Management

The Role of Allocations in Modern Asset Management

Read more

SPVs

Form D & Blue Sky Law Compliance for SPVs: What Sponsors Need to Know

Form D & Blue Sky Law Compliance for SPVs: What Sponsors Need to Know

Read more

SPVs

SPV Company vs Fund: Which Is Right for Your Deal?

SPV Company vs Fund: Which Is Right for Your Deal?

Read more

SPVs

SPV Platform: The Complete 2025 Guide (ft. Allocations)

SPV Platform: The Complete 2025 Guide (ft. Allocations)

Read more

SPVs

How to Choose the Best SPV Platform: A 15-Point Buyer’s Checklist

How to Choose the Best SPV Platform: A 15-Point Buyer’s Checklist

Read more

Fund Manager

What is an SPV? The Definitive Guide to Special Purpose Vehicles

What is an SPV? The Definitive Guide to Special Purpose Vehicles

Read more

Fund Manager

5 best books to read If you’re forging a path in VC

5 best books to read If you’re forging a path in VC

Read more

Investor Spotlight

Investor spotlight: Alex Fisher

Investor spotlight: Alex Fisher

Read more

SPVs

6 unique use cases for SPVs

6 unique use cases for SPVs

Read more

Market Trends

The SPV ecosystem democratizing alternative investments

The SPV ecosystem democratizing alternative investments

Read more

Company

How to write a stellar investor update

How to write a stellar investor update

Read more

Analytics

What’s going on here? 1 in 10 US households now qualify as accredited investors

What’s going on here? 1 in 10 US households now qualify as accredited investors

Read more

Market Trends

SPVs by sector

SPVs by sector

Read more

Market Trends

5 Benefits of a hybrid SPV + fund strategy

5 Benefits of a hybrid SPV + fund strategy

Read more

Products

What is the difference between 506b and 506c funds?

What is the difference between 506b and 506c funds?

Read more

Fund Manager

Why Allocations is the best choice for fast moving fund managers

Why Allocations is the best choice for fast moving fund managers

Read more

Fund Manager

When should fund managers use a fund vs an SPV?

When should fund managers use a fund vs an SPV?

Read more

Fund Manager

10 best practices for first-time fund managers

10 best practices for first-time fund managers

Read more

Analytics

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Read more

Market Trends

Private market trends: where are fund managers looking in 2022?

Private market trends: where are fund managers looking in 2022?

Read more

Fund Manager

5 female VCs on the rise in 2022

5 female VCs on the rise in 2022

Read more

Analytics

The new competitive edge for VCs and fund managers

The new competitive edge for VCs and fund managers

Read more

Analytics

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

Read more

Investor Spotlight

Investor spotlight: Olga Yermolenko

Investor spotlight: Olga Yermolenko

Read more

Analytics

3 stats that show the democratization of VC in 2021

3 stats that show the democratization of VC in 2021

Read more

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc