Back

SPVs

SPV Investment Structures: How Money Flows from Investors to Startups

SPV Investment Structures: How Money Flows from Investors to Startups

SPV Investment Structures: How Money Flows from Investors to Startups

At a glance, an SPV investment may look simple. Investors commit capital, a vehicle is formed, and a startup receives funding. In practice, the flow of money through a Special Purpose Vehicle is carefully structured to ensure legal separation, regulatory compliance, accurate ownership tracking, and clean distributions at exit.

This article breaks down how money actually moves through an SPV, from the moment investors commit capital to the point where a startup receives funds and, eventually, returns capital to investors.

Understanding this flow is essential for investors, founders, and sponsors who want to use SPVs effectively and avoid costly mistakes.

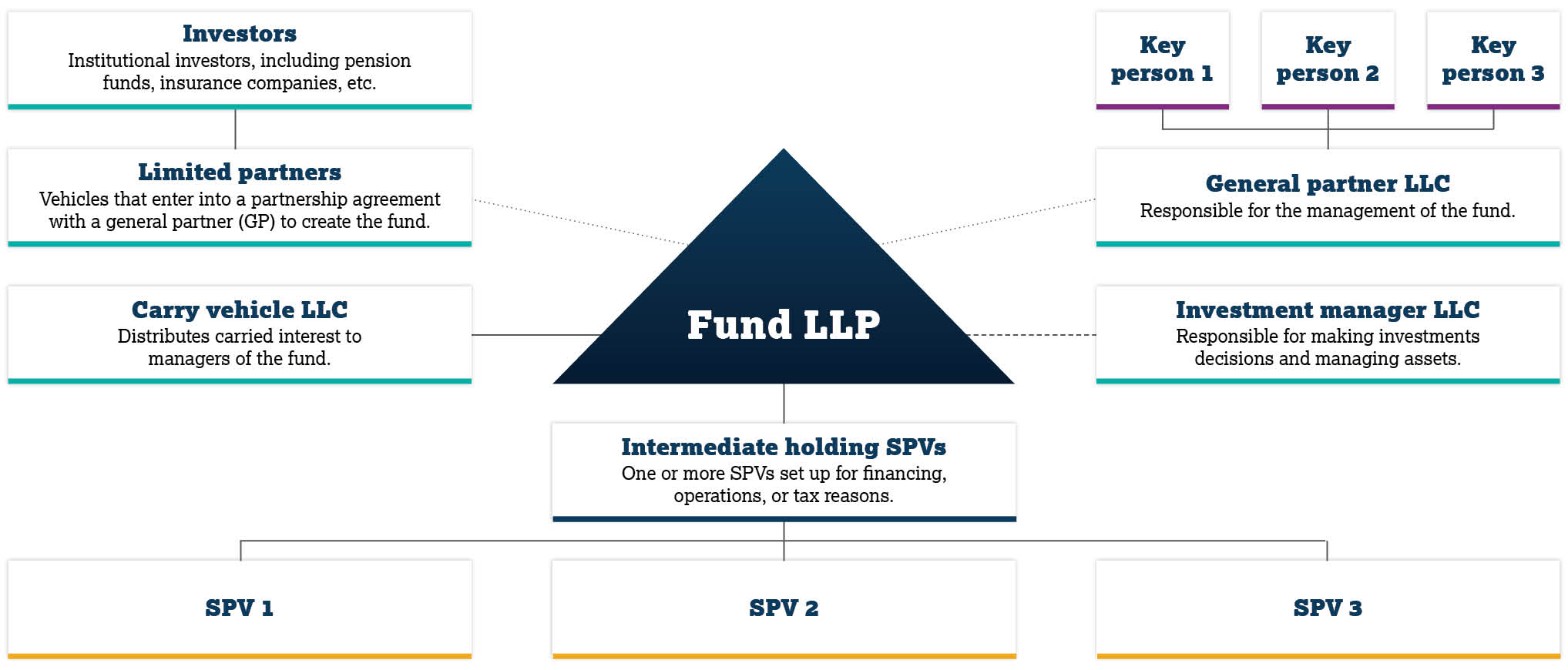

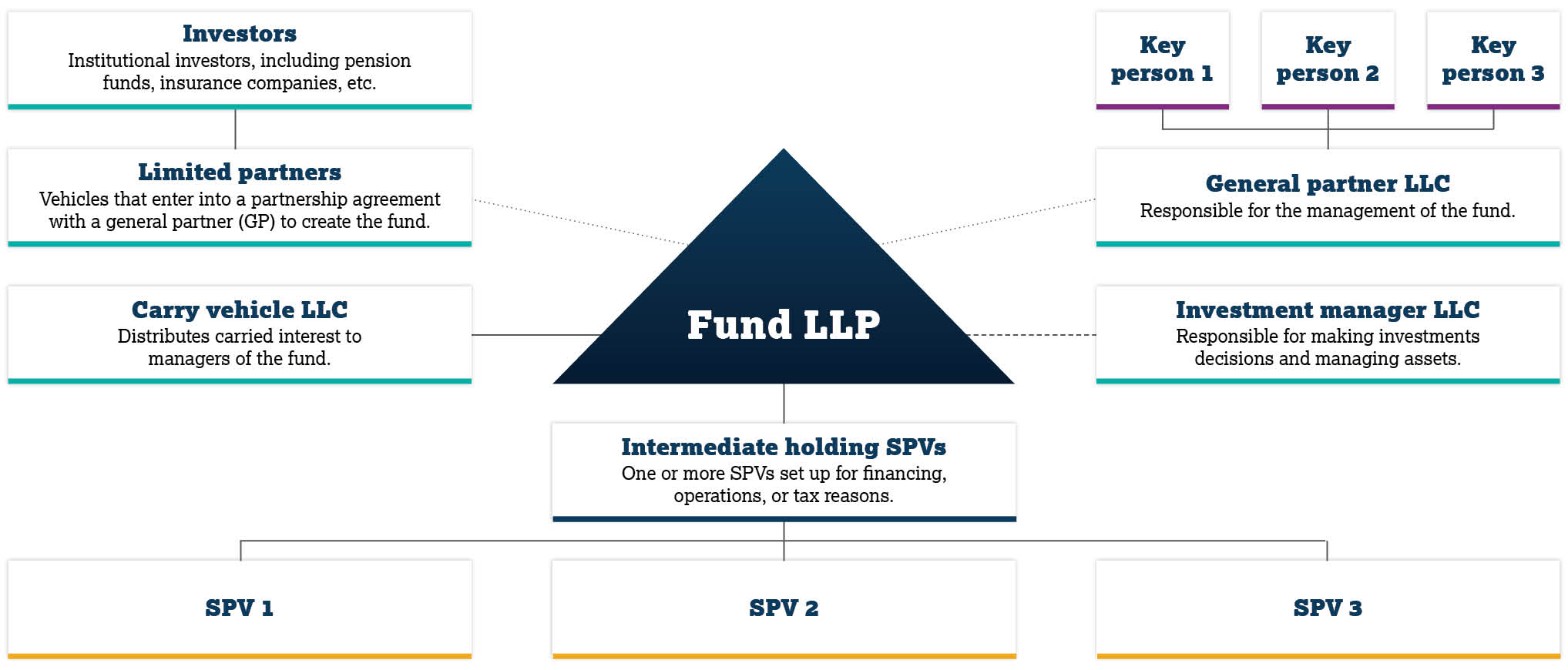

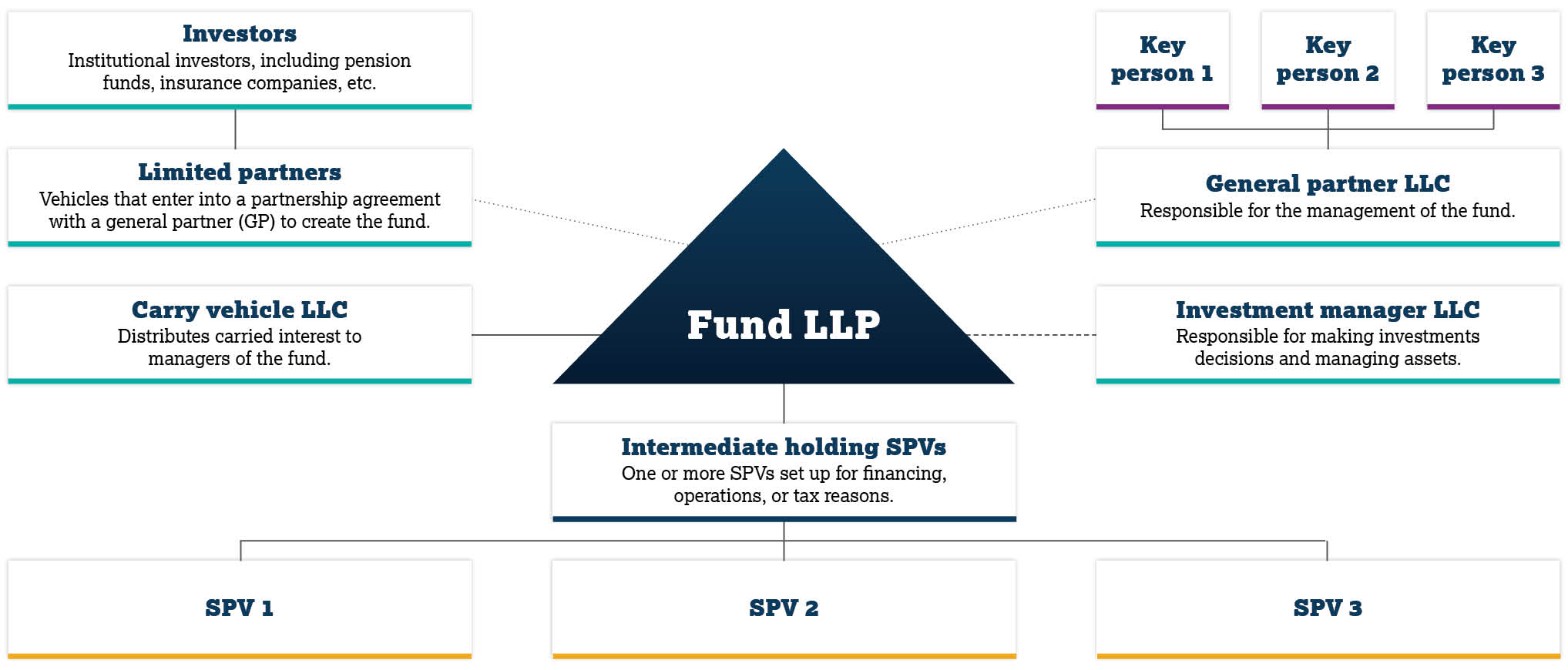

The Core SPV Investment Model

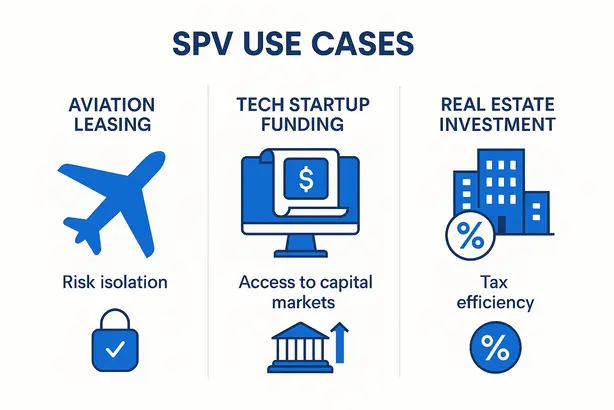

An SPV is a legally separate entity created to invest in a single asset, most commonly equity in a startup. Investors do not invest directly into the company. Instead, they invest into the SPV, which then acts as the sole investing party on the company’s cap table.

This structure creates three distinct layers:

Investors

The SPV entity

The portfolio company

Each layer has a specific role, and capital must move between them in a controlled and auditable way.

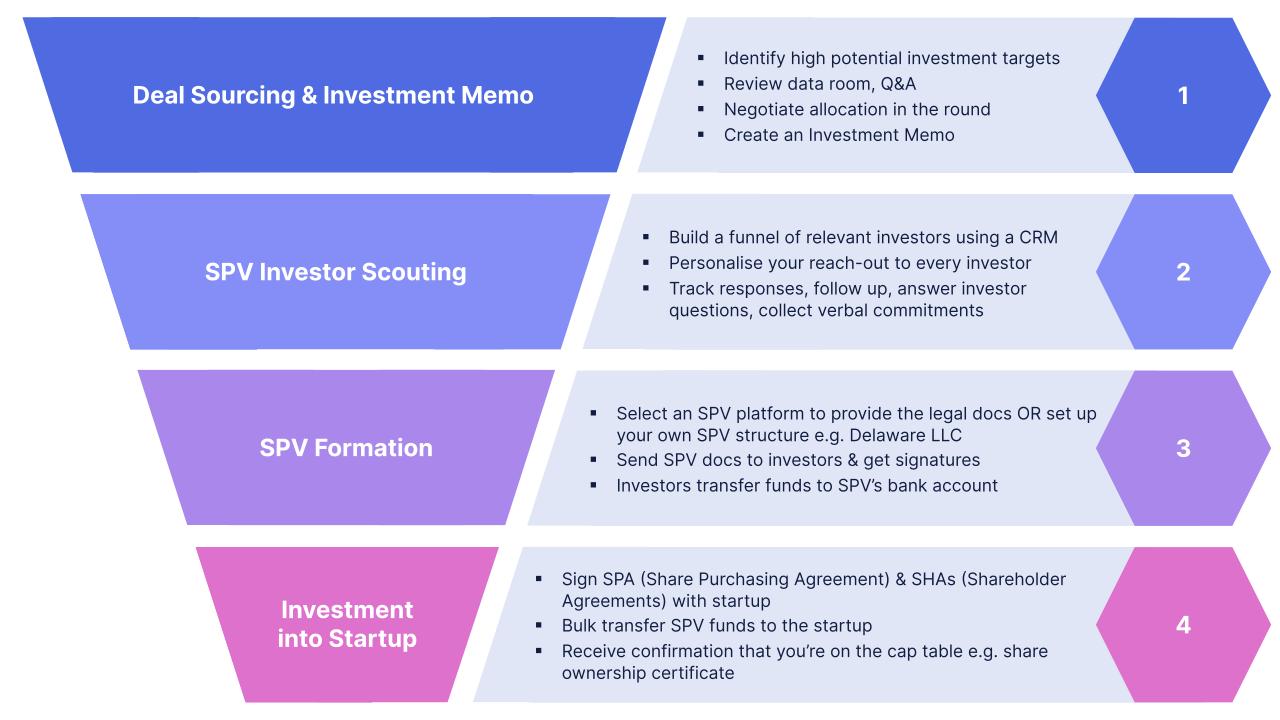

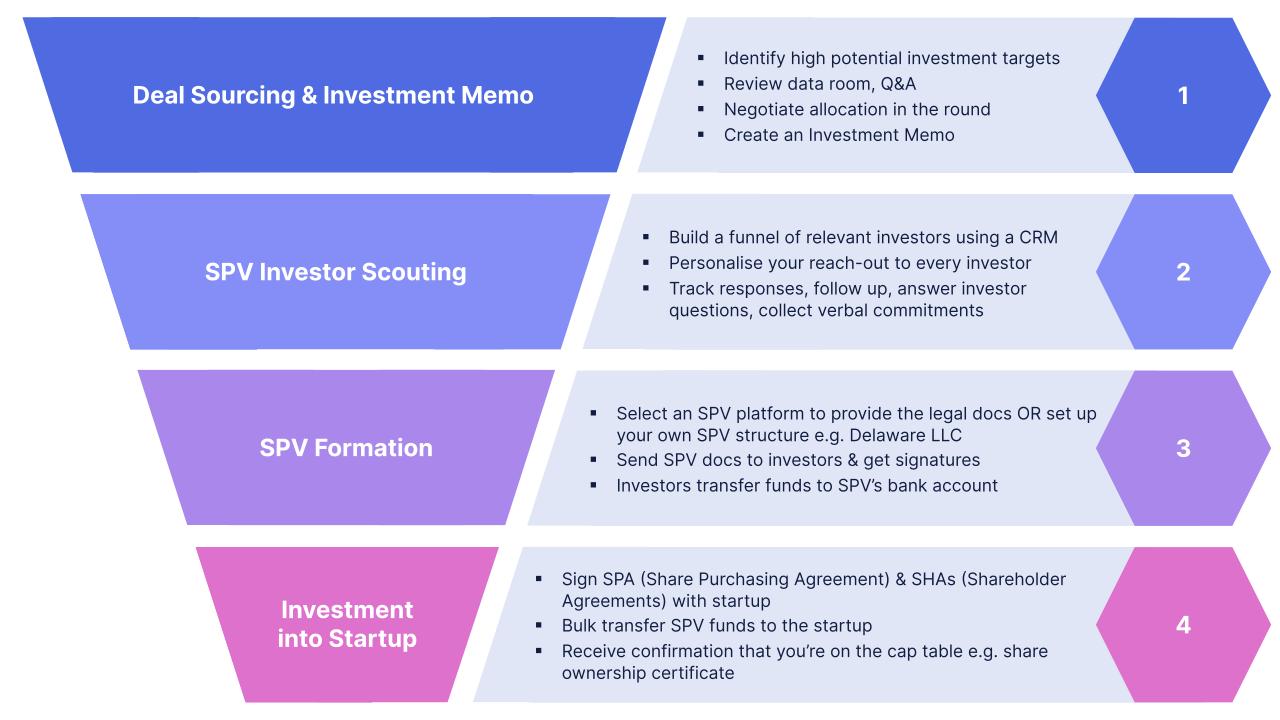

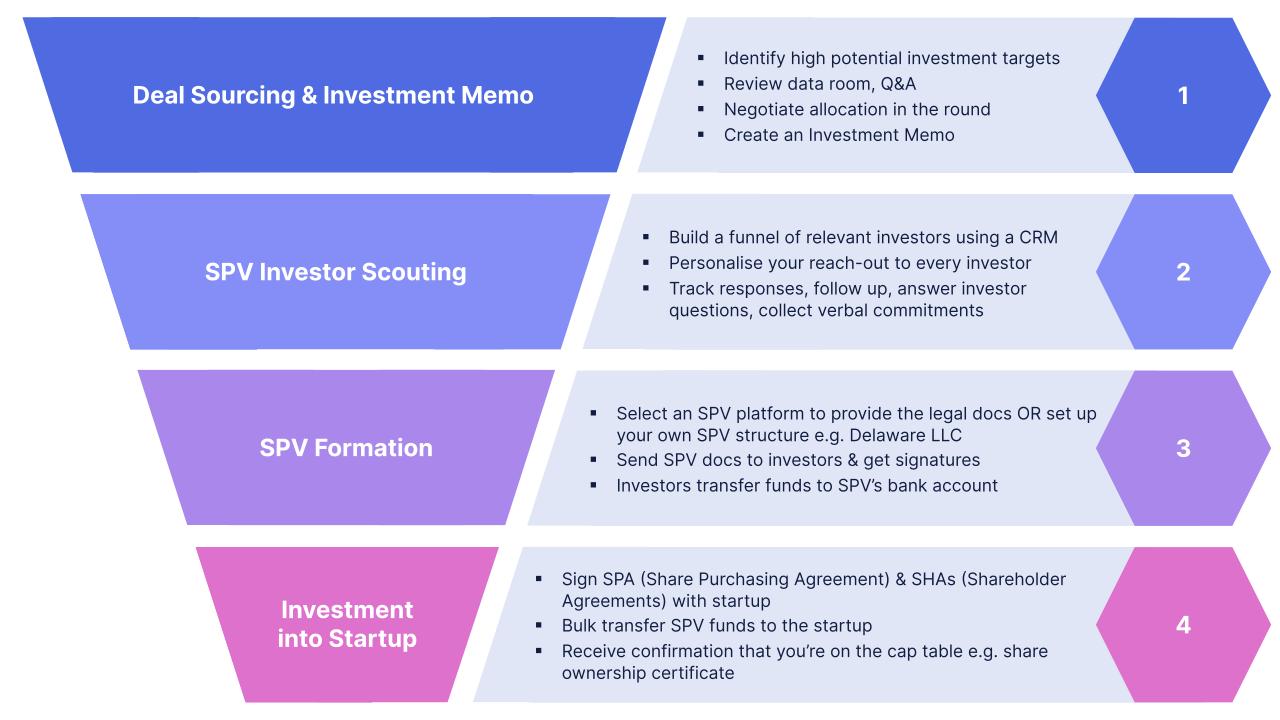

Step 1: Investor Commitments and Subscription

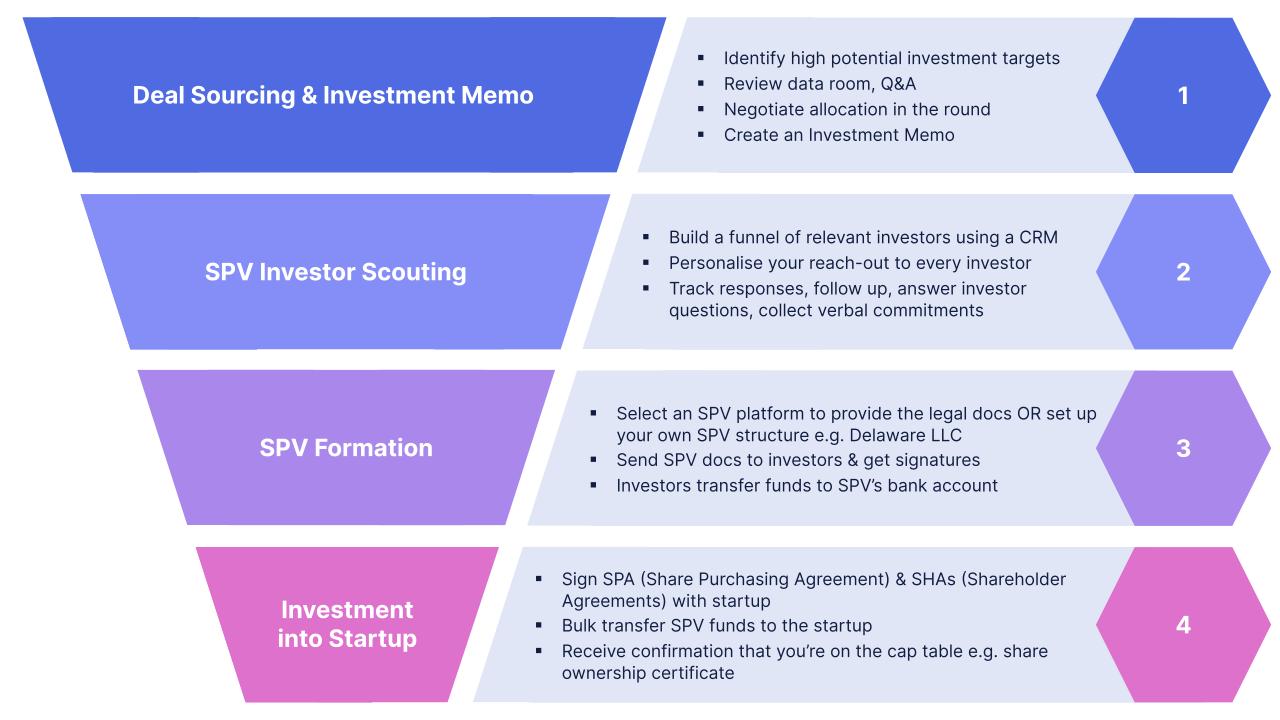

The capital flow begins with investor commitments. Investors review the SPV terms, including economics, governance, and risk disclosures, and then execute subscription agreements. These agreements legally bind the investor to contribute a defined amount of capital to the SPV.

At this stage, no money has yet reached the startup. Capital commitments exist only as contractual obligations.

Investor onboarding typically includes:

Accreditation verification

KYC and AML checks

Review of SPV governing documents

Only after these steps are complete can capital be accepted.

Step 2: Capital Collection into the SPV Account

Once the SPV is formally established, a dedicated SPV bank account is opened in the name of the entity. This account is legally separate from the sponsor, the platform, and any other SPVs.

Investors wire funds directly into this SPV account.

This step is critical for several reasons:

Investor funds must never be commingled

The SPV must maintain a clean audit trail

Regulators and auditors require entity-level segregation

Until capital reaches the SPV account, it cannot be deployed.

Step 3: Closing the SPV

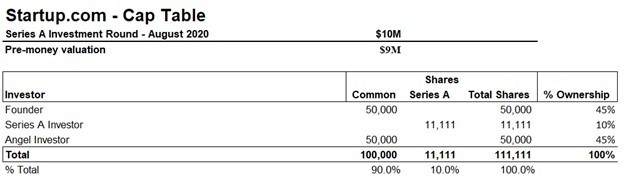

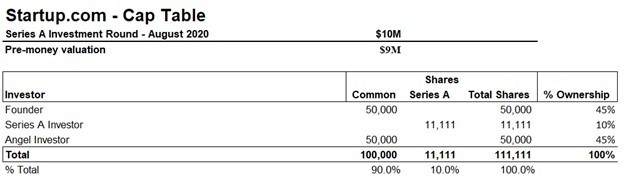

The SPV reaches “close” when all required capital has been received and the closing conditions defined in the SPV agreement are met. At this point, investor ownership interests in the SPV are formally issued.

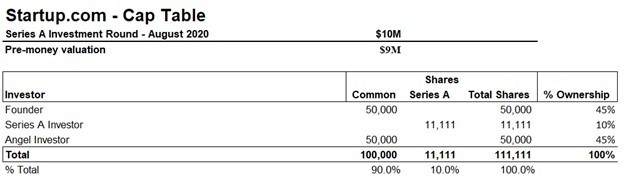

Ownership is typically proportional to capital contributed. For example, an investor contributing ten percent of the total SPV capital owns ten percent of the SPV.

This ownership determines:

Economic participation

Distribution rights

Voting rights, if applicable

After closing, the SPV is fully authorized to deploy capital.

Step 4: Capital Deployment into the Startup

Once the SPV closes, funds are transferred from the SPV bank account to the startup in exchange for equity or other securities. This transfer is executed under the startup’s financing documents, just like any other investor investment.

From the startup’s perspective:

The SPV appears as a single investor

The cap table remains clean

Governance complexity is reduced

From the investor’s perspective:

Exposure is indirect through the SPV

Legal ownership sits at the SPV level

Economic rights flow through the SPV

This is the point where capital officially enters the company.

Step 5: Ongoing Value and Information Flow

After investment, money stops moving for a while, but information continues to flow.

The startup provides updates to shareholders, including the SPV. The SPV manager or sponsor consolidates this information and communicates it to investors.

This includes:

Company performance updates

Financing activity

Material events

Risk disclosures

While not a capital flow, this information flow is a core part of SPV structure and investor trust.

Step 6: Follow-On Events and Secondary Liquidity

SPVs may encounter additional financial events during their lifetime.

Examples include:

Follow-on funding rounds

Tender offers

Partial secondary sales

Dividends or distributions

In each case, the SPV acts as the decision-making and execution layer. Capital flows may move from the startup back to the SPV, or from the SPV back into the startup if additional investment is permitted.

These flows are governed strictly by the SPV agreement.

Step 7: Exit and Return of Capital

When a liquidity event occurs, such as an acquisition or IPO, proceeds flow from the startup to the SPV.

The SPV then:

Receives gross proceeds

Pays any outstanding expenses

Applies the distribution waterfall

Distributes net proceeds to investors

This is where accurate recordkeeping and ownership tracking are essential. Errors at this stage can lead to disputes, delays, or regulatory exposure.

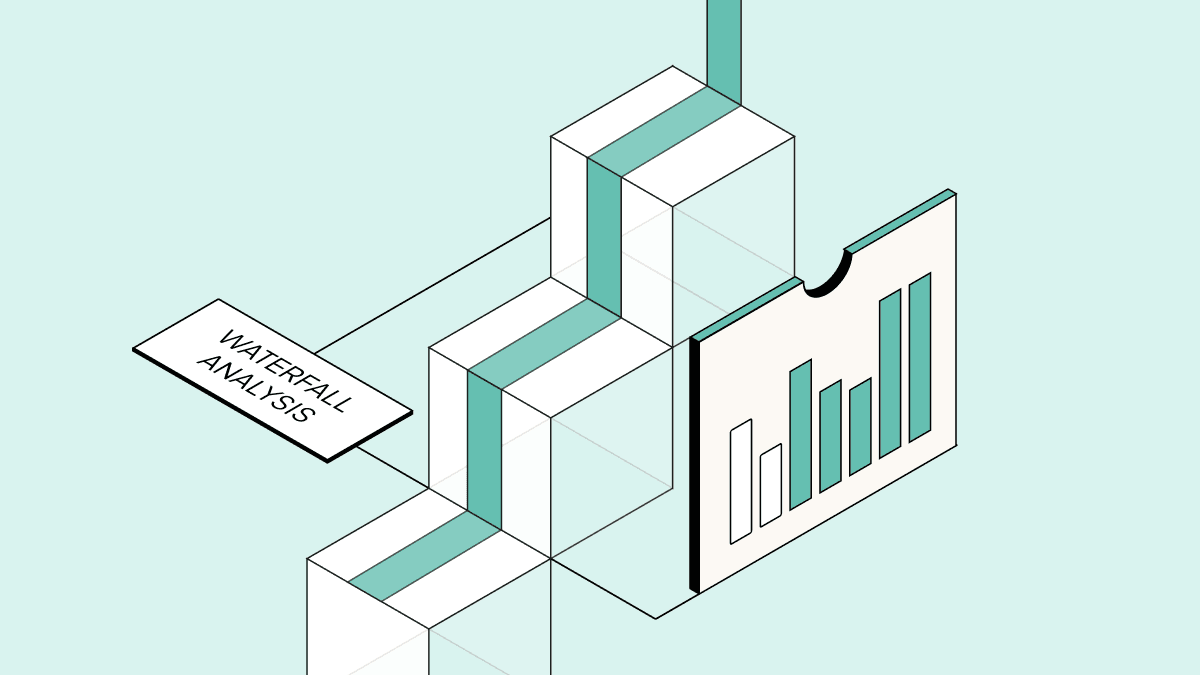

Distribution Waterfalls Explained

Most SPVs use a simple distribution waterfall:

Return of investor capital

Allocation of profits

Payment of carry, if applicable

Unlike traditional venture funds, SPV waterfalls are usually deal-specific and easier to understand. However, they must be executed precisely according to the governing documents.

Why Structure Matters More Than Speed

SPVs are often praised for speed, but structure is far more important than velocity. Poorly designed capital flows can result in:

Commingled funds

Tax reporting errors

Regulatory violations

Delayed exits

Well-structured SPVs prioritize correctness first and speed second.

Infrastructure and Capital Flow Automation

Managing these flows manually increases risk. This is why many sponsors use platforms like Allocations to centralize:

Investor onboarding

Banking workflows

Capital tracking

Distribution execution

Reporting and compliance

Centralized infrastructure ensures that every dollar is traceable from investor to startup and back again.

SPVs as Financial Plumbing of Private Markets

SPVs are not just legal wrappers. They are financial plumbing systems that route capital safely and efficiently through private markets. When designed correctly, they disappear into the background and simply work.

Understanding how money flows through an SPV is essential for anyone participating in private investing today. The mechanics may be invisible to the startup, but they are foundational to investor protection, regulatory compliance, and clean outcomes.

At a glance, an SPV investment may look simple. Investors commit capital, a vehicle is formed, and a startup receives funding. In practice, the flow of money through a Special Purpose Vehicle is carefully structured to ensure legal separation, regulatory compliance, accurate ownership tracking, and clean distributions at exit.

This article breaks down how money actually moves through an SPV, from the moment investors commit capital to the point where a startup receives funds and, eventually, returns capital to investors.

Understanding this flow is essential for investors, founders, and sponsors who want to use SPVs effectively and avoid costly mistakes.

The Core SPV Investment Model

An SPV is a legally separate entity created to invest in a single asset, most commonly equity in a startup. Investors do not invest directly into the company. Instead, they invest into the SPV, which then acts as the sole investing party on the company’s cap table.

This structure creates three distinct layers:

Investors

The SPV entity

The portfolio company

Each layer has a specific role, and capital must move between them in a controlled and auditable way.

Step 1: Investor Commitments and Subscription

The capital flow begins with investor commitments. Investors review the SPV terms, including economics, governance, and risk disclosures, and then execute subscription agreements. These agreements legally bind the investor to contribute a defined amount of capital to the SPV.

At this stage, no money has yet reached the startup. Capital commitments exist only as contractual obligations.

Investor onboarding typically includes:

Accreditation verification

KYC and AML checks

Review of SPV governing documents

Only after these steps are complete can capital be accepted.

Step 2: Capital Collection into the SPV Account

Once the SPV is formally established, a dedicated SPV bank account is opened in the name of the entity. This account is legally separate from the sponsor, the platform, and any other SPVs.

Investors wire funds directly into this SPV account.

This step is critical for several reasons:

Investor funds must never be commingled

The SPV must maintain a clean audit trail

Regulators and auditors require entity-level segregation

Until capital reaches the SPV account, it cannot be deployed.

Step 3: Closing the SPV

The SPV reaches “close” when all required capital has been received and the closing conditions defined in the SPV agreement are met. At this point, investor ownership interests in the SPV are formally issued.

Ownership is typically proportional to capital contributed. For example, an investor contributing ten percent of the total SPV capital owns ten percent of the SPV.

This ownership determines:

Economic participation

Distribution rights

Voting rights, if applicable

After closing, the SPV is fully authorized to deploy capital.

Step 4: Capital Deployment into the Startup

Once the SPV closes, funds are transferred from the SPV bank account to the startup in exchange for equity or other securities. This transfer is executed under the startup’s financing documents, just like any other investor investment.

From the startup’s perspective:

The SPV appears as a single investor

The cap table remains clean

Governance complexity is reduced

From the investor’s perspective:

Exposure is indirect through the SPV

Legal ownership sits at the SPV level

Economic rights flow through the SPV

This is the point where capital officially enters the company.

Step 5: Ongoing Value and Information Flow

After investment, money stops moving for a while, but information continues to flow.

The startup provides updates to shareholders, including the SPV. The SPV manager or sponsor consolidates this information and communicates it to investors.

This includes:

Company performance updates

Financing activity

Material events

Risk disclosures

While not a capital flow, this information flow is a core part of SPV structure and investor trust.

Step 6: Follow-On Events and Secondary Liquidity

SPVs may encounter additional financial events during their lifetime.

Examples include:

Follow-on funding rounds

Tender offers

Partial secondary sales

Dividends or distributions

In each case, the SPV acts as the decision-making and execution layer. Capital flows may move from the startup back to the SPV, or from the SPV back into the startup if additional investment is permitted.

These flows are governed strictly by the SPV agreement.

Step 7: Exit and Return of Capital

When a liquidity event occurs, such as an acquisition or IPO, proceeds flow from the startup to the SPV.

The SPV then:

Receives gross proceeds

Pays any outstanding expenses

Applies the distribution waterfall

Distributes net proceeds to investors

This is where accurate recordkeeping and ownership tracking are essential. Errors at this stage can lead to disputes, delays, or regulatory exposure.

Distribution Waterfalls Explained

Most SPVs use a simple distribution waterfall:

Return of investor capital

Allocation of profits

Payment of carry, if applicable

Unlike traditional venture funds, SPV waterfalls are usually deal-specific and easier to understand. However, they must be executed precisely according to the governing documents.

Why Structure Matters More Than Speed

SPVs are often praised for speed, but structure is far more important than velocity. Poorly designed capital flows can result in:

Commingled funds

Tax reporting errors

Regulatory violations

Delayed exits

Well-structured SPVs prioritize correctness first and speed second.

Infrastructure and Capital Flow Automation

Managing these flows manually increases risk. This is why many sponsors use platforms like Allocations to centralize:

Investor onboarding

Banking workflows

Capital tracking

Distribution execution

Reporting and compliance

Centralized infrastructure ensures that every dollar is traceable from investor to startup and back again.

SPVs as Financial Plumbing of Private Markets

SPVs are not just legal wrappers. They are financial plumbing systems that route capital safely and efficiently through private markets. When designed correctly, they disappear into the background and simply work.

Understanding how money flows through an SPV is essential for anyone participating in private investing today. The mechanics may be invisible to the startup, but they are foundational to investor protection, regulatory compliance, and clean outcomes.

At a glance, an SPV investment may look simple. Investors commit capital, a vehicle is formed, and a startup receives funding. In practice, the flow of money through a Special Purpose Vehicle is carefully structured to ensure legal separation, regulatory compliance, accurate ownership tracking, and clean distributions at exit.

This article breaks down how money actually moves through an SPV, from the moment investors commit capital to the point where a startup receives funds and, eventually, returns capital to investors.

Understanding this flow is essential for investors, founders, and sponsors who want to use SPVs effectively and avoid costly mistakes.

The Core SPV Investment Model

An SPV is a legally separate entity created to invest in a single asset, most commonly equity in a startup. Investors do not invest directly into the company. Instead, they invest into the SPV, which then acts as the sole investing party on the company’s cap table.

This structure creates three distinct layers:

Investors

The SPV entity

The portfolio company

Each layer has a specific role, and capital must move between them in a controlled and auditable way.

Step 1: Investor Commitments and Subscription

The capital flow begins with investor commitments. Investors review the SPV terms, including economics, governance, and risk disclosures, and then execute subscription agreements. These agreements legally bind the investor to contribute a defined amount of capital to the SPV.

At this stage, no money has yet reached the startup. Capital commitments exist only as contractual obligations.

Investor onboarding typically includes:

Accreditation verification

KYC and AML checks

Review of SPV governing documents

Only after these steps are complete can capital be accepted.

Step 2: Capital Collection into the SPV Account

Once the SPV is formally established, a dedicated SPV bank account is opened in the name of the entity. This account is legally separate from the sponsor, the platform, and any other SPVs.

Investors wire funds directly into this SPV account.

This step is critical for several reasons:

Investor funds must never be commingled

The SPV must maintain a clean audit trail

Regulators and auditors require entity-level segregation

Until capital reaches the SPV account, it cannot be deployed.

Step 3: Closing the SPV

The SPV reaches “close” when all required capital has been received and the closing conditions defined in the SPV agreement are met. At this point, investor ownership interests in the SPV are formally issued.

Ownership is typically proportional to capital contributed. For example, an investor contributing ten percent of the total SPV capital owns ten percent of the SPV.

This ownership determines:

Economic participation

Distribution rights

Voting rights, if applicable

After closing, the SPV is fully authorized to deploy capital.

Step 4: Capital Deployment into the Startup

Once the SPV closes, funds are transferred from the SPV bank account to the startup in exchange for equity or other securities. This transfer is executed under the startup’s financing documents, just like any other investor investment.

From the startup’s perspective:

The SPV appears as a single investor

The cap table remains clean

Governance complexity is reduced

From the investor’s perspective:

Exposure is indirect through the SPV

Legal ownership sits at the SPV level

Economic rights flow through the SPV

This is the point where capital officially enters the company.

Step 5: Ongoing Value and Information Flow

After investment, money stops moving for a while, but information continues to flow.

The startup provides updates to shareholders, including the SPV. The SPV manager or sponsor consolidates this information and communicates it to investors.

This includes:

Company performance updates

Financing activity

Material events

Risk disclosures

While not a capital flow, this information flow is a core part of SPV structure and investor trust.

Step 6: Follow-On Events and Secondary Liquidity

SPVs may encounter additional financial events during their lifetime.

Examples include:

Follow-on funding rounds

Tender offers

Partial secondary sales

Dividends or distributions

In each case, the SPV acts as the decision-making and execution layer. Capital flows may move from the startup back to the SPV, or from the SPV back into the startup if additional investment is permitted.

These flows are governed strictly by the SPV agreement.

Step 7: Exit and Return of Capital

When a liquidity event occurs, such as an acquisition or IPO, proceeds flow from the startup to the SPV.

The SPV then:

Receives gross proceeds

Pays any outstanding expenses

Applies the distribution waterfall

Distributes net proceeds to investors

This is where accurate recordkeeping and ownership tracking are essential. Errors at this stage can lead to disputes, delays, or regulatory exposure.

Distribution Waterfalls Explained

Most SPVs use a simple distribution waterfall:

Return of investor capital

Allocation of profits

Payment of carry, if applicable

Unlike traditional venture funds, SPV waterfalls are usually deal-specific and easier to understand. However, they must be executed precisely according to the governing documents.

Why Structure Matters More Than Speed

SPVs are often praised for speed, but structure is far more important than velocity. Poorly designed capital flows can result in:

Commingled funds

Tax reporting errors

Regulatory violations

Delayed exits

Well-structured SPVs prioritize correctness first and speed second.

Infrastructure and Capital Flow Automation

Managing these flows manually increases risk. This is why many sponsors use platforms like Allocations to centralize:

Investor onboarding

Banking workflows

Capital tracking

Distribution execution

Reporting and compliance

Centralized infrastructure ensures that every dollar is traceable from investor to startup and back again.

SPVs as Financial Plumbing of Private Markets

SPVs are not just legal wrappers. They are financial plumbing systems that route capital safely and efficiently through private markets. When designed correctly, they disappear into the background and simply work.

Understanding how money flows through an SPV is essential for anyone participating in private investing today. The mechanics may be invisible to the startup, but they are foundational to investor protection, regulatory compliance, and clean outcomes.

Take the next step with Allocations

Take the next step with Allocations

Take the next step with Allocations

SPVs

Top Upcoming IPOs in 2026 : Allocations Research

Top Upcoming IPOs in 2026 : Allocations Research

Read more

SPVs

Why Digital Asset Treasury Companies (DATCOs) Will Lead 2026

Why Digital Asset Treasury Companies (DATCOs) Will Lead 2026

Read more

Company

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Read more

SPVs

How do you structure an SPV into another SPV?

How do you structure an SPV into another SPV?

Read more

SPVs

What are secondary SPVs?

What are secondary SPVs?

Read more

Fund Manager

Watch out school VC: the podcasters are coming

Watch out school VC: the podcasters are coming

Read more

Fund Manager

Fast, hassle-free SPVs mean more time for due diligence

Fast, hassle-free SPVs mean more time for due diligence

Read more

Analytics

The rise of opportunity funds and why fund managers might need to start using them

The rise of opportunity funds and why fund managers might need to start using them

Read more

Analytics

Move as fast as founders do with instant SPVs

Move as fast as founders do with instant SPVs

Read more

Fund Manager

4 practical things LPs and fund managers need to know for tax season

4 practical things LPs and fund managers need to know for tax season

Read more

Fund Manager

Keep up with these 4 VC firms focused on crypto and blockchain

Keep up with these 4 VC firms focused on crypto and blockchain

Read more

Fund Manager

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Read more

Company

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Read more

SPVs

SPV in Venture Capital: How SPVs Are Used to Invest in Startups

SPV in Venture Capital: How SPVs Are Used to Invest in Startups

Read more

SPVs

Types of SPV: Allocations Research 2026

Types of SPV: Allocations Research 2026

Read more

SPVs

Setup your next entity in GIFT City with Allocations

Setup your next entity in GIFT City with Allocations

Read more

SPVs

What Is an SPV in Business? Real-World Examples and the Role of SPVs in Private Equity

What Is an SPV in Business? Real-World Examples and the Role of SPVs in Private Equity

Read more

SPVs

Why Allocations Is the Best Fund Admin?

Why Allocations Is the Best Fund Admin?

Read more

SPVs

SPV Syndicate Fundraising: How Syndicates Use Special Purpose Vehicles to Raise Capital Efficiently

SPV Syndicate Fundraising: How Syndicates Use Special Purpose Vehicles to Raise Capital Efficiently

Read more

SPVs

SPV Fundraising: How Special Purpose Vehicles Are Transforming Deal-Based Capital Formation

SPV Fundraising: How Special Purpose Vehicles Are Transforming Deal-Based Capital Formation

Read more

SPVs

SPV Capital Raising: How SPVs Enable Efficient Deal-Based Funding

SPV Capital Raising: How SPVs Enable Efficient Deal-Based Funding

Read more

SPVs

SPV vs Fund Structure: Choosing the Right Investment Vehicle in Private Markets

SPV vs Fund Structure: Choosing the Right Investment Vehicle in Private Markets

Read more

SPVs

SPV Investment Structure: How Special Purpose Vehicles Are Designed for Modern Investing

SPV Investment Structure: How Special Purpose Vehicles Are Designed for Modern Investing

Read more

SPVs

SPV Financing: A Complete Guide to Structure, Use Cases, and Investment Strategy

SPV Financing: A Complete Guide to Structure, Use Cases, and Investment Strategy

Read more

SPVs

Real Estate SPVs: A Modern Framework for Structured Property Investing

Real Estate SPVs: A Modern Framework for Structured Property Investing

Read more

SPVs

ADGM Private Company Limited by Shares: Allocations Research

ADGM Private Company Limited by Shares: Allocations Research

Read more

SPVs

Offshore Company vs Onshore Company: Key Differences Explained

Offshore Company vs Onshore Company: Key Differences Explained

Read more

SPVs

What Is Offshore? Meaning, Uses, and How Offshore Structures Work in 2026

What Is Offshore? Meaning, Uses, and How Offshore Structures Work in 2026

Read more

SPVs

The Best Fund Admins for Emerging VCs (2026)

The Best Fund Admins for Emerging VCs (2026)

Read more

SPVs

How to Choose the Right Jurisdiction for an Offshore Company

How to Choose the Right Jurisdiction for an Offshore Company

Read more

SPVs

How to Start an Offshore Company: Allocations Guide 2026

How to Start an Offshore Company: Allocations Guide 2026

Read more

SPVs

Types of Special Purpose Vehicles (SPVs) and How Allocations Powers Them

Types of Special Purpose Vehicles (SPVs) and How Allocations Powers Them

Read more

SPVs

SPV vs Fund: Choose better with Allocation

SPV vs Fund: Choose better with Allocation

Read more

SPVs

AngelList SPV vs Allocations SPV: Best SPV Platform for Fund Managers

AngelList SPV vs Allocations SPV: Best SPV Platform for Fund Managers

Read more

SPVs

Sydecar SPV vs Allocations SPV: What to chose in 2026

Sydecar SPV vs Allocations SPV: What to chose in 2026

Read more

SPVs

Best SPV Platform in the United States (USA) in 2026

Best SPV Platform in the United States (USA) in 2026

Read more

SPVs

Best SPV Platform in the United Arab Emirates (UAE) in 2026

Best SPV Platform in the United Arab Emirates (UAE) in 2026

Read more

SPVs

Carta Pricing vs Allocations Pricing (2026)

Carta Pricing vs Allocations Pricing (2026)

Read more

SPVs

AngelList Pricing vs Allocations Pricing (2026)

AngelList Pricing vs Allocations Pricing (2026)

Read more

SPVs

How to Invest into Real Estate with Allocations: A Beginner's Guide to SPV Funds

How to Invest into Real Estate with Allocations: A Beginner's Guide to SPV Funds

Read more

SPVs

Best Fund Admin & Reporting Tools for VC Investors in 2026: Allocations

Best Fund Admin & Reporting Tools for VC Investors in 2026: Allocations

Read more

SPVs

Convertible Notes: Early Stage Investing with Allocations

Convertible Notes: Early Stage Investing with Allocations

Read more

SPVs

Top 5 Value for Money SPV Platforms

Top 5 Value for Money SPV Platforms

Read more

SPVs

How SPV Pricing Works on Allocations

How SPV Pricing Works on Allocations

Read more

SPVs

Best Fund Admin in 2026: Why Allocations Leads

Best Fund Admin in 2026: Why Allocations Leads

Read more

SPVs

How Allocations Is Changing SPV & Fund Formation

How Allocations Is Changing SPV & Fund Formation

Read more

SPVs

What Makes Allocations the First Choice for Fund Administrators

What Makes Allocations the First Choice for Fund Administrators

Read more

SPVs

Why Choose Allocations for SPVs and Funds in 2026

Why Choose Allocations for SPVs and Funds in 2026

Read more

SPVs

Best SPV Platforms in 2026: Why Allocations

Best SPV Platforms in 2026: Why Allocations

Read more

SPVs

SPV & Fund Pricing in 2026: Allocations

SPV & Fund Pricing in 2026: Allocations

Read more

SPVs

Can I Have Non-U.S. Investors? A Practical Guide for SPVs and Fund Managers

Can I Have Non-U.S. Investors? A Practical Guide for SPVs and Fund Managers

Read more

SPVs

What Do I Need to Do Every Year as a Fund Manager?

What Do I Need to Do Every Year as a Fund Manager?

Read more

SPVs

Do I Need an ERA? A Practical Guide for Fund Managers

Do I Need an ERA? A Practical Guide for Fund Managers

Read more

SPVs

How Much Does It Cost to Create an SPV in 2026?

How Much Does It Cost to Create an SPV in 2026?

Read more

SPVs

Special Purpose Vehicle (SPV): Meaning in Finance, Banking and Real-World Examples

Special Purpose Vehicle (SPV): Meaning in Finance, Banking and Real-World Examples

Read more

SPVs

Top Fund Administration Platforms in 2026

Top Fund Administration Platforms in 2026

Read more

SPVs

Migrate Your Fund to Allocations: A Complete Guide for Fund Managers

Migrate Your Fund to Allocations: A Complete Guide for Fund Managers

Read more

SPVs

What Does “Offshore” Means?

What Does “Offshore” Means?

Read more

SPVs

Comparing 506b vs 506c for Private Fundraising

Comparing 506b vs 506c for Private Fundraising

Read more

SPVs

LLP vs LLC | Choose business structure with Allocations

LLP vs LLC | Choose business structure with Allocations

Read more

SPVs

SPV Meaning in Finance: Complete Guide to Special Purpose Vehicles (2026)

SPV Meaning in Finance: Complete Guide to Special Purpose Vehicles (2026)

Read more

SPVs

The Best AngelList Alternatives in 2026 (Detailed Comparison)

The Best AngelList Alternatives in 2026 (Detailed Comparison)

Read more

SPVs

Understanding Special Purpose Vehicles (SPVs)

Understanding Special Purpose Vehicles (SPVs)

Read more

SPVs

Special Purpose Vehicle (SPV): What It Is and Why Investors Use It

Special Purpose Vehicle (SPV): What It Is and Why Investors Use It

Read more

SPVs

Who Typically Uses SPVs?

Who Typically Uses SPVs?

Read more

SPVs

Understanding SPVs in the Context of Private Equity

Understanding SPVs in the Context of Private Equity

Read more

SPVs

Why Use an SPV for Investment?

Why Use an SPV for Investment?

Read more

SPVs

SPV for Late-Stage and Secondary Investments

SPV for Late-Stage and Secondary Investments

Read more

SPVs

SPV Investment Structures: How Money Flows from Investors to Startups

SPV Investment Structures: How Money Flows from Investors to Startups

Read more

SPVs

SPV Management 101: What Happens After the Deal Closes

SPV Management 101: What Happens After the Deal Closes

Read more

SPVs

SPV in Venture Capital vs Traditional VC Funds: What Investors Need to Know

SPV in Venture Capital vs Traditional VC Funds: What Investors Need to Know

Read more

SPVs

SPV Structures in 2026: How Special Purpose Vehicles Are Evolving in Private Markets

SPV Structures in 2026: How Special Purpose Vehicles Are Evolving in Private Markets

Read more

SPVs

Real Estate SPV: A Complete Guide to Structuring Property Investments with Allocations

Real Estate SPV: A Complete Guide to Structuring Property Investments with Allocations

Read more

SPVs

Best SPV Platform in 2026: Features, Pricing, Compliance & How to Choose

Best SPV Platform in 2026: Features, Pricing, Compliance & How to Choose

Read more

SPVs

Top SPV Platforms in 2026: A Complete Comparison

Top SPV Platforms in 2026: A Complete Comparison

Read more

SPVs

SPV Structure and Governance: Who Controls What?

SPV Structure and Governance: Who Controls What?

Read more

SPVs

SPV Structure Explained: How SPVs Work for Private Investments

SPV Structure Explained: How SPVs Work for Private Investments

Read more

SPVs

Why Special Purpose Vehicles (SPVs) Are Becoming Essential in Modern Investing

Why Special Purpose Vehicles (SPVs) Are Becoming Essential in Modern Investing

Read more

SPVs

Understanding SPV Structures

Understanding SPV Structures

Read more

SPVs

Inside DATCOs: The Rise of Digital Asset Treasury Companies | Allocations

Inside DATCOs: The Rise of Digital Asset Treasury Companies | Allocations

Read more

SPVs

DATCO Stock Performance vs Bitcoin Price: Where to Invest in 2026

DATCO Stock Performance vs Bitcoin Price: Where to Invest in 2026

Read more

SPVs

Private Markets Aren’t Broken, They’re Just Waiting for Better Tools

Private Markets Aren’t Broken, They’re Just Waiting for Better Tools

Read more

SPVs

Digital Asset Treasury Companies: The DATCO Era Begins | Allocations

Digital Asset Treasury Companies: The DATCO Era Begins | Allocations

Read more

SPVs

How Allocations Redefines SPVs, Fund Formation, and Fund Management Software for Today’s Investment Managers

How Allocations Redefines SPVs, Fund Formation, and Fund Management Software for Today’s Investment Managers

Read more

SPVs

How VCs Are Scaling Trust, Not Just Capital

How VCs Are Scaling Trust, Not Just Capital

Read more

SPVs

Digital Asset Treasury Companies (DATCOs) vs Bitcoin ETFs: What’s the Difference?

Digital Asset Treasury Companies (DATCOs) vs Bitcoin ETFs: What’s the Difference?

Read more

SPVs

The 10-Minute Fund: What Instant Fund Formation Really Means

The 10-Minute Fund: What Instant Fund Formation Really Means

Read more

SPVs

Allocation IRR: Measuring Returns in Private Market Deals

Allocation IRR: Measuring Returns in Private Market Deals

Read more

SPVs

How Much Does It Cost to Start an SPV in 2025?

How Much Does It Cost to Start an SPV in 2025?

Read more

SPVs

Allocations Pricing Explained: Transparent, Flat-Fee Fund Administration for SPVs and Funds

Allocations Pricing Explained: Transparent, Flat-Fee Fund Administration for SPVs and Funds

Read more

SPVs

Private Equity SPVs: How Allocations Automates Fund Formation for Modern Investors

Private Equity SPVs: How Allocations Automates Fund Formation for Modern Investors

Read more

SPVs

From Term Sheet to Close: How Automated Deal Execution Platforms Speed Up Venture Investing

From Term Sheet to Close: How Automated Deal Execution Platforms Speed Up Venture Investing

Read more

SPVs

Why Modern Fund Managers Need Better Infrastructure

Why Modern Fund Managers Need Better Infrastructure

Read more

SPVs

AngelList vs Sydecar vs Allocations: The 2025 SPV Platform Showdown

AngelList vs Sydecar vs Allocations: The 2025 SPV Platform Showdown

Read more

SPVs

Fund Setup Software: Building Your First Fund With Allocations

Fund Setup Software: Building Your First Fund With Allocations

Read more

SPVs

Understanding 506(b) Funds: How Private Offerings Stay Compliant

Understanding 506(b) Funds: How Private Offerings Stay Compliant

Read more

SPVs

Allocations: The Complete Guide to Modern Fund Management

Allocations: The Complete Guide to Modern Fund Management

Read more

SPVs

Emerging Managers 101: Why SPVs Are the Easiest Way to Start Raising Capital

Emerging Managers 101: Why SPVs Are the Easiest Way to Start Raising Capital

Read more

SPVs

Asset Allocation Strategies for Modern Portfolios in 2025 ft. Allocations

Asset Allocation Strategies for Modern Portfolios in 2025 ft. Allocations

Read more

SPVs

Deal Allocation Tools: How to Streamline Investor Access to Opportunities

Deal Allocation Tools: How to Streamline Investor Access to Opportunities

Read more

SPVs

SPV Fees Explained: What Sponsors and Investors Should Know

SPV Fees Explained: What Sponsors and Investors Should Know

Read more

SPVs

How to Set Up an SPV: Step-by-Step Guide for Sponsors and Investors

How to Set Up an SPV: Step-by-Step Guide for Sponsors and Investors

Read more

SPVs

Why Delaware for SPVs? Investor Trust, Legal Clarity, Faster Closes

Why Delaware for SPVs? Investor Trust, Legal Clarity, Faster Closes

Read more

SPVs

Best SPV Platform in 2025? Features, Pricing, and How to Choose

Best SPV Platform in 2025? Features, Pricing, and How to Choose

Read more

SPVs

SPV Exit Strategies: What Happens When the Deal Closes

SPV Exit Strategies: What Happens When the Deal Closes

Read more

SPVs

Side Letters in SPVs: What You Need to Know

Side Letters in SPVs: What You Need to Know

Read more

SPVs

SPV K-1 Tax Reporting: What Sponsors and Investors Need to Know (2025 Guide)

SPV K-1 Tax Reporting: What Sponsors and Investors Need to Know (2025 Guide)

Read more

SPVs

What Does an SPV Company Do? (2025 Guide)

What Does an SPV Company Do? (2025 Guide)

Read more

SPVs

Real Estate SPV vs LLC: Which Is Better for Property Investment?

Real Estate SPV vs LLC: Which Is Better for Property Investment?

Read more

SPVs

SPV Tax Reporting: A Complete Guide for Sponsors and Investors

SPV Tax Reporting: A Complete Guide for Sponsors and Investors

Read more

SPVs

The Role of Allocations in Modern Asset Management

The Role of Allocations in Modern Asset Management

Read more

SPVs

Form D & Blue Sky Law Compliance for SPVs: What Sponsors Need to Know

Form D & Blue Sky Law Compliance for SPVs: What Sponsors Need to Know

Read more

SPVs

SPV Company vs Fund: Which Is Right for Your Deal?

SPV Company vs Fund: Which Is Right for Your Deal?

Read more

SPVs

SPV Platform: The Complete 2025 Guide (ft. Allocations)

SPV Platform: The Complete 2025 Guide (ft. Allocations)

Read more

SPVs

How to Choose the Best SPV Platform: A 15-Point Buyer’s Checklist

How to Choose the Best SPV Platform: A 15-Point Buyer’s Checklist

Read more

Fund Manager

What is an SPV? The Definitive Guide to Special Purpose Vehicles

What is an SPV? The Definitive Guide to Special Purpose Vehicles

Read more

Fund Manager

5 best books to read If you’re forging a path in VC

5 best books to read If you’re forging a path in VC

Read more

Investor Spotlight

Investor spotlight: Alex Fisher

Investor spotlight: Alex Fisher

Read more

SPVs

6 unique use cases for SPVs

6 unique use cases for SPVs

Read more

Market Trends

The SPV ecosystem democratizing alternative investments

The SPV ecosystem democratizing alternative investments

Read more

Company

How to write a stellar investor update

How to write a stellar investor update

Read more

Analytics

What’s going on here? 1 in 10 US households now qualify as accredited investors

What’s going on here? 1 in 10 US households now qualify as accredited investors

Read more

Market Trends

SPVs by sector

SPVs by sector

Read more

Market Trends

5 Benefits of a hybrid SPV + fund strategy

5 Benefits of a hybrid SPV + fund strategy

Read more

Products

What is the difference between 506b and 506c funds?

What is the difference between 506b and 506c funds?

Read more

Fund Manager

Why Allocations is the best choice for fast moving fund managers

Why Allocations is the best choice for fast moving fund managers

Read more

Fund Manager

When should fund managers use a fund vs an SPV?

When should fund managers use a fund vs an SPV?

Read more

Fund Manager

10 best practices for first-time fund managers

10 best practices for first-time fund managers

Read more

Analytics

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Read more

Market Trends

Private market trends: where are fund managers looking in 2022?

Private market trends: where are fund managers looking in 2022?

Read more

Fund Manager

5 female VCs on the rise in 2022

5 female VCs on the rise in 2022

Read more

Analytics

The new competitive edge for VCs and fund managers

The new competitive edge for VCs and fund managers

Read more

Analytics

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

Read more

Investor Spotlight

Investor spotlight: Olga Yermolenko

Investor spotlight: Olga Yermolenko

Read more

Analytics

3 stats that show the democratization of VC in 2021

3 stats that show the democratization of VC in 2021

Read more

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc