Back

SPVs

SPV in Venture Capital: How SPVs Are Used to Invest in Startups

SPV in Venture Capital: How SPVs Are Used to Invest in Startups

SPV in Venture Capital: How SPVs Are Used to Invest in Startups

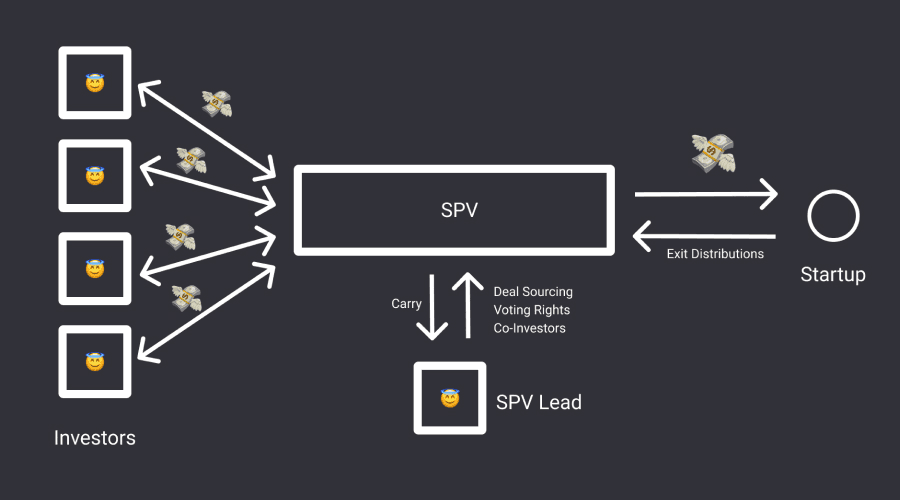

In modern venture capital, Special Purpose Vehicles, commonly known as SPVs, have become one of the most important structural tools for investing in startups. While they often operate quietly in the background, SPVs now power a large share of angel rounds, syndicates, scout programs, and even late-stage private transactions.

At their core, SPVs solve a simple but critical problem. Early-stage and growth companies want capital, but they do not want dozens or hundreds of small investors cluttering their cap table. Investors, on the other hand, want access to high-quality private deals without needing to commit to an entire fund or manage complex legal and tax work on their own. The SPV sits between these two needs and makes the transaction work smoothly for both sides.

What Is an SPV in Venture Capital?

An SPV in venture capital is a single-purpose investment vehicle created to invest in one specific startup. Instead of each investor writing a check directly to the company, investors pool their capital into the SPV. The SPV then makes one consolidated investment into the startup and appears on the cap table as a single shareholder.

From the company’s perspective, this keeps ownership clean and governance simple. From the investor’s perspective, it provides access to deals that might otherwise be difficult or impossible to participate in individually. The SPV holds the shares, manages distributions, and handles ongoing administration until the investment exits.

This structure is now widely used across early-stage and late-stage venture deals, particularly as private markets have grown more competitive and globally distributed.

How SPVs Are Commonly Used in Venture Deals

SPVs show up across many parts of the venture ecosystem. Angel syndicates use SPVs to allow a lead investor to bring together dozens of smaller checks into a single allocation. Rolling funds and scout programs rely on SPVs to back individual companies without creating a new blind-pool fund for each strategy. Founder-led rounds often use SPVs when a startup wants to raise capital from a trusted network without opening the round to a broad set of direct investors.

SPVs are also increasingly common in late-stage secondary transactions. As companies stay private longer, employees and early investors look for liquidity before an IPO. SPVs allow buyers to purchase blocks of private shares while keeping the cap table streamlined and compliant.

High-profile companies such as SpaceX have frequently been accessed through SPV structures, allowing investors to participate in private rounds without the operational burden of direct ownership. Large hedge funds and family offices, including structures similar to those used by Citadel, also rely on SPVs to isolate exposure to specific deals or strategies.

SPV Fund vs SPV Company vs SPV LLC

Although the terminology varies, most venture SPVs fall into a small number of structural categories. An SPV fund typically refers to a pooled investment vehicle that brings together multiple investors for a single deal, often structured as a limited partnership or limited liability company. An SPV company is a broader term describing any standalone legal entity created for a specific transaction. In practice, most US-based venture SPVs are formed as SPV LLCs, which offer flexibility, pass-through taxation, and straightforward governance.

The phrase “SPV vehicle” is often used generically to describe any of these structures. Regardless of the label, the defining characteristic is that the entity exists for one investment and one investment only.

Bankruptcy-Remote SPVs and Risk Isolation

One of the most important but least understood features of an SPV is bankruptcy remoteness. A bankruptcy-remote SPV is structured so that its assets are legally separated from the sponsor or manager. If the sponsor encounters financial trouble, creditors cannot claim the assets held inside the SPV.

This separation is essential in venture capital, where investors expect their exposure to be limited strictly to the underlying startup. Bankruptcy remoteness is achieved through careful legal design, including independent governance provisions, narrowly defined operating purposes, ring-fenced bank accounts, and tightly drafted SPV agreements.

Beyond venture capital, bankruptcy-remote SPVs are also critical in credit strategies, securitization structures, and tokenized funds. As private markets become more complex and interconnected, this level of legal isolation is no longer optional. It is foundational.

SPV Accounts, Banking, and Capital Flow

Every SPV requires its own dedicated bank account. This is not just a best practice but a core compliance requirement. Investor funds must never be commingled with the sponsor’s operating accounts or with other vehicles. A clean banking setup ensures a clear audit trail, accurate reporting, and smooth distributions when liquidity events occur.

Modern SPV platforms now handle much of this complexity behind the scenes. They support bank account setup, capital calls, investor wiring, and distributions within a single system. This is where platforms like Allocations differentiate themselves by offering end-to-end SPV management rather than forcing managers to stitch together legal firms, banks, and spreadsheets.

How SPVs Are Formed

The formation of an SPV follows a relatively standard process. First, the sponsor selects a jurisdiction, most commonly Delaware for US deals or offshore jurisdictions such as the Cayman Islands for international structures. Next, the legal entity is formed as an LLC or limited partnership. The governing documents are drafted, including the operating or partnership agreement and investor subscription documents. A dedicated bank account is opened, investors are onboarded through KYC and AML checks, and capital is collected. Once the close is complete, the SPV deploys capital into the target startup.

What once took weeks or even months can now be completed in a matter of days with the right infrastructure in place.

SPV Agreements and Legal Governance

The SPV agreement is the legal backbone of the vehicle. It defines investor rights, economic terms, management fees, carried interest, voting mechanics, and how exits and distributions are handled. Depending on the structure, this may take the form of an LLC operating agreement or a limited partnership agreement, supplemented by subscription documents and side letters.

Well-drafted SPV agreements are critical not only for investor protection but also for operational efficiency. Clear terms reduce friction during exits and ensure that distributions are handled predictably.

SPV Loans and Credit Structures

In some cases, SPVs may also take on debt. An SPV loan allows the vehicle to borrow capital while keeping liability isolated from the sponsor. The assets held inside the SPV typically serve as collateral. This approach is used in venture debt, real estate SPVs, structured credit, and revenue-based financing strategies. As private credit markets expand, loan-enabled SPVs are becoming more common.

Ongoing SPV Management

SPV management does not end once the investment is made. Ongoing responsibilities include investor communications, tax filings such as K-1s, regulatory filings like Form D, distribution processing, and exit management. Audits may also be required depending on the structure and investor base.

Because of this ongoing workload, many investors and managers now prefer full-service SPV platforms over do-it-yourself approaches.

Comparing SPV Platforms

Traditional tools like Carta offer SPVs as an extension of their cap table services, but SPVs are not their core focus. Sydecar specializes in venture syndicates but remains largely VC-specific. Newer platforms such as Allocations aim to cover SPVs, funds, and emerging asset classes within a single infrastructure layer.

Modern SPV managers increasingly expect faster closes, support for international investors, flexibility across asset types, predictable pricing, and automation rather than manual paperwork.

Why SPVs Matter Going Forward

SPVs are no longer a niche tool used only by sophisticated funds. They have become the default building block of private market investing across venture capital, real estate, private credit, and digital assets. As ownership structures evolve and private markets continue to grow, SPVs will only become more central.

If you invest in private markets today, you are almost certainly using SPVs, whether directly or indirectly. Understanding how they work is no longer optional. It is foundational to modern investing.

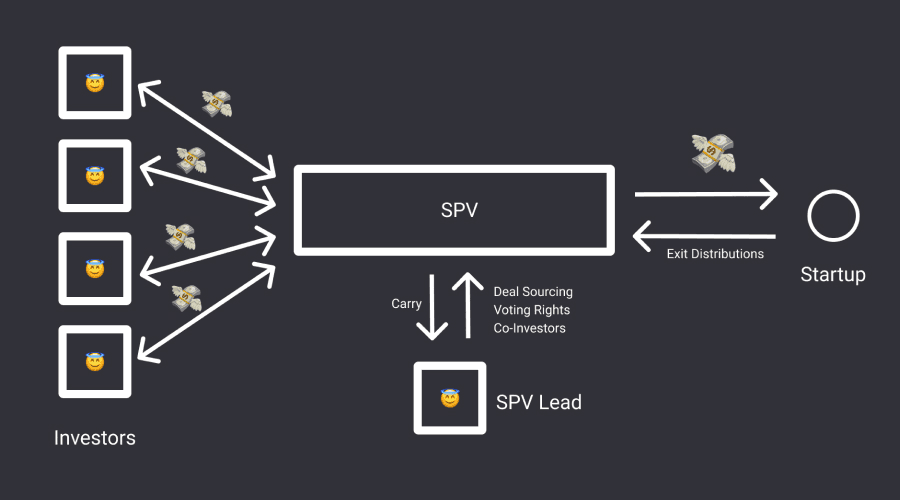

In modern venture capital, Special Purpose Vehicles, commonly known as SPVs, have become one of the most important structural tools for investing in startups. While they often operate quietly in the background, SPVs now power a large share of angel rounds, syndicates, scout programs, and even late-stage private transactions.

At their core, SPVs solve a simple but critical problem. Early-stage and growth companies want capital, but they do not want dozens or hundreds of small investors cluttering their cap table. Investors, on the other hand, want access to high-quality private deals without needing to commit to an entire fund or manage complex legal and tax work on their own. The SPV sits between these two needs and makes the transaction work smoothly for both sides.

What Is an SPV in Venture Capital?

An SPV in venture capital is a single-purpose investment vehicle created to invest in one specific startup. Instead of each investor writing a check directly to the company, investors pool their capital into the SPV. The SPV then makes one consolidated investment into the startup and appears on the cap table as a single shareholder.

From the company’s perspective, this keeps ownership clean and governance simple. From the investor’s perspective, it provides access to deals that might otherwise be difficult or impossible to participate in individually. The SPV holds the shares, manages distributions, and handles ongoing administration until the investment exits.

This structure is now widely used across early-stage and late-stage venture deals, particularly as private markets have grown more competitive and globally distributed.

How SPVs Are Commonly Used in Venture Deals

SPVs show up across many parts of the venture ecosystem. Angel syndicates use SPVs to allow a lead investor to bring together dozens of smaller checks into a single allocation. Rolling funds and scout programs rely on SPVs to back individual companies without creating a new blind-pool fund for each strategy. Founder-led rounds often use SPVs when a startup wants to raise capital from a trusted network without opening the round to a broad set of direct investors.

SPVs are also increasingly common in late-stage secondary transactions. As companies stay private longer, employees and early investors look for liquidity before an IPO. SPVs allow buyers to purchase blocks of private shares while keeping the cap table streamlined and compliant.

High-profile companies such as SpaceX have frequently been accessed through SPV structures, allowing investors to participate in private rounds without the operational burden of direct ownership. Large hedge funds and family offices, including structures similar to those used by Citadel, also rely on SPVs to isolate exposure to specific deals or strategies.

SPV Fund vs SPV Company vs SPV LLC

Although the terminology varies, most venture SPVs fall into a small number of structural categories. An SPV fund typically refers to a pooled investment vehicle that brings together multiple investors for a single deal, often structured as a limited partnership or limited liability company. An SPV company is a broader term describing any standalone legal entity created for a specific transaction. In practice, most US-based venture SPVs are formed as SPV LLCs, which offer flexibility, pass-through taxation, and straightforward governance.

The phrase “SPV vehicle” is often used generically to describe any of these structures. Regardless of the label, the defining characteristic is that the entity exists for one investment and one investment only.

Bankruptcy-Remote SPVs and Risk Isolation

One of the most important but least understood features of an SPV is bankruptcy remoteness. A bankruptcy-remote SPV is structured so that its assets are legally separated from the sponsor or manager. If the sponsor encounters financial trouble, creditors cannot claim the assets held inside the SPV.

This separation is essential in venture capital, where investors expect their exposure to be limited strictly to the underlying startup. Bankruptcy remoteness is achieved through careful legal design, including independent governance provisions, narrowly defined operating purposes, ring-fenced bank accounts, and tightly drafted SPV agreements.

Beyond venture capital, bankruptcy-remote SPVs are also critical in credit strategies, securitization structures, and tokenized funds. As private markets become more complex and interconnected, this level of legal isolation is no longer optional. It is foundational.

SPV Accounts, Banking, and Capital Flow

Every SPV requires its own dedicated bank account. This is not just a best practice but a core compliance requirement. Investor funds must never be commingled with the sponsor’s operating accounts or with other vehicles. A clean banking setup ensures a clear audit trail, accurate reporting, and smooth distributions when liquidity events occur.

Modern SPV platforms now handle much of this complexity behind the scenes. They support bank account setup, capital calls, investor wiring, and distributions within a single system. This is where platforms like Allocations differentiate themselves by offering end-to-end SPV management rather than forcing managers to stitch together legal firms, banks, and spreadsheets.

How SPVs Are Formed

The formation of an SPV follows a relatively standard process. First, the sponsor selects a jurisdiction, most commonly Delaware for US deals or offshore jurisdictions such as the Cayman Islands for international structures. Next, the legal entity is formed as an LLC or limited partnership. The governing documents are drafted, including the operating or partnership agreement and investor subscription documents. A dedicated bank account is opened, investors are onboarded through KYC and AML checks, and capital is collected. Once the close is complete, the SPV deploys capital into the target startup.

What once took weeks or even months can now be completed in a matter of days with the right infrastructure in place.

SPV Agreements and Legal Governance

The SPV agreement is the legal backbone of the vehicle. It defines investor rights, economic terms, management fees, carried interest, voting mechanics, and how exits and distributions are handled. Depending on the structure, this may take the form of an LLC operating agreement or a limited partnership agreement, supplemented by subscription documents and side letters.

Well-drafted SPV agreements are critical not only for investor protection but also for operational efficiency. Clear terms reduce friction during exits and ensure that distributions are handled predictably.

SPV Loans and Credit Structures

In some cases, SPVs may also take on debt. An SPV loan allows the vehicle to borrow capital while keeping liability isolated from the sponsor. The assets held inside the SPV typically serve as collateral. This approach is used in venture debt, real estate SPVs, structured credit, and revenue-based financing strategies. As private credit markets expand, loan-enabled SPVs are becoming more common.

Ongoing SPV Management

SPV management does not end once the investment is made. Ongoing responsibilities include investor communications, tax filings such as K-1s, regulatory filings like Form D, distribution processing, and exit management. Audits may also be required depending on the structure and investor base.

Because of this ongoing workload, many investors and managers now prefer full-service SPV platforms over do-it-yourself approaches.

Comparing SPV Platforms

Traditional tools like Carta offer SPVs as an extension of their cap table services, but SPVs are not their core focus. Sydecar specializes in venture syndicates but remains largely VC-specific. Newer platforms such as Allocations aim to cover SPVs, funds, and emerging asset classes within a single infrastructure layer.

Modern SPV managers increasingly expect faster closes, support for international investors, flexibility across asset types, predictable pricing, and automation rather than manual paperwork.

Why SPVs Matter Going Forward

SPVs are no longer a niche tool used only by sophisticated funds. They have become the default building block of private market investing across venture capital, real estate, private credit, and digital assets. As ownership structures evolve and private markets continue to grow, SPVs will only become more central.

If you invest in private markets today, you are almost certainly using SPVs, whether directly or indirectly. Understanding how they work is no longer optional. It is foundational to modern investing.

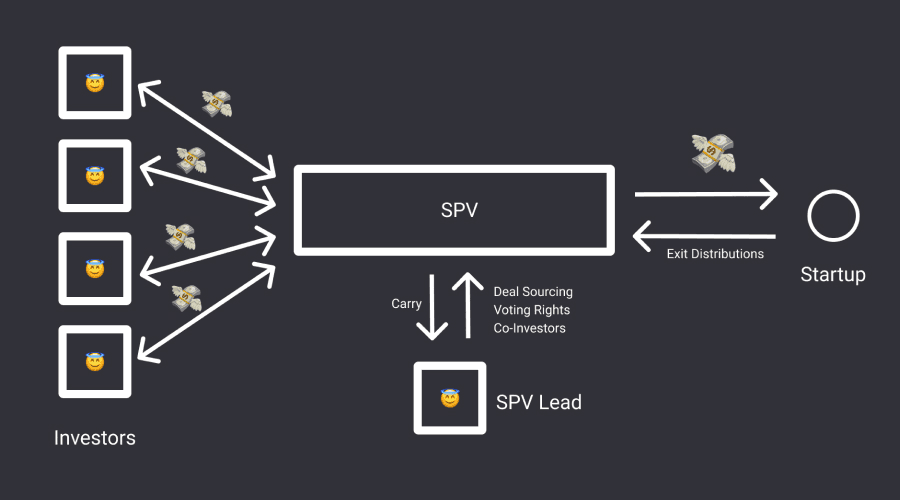

In modern venture capital, Special Purpose Vehicles, commonly known as SPVs, have become one of the most important structural tools for investing in startups. While they often operate quietly in the background, SPVs now power a large share of angel rounds, syndicates, scout programs, and even late-stage private transactions.

At their core, SPVs solve a simple but critical problem. Early-stage and growth companies want capital, but they do not want dozens or hundreds of small investors cluttering their cap table. Investors, on the other hand, want access to high-quality private deals without needing to commit to an entire fund or manage complex legal and tax work on their own. The SPV sits between these two needs and makes the transaction work smoothly for both sides.

What Is an SPV in Venture Capital?

An SPV in venture capital is a single-purpose investment vehicle created to invest in one specific startup. Instead of each investor writing a check directly to the company, investors pool their capital into the SPV. The SPV then makes one consolidated investment into the startup and appears on the cap table as a single shareholder.

From the company’s perspective, this keeps ownership clean and governance simple. From the investor’s perspective, it provides access to deals that might otherwise be difficult or impossible to participate in individually. The SPV holds the shares, manages distributions, and handles ongoing administration until the investment exits.

This structure is now widely used across early-stage and late-stage venture deals, particularly as private markets have grown more competitive and globally distributed.

How SPVs Are Commonly Used in Venture Deals

SPVs show up across many parts of the venture ecosystem. Angel syndicates use SPVs to allow a lead investor to bring together dozens of smaller checks into a single allocation. Rolling funds and scout programs rely on SPVs to back individual companies without creating a new blind-pool fund for each strategy. Founder-led rounds often use SPVs when a startup wants to raise capital from a trusted network without opening the round to a broad set of direct investors.

SPVs are also increasingly common in late-stage secondary transactions. As companies stay private longer, employees and early investors look for liquidity before an IPO. SPVs allow buyers to purchase blocks of private shares while keeping the cap table streamlined and compliant.

High-profile companies such as SpaceX have frequently been accessed through SPV structures, allowing investors to participate in private rounds without the operational burden of direct ownership. Large hedge funds and family offices, including structures similar to those used by Citadel, also rely on SPVs to isolate exposure to specific deals or strategies.

SPV Fund vs SPV Company vs SPV LLC

Although the terminology varies, most venture SPVs fall into a small number of structural categories. An SPV fund typically refers to a pooled investment vehicle that brings together multiple investors for a single deal, often structured as a limited partnership or limited liability company. An SPV company is a broader term describing any standalone legal entity created for a specific transaction. In practice, most US-based venture SPVs are formed as SPV LLCs, which offer flexibility, pass-through taxation, and straightforward governance.

The phrase “SPV vehicle” is often used generically to describe any of these structures. Regardless of the label, the defining characteristic is that the entity exists for one investment and one investment only.

Bankruptcy-Remote SPVs and Risk Isolation

One of the most important but least understood features of an SPV is bankruptcy remoteness. A bankruptcy-remote SPV is structured so that its assets are legally separated from the sponsor or manager. If the sponsor encounters financial trouble, creditors cannot claim the assets held inside the SPV.

This separation is essential in venture capital, where investors expect their exposure to be limited strictly to the underlying startup. Bankruptcy remoteness is achieved through careful legal design, including independent governance provisions, narrowly defined operating purposes, ring-fenced bank accounts, and tightly drafted SPV agreements.

Beyond venture capital, bankruptcy-remote SPVs are also critical in credit strategies, securitization structures, and tokenized funds. As private markets become more complex and interconnected, this level of legal isolation is no longer optional. It is foundational.

SPV Accounts, Banking, and Capital Flow

Every SPV requires its own dedicated bank account. This is not just a best practice but a core compliance requirement. Investor funds must never be commingled with the sponsor’s operating accounts or with other vehicles. A clean banking setup ensures a clear audit trail, accurate reporting, and smooth distributions when liquidity events occur.

Modern SPV platforms now handle much of this complexity behind the scenes. They support bank account setup, capital calls, investor wiring, and distributions within a single system. This is where platforms like Allocations differentiate themselves by offering end-to-end SPV management rather than forcing managers to stitch together legal firms, banks, and spreadsheets.

How SPVs Are Formed

The formation of an SPV follows a relatively standard process. First, the sponsor selects a jurisdiction, most commonly Delaware for US deals or offshore jurisdictions such as the Cayman Islands for international structures. Next, the legal entity is formed as an LLC or limited partnership. The governing documents are drafted, including the operating or partnership agreement and investor subscription documents. A dedicated bank account is opened, investors are onboarded through KYC and AML checks, and capital is collected. Once the close is complete, the SPV deploys capital into the target startup.

What once took weeks or even months can now be completed in a matter of days with the right infrastructure in place.

SPV Agreements and Legal Governance

The SPV agreement is the legal backbone of the vehicle. It defines investor rights, economic terms, management fees, carried interest, voting mechanics, and how exits and distributions are handled. Depending on the structure, this may take the form of an LLC operating agreement or a limited partnership agreement, supplemented by subscription documents and side letters.

Well-drafted SPV agreements are critical not only for investor protection but also for operational efficiency. Clear terms reduce friction during exits and ensure that distributions are handled predictably.

SPV Loans and Credit Structures

In some cases, SPVs may also take on debt. An SPV loan allows the vehicle to borrow capital while keeping liability isolated from the sponsor. The assets held inside the SPV typically serve as collateral. This approach is used in venture debt, real estate SPVs, structured credit, and revenue-based financing strategies. As private credit markets expand, loan-enabled SPVs are becoming more common.

Ongoing SPV Management

SPV management does not end once the investment is made. Ongoing responsibilities include investor communications, tax filings such as K-1s, regulatory filings like Form D, distribution processing, and exit management. Audits may also be required depending on the structure and investor base.

Because of this ongoing workload, many investors and managers now prefer full-service SPV platforms over do-it-yourself approaches.

Comparing SPV Platforms

Traditional tools like Carta offer SPVs as an extension of their cap table services, but SPVs are not their core focus. Sydecar specializes in venture syndicates but remains largely VC-specific. Newer platforms such as Allocations aim to cover SPVs, funds, and emerging asset classes within a single infrastructure layer.

Modern SPV managers increasingly expect faster closes, support for international investors, flexibility across asset types, predictable pricing, and automation rather than manual paperwork.

Why SPVs Matter Going Forward

SPVs are no longer a niche tool used only by sophisticated funds. They have become the default building block of private market investing across venture capital, real estate, private credit, and digital assets. As ownership structures evolve and private markets continue to grow, SPVs will only become more central.

If you invest in private markets today, you are almost certainly using SPVs, whether directly or indirectly. Understanding how they work is no longer optional. It is foundational to modern investing.

Take the next step with Allocations

Take the next step with Allocations

Take the next step with Allocations

SPVs

Top Upcoming IPOs in 2026 : Allocations Research

Top Upcoming IPOs in 2026 : Allocations Research

Read more

SPVs

Why Digital Asset Treasury Companies (DATCOs) Will Lead 2026

Why Digital Asset Treasury Companies (DATCOs) Will Lead 2026

Read more

Company

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Read more

SPVs

How do you structure an SPV into another SPV?

How do you structure an SPV into another SPV?

Read more

SPVs

What are secondary SPVs?

What are secondary SPVs?

Read more

Fund Manager

Watch out school VC: the podcasters are coming

Watch out school VC: the podcasters are coming

Read more

Fund Manager

Fast, hassle-free SPVs mean more time for due diligence

Fast, hassle-free SPVs mean more time for due diligence

Read more

Analytics

The rise of opportunity funds and why fund managers might need to start using them

The rise of opportunity funds and why fund managers might need to start using them

Read more

Analytics

Move as fast as founders do with instant SPVs

Move as fast as founders do with instant SPVs

Read more

Fund Manager

4 practical things LPs and fund managers need to know for tax season

4 practical things LPs and fund managers need to know for tax season

Read more

Fund Manager

Keep up with these 4 VC firms focused on crypto and blockchain

Keep up with these 4 VC firms focused on crypto and blockchain

Read more

Fund Manager

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Read more

Company

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Read more

SPVs

SPV in Venture Capital: How SPVs Are Used to Invest in Startups

SPV in Venture Capital: How SPVs Are Used to Invest in Startups

Read more

SPVs

Types of SPV: Allocations Research 2026

Types of SPV: Allocations Research 2026

Read more

SPVs

Setup your next entity in GIFT City with Allocations

Setup your next entity in GIFT City with Allocations

Read more

SPVs

What Is an SPV in Business? Real-World Examples and the Role of SPVs in Private Equity

What Is an SPV in Business? Real-World Examples and the Role of SPVs in Private Equity

Read more

SPVs

Why Allocations Is the Best Fund Admin?

Why Allocations Is the Best Fund Admin?

Read more

SPVs

SPV Syndicate Fundraising: How Syndicates Use Special Purpose Vehicles to Raise Capital Efficiently

SPV Syndicate Fundraising: How Syndicates Use Special Purpose Vehicles to Raise Capital Efficiently

Read more

SPVs

SPV Fundraising: How Special Purpose Vehicles Are Transforming Deal-Based Capital Formation

SPV Fundraising: How Special Purpose Vehicles Are Transforming Deal-Based Capital Formation

Read more

SPVs

SPV Capital Raising: How SPVs Enable Efficient Deal-Based Funding

SPV Capital Raising: How SPVs Enable Efficient Deal-Based Funding

Read more

SPVs

SPV vs Fund Structure: Choosing the Right Investment Vehicle in Private Markets

SPV vs Fund Structure: Choosing the Right Investment Vehicle in Private Markets

Read more

SPVs

SPV Investment Structure: How Special Purpose Vehicles Are Designed for Modern Investing

SPV Investment Structure: How Special Purpose Vehicles Are Designed for Modern Investing

Read more

SPVs

SPV Financing: A Complete Guide to Structure, Use Cases, and Investment Strategy

SPV Financing: A Complete Guide to Structure, Use Cases, and Investment Strategy

Read more

SPVs

Real Estate SPVs: A Modern Framework for Structured Property Investing

Real Estate SPVs: A Modern Framework for Structured Property Investing

Read more

SPVs

ADGM Private Company Limited by Shares: Allocations Research

ADGM Private Company Limited by Shares: Allocations Research

Read more

SPVs

Offshore Company vs Onshore Company: Key Differences Explained

Offshore Company vs Onshore Company: Key Differences Explained

Read more

SPVs

What Is Offshore? Meaning, Uses, and How Offshore Structures Work in 2026

What Is Offshore? Meaning, Uses, and How Offshore Structures Work in 2026

Read more

SPVs

The Best Fund Admins for Emerging VCs (2026)

The Best Fund Admins for Emerging VCs (2026)

Read more

SPVs

How to Choose the Right Jurisdiction for an Offshore Company

How to Choose the Right Jurisdiction for an Offshore Company

Read more

SPVs

How to Start an Offshore Company: Allocations Guide 2026

How to Start an Offshore Company: Allocations Guide 2026

Read more

SPVs

Types of Special Purpose Vehicles (SPVs) and How Allocations Powers Them

Types of Special Purpose Vehicles (SPVs) and How Allocations Powers Them

Read more

SPVs

SPV vs Fund: Choose better with Allocation

SPV vs Fund: Choose better with Allocation

Read more

SPVs

AngelList SPV vs Allocations SPV: Best SPV Platform for Fund Managers

AngelList SPV vs Allocations SPV: Best SPV Platform for Fund Managers

Read more

SPVs

Sydecar SPV vs Allocations SPV: What to chose in 2026

Sydecar SPV vs Allocations SPV: What to chose in 2026

Read more

SPVs

Best SPV Platform in the United States (USA) in 2026

Best SPV Platform in the United States (USA) in 2026

Read more

SPVs

Best SPV Platform in the United Arab Emirates (UAE) in 2026

Best SPV Platform in the United Arab Emirates (UAE) in 2026

Read more

SPVs

Carta Pricing vs Allocations Pricing (2026)

Carta Pricing vs Allocations Pricing (2026)

Read more

SPVs

AngelList Pricing vs Allocations Pricing (2026)

AngelList Pricing vs Allocations Pricing (2026)

Read more

SPVs

How to Invest into Real Estate with Allocations: A Beginner's Guide to SPV Funds

How to Invest into Real Estate with Allocations: A Beginner's Guide to SPV Funds

Read more

SPVs

Best Fund Admin & Reporting Tools for VC Investors in 2026: Allocations

Best Fund Admin & Reporting Tools for VC Investors in 2026: Allocations

Read more

SPVs

Convertible Notes: Early Stage Investing with Allocations

Convertible Notes: Early Stage Investing with Allocations

Read more

SPVs

Top 5 Value for Money SPV Platforms

Top 5 Value for Money SPV Platforms

Read more

SPVs

How SPV Pricing Works on Allocations

How SPV Pricing Works on Allocations

Read more

SPVs

Best Fund Admin in 2026: Why Allocations Leads

Best Fund Admin in 2026: Why Allocations Leads

Read more

SPVs

How Allocations Is Changing SPV & Fund Formation

How Allocations Is Changing SPV & Fund Formation

Read more

SPVs

What Makes Allocations the First Choice for Fund Administrators

What Makes Allocations the First Choice for Fund Administrators

Read more

SPVs

Why Choose Allocations for SPVs and Funds in 2026

Why Choose Allocations for SPVs and Funds in 2026

Read more

SPVs

Best SPV Platforms in 2026: Why Allocations

Best SPV Platforms in 2026: Why Allocations

Read more

SPVs

SPV & Fund Pricing in 2026: Allocations

SPV & Fund Pricing in 2026: Allocations

Read more

SPVs

Can I Have Non-U.S. Investors? A Practical Guide for SPVs and Fund Managers

Can I Have Non-U.S. Investors? A Practical Guide for SPVs and Fund Managers

Read more

SPVs

What Do I Need to Do Every Year as a Fund Manager?

What Do I Need to Do Every Year as a Fund Manager?

Read more

SPVs

Do I Need an ERA? A Practical Guide for Fund Managers

Do I Need an ERA? A Practical Guide for Fund Managers

Read more

SPVs

How Much Does It Cost to Create an SPV in 2026?

How Much Does It Cost to Create an SPV in 2026?

Read more

SPVs

Special Purpose Vehicle (SPV): Meaning in Finance, Banking and Real-World Examples

Special Purpose Vehicle (SPV): Meaning in Finance, Banking and Real-World Examples

Read more

SPVs

Top Fund Administration Platforms in 2026

Top Fund Administration Platforms in 2026

Read more

SPVs

Migrate Your Fund to Allocations: A Complete Guide for Fund Managers

Migrate Your Fund to Allocations: A Complete Guide for Fund Managers

Read more

SPVs

What Does “Offshore” Means?

What Does “Offshore” Means?

Read more

SPVs

Comparing 506b vs 506c for Private Fundraising

Comparing 506b vs 506c for Private Fundraising

Read more

SPVs

LLP vs LLC | Choose business structure with Allocations

LLP vs LLC | Choose business structure with Allocations

Read more

SPVs

SPV Meaning in Finance: Complete Guide to Special Purpose Vehicles (2026)

SPV Meaning in Finance: Complete Guide to Special Purpose Vehicles (2026)

Read more

SPVs

The Best AngelList Alternatives in 2026 (Detailed Comparison)

The Best AngelList Alternatives in 2026 (Detailed Comparison)

Read more

SPVs

Understanding Special Purpose Vehicles (SPVs)

Understanding Special Purpose Vehicles (SPVs)

Read more

SPVs

Special Purpose Vehicle (SPV): What It Is and Why Investors Use It

Special Purpose Vehicle (SPV): What It Is and Why Investors Use It

Read more

SPVs

Who Typically Uses SPVs?

Who Typically Uses SPVs?

Read more

SPVs

Understanding SPVs in the Context of Private Equity

Understanding SPVs in the Context of Private Equity

Read more

SPVs

Why Use an SPV for Investment?

Why Use an SPV for Investment?

Read more

SPVs

SPV for Late-Stage and Secondary Investments

SPV for Late-Stage and Secondary Investments

Read more

SPVs

SPV Investment Structures: How Money Flows from Investors to Startups

SPV Investment Structures: How Money Flows from Investors to Startups

Read more

SPVs

SPV Management 101: What Happens After the Deal Closes

SPV Management 101: What Happens After the Deal Closes

Read more

SPVs

SPV in Venture Capital vs Traditional VC Funds: What Investors Need to Know

SPV in Venture Capital vs Traditional VC Funds: What Investors Need to Know

Read more

SPVs

SPV Structures in 2026: How Special Purpose Vehicles Are Evolving in Private Markets

SPV Structures in 2026: How Special Purpose Vehicles Are Evolving in Private Markets

Read more

SPVs

Real Estate SPV: A Complete Guide to Structuring Property Investments with Allocations

Real Estate SPV: A Complete Guide to Structuring Property Investments with Allocations

Read more

SPVs

Best SPV Platform in 2026: Features, Pricing, Compliance & How to Choose

Best SPV Platform in 2026: Features, Pricing, Compliance & How to Choose

Read more

SPVs

Top SPV Platforms in 2026: A Complete Comparison

Top SPV Platforms in 2026: A Complete Comparison

Read more

SPVs

SPV Structure and Governance: Who Controls What?

SPV Structure and Governance: Who Controls What?

Read more

SPVs

SPV Structure Explained: How SPVs Work for Private Investments

SPV Structure Explained: How SPVs Work for Private Investments

Read more

SPVs

Why Special Purpose Vehicles (SPVs) Are Becoming Essential in Modern Investing

Why Special Purpose Vehicles (SPVs) Are Becoming Essential in Modern Investing

Read more

SPVs

Understanding SPV Structures

Understanding SPV Structures

Read more

SPVs

Inside DATCOs: The Rise of Digital Asset Treasury Companies | Allocations

Inside DATCOs: The Rise of Digital Asset Treasury Companies | Allocations

Read more

SPVs

DATCO Stock Performance vs Bitcoin Price: Where to Invest in 2026

DATCO Stock Performance vs Bitcoin Price: Where to Invest in 2026

Read more

SPVs

Private Markets Aren’t Broken, They’re Just Waiting for Better Tools

Private Markets Aren’t Broken, They’re Just Waiting for Better Tools

Read more

SPVs

Digital Asset Treasury Companies: The DATCO Era Begins | Allocations

Digital Asset Treasury Companies: The DATCO Era Begins | Allocations

Read more

SPVs

How Allocations Redefines SPVs, Fund Formation, and Fund Management Software for Today’s Investment Managers

How Allocations Redefines SPVs, Fund Formation, and Fund Management Software for Today’s Investment Managers

Read more

SPVs

How VCs Are Scaling Trust, Not Just Capital

How VCs Are Scaling Trust, Not Just Capital

Read more

SPVs

Digital Asset Treasury Companies (DATCOs) vs Bitcoin ETFs: What’s the Difference?

Digital Asset Treasury Companies (DATCOs) vs Bitcoin ETFs: What’s the Difference?

Read more

SPVs

The 10-Minute Fund: What Instant Fund Formation Really Means

The 10-Minute Fund: What Instant Fund Formation Really Means

Read more

SPVs

Allocation IRR: Measuring Returns in Private Market Deals

Allocation IRR: Measuring Returns in Private Market Deals

Read more

SPVs

How Much Does It Cost to Start an SPV in 2025?

How Much Does It Cost to Start an SPV in 2025?

Read more

SPVs

Allocations Pricing Explained: Transparent, Flat-Fee Fund Administration for SPVs and Funds

Allocations Pricing Explained: Transparent, Flat-Fee Fund Administration for SPVs and Funds

Read more

SPVs

Private Equity SPVs: How Allocations Automates Fund Formation for Modern Investors

Private Equity SPVs: How Allocations Automates Fund Formation for Modern Investors

Read more

SPVs

From Term Sheet to Close: How Automated Deal Execution Platforms Speed Up Venture Investing

From Term Sheet to Close: How Automated Deal Execution Platforms Speed Up Venture Investing

Read more

SPVs

Why Modern Fund Managers Need Better Infrastructure

Why Modern Fund Managers Need Better Infrastructure

Read more

SPVs

AngelList vs Sydecar vs Allocations: The 2025 SPV Platform Showdown

AngelList vs Sydecar vs Allocations: The 2025 SPV Platform Showdown

Read more

SPVs

Fund Setup Software: Building Your First Fund With Allocations

Fund Setup Software: Building Your First Fund With Allocations

Read more

SPVs

Understanding 506(b) Funds: How Private Offerings Stay Compliant

Understanding 506(b) Funds: How Private Offerings Stay Compliant

Read more

SPVs

Allocations: The Complete Guide to Modern Fund Management

Allocations: The Complete Guide to Modern Fund Management

Read more

SPVs

Emerging Managers 101: Why SPVs Are the Easiest Way to Start Raising Capital

Emerging Managers 101: Why SPVs Are the Easiest Way to Start Raising Capital

Read more

SPVs

Asset Allocation Strategies for Modern Portfolios in 2025 ft. Allocations

Asset Allocation Strategies for Modern Portfolios in 2025 ft. Allocations

Read more

SPVs

Deal Allocation Tools: How to Streamline Investor Access to Opportunities

Deal Allocation Tools: How to Streamline Investor Access to Opportunities

Read more

SPVs

SPV Fees Explained: What Sponsors and Investors Should Know

SPV Fees Explained: What Sponsors and Investors Should Know

Read more

SPVs

How to Set Up an SPV: Step-by-Step Guide for Sponsors and Investors

How to Set Up an SPV: Step-by-Step Guide for Sponsors and Investors

Read more

SPVs

Why Delaware for SPVs? Investor Trust, Legal Clarity, Faster Closes

Why Delaware for SPVs? Investor Trust, Legal Clarity, Faster Closes

Read more

SPVs

Best SPV Platform in 2025? Features, Pricing, and How to Choose

Best SPV Platform in 2025? Features, Pricing, and How to Choose

Read more

SPVs

SPV Exit Strategies: What Happens When the Deal Closes

SPV Exit Strategies: What Happens When the Deal Closes

Read more

SPVs

Side Letters in SPVs: What You Need to Know

Side Letters in SPVs: What You Need to Know

Read more

SPVs

SPV K-1 Tax Reporting: What Sponsors and Investors Need to Know (2025 Guide)

SPV K-1 Tax Reporting: What Sponsors and Investors Need to Know (2025 Guide)

Read more

SPVs

What Does an SPV Company Do? (2025 Guide)

What Does an SPV Company Do? (2025 Guide)

Read more

SPVs

Real Estate SPV vs LLC: Which Is Better for Property Investment?

Real Estate SPV vs LLC: Which Is Better for Property Investment?

Read more

SPVs

SPV Tax Reporting: A Complete Guide for Sponsors and Investors

SPV Tax Reporting: A Complete Guide for Sponsors and Investors

Read more

SPVs

The Role of Allocations in Modern Asset Management

The Role of Allocations in Modern Asset Management

Read more

SPVs

Form D & Blue Sky Law Compliance for SPVs: What Sponsors Need to Know

Form D & Blue Sky Law Compliance for SPVs: What Sponsors Need to Know

Read more

SPVs

SPV Company vs Fund: Which Is Right for Your Deal?

SPV Company vs Fund: Which Is Right for Your Deal?

Read more

SPVs

SPV Platform: The Complete 2025 Guide (ft. Allocations)

SPV Platform: The Complete 2025 Guide (ft. Allocations)

Read more

SPVs

How to Choose the Best SPV Platform: A 15-Point Buyer’s Checklist

How to Choose the Best SPV Platform: A 15-Point Buyer’s Checklist

Read more

Fund Manager

What is an SPV? The Definitive Guide to Special Purpose Vehicles

What is an SPV? The Definitive Guide to Special Purpose Vehicles

Read more

Fund Manager

5 best books to read If you’re forging a path in VC

5 best books to read If you’re forging a path in VC

Read more

Investor Spotlight

Investor spotlight: Alex Fisher

Investor spotlight: Alex Fisher

Read more

SPVs

6 unique use cases for SPVs

6 unique use cases for SPVs

Read more

Market Trends

The SPV ecosystem democratizing alternative investments

The SPV ecosystem democratizing alternative investments

Read more

Company

How to write a stellar investor update

How to write a stellar investor update

Read more

Analytics

What’s going on here? 1 in 10 US households now qualify as accredited investors

What’s going on here? 1 in 10 US households now qualify as accredited investors

Read more

Market Trends

SPVs by sector

SPVs by sector

Read more

Market Trends

5 Benefits of a hybrid SPV + fund strategy

5 Benefits of a hybrid SPV + fund strategy

Read more

Products

What is the difference between 506b and 506c funds?

What is the difference between 506b and 506c funds?

Read more

Fund Manager

Why Allocations is the best choice for fast moving fund managers

Why Allocations is the best choice for fast moving fund managers

Read more

Fund Manager

When should fund managers use a fund vs an SPV?

When should fund managers use a fund vs an SPV?

Read more

Fund Manager

10 best practices for first-time fund managers

10 best practices for first-time fund managers

Read more

Analytics

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Read more

Market Trends

Private market trends: where are fund managers looking in 2022?

Private market trends: where are fund managers looking in 2022?

Read more

Fund Manager

5 female VCs on the rise in 2022

5 female VCs on the rise in 2022

Read more

Analytics

The new competitive edge for VCs and fund managers

The new competitive edge for VCs and fund managers

Read more

Analytics

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

Read more

Investor Spotlight

Investor spotlight: Olga Yermolenko

Investor spotlight: Olga Yermolenko

Read more

Analytics

3 stats that show the democratization of VC in 2021

3 stats that show the democratization of VC in 2021

Read more

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc