Back

SPVs

Top Upcoming IPOs in 2026 : Allocations Research

Top Upcoming IPOs in 2026 : Allocations Research

Top Upcoming IPOs in 2026 : Allocations Research

The IPO market is expected to reopen meaningfully in 2026–2027 after years of muted public listings. As interest rates stabilize, late-stage private companies with strong revenue, AI exposure, or infrastructure dominance are preparing for long-awaited public debuts.

For investors, this next IPO cycle will look very different from 2021. Companies are larger, more mature, more profitable, and increasingly accessed before IPO via SPVs, secondary deals, and structured vehicles.

In this guide, we break down the most anticipated IPO candidates for 2026–2027, their business models, expected valuations, timing assumptions, and how investors typically gain exposure before listing.

Why 2026 - 2027 Is Expected to Be a Major IPO Cycle

Several macro and market factors are aligning:

Interest rates are expected to normalize

AI-driven revenue growth has accelerated private valuations

Venture funds raised in 2019–2021 are reaching liquidity timelines

Late-stage companies are prioritizing profitability over growth-at-all-costs

Public markets are rewarding durable cash flows again

As a result, many unicorns that delayed IPOs in 2022–2024 are now restructuring, consolidating, or preparing audited financials for public markets.

Most Anticipated IPOs in 2026 - 2027

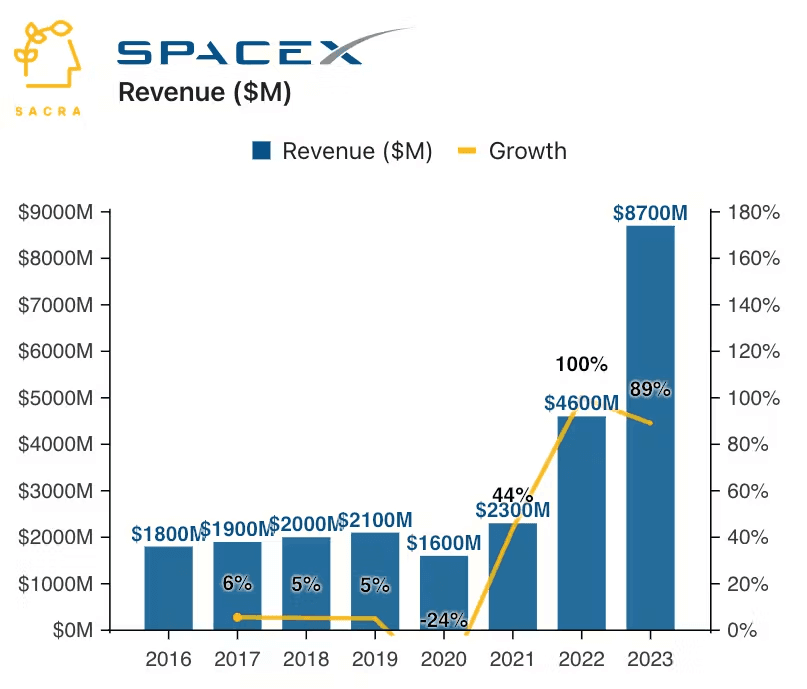

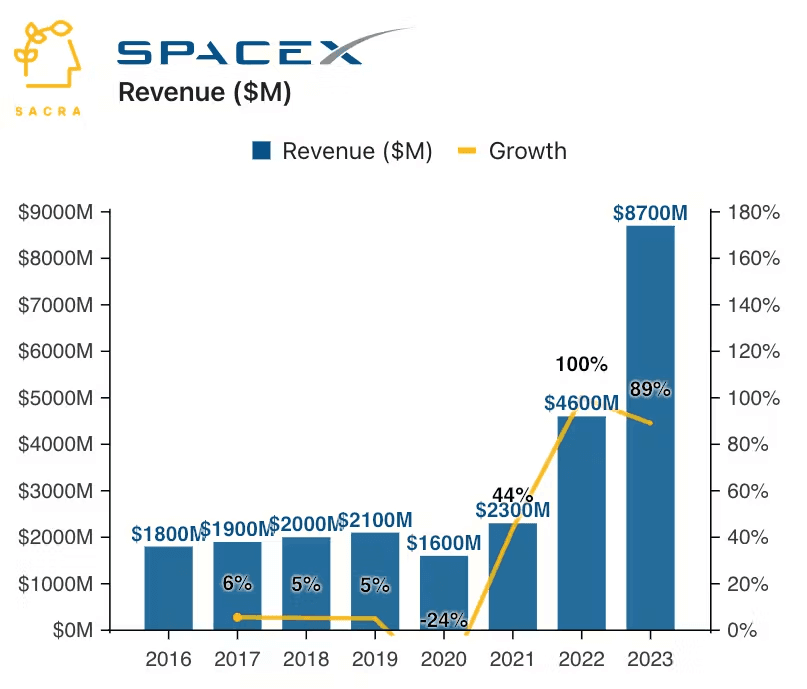

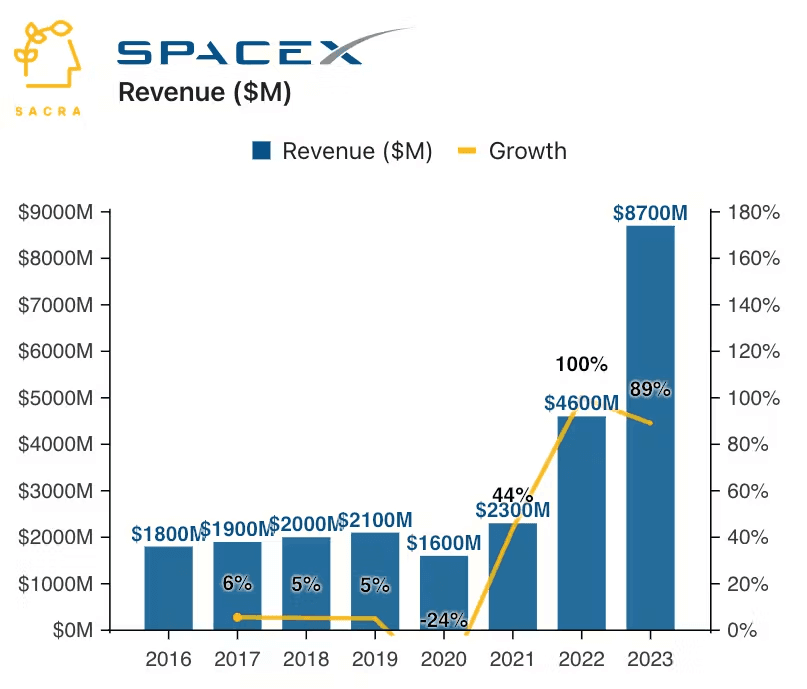

SpaceX

Revenue:

Industry: Aerospace, Satellites, Defense

Expected IPO Window: 2026–2027 (Starlink-led)

Estimated Valuation: $800B+

SpaceX remains the most valuable private company globally. While SpaceX itself may remain private, Starlink, its satellite internet division, is widely expected to IPO first.

Key Drivers

Recurring subscription revenue

Global broadband demand

Government & defense contracts

Capital-intensive expansion needs

Pre-IPO Exposure

Secondary share purchases

SPVs holding late-stage equity

Structured funds with aerospace exposure

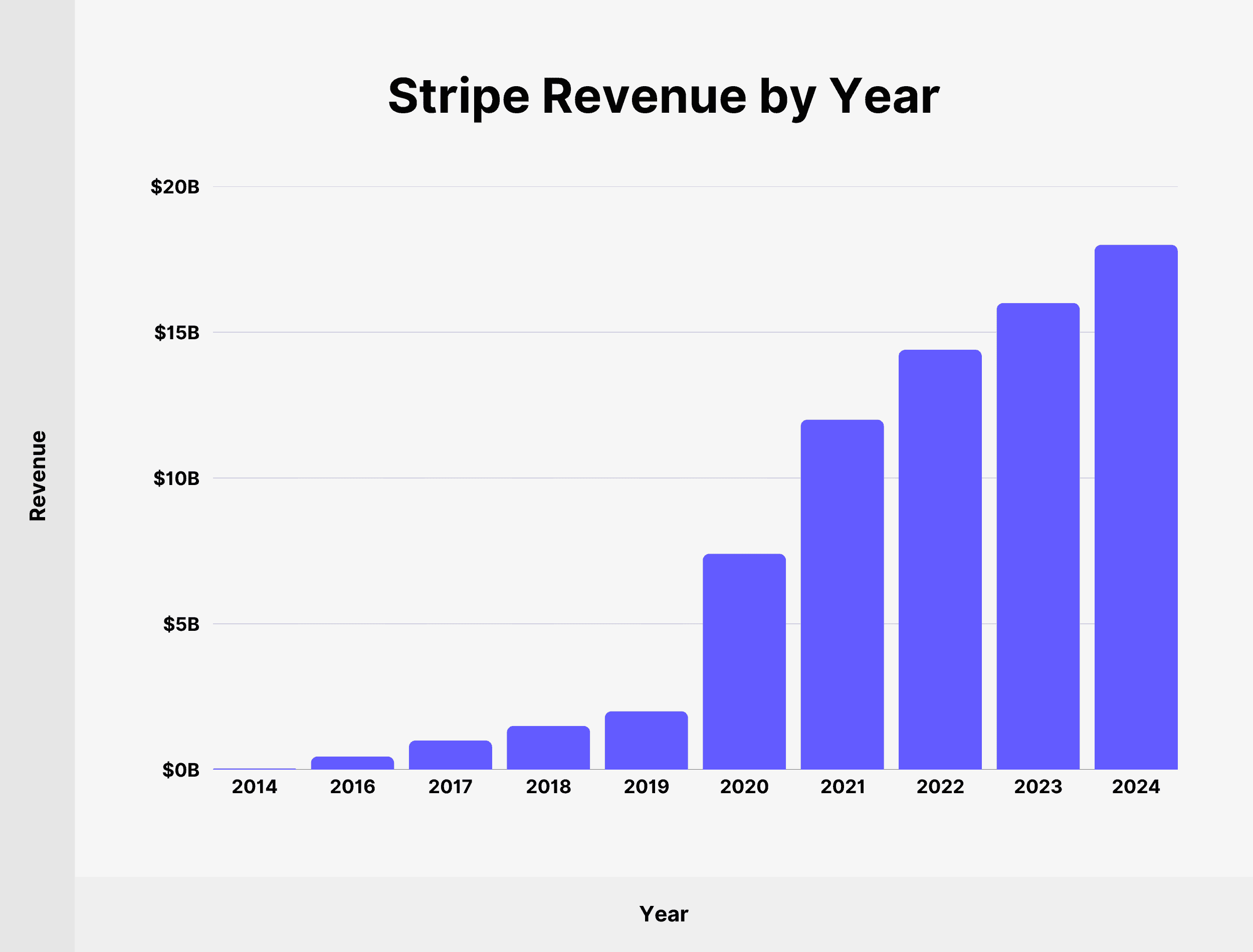

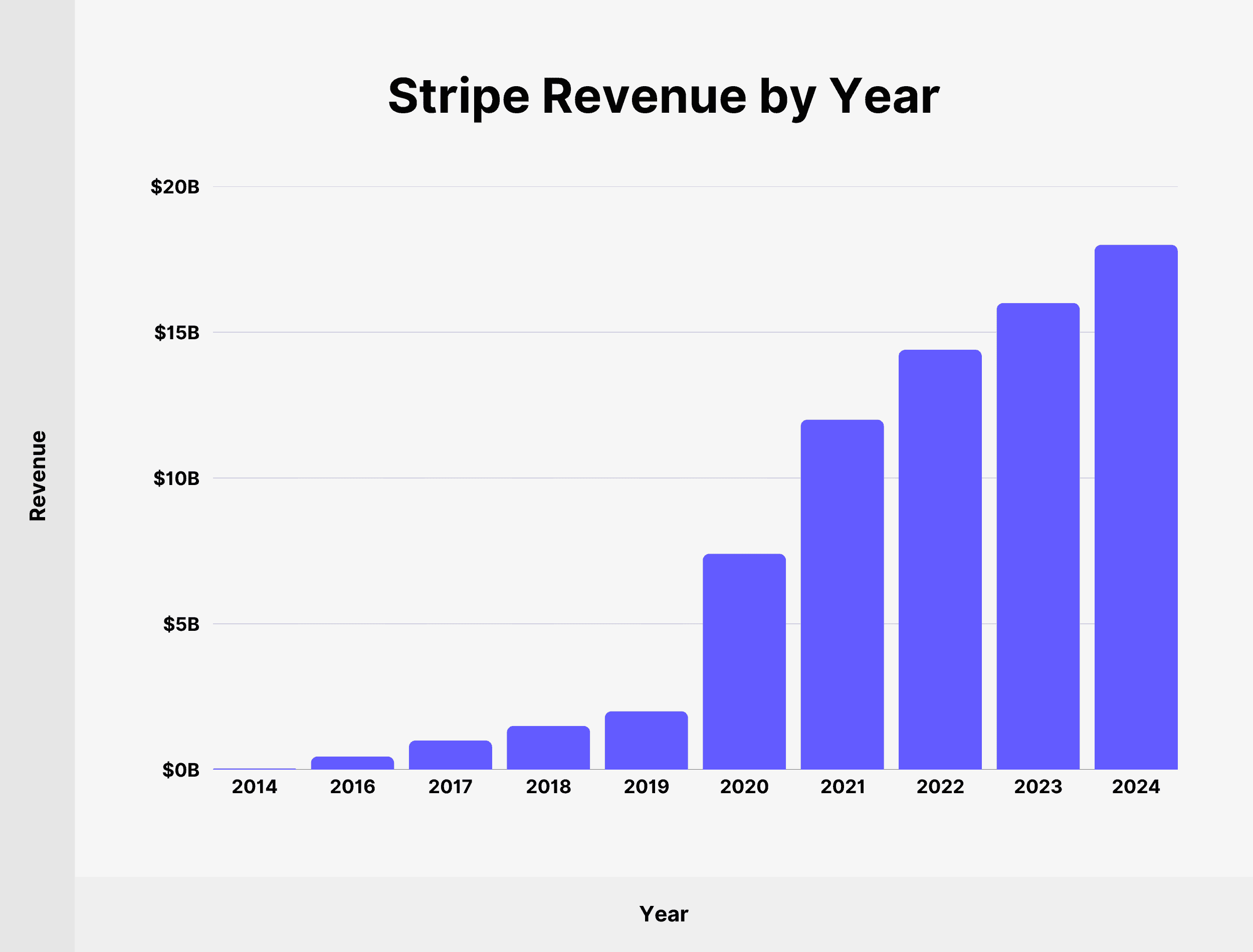

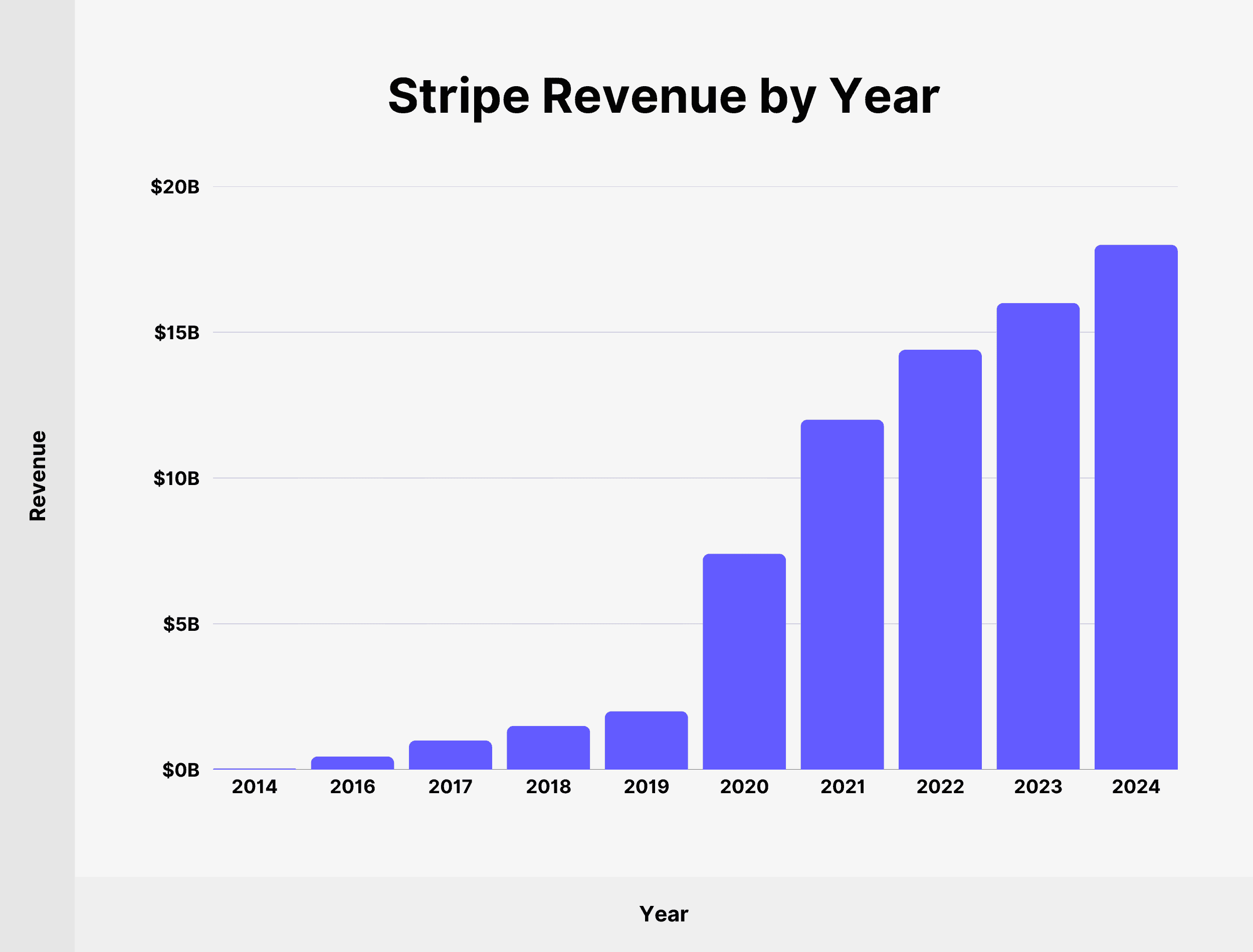

Stripe

Revenue:

Industry: Fintech, Payments Infrastructure

Expected IPO Window: Late 2026

Estimated Valuation: $106.7B+

Stripe has consistently delayed IPO plans, focusing on profitability, cost discipline, and AI-powered payments tooling.

Why Stripe Matters

Mission-critical internet infrastructure

Strong enterprise penetration

High gross margins

Predictable revenue streams

Investor Insight: Stripe has facilitated liquidity for employees via tender offers, a common sign of IPO preparation.

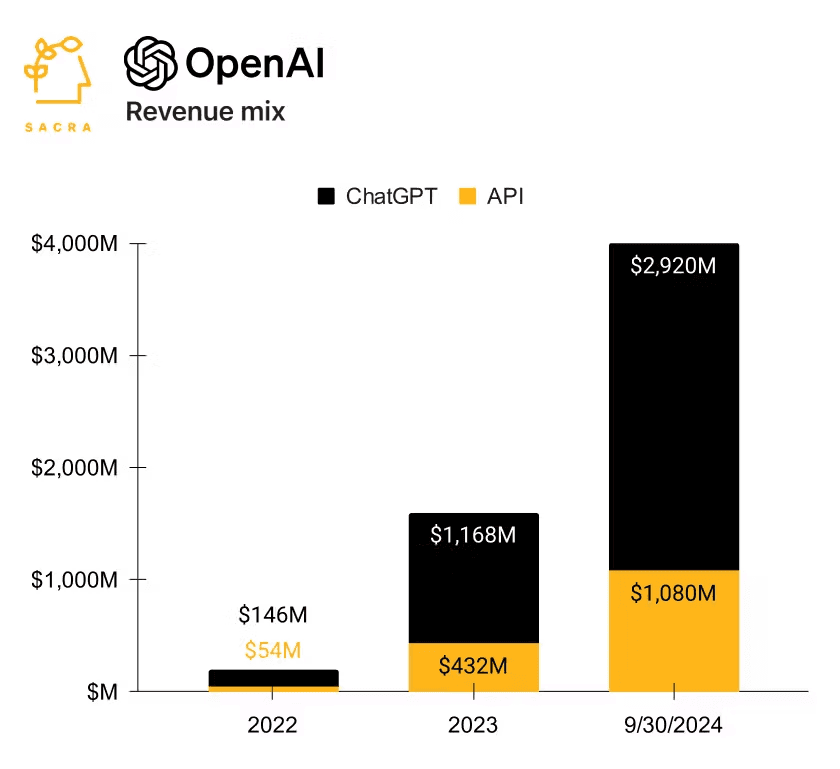

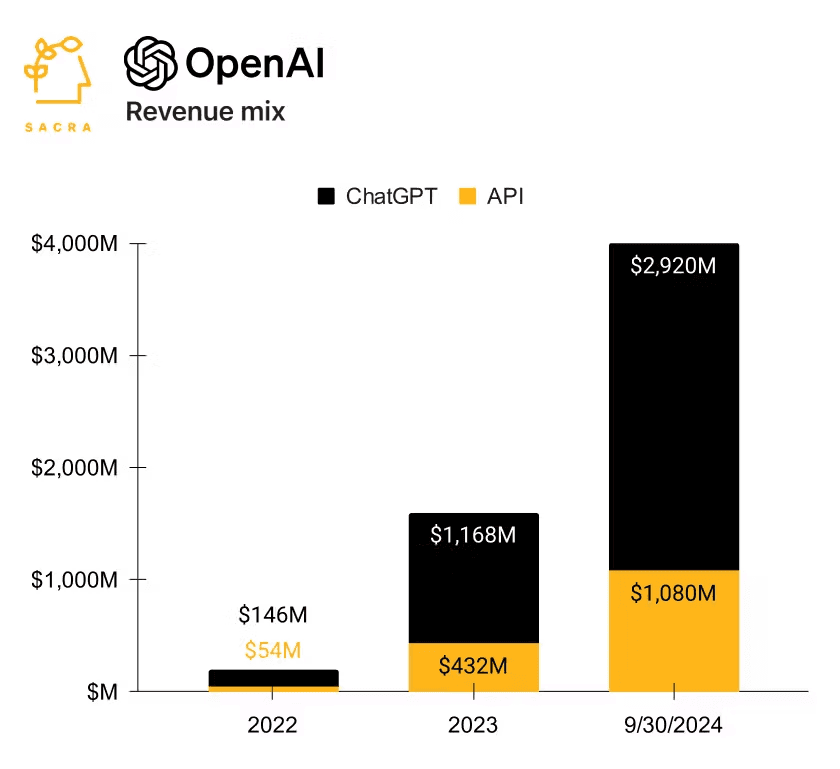

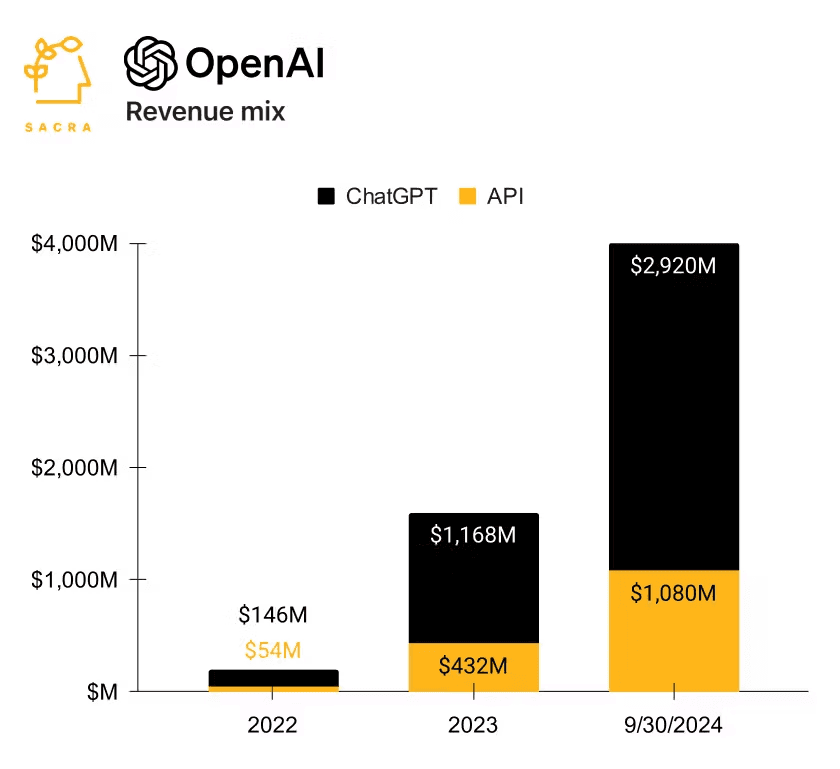

OpenAI

Revenue:

Industry: Artificial Intelligence

Expected IPO Window: 2026–2027 (structure dependent)

Estimated Valuation: $830B+

OpenAI’s corporate structure remains complex, but commercialization via enterprise AI subscriptions, APIs, and partnerships makes an eventual public listing plausible.

Key Considerations

AI regulation risk

Compute cost structure

Revenue concentration

Governance model evolution

Pre-IPO Access

Highly limited

Mostly through strategic or institutional SPVs

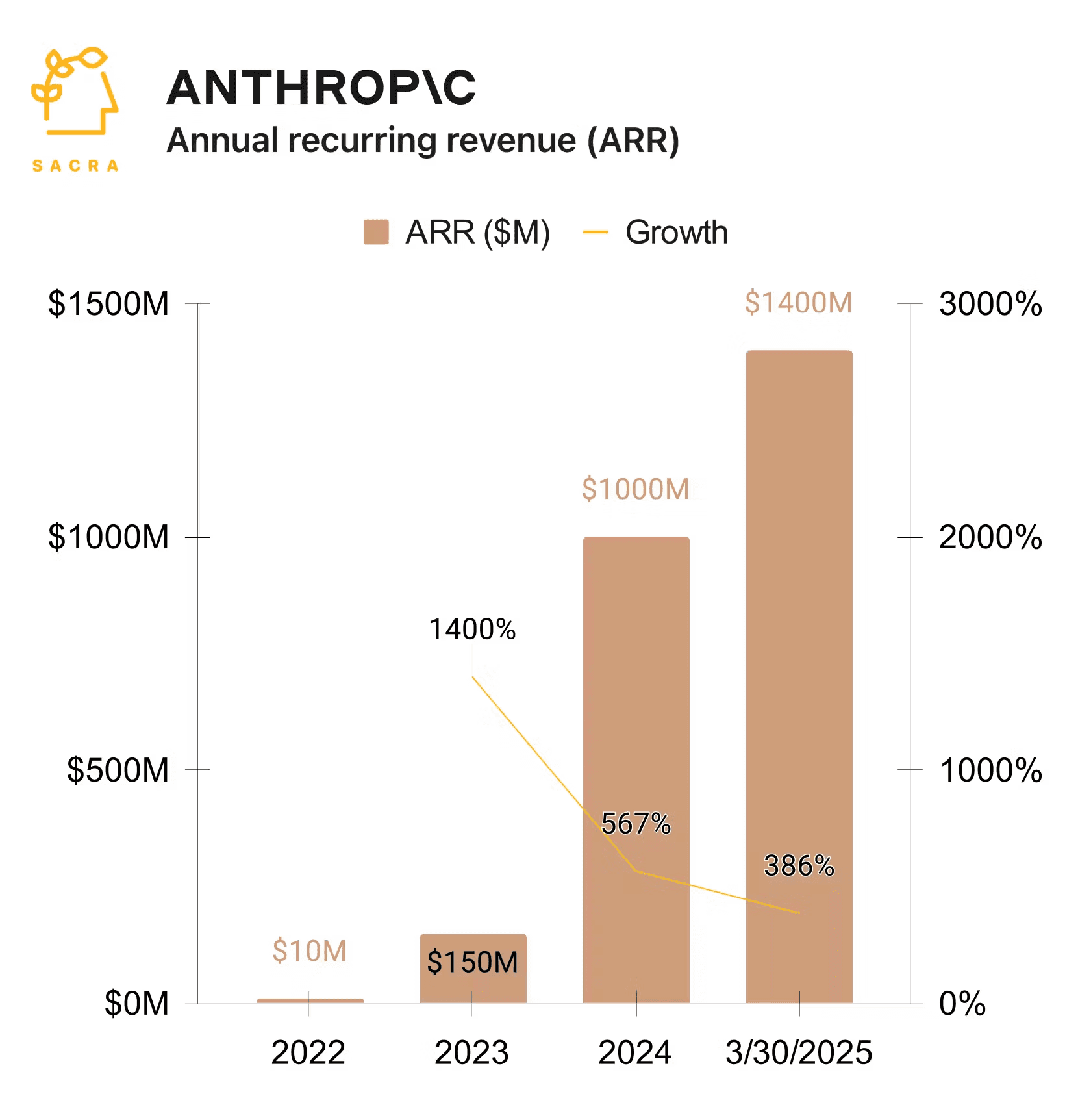

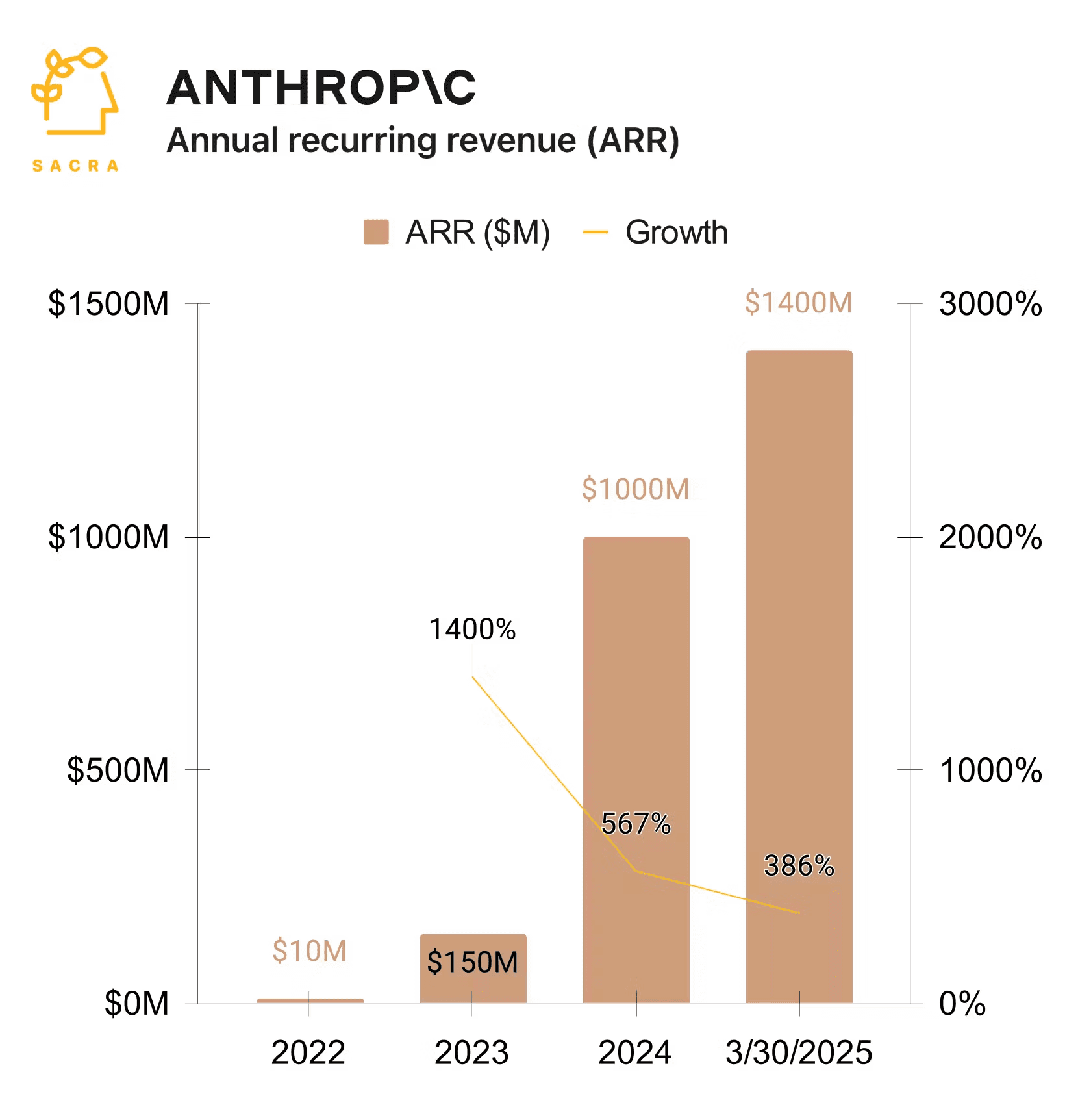

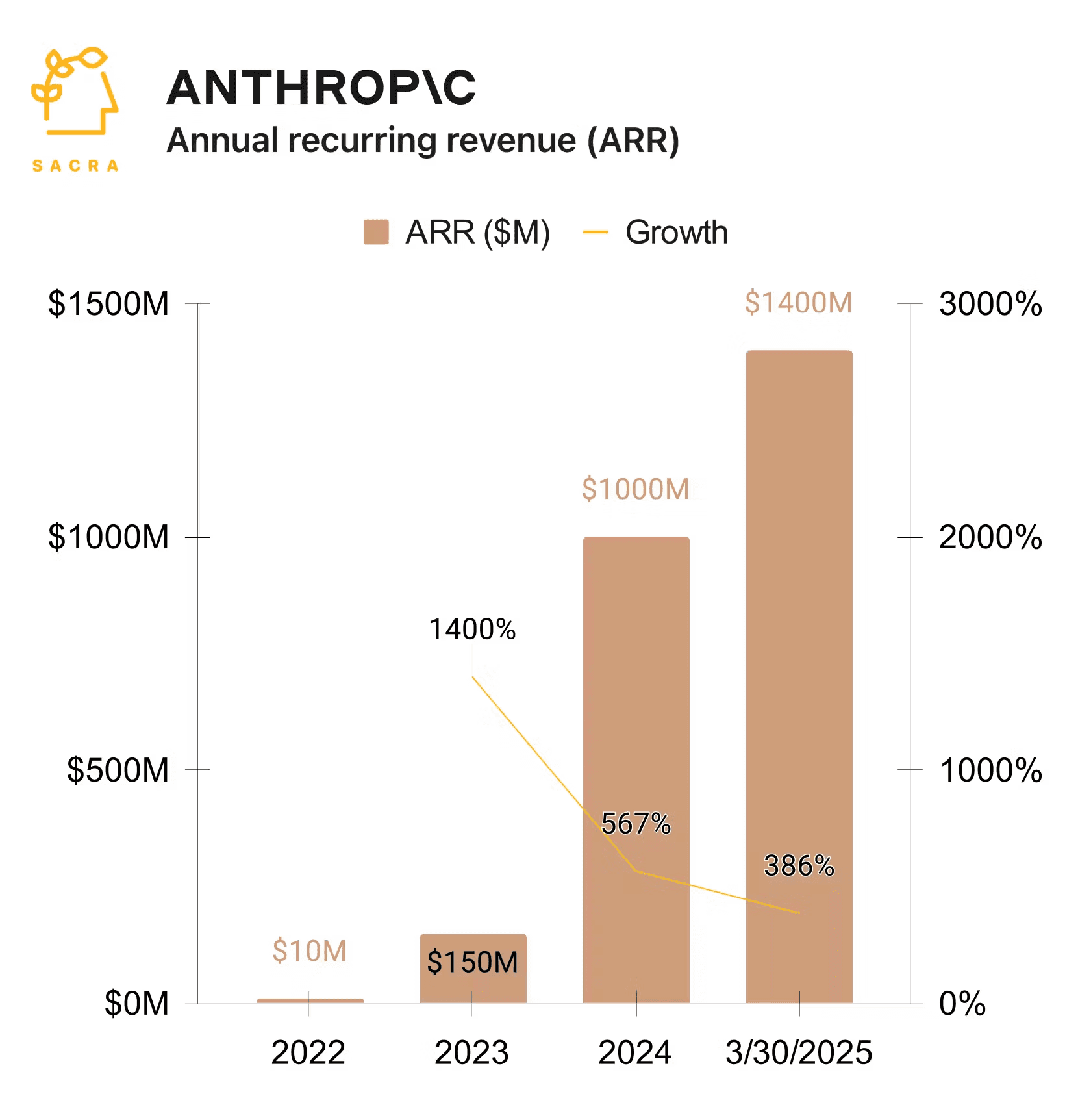

Anthropic

Revenue:

Industry: AI Infrastructure & Safety

Expected IPO Window: 2027

Estimated Valuation (Speculative): $350B

Anthropic has rapidly positioned itself as one of the most credible competitors to OpenAI, particularly in enterprise and regulated-market use cases. Founded by former OpenAI researchers, the company has differentiated itself through a strong emphasis on AI safety, model alignment, and enterprise-grade deployment.

Its flagship Claude models are increasingly adopted by large organizations that prioritize reliability, interpretability, and compliance over pure consumer reach. Anthropic’s partnerships with major cloud providers have significantly expanded its distribution, lowering go-to-market friction while ensuring access to large-scale compute infrastructure.

From an IPO-readiness perspective, Anthropic benefits from:

Long-term enterprise contracts

API-based recurring revenue

Growing demand for “safe AI” in regulated industries

Strategic capital from hyperscalers rather than traditional VC-only backing

While 2027 remains a tentative window, continued revenue growth and clearer AI regulatory frameworks could accelerate public-market readiness.

Why Investors Watch Anthropic

Clear positioning around AI safety and governance

Enterprise-first monetization rather than consumer dependency

Deep technical moat built by foundational model research

Strategic alignment with cloud infrastructure leaders

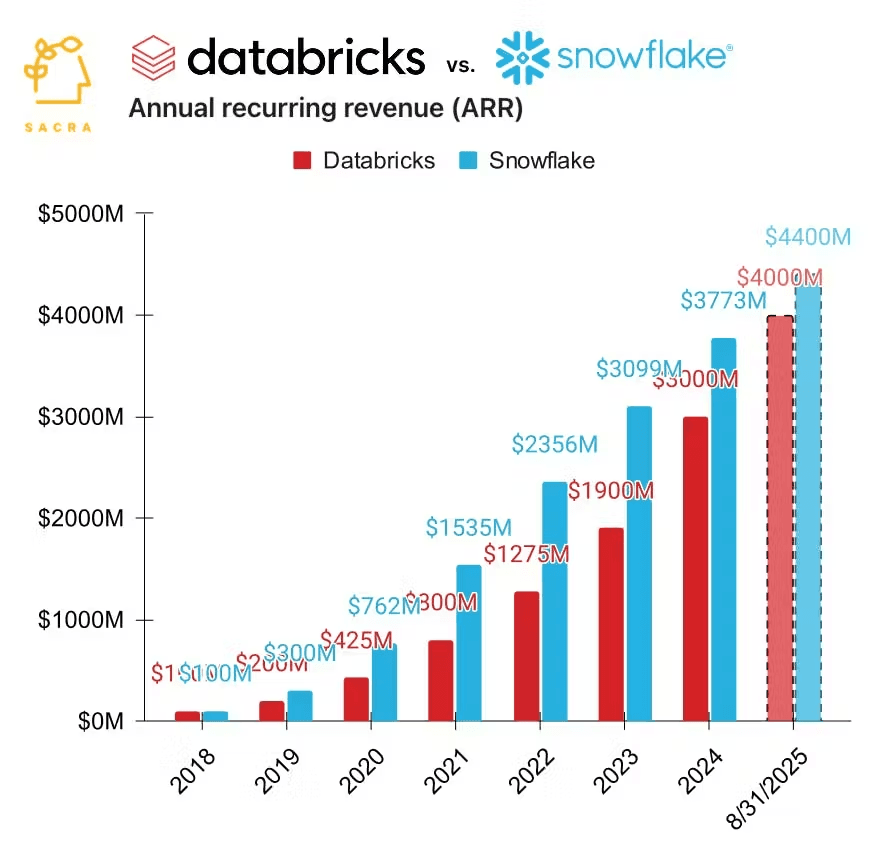

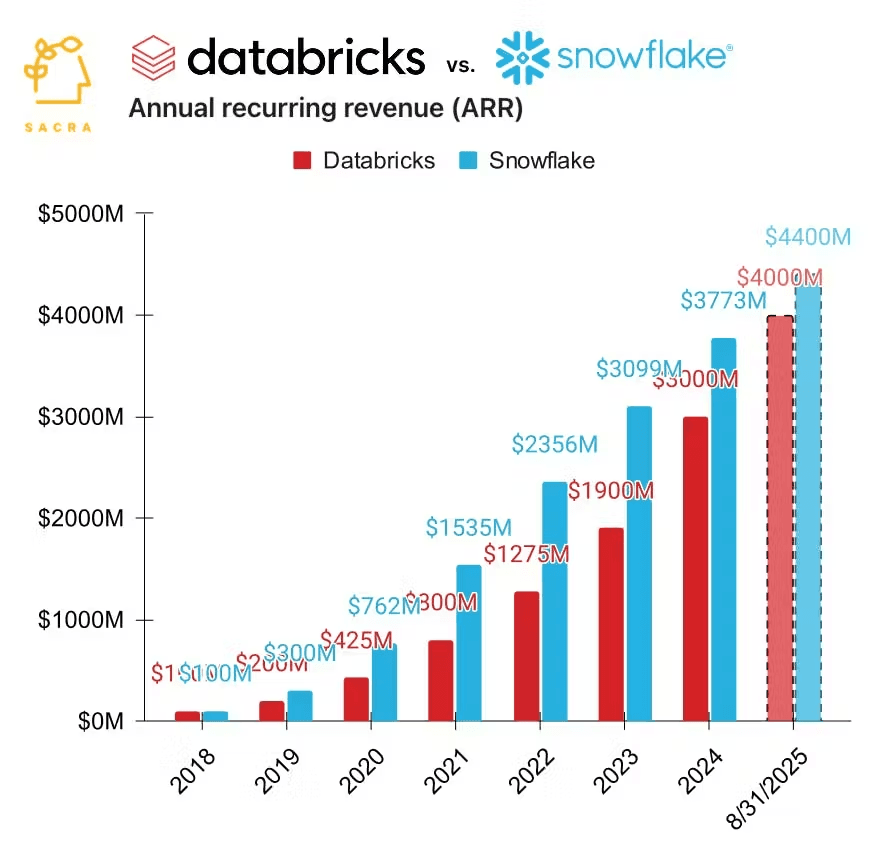

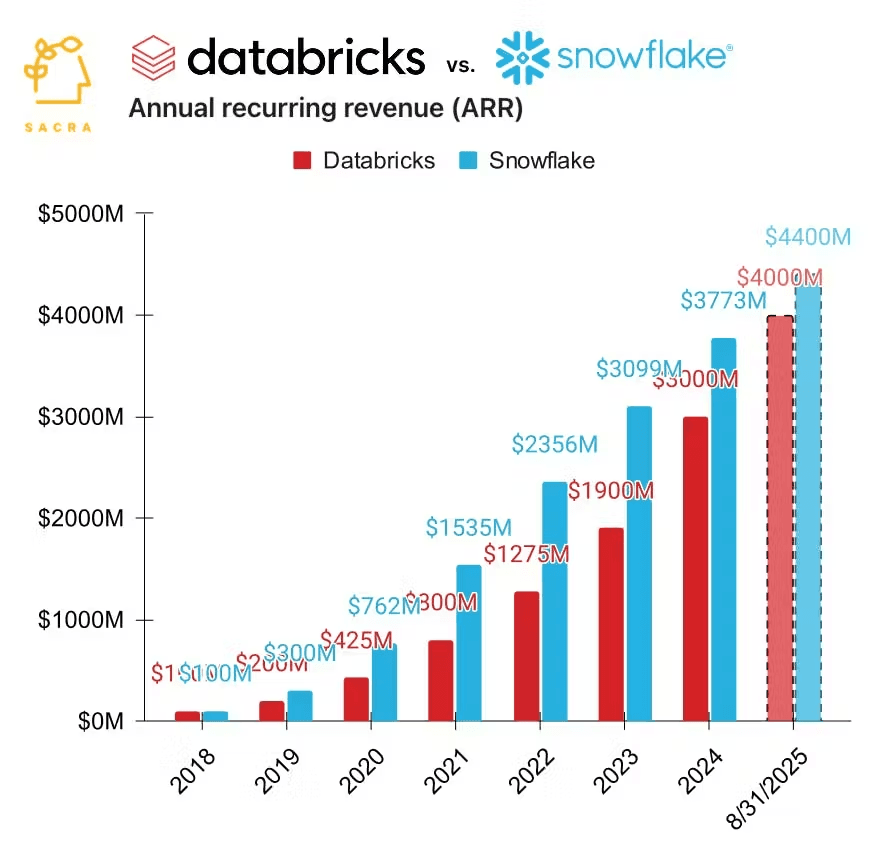

Databricks

Revenue:

Industry: Data Infrastructure, AI

Expected IPO Window: 2026

Estimated Valuation (Speculative): $134B+

Databricks is widely regarded as one of the most IPO-ready private companies globally. Built around the Apache Spark ecosystem, Databricks has evolved into a mission-critical data and AI platform for large enterprises managing massive, complex datasets.

The company’s strength lies in its ability to sit at the intersection of data engineering, analytics, and machine learning, making it deeply embedded within customer workflows. This creates high switching costs and strong net revenue retention, two characteristics public markets tend to reward.

Databricks has also benefited from the AI boom, as enterprises increasingly require unified platforms to train, deploy, and manage AI models at scale.

IPO Readiness Signals

Predictable, subscription-based SaaS revenue

Large and diversified enterprise customer base

Mature internal financial controls

Clear path to sustained profitability

Long-term contracts with Fortune 500 companies

Among 2026 candidates, Databricks is often considered a “when, not if” IPO.

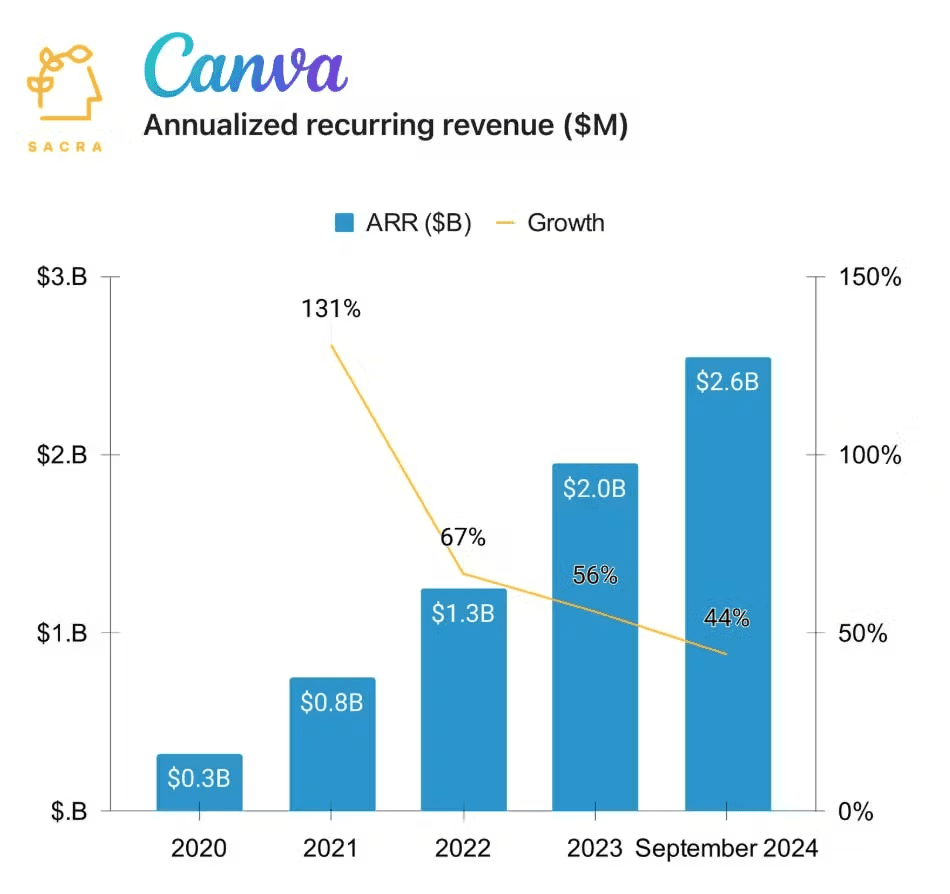

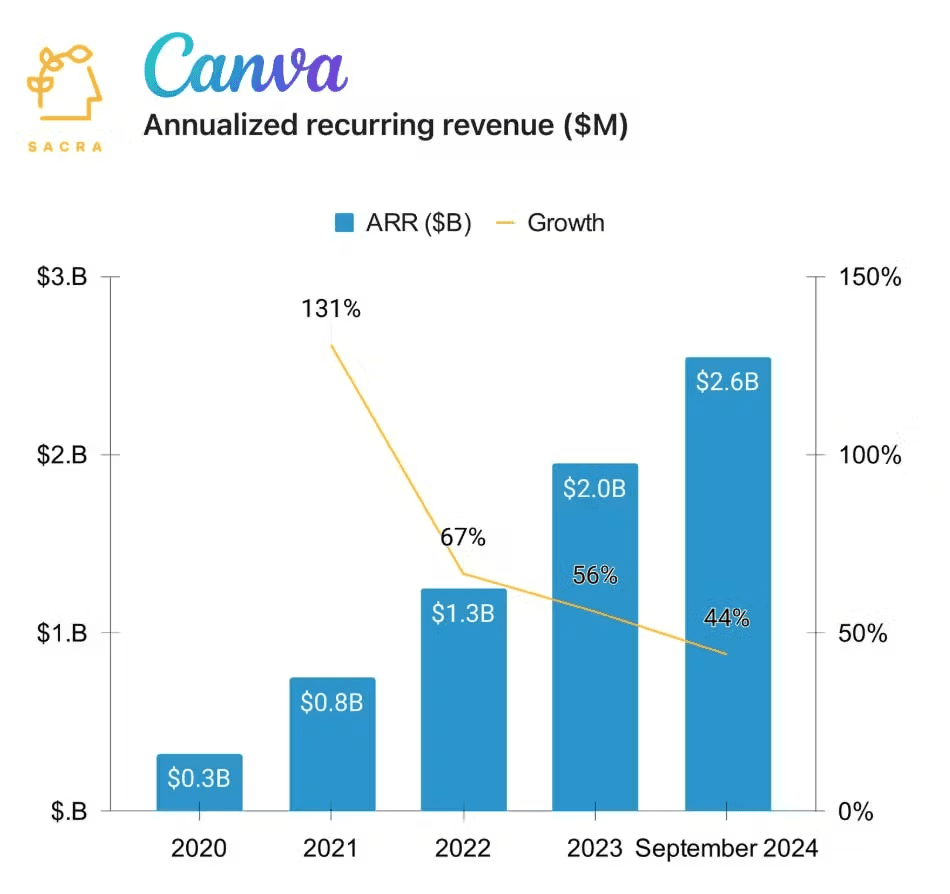

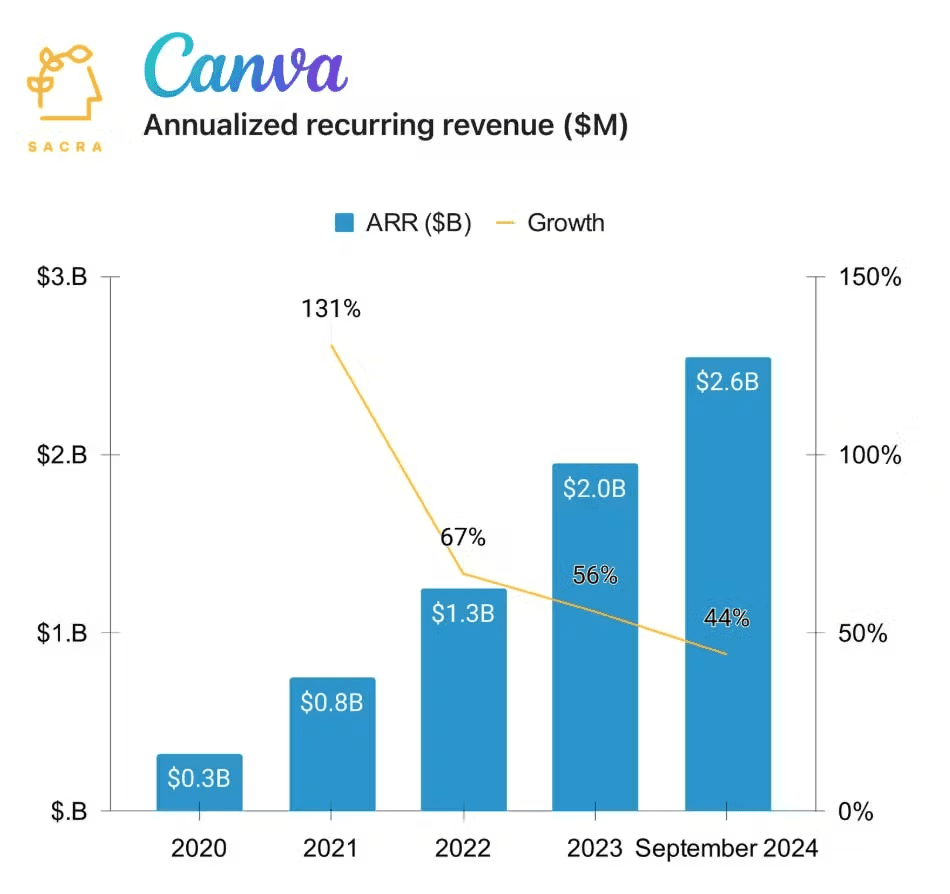

Canva

Revenue:

Industry: Design SaaS

Expected IPO Window: 2026

Estimated Valuation (Speculative): $30B–$45B

Canva has quietly built one of the most impressive SaaS businesses of the last decade. What began as a consumer-friendly design tool has evolved into a global platform used by individuals, teams, enterprises, educators, and marketers.

Unlike many late-stage private companies, Canva is frequently cited as cash-flow positive, with strong unit economics and diversified revenue streams across subscriptions, enterprise plans, and template marketplaces.

Its global footprint, particularly outside the US, gives Canva exposure to emerging markets while maintaining strong penetration in developed economies.

From a public-market perspective, Canva’s simplicity, brand recognition, and profitability profile make it especially attractive during a cautious IPO environment.

Key Strengths

Profitable or near-profitable operations

Massive global user base

High-margin SaaS subscriptions

Strong brand moat and low customer acquisition costs

Expansion into enterprise and collaboration tools

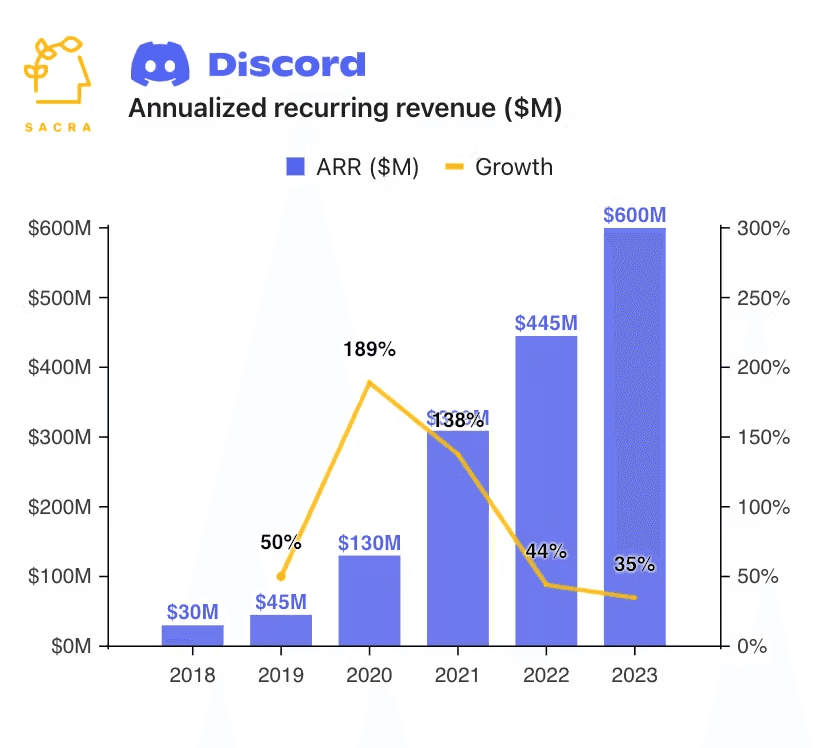

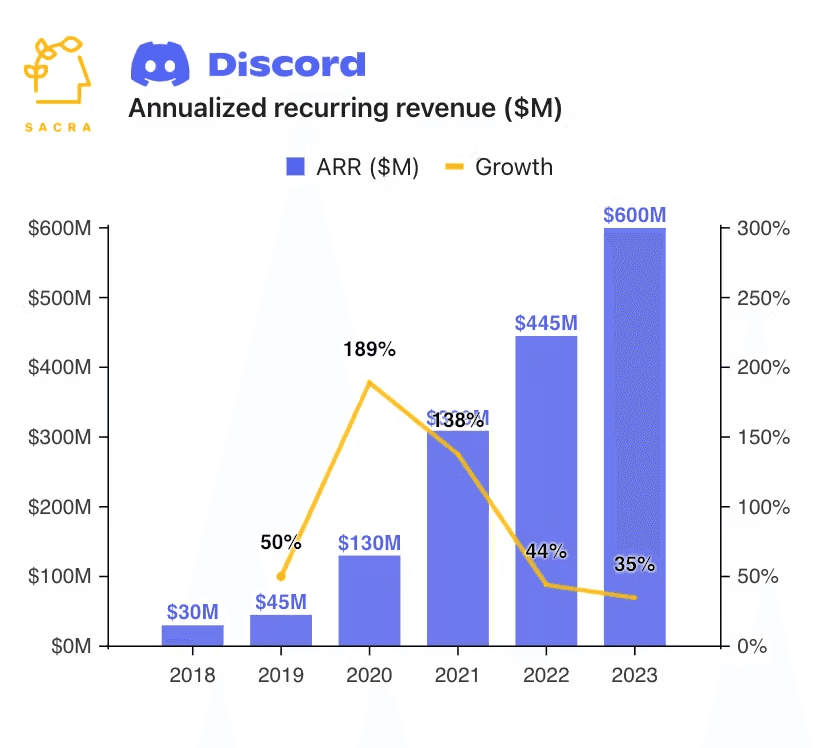

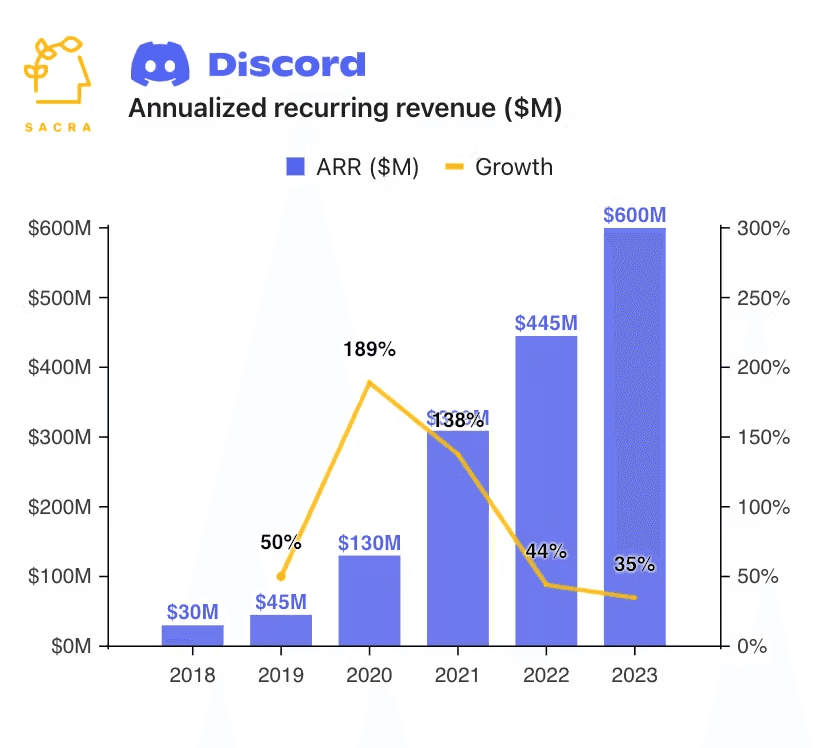

Discord

Revenue:

Industry: Social, Gaming Infrastructure

Expected IPO Window: 2026–2027

Estimated Valuation (Speculative): $20B–$30B

Discord has become a foundational communication layer for gaming communities, creators, DAOs, and online interest groups. Its challenge and opportunity lie in monetizing high engagement without compromising community trust.

While monetization has historically lagged user growth, Discord’s subscription products, server monetization tools, and enterprise/community use cases are expanding steadily.

Public-market investors will focus heavily on Discord’s ability to:

Increase revenue per user

Diversify monetization beyond gaming

Maintain engagement while scaling ads or premium features

If Discord demonstrates consistent revenue expansion alongside stable user growth, a 2026–2027 IPO becomes increasingly plausible.

Why Discord Remains on IPO Radars

Extremely high engagement metrics

Strong network effects

Cultural relevance among Gen Z and creators

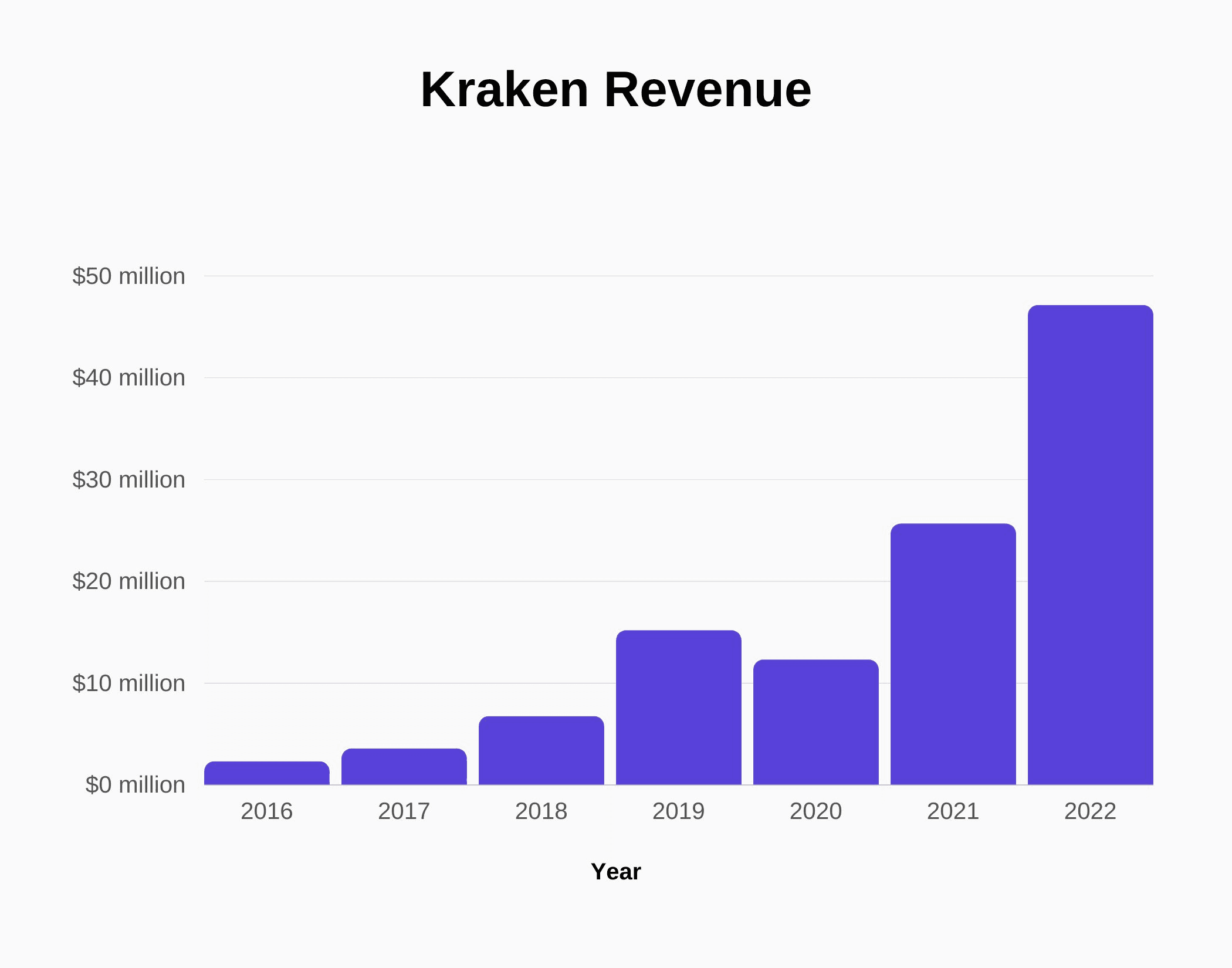

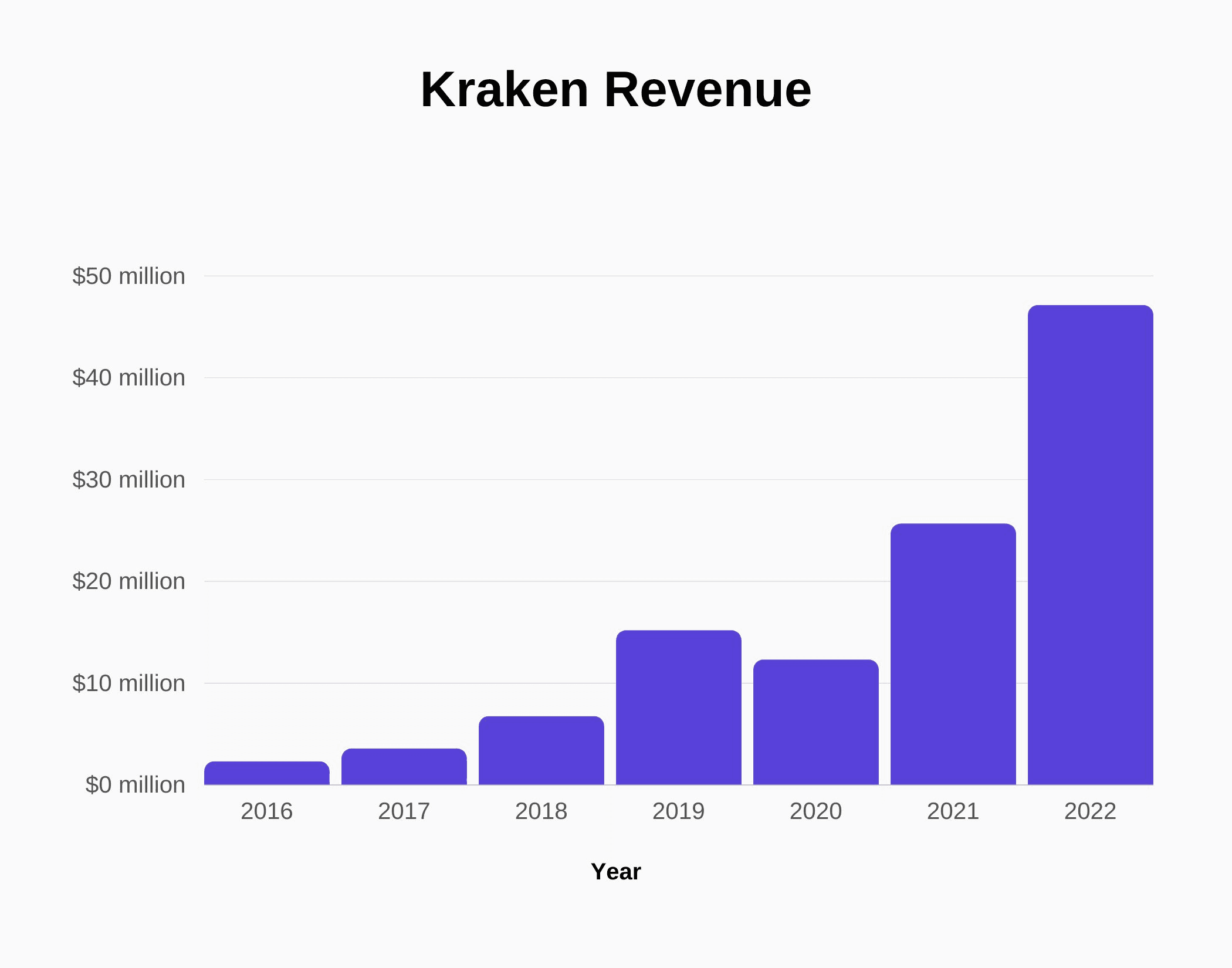

Optionality across gaming, education, and enterprise communitiesKraken

Industry: Crypto Exchange

Expected IPO Window: 2026 (regulation dependent)

Estimated Valuation: $15B–$25B

Kraken has publicly stated IPO ambitions once regulatory clarity improves.

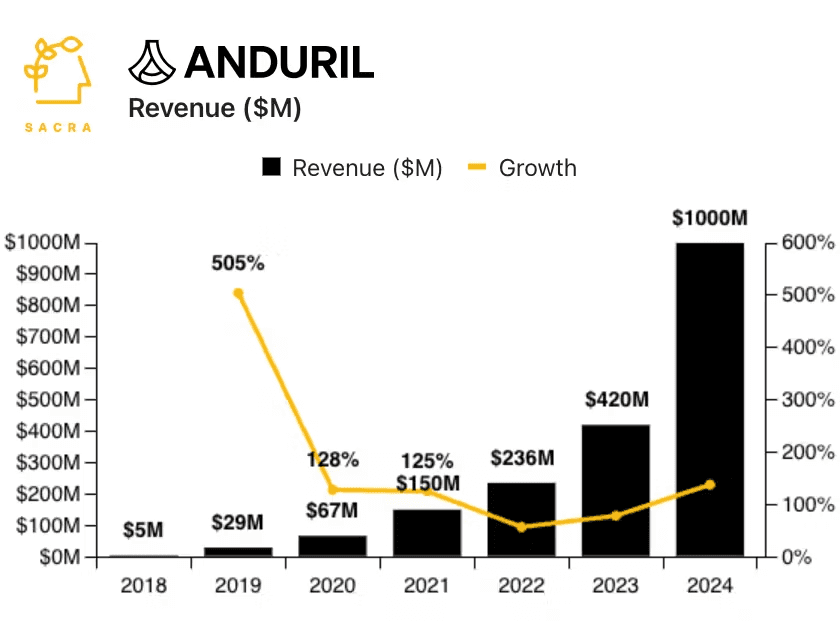

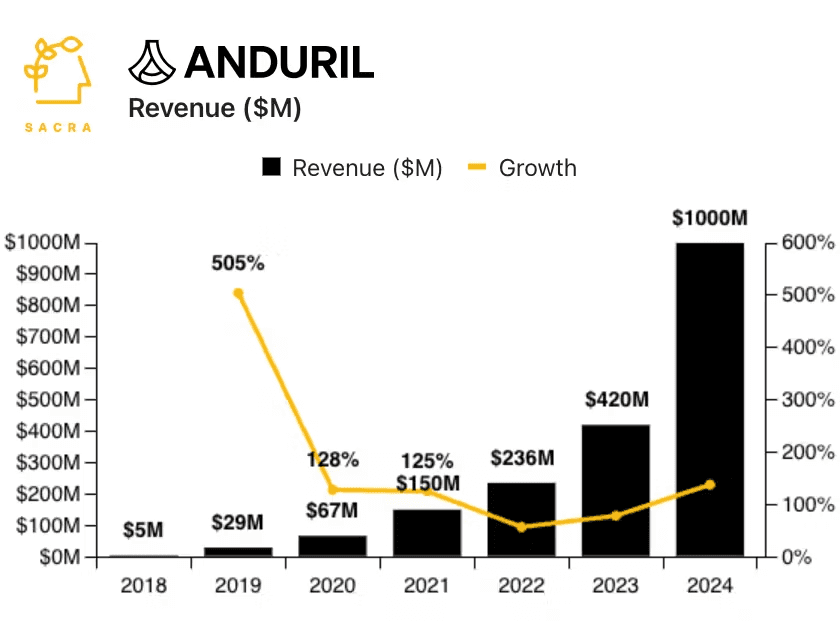

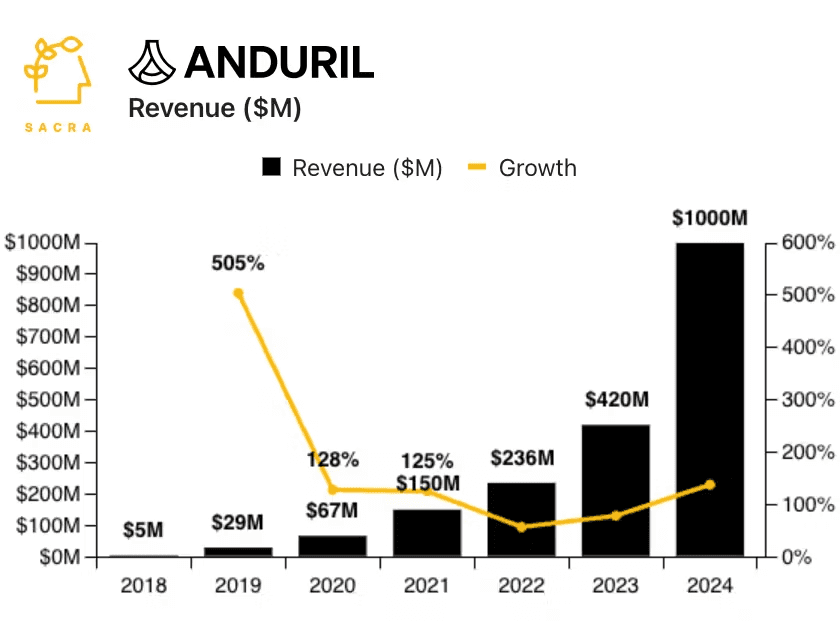

Anduril

Revenue:

Industry: Defense Technology

Expected IPO Window: 2026–2027

Estimated Valuation (Speculative): $30B+

Anduril represents a new generation of defense contractors, combining AI, autonomous systems, and advanced hardware with Silicon Valley-style software iteration. Its customer base spans government defense agencies, border security, and national infrastructure protection.

Unlike traditional defense primes, Anduril operates with:

Faster product development cycles

Software-first defense platforms

Long-term government contracts with recurring revenue

As global defense spending increases and geopolitical uncertainty persists, investor interest in defense technology has grown significantly.

Why Anduril Stands Out

Strong government demand

High switching costs once deployed

AI-driven autonomous defense systems

Long-term contract visibility

A public listing would mark a major shift in how defense technology companies access capital markets.

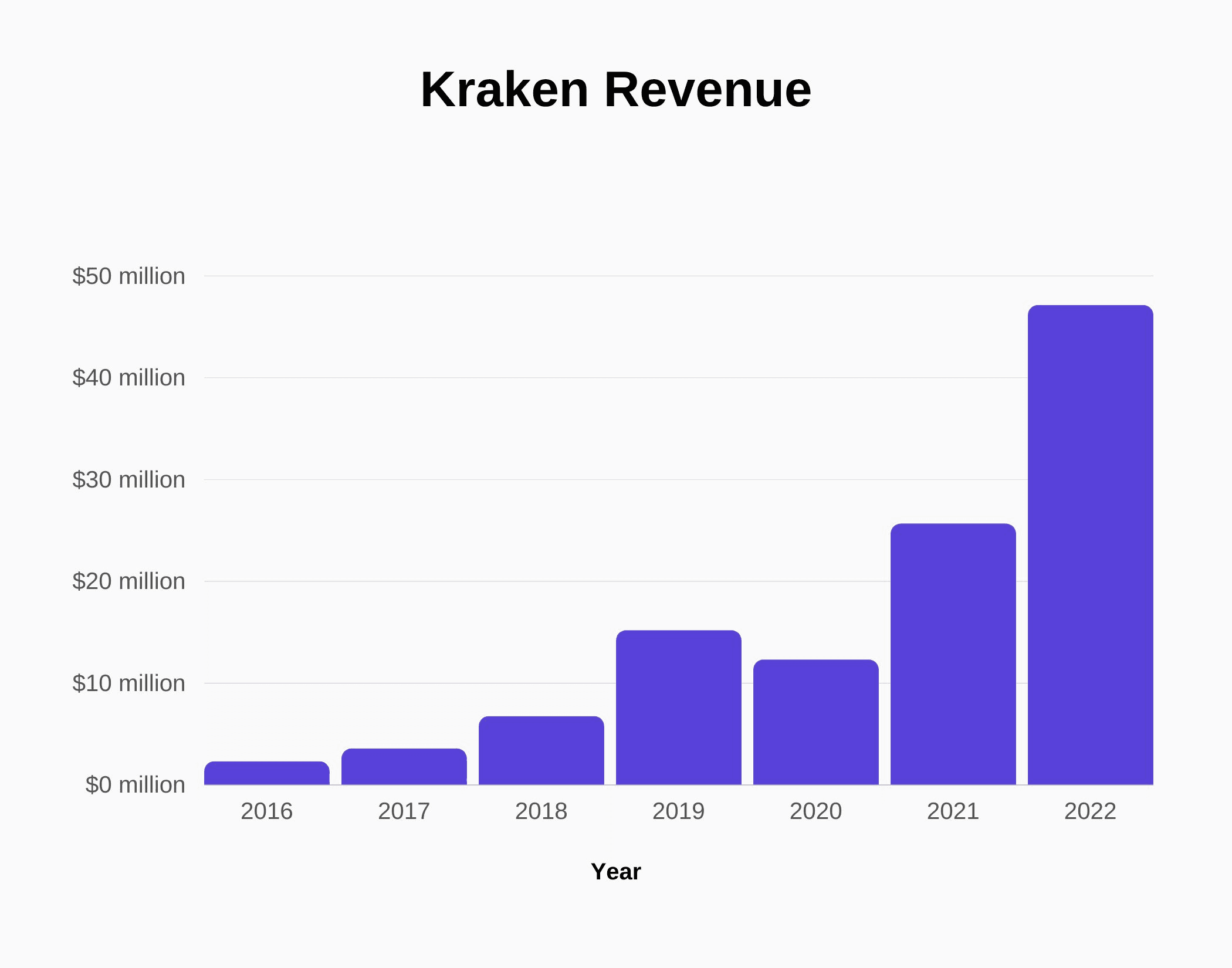

Kraken

Revenue:

Industry: Crypto Exchange

Expected IPO Window: 2026 (regulation dependent)

Estimated Valuation (Speculative): $15B–$25B

Kraken is one of the longest-operating cryptocurrency exchanges globally and has repeatedly signaled its intent to go public once regulatory clarity improves, particularly in the United States.

Unlike many crypto-native companies, Kraken has emphasized compliance, transparency, and operational discipline, traits that could resonate well with public-market investors if regulatory conditions stabilize.

However, timing remains highly sensitive to:

Crypto market cycles

Global regulatory developments

Exchange profitability during lower-volume periods

A successful Kraken IPO would likely be viewed as a bellwether for broader crypto-market legitimacy in public equities.

How Investors Gain Exposure Before the IPO

Most individual investors never get direct IPO allocations. Instead, exposure often happens before listing through:

SPVs (Special Purpose Vehicles)

Secondary market transactions

Pre-IPO structured funds

Employee liquidity programs

Late-stage venture rounds

This is where platforms like Allocations play a role, enabling compliant, structured access to private market opportunities.

Final Thoughts: The Next IPO Cycle Will Be Different

The 2026–2027 IPO class is shaping up to be smaller, higher quality, and more disciplined than previous cycles. These companies are no longer experimental startups; they are global infrastructure players.

For investors, the real opportunity increasingly lies before the IPO, where access, structure, and compliance matter more than hype.

The IPO market is expected to reopen meaningfully in 2026–2027 after years of muted public listings. As interest rates stabilize, late-stage private companies with strong revenue, AI exposure, or infrastructure dominance are preparing for long-awaited public debuts.

For investors, this next IPO cycle will look very different from 2021. Companies are larger, more mature, more profitable, and increasingly accessed before IPO via SPVs, secondary deals, and structured vehicles.

In this guide, we break down the most anticipated IPO candidates for 2026–2027, their business models, expected valuations, timing assumptions, and how investors typically gain exposure before listing.

Why 2026 - 2027 Is Expected to Be a Major IPO Cycle

Several macro and market factors are aligning:

Interest rates are expected to normalize

AI-driven revenue growth has accelerated private valuations

Venture funds raised in 2019–2021 are reaching liquidity timelines

Late-stage companies are prioritizing profitability over growth-at-all-costs

Public markets are rewarding durable cash flows again

As a result, many unicorns that delayed IPOs in 2022–2024 are now restructuring, consolidating, or preparing audited financials for public markets.

Most Anticipated IPOs in 2026 - 2027

SpaceX

Revenue:

Industry: Aerospace, Satellites, Defense

Expected IPO Window: 2026–2027 (Starlink-led)

Estimated Valuation: $800B+

SpaceX remains the most valuable private company globally. While SpaceX itself may remain private, Starlink, its satellite internet division, is widely expected to IPO first.

Key Drivers

Recurring subscription revenue

Global broadband demand

Government & defense contracts

Capital-intensive expansion needs

Pre-IPO Exposure

Secondary share purchases

SPVs holding late-stage equity

Structured funds with aerospace exposure

Stripe

Revenue:

Industry: Fintech, Payments Infrastructure

Expected IPO Window: Late 2026

Estimated Valuation: $106.7B+

Stripe has consistently delayed IPO plans, focusing on profitability, cost discipline, and AI-powered payments tooling.

Why Stripe Matters

Mission-critical internet infrastructure

Strong enterprise penetration

High gross margins

Predictable revenue streams

Investor Insight: Stripe has facilitated liquidity for employees via tender offers, a common sign of IPO preparation.

OpenAI

Revenue:

Industry: Artificial Intelligence

Expected IPO Window: 2026–2027 (structure dependent)

Estimated Valuation: $830B+

OpenAI’s corporate structure remains complex, but commercialization via enterprise AI subscriptions, APIs, and partnerships makes an eventual public listing plausible.

Key Considerations

AI regulation risk

Compute cost structure

Revenue concentration

Governance model evolution

Pre-IPO Access

Highly limited

Mostly through strategic or institutional SPVs

Anthropic

Revenue:

Industry: AI Infrastructure & Safety

Expected IPO Window: 2027

Estimated Valuation (Speculative): $350B

Anthropic has rapidly positioned itself as one of the most credible competitors to OpenAI, particularly in enterprise and regulated-market use cases. Founded by former OpenAI researchers, the company has differentiated itself through a strong emphasis on AI safety, model alignment, and enterprise-grade deployment.

Its flagship Claude models are increasingly adopted by large organizations that prioritize reliability, interpretability, and compliance over pure consumer reach. Anthropic’s partnerships with major cloud providers have significantly expanded its distribution, lowering go-to-market friction while ensuring access to large-scale compute infrastructure.

From an IPO-readiness perspective, Anthropic benefits from:

Long-term enterprise contracts

API-based recurring revenue

Growing demand for “safe AI” in regulated industries

Strategic capital from hyperscalers rather than traditional VC-only backing

While 2027 remains a tentative window, continued revenue growth and clearer AI regulatory frameworks could accelerate public-market readiness.

Why Investors Watch Anthropic

Clear positioning around AI safety and governance

Enterprise-first monetization rather than consumer dependency

Deep technical moat built by foundational model research

Strategic alignment with cloud infrastructure leaders

Databricks

Revenue:

Industry: Data Infrastructure, AI

Expected IPO Window: 2026

Estimated Valuation (Speculative): $134B+

Databricks is widely regarded as one of the most IPO-ready private companies globally. Built around the Apache Spark ecosystem, Databricks has evolved into a mission-critical data and AI platform for large enterprises managing massive, complex datasets.

The company’s strength lies in its ability to sit at the intersection of data engineering, analytics, and machine learning, making it deeply embedded within customer workflows. This creates high switching costs and strong net revenue retention, two characteristics public markets tend to reward.

Databricks has also benefited from the AI boom, as enterprises increasingly require unified platforms to train, deploy, and manage AI models at scale.

IPO Readiness Signals

Predictable, subscription-based SaaS revenue

Large and diversified enterprise customer base

Mature internal financial controls

Clear path to sustained profitability

Long-term contracts with Fortune 500 companies

Among 2026 candidates, Databricks is often considered a “when, not if” IPO.

Canva

Revenue:

Industry: Design SaaS

Expected IPO Window: 2026

Estimated Valuation (Speculative): $30B–$45B

Canva has quietly built one of the most impressive SaaS businesses of the last decade. What began as a consumer-friendly design tool has evolved into a global platform used by individuals, teams, enterprises, educators, and marketers.

Unlike many late-stage private companies, Canva is frequently cited as cash-flow positive, with strong unit economics and diversified revenue streams across subscriptions, enterprise plans, and template marketplaces.

Its global footprint, particularly outside the US, gives Canva exposure to emerging markets while maintaining strong penetration in developed economies.

From a public-market perspective, Canva’s simplicity, brand recognition, and profitability profile make it especially attractive during a cautious IPO environment.

Key Strengths

Profitable or near-profitable operations

Massive global user base

High-margin SaaS subscriptions

Strong brand moat and low customer acquisition costs

Expansion into enterprise and collaboration tools

Discord

Revenue:

Industry: Social, Gaming Infrastructure

Expected IPO Window: 2026–2027

Estimated Valuation (Speculative): $20B–$30B

Discord has become a foundational communication layer for gaming communities, creators, DAOs, and online interest groups. Its challenge and opportunity lie in monetizing high engagement without compromising community trust.

While monetization has historically lagged user growth, Discord’s subscription products, server monetization tools, and enterprise/community use cases are expanding steadily.

Public-market investors will focus heavily on Discord’s ability to:

Increase revenue per user

Diversify monetization beyond gaming

Maintain engagement while scaling ads or premium features

If Discord demonstrates consistent revenue expansion alongside stable user growth, a 2026–2027 IPO becomes increasingly plausible.

Why Discord Remains on IPO Radars

Extremely high engagement metrics

Strong network effects

Cultural relevance among Gen Z and creators

Optionality across gaming, education, and enterprise communitiesKraken

Industry: Crypto Exchange

Expected IPO Window: 2026 (regulation dependent)

Estimated Valuation: $15B–$25B

Kraken has publicly stated IPO ambitions once regulatory clarity improves.

Anduril

Revenue:

Industry: Defense Technology

Expected IPO Window: 2026–2027

Estimated Valuation (Speculative): $30B+

Anduril represents a new generation of defense contractors, combining AI, autonomous systems, and advanced hardware with Silicon Valley-style software iteration. Its customer base spans government defense agencies, border security, and national infrastructure protection.

Unlike traditional defense primes, Anduril operates with:

Faster product development cycles

Software-first defense platforms

Long-term government contracts with recurring revenue

As global defense spending increases and geopolitical uncertainty persists, investor interest in defense technology has grown significantly.

Why Anduril Stands Out

Strong government demand

High switching costs once deployed

AI-driven autonomous defense systems

Long-term contract visibility

A public listing would mark a major shift in how defense technology companies access capital markets.

Kraken

Revenue:

Industry: Crypto Exchange

Expected IPO Window: 2026 (regulation dependent)

Estimated Valuation (Speculative): $15B–$25B

Kraken is one of the longest-operating cryptocurrency exchanges globally and has repeatedly signaled its intent to go public once regulatory clarity improves, particularly in the United States.

Unlike many crypto-native companies, Kraken has emphasized compliance, transparency, and operational discipline, traits that could resonate well with public-market investors if regulatory conditions stabilize.

However, timing remains highly sensitive to:

Crypto market cycles

Global regulatory developments

Exchange profitability during lower-volume periods

A successful Kraken IPO would likely be viewed as a bellwether for broader crypto-market legitimacy in public equities.

How Investors Gain Exposure Before the IPO

Most individual investors never get direct IPO allocations. Instead, exposure often happens before listing through:

SPVs (Special Purpose Vehicles)

Secondary market transactions

Pre-IPO structured funds

Employee liquidity programs

Late-stage venture rounds

This is where platforms like Allocations play a role, enabling compliant, structured access to private market opportunities.

Final Thoughts: The Next IPO Cycle Will Be Different

The 2026–2027 IPO class is shaping up to be smaller, higher quality, and more disciplined than previous cycles. These companies are no longer experimental startups; they are global infrastructure players.

For investors, the real opportunity increasingly lies before the IPO, where access, structure, and compliance matter more than hype.

The IPO market is expected to reopen meaningfully in 2026–2027 after years of muted public listings. As interest rates stabilize, late-stage private companies with strong revenue, AI exposure, or infrastructure dominance are preparing for long-awaited public debuts.

For investors, this next IPO cycle will look very different from 2021. Companies are larger, more mature, more profitable, and increasingly accessed before IPO via SPVs, secondary deals, and structured vehicles.

In this guide, we break down the most anticipated IPO candidates for 2026–2027, their business models, expected valuations, timing assumptions, and how investors typically gain exposure before listing.

Why 2026 - 2027 Is Expected to Be a Major IPO Cycle

Several macro and market factors are aligning:

Interest rates are expected to normalize

AI-driven revenue growth has accelerated private valuations

Venture funds raised in 2019–2021 are reaching liquidity timelines

Late-stage companies are prioritizing profitability over growth-at-all-costs

Public markets are rewarding durable cash flows again

As a result, many unicorns that delayed IPOs in 2022–2024 are now restructuring, consolidating, or preparing audited financials for public markets.

Most Anticipated IPOs in 2026 - 2027

SpaceX

Revenue:

Industry: Aerospace, Satellites, Defense

Expected IPO Window: 2026–2027 (Starlink-led)

Estimated Valuation: $800B+

SpaceX remains the most valuable private company globally. While SpaceX itself may remain private, Starlink, its satellite internet division, is widely expected to IPO first.

Key Drivers

Recurring subscription revenue

Global broadband demand

Government & defense contracts

Capital-intensive expansion needs

Pre-IPO Exposure

Secondary share purchases

SPVs holding late-stage equity

Structured funds with aerospace exposure

Stripe

Revenue:

Industry: Fintech, Payments Infrastructure

Expected IPO Window: Late 2026

Estimated Valuation: $106.7B+

Stripe has consistently delayed IPO plans, focusing on profitability, cost discipline, and AI-powered payments tooling.

Why Stripe Matters

Mission-critical internet infrastructure

Strong enterprise penetration

High gross margins

Predictable revenue streams

Investor Insight: Stripe has facilitated liquidity for employees via tender offers, a common sign of IPO preparation.

OpenAI

Revenue:

Industry: Artificial Intelligence

Expected IPO Window: 2026–2027 (structure dependent)

Estimated Valuation: $830B+

OpenAI’s corporate structure remains complex, but commercialization via enterprise AI subscriptions, APIs, and partnerships makes an eventual public listing plausible.

Key Considerations

AI regulation risk

Compute cost structure

Revenue concentration

Governance model evolution

Pre-IPO Access

Highly limited

Mostly through strategic or institutional SPVs

Anthropic

Revenue:

Industry: AI Infrastructure & Safety

Expected IPO Window: 2027

Estimated Valuation (Speculative): $350B

Anthropic has rapidly positioned itself as one of the most credible competitors to OpenAI, particularly in enterprise and regulated-market use cases. Founded by former OpenAI researchers, the company has differentiated itself through a strong emphasis on AI safety, model alignment, and enterprise-grade deployment.

Its flagship Claude models are increasingly adopted by large organizations that prioritize reliability, interpretability, and compliance over pure consumer reach. Anthropic’s partnerships with major cloud providers have significantly expanded its distribution, lowering go-to-market friction while ensuring access to large-scale compute infrastructure.

From an IPO-readiness perspective, Anthropic benefits from:

Long-term enterprise contracts

API-based recurring revenue

Growing demand for “safe AI” in regulated industries

Strategic capital from hyperscalers rather than traditional VC-only backing

While 2027 remains a tentative window, continued revenue growth and clearer AI regulatory frameworks could accelerate public-market readiness.

Why Investors Watch Anthropic

Clear positioning around AI safety and governance

Enterprise-first monetization rather than consumer dependency

Deep technical moat built by foundational model research

Strategic alignment with cloud infrastructure leaders

Databricks

Revenue:

Industry: Data Infrastructure, AI

Expected IPO Window: 2026

Estimated Valuation (Speculative): $134B+

Databricks is widely regarded as one of the most IPO-ready private companies globally. Built around the Apache Spark ecosystem, Databricks has evolved into a mission-critical data and AI platform for large enterprises managing massive, complex datasets.

The company’s strength lies in its ability to sit at the intersection of data engineering, analytics, and machine learning, making it deeply embedded within customer workflows. This creates high switching costs and strong net revenue retention, two characteristics public markets tend to reward.

Databricks has also benefited from the AI boom, as enterprises increasingly require unified platforms to train, deploy, and manage AI models at scale.

IPO Readiness Signals

Predictable, subscription-based SaaS revenue

Large and diversified enterprise customer base

Mature internal financial controls

Clear path to sustained profitability

Long-term contracts with Fortune 500 companies

Among 2026 candidates, Databricks is often considered a “when, not if” IPO.

Canva

Revenue:

Industry: Design SaaS

Expected IPO Window: 2026

Estimated Valuation (Speculative): $30B–$45B

Canva has quietly built one of the most impressive SaaS businesses of the last decade. What began as a consumer-friendly design tool has evolved into a global platform used by individuals, teams, enterprises, educators, and marketers.

Unlike many late-stage private companies, Canva is frequently cited as cash-flow positive, with strong unit economics and diversified revenue streams across subscriptions, enterprise plans, and template marketplaces.

Its global footprint, particularly outside the US, gives Canva exposure to emerging markets while maintaining strong penetration in developed economies.

From a public-market perspective, Canva’s simplicity, brand recognition, and profitability profile make it especially attractive during a cautious IPO environment.

Key Strengths

Profitable or near-profitable operations

Massive global user base

High-margin SaaS subscriptions

Strong brand moat and low customer acquisition costs

Expansion into enterprise and collaboration tools

Discord

Revenue:

Industry: Social, Gaming Infrastructure

Expected IPO Window: 2026–2027

Estimated Valuation (Speculative): $20B–$30B

Discord has become a foundational communication layer for gaming communities, creators, DAOs, and online interest groups. Its challenge and opportunity lie in monetizing high engagement without compromising community trust.

While monetization has historically lagged user growth, Discord’s subscription products, server monetization tools, and enterprise/community use cases are expanding steadily.

Public-market investors will focus heavily on Discord’s ability to:

Increase revenue per user

Diversify monetization beyond gaming

Maintain engagement while scaling ads or premium features

If Discord demonstrates consistent revenue expansion alongside stable user growth, a 2026–2027 IPO becomes increasingly plausible.

Why Discord Remains on IPO Radars

Extremely high engagement metrics

Strong network effects

Cultural relevance among Gen Z and creators

Optionality across gaming, education, and enterprise communitiesKraken

Industry: Crypto Exchange

Expected IPO Window: 2026 (regulation dependent)

Estimated Valuation: $15B–$25B

Kraken has publicly stated IPO ambitions once regulatory clarity improves.

Anduril

Revenue:

Industry: Defense Technology

Expected IPO Window: 2026–2027

Estimated Valuation (Speculative): $30B+

Anduril represents a new generation of defense contractors, combining AI, autonomous systems, and advanced hardware with Silicon Valley-style software iteration. Its customer base spans government defense agencies, border security, and national infrastructure protection.

Unlike traditional defense primes, Anduril operates with:

Faster product development cycles

Software-first defense platforms

Long-term government contracts with recurring revenue

As global defense spending increases and geopolitical uncertainty persists, investor interest in defense technology has grown significantly.

Why Anduril Stands Out

Strong government demand

High switching costs once deployed

AI-driven autonomous defense systems

Long-term contract visibility

A public listing would mark a major shift in how defense technology companies access capital markets.

Kraken

Revenue:

Industry: Crypto Exchange

Expected IPO Window: 2026 (regulation dependent)

Estimated Valuation (Speculative): $15B–$25B

Kraken is one of the longest-operating cryptocurrency exchanges globally and has repeatedly signaled its intent to go public once regulatory clarity improves, particularly in the United States.

Unlike many crypto-native companies, Kraken has emphasized compliance, transparency, and operational discipline, traits that could resonate well with public-market investors if regulatory conditions stabilize.

However, timing remains highly sensitive to:

Crypto market cycles

Global regulatory developments

Exchange profitability during lower-volume periods

A successful Kraken IPO would likely be viewed as a bellwether for broader crypto-market legitimacy in public equities.

How Investors Gain Exposure Before the IPO

Most individual investors never get direct IPO allocations. Instead, exposure often happens before listing through:

SPVs (Special Purpose Vehicles)

Secondary market transactions

Pre-IPO structured funds

Employee liquidity programs

Late-stage venture rounds

This is where platforms like Allocations play a role, enabling compliant, structured access to private market opportunities.

Final Thoughts: The Next IPO Cycle Will Be Different

The 2026–2027 IPO class is shaping up to be smaller, higher quality, and more disciplined than previous cycles. These companies are no longer experimental startups; they are global infrastructure players.

For investors, the real opportunity increasingly lies before the IPO, where access, structure, and compliance matter more than hype.

Take the next step with Allocations

Take the next step with Allocations

Take the next step with Allocations

SPVs

Top Upcoming IPOs in 2026 : Allocations Research

Top Upcoming IPOs in 2026 : Allocations Research

Read more

SPVs

Why Digital Asset Treasury Companies (DATCOs) Will Lead 2026

Why Digital Asset Treasury Companies (DATCOs) Will Lead 2026

Read more

Company

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Revolutionizing Fund Management: The Evolution of Allocations.com in 2025

Read more

SPVs

How do you structure an SPV into another SPV?

How do you structure an SPV into another SPV?

Read more

SPVs

What are secondary SPVs?

What are secondary SPVs?

Read more

Fund Manager

Watch out school VC: the podcasters are coming

Watch out school VC: the podcasters are coming

Read more

Fund Manager

Fast, hassle-free SPVs mean more time for due diligence

Fast, hassle-free SPVs mean more time for due diligence

Read more

Analytics

The rise of opportunity funds and why fund managers might need to start using them

The rise of opportunity funds and why fund managers might need to start using them

Read more

Analytics

Move as fast as founders do with instant SPVs

Move as fast as founders do with instant SPVs

Read more

Fund Manager

4 practical things LPs and fund managers need to know for tax season

4 practical things LPs and fund managers need to know for tax season

Read more

Fund Manager

Keep up with these 4 VC firms focused on crypto and blockchain

Keep up with these 4 VC firms focused on crypto and blockchain

Read more

Fund Manager

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Fill your moleskine journals with tips from these 5 timeless angel investing blogs

Read more

Company

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Allocations partners with angeles investors to support hispanic and latinx founders and investors

Read more

SPVs

SPV in Venture Capital: How SPVs Are Used to Invest in Startups

SPV in Venture Capital: How SPVs Are Used to Invest in Startups

Read more

SPVs

Types of SPV: Allocations Research 2026

Types of SPV: Allocations Research 2026

Read more

SPVs

Setup your next entity in GIFT City with Allocations

Setup your next entity in GIFT City with Allocations

Read more

SPVs

What Is an SPV in Business? Real-World Examples and the Role of SPVs in Private Equity

What Is an SPV in Business? Real-World Examples and the Role of SPVs in Private Equity

Read more

SPVs

Why Allocations Is the Best Fund Admin?

Why Allocations Is the Best Fund Admin?

Read more

SPVs

SPV Syndicate Fundraising: How Syndicates Use Special Purpose Vehicles to Raise Capital Efficiently

SPV Syndicate Fundraising: How Syndicates Use Special Purpose Vehicles to Raise Capital Efficiently

Read more

SPVs

SPV Fundraising: How Special Purpose Vehicles Are Transforming Deal-Based Capital Formation

SPV Fundraising: How Special Purpose Vehicles Are Transforming Deal-Based Capital Formation

Read more

SPVs

SPV Capital Raising: How SPVs Enable Efficient Deal-Based Funding

SPV Capital Raising: How SPVs Enable Efficient Deal-Based Funding

Read more

SPVs

SPV vs Fund Structure: Choosing the Right Investment Vehicle in Private Markets

SPV vs Fund Structure: Choosing the Right Investment Vehicle in Private Markets

Read more

SPVs

SPV Investment Structure: How Special Purpose Vehicles Are Designed for Modern Investing

SPV Investment Structure: How Special Purpose Vehicles Are Designed for Modern Investing

Read more

SPVs

SPV Financing: A Complete Guide to Structure, Use Cases, and Investment Strategy

SPV Financing: A Complete Guide to Structure, Use Cases, and Investment Strategy

Read more

SPVs

Real Estate SPVs: A Modern Framework for Structured Property Investing

Real Estate SPVs: A Modern Framework for Structured Property Investing

Read more

SPVs

ADGM Private Company Limited by Shares: Allocations Research

ADGM Private Company Limited by Shares: Allocations Research

Read more

SPVs

Offshore Company vs Onshore Company: Key Differences Explained

Offshore Company vs Onshore Company: Key Differences Explained

Read more

SPVs

What Is Offshore? Meaning, Uses, and How Offshore Structures Work in 2026

What Is Offshore? Meaning, Uses, and How Offshore Structures Work in 2026

Read more

SPVs

The Best Fund Admins for Emerging VCs (2026)

The Best Fund Admins for Emerging VCs (2026)

Read more

SPVs

How to Choose the Right Jurisdiction for an Offshore Company

How to Choose the Right Jurisdiction for an Offshore Company

Read more

SPVs

How to Start an Offshore Company: Allocations Guide 2026

How to Start an Offshore Company: Allocations Guide 2026

Read more

SPVs

Types of Special Purpose Vehicles (SPVs) and How Allocations Powers Them

Types of Special Purpose Vehicles (SPVs) and How Allocations Powers Them

Read more

SPVs

SPV vs Fund: Choose better with Allocation

SPV vs Fund: Choose better with Allocation

Read more

SPVs

AngelList SPV vs Allocations SPV: Best SPV Platform for Fund Managers

AngelList SPV vs Allocations SPV: Best SPV Platform for Fund Managers

Read more

SPVs

Sydecar SPV vs Allocations SPV: What to chose in 2026

Sydecar SPV vs Allocations SPV: What to chose in 2026

Read more

SPVs

Best SPV Platform in the United States (USA) in 2026

Best SPV Platform in the United States (USA) in 2026

Read more

SPVs

Best SPV Platform in the United Arab Emirates (UAE) in 2026

Best SPV Platform in the United Arab Emirates (UAE) in 2026

Read more

SPVs

Carta Pricing vs Allocations Pricing (2026)

Carta Pricing vs Allocations Pricing (2026)

Read more

SPVs

AngelList Pricing vs Allocations Pricing (2026)

AngelList Pricing vs Allocations Pricing (2026)

Read more

SPVs

How to Invest into Real Estate with Allocations: A Beginner's Guide to SPV Funds

How to Invest into Real Estate with Allocations: A Beginner's Guide to SPV Funds

Read more

SPVs

Best Fund Admin & Reporting Tools for VC Investors in 2026: Allocations

Best Fund Admin & Reporting Tools for VC Investors in 2026: Allocations

Read more

SPVs

Convertible Notes: Early Stage Investing with Allocations

Convertible Notes: Early Stage Investing with Allocations

Read more

SPVs

Top 5 Value for Money SPV Platforms

Top 5 Value for Money SPV Platforms

Read more

SPVs

How SPV Pricing Works on Allocations

How SPV Pricing Works on Allocations

Read more

SPVs

Best Fund Admin in 2026: Why Allocations Leads

Best Fund Admin in 2026: Why Allocations Leads

Read more

SPVs

How Allocations Is Changing SPV & Fund Formation

How Allocations Is Changing SPV & Fund Formation

Read more

SPVs

What Makes Allocations the First Choice for Fund Administrators

What Makes Allocations the First Choice for Fund Administrators

Read more

SPVs

Why Choose Allocations for SPVs and Funds in 2026

Why Choose Allocations for SPVs and Funds in 2026

Read more

SPVs

Best SPV Platforms in 2026: Why Allocations

Best SPV Platforms in 2026: Why Allocations

Read more

SPVs

SPV & Fund Pricing in 2026: Allocations

SPV & Fund Pricing in 2026: Allocations

Read more

SPVs

Can I Have Non-U.S. Investors? A Practical Guide for SPVs and Fund Managers

Can I Have Non-U.S. Investors? A Practical Guide for SPVs and Fund Managers

Read more

SPVs

What Do I Need to Do Every Year as a Fund Manager?

What Do I Need to Do Every Year as a Fund Manager?

Read more

SPVs

Do I Need an ERA? A Practical Guide for Fund Managers

Do I Need an ERA? A Practical Guide for Fund Managers

Read more

SPVs

How Much Does It Cost to Create an SPV in 2026?

How Much Does It Cost to Create an SPV in 2026?

Read more

SPVs

Special Purpose Vehicle (SPV): Meaning in Finance, Banking and Real-World Examples

Special Purpose Vehicle (SPV): Meaning in Finance, Banking and Real-World Examples

Read more

SPVs

Top Fund Administration Platforms in 2026

Top Fund Administration Platforms in 2026

Read more

SPVs

Migrate Your Fund to Allocations: A Complete Guide for Fund Managers

Migrate Your Fund to Allocations: A Complete Guide for Fund Managers

Read more

SPVs

What Does “Offshore” Means?

What Does “Offshore” Means?

Read more

SPVs

Comparing 506b vs 506c for Private Fundraising

Comparing 506b vs 506c for Private Fundraising

Read more

SPVs

LLP vs LLC | Choose business structure with Allocations

LLP vs LLC | Choose business structure with Allocations

Read more

SPVs

SPV Meaning in Finance: Complete Guide to Special Purpose Vehicles (2026)

SPV Meaning in Finance: Complete Guide to Special Purpose Vehicles (2026)

Read more

SPVs

The Best AngelList Alternatives in 2026 (Detailed Comparison)

The Best AngelList Alternatives in 2026 (Detailed Comparison)

Read more

SPVs

Understanding Special Purpose Vehicles (SPVs)

Understanding Special Purpose Vehicles (SPVs)

Read more

SPVs

Special Purpose Vehicle (SPV): What It Is and Why Investors Use It

Special Purpose Vehicle (SPV): What It Is and Why Investors Use It

Read more

SPVs

Who Typically Uses SPVs?

Who Typically Uses SPVs?

Read more

SPVs

Understanding SPVs in the Context of Private Equity

Understanding SPVs in the Context of Private Equity

Read more

SPVs

Why Use an SPV for Investment?

Why Use an SPV for Investment?

Read more

SPVs

SPV for Late-Stage and Secondary Investments

SPV for Late-Stage and Secondary Investments

Read more

SPVs

SPV Investment Structures: How Money Flows from Investors to Startups

SPV Investment Structures: How Money Flows from Investors to Startups

Read more

SPVs

SPV Management 101: What Happens After the Deal Closes

SPV Management 101: What Happens After the Deal Closes

Read more

SPVs

SPV in Venture Capital vs Traditional VC Funds: What Investors Need to Know

SPV in Venture Capital vs Traditional VC Funds: What Investors Need to Know

Read more

SPVs

SPV Structures in 2026: How Special Purpose Vehicles Are Evolving in Private Markets

SPV Structures in 2026: How Special Purpose Vehicles Are Evolving in Private Markets

Read more

SPVs

Real Estate SPV: A Complete Guide to Structuring Property Investments with Allocations

Real Estate SPV: A Complete Guide to Structuring Property Investments with Allocations

Read more

SPVs

Best SPV Platform in 2026: Features, Pricing, Compliance & How to Choose

Best SPV Platform in 2026: Features, Pricing, Compliance & How to Choose

Read more

SPVs

Top SPV Platforms in 2026: A Complete Comparison

Top SPV Platforms in 2026: A Complete Comparison

Read more

SPVs

SPV Structure and Governance: Who Controls What?

SPV Structure and Governance: Who Controls What?

Read more

SPVs

SPV Structure Explained: How SPVs Work for Private Investments

SPV Structure Explained: How SPVs Work for Private Investments

Read more

SPVs

Why Special Purpose Vehicles (SPVs) Are Becoming Essential in Modern Investing

Why Special Purpose Vehicles (SPVs) Are Becoming Essential in Modern Investing

Read more

SPVs

Understanding SPV Structures

Understanding SPV Structures

Read more

SPVs

Inside DATCOs: The Rise of Digital Asset Treasury Companies | Allocations

Inside DATCOs: The Rise of Digital Asset Treasury Companies | Allocations

Read more

SPVs

DATCO Stock Performance vs Bitcoin Price: Where to Invest in 2026

DATCO Stock Performance vs Bitcoin Price: Where to Invest in 2026

Read more

SPVs

Private Markets Aren’t Broken, They’re Just Waiting for Better Tools

Private Markets Aren’t Broken, They’re Just Waiting for Better Tools

Read more

SPVs

Digital Asset Treasury Companies: The DATCO Era Begins | Allocations

Digital Asset Treasury Companies: The DATCO Era Begins | Allocations

Read more

SPVs

How Allocations Redefines SPVs, Fund Formation, and Fund Management Software for Today’s Investment Managers

How Allocations Redefines SPVs, Fund Formation, and Fund Management Software for Today’s Investment Managers

Read more

SPVs

How VCs Are Scaling Trust, Not Just Capital

How VCs Are Scaling Trust, Not Just Capital

Read more

SPVs

Digital Asset Treasury Companies (DATCOs) vs Bitcoin ETFs: What’s the Difference?

Digital Asset Treasury Companies (DATCOs) vs Bitcoin ETFs: What’s the Difference?

Read more

SPVs

The 10-Minute Fund: What Instant Fund Formation Really Means

The 10-Minute Fund: What Instant Fund Formation Really Means

Read more

SPVs

Allocation IRR: Measuring Returns in Private Market Deals

Allocation IRR: Measuring Returns in Private Market Deals

Read more

SPVs

How Much Does It Cost to Start an SPV in 2025?

How Much Does It Cost to Start an SPV in 2025?

Read more

SPVs

Allocations Pricing Explained: Transparent, Flat-Fee Fund Administration for SPVs and Funds

Allocations Pricing Explained: Transparent, Flat-Fee Fund Administration for SPVs and Funds

Read more

SPVs

Private Equity SPVs: How Allocations Automates Fund Formation for Modern Investors

Private Equity SPVs: How Allocations Automates Fund Formation for Modern Investors

Read more

SPVs

From Term Sheet to Close: How Automated Deal Execution Platforms Speed Up Venture Investing

From Term Sheet to Close: How Automated Deal Execution Platforms Speed Up Venture Investing

Read more

SPVs

Why Modern Fund Managers Need Better Infrastructure

Why Modern Fund Managers Need Better Infrastructure

Read more

SPVs

AngelList vs Sydecar vs Allocations: The 2025 SPV Platform Showdown

AngelList vs Sydecar vs Allocations: The 2025 SPV Platform Showdown

Read more

SPVs

Fund Setup Software: Building Your First Fund With Allocations

Fund Setup Software: Building Your First Fund With Allocations

Read more

SPVs

Understanding 506(b) Funds: How Private Offerings Stay Compliant

Understanding 506(b) Funds: How Private Offerings Stay Compliant

Read more

SPVs

Allocations: The Complete Guide to Modern Fund Management

Allocations: The Complete Guide to Modern Fund Management

Read more

SPVs

Emerging Managers 101: Why SPVs Are the Easiest Way to Start Raising Capital

Emerging Managers 101: Why SPVs Are the Easiest Way to Start Raising Capital

Read more

SPVs

Asset Allocation Strategies for Modern Portfolios in 2025 ft. Allocations

Asset Allocation Strategies for Modern Portfolios in 2025 ft. Allocations

Read more

SPVs

Deal Allocation Tools: How to Streamline Investor Access to Opportunities

Deal Allocation Tools: How to Streamline Investor Access to Opportunities

Read more

SPVs

SPV Fees Explained: What Sponsors and Investors Should Know

SPV Fees Explained: What Sponsors and Investors Should Know

Read more

SPVs

How to Set Up an SPV: Step-by-Step Guide for Sponsors and Investors

How to Set Up an SPV: Step-by-Step Guide for Sponsors and Investors

Read more

SPVs

Why Delaware for SPVs? Investor Trust, Legal Clarity, Faster Closes

Why Delaware for SPVs? Investor Trust, Legal Clarity, Faster Closes

Read more

SPVs

Best SPV Platform in 2025? Features, Pricing, and How to Choose

Best SPV Platform in 2025? Features, Pricing, and How to Choose

Read more

SPVs

SPV Exit Strategies: What Happens When the Deal Closes

SPV Exit Strategies: What Happens When the Deal Closes

Read more

SPVs

Side Letters in SPVs: What You Need to Know

Side Letters in SPVs: What You Need to Know

Read more

SPVs

SPV K-1 Tax Reporting: What Sponsors and Investors Need to Know (2025 Guide)

SPV K-1 Tax Reporting: What Sponsors and Investors Need to Know (2025 Guide)

Read more

SPVs

What Does an SPV Company Do? (2025 Guide)

What Does an SPV Company Do? (2025 Guide)

Read more

SPVs

Real Estate SPV vs LLC: Which Is Better for Property Investment?

Real Estate SPV vs LLC: Which Is Better for Property Investment?

Read more

SPVs

SPV Tax Reporting: A Complete Guide for Sponsors and Investors

SPV Tax Reporting: A Complete Guide for Sponsors and Investors

Read more

SPVs

The Role of Allocations in Modern Asset Management

The Role of Allocations in Modern Asset Management

Read more

SPVs

Form D & Blue Sky Law Compliance for SPVs: What Sponsors Need to Know

Form D & Blue Sky Law Compliance for SPVs: What Sponsors Need to Know

Read more

SPVs

SPV Company vs Fund: Which Is Right for Your Deal?

SPV Company vs Fund: Which Is Right for Your Deal?

Read more

SPVs

SPV Platform: The Complete 2025 Guide (ft. Allocations)

SPV Platform: The Complete 2025 Guide (ft. Allocations)

Read more

SPVs

How to Choose the Best SPV Platform: A 15-Point Buyer’s Checklist

How to Choose the Best SPV Platform: A 15-Point Buyer’s Checklist

Read more

Fund Manager

What is an SPV? The Definitive Guide to Special Purpose Vehicles

What is an SPV? The Definitive Guide to Special Purpose Vehicles

Read more

Fund Manager

5 best books to read If you’re forging a path in VC

5 best books to read If you’re forging a path in VC

Read more

Investor Spotlight

Investor spotlight: Alex Fisher

Investor spotlight: Alex Fisher

Read more

SPVs

6 unique use cases for SPVs

6 unique use cases for SPVs

Read more

Market Trends

The SPV ecosystem democratizing alternative investments

The SPV ecosystem democratizing alternative investments

Read more

Company

How to write a stellar investor update

How to write a stellar investor update

Read more

Analytics

What’s going on here? 1 in 10 US households now qualify as accredited investors

What’s going on here? 1 in 10 US households now qualify as accredited investors

Read more

Market Trends

SPVs by sector

SPVs by sector

Read more

Market Trends

5 Benefits of a hybrid SPV + fund strategy

5 Benefits of a hybrid SPV + fund strategy

Read more

Products

What is the difference between 506b and 506c funds?

What is the difference between 506b and 506c funds?

Read more

Fund Manager

Why Allocations is the best choice for fast moving fund managers

Why Allocations is the best choice for fast moving fund managers

Read more

Fund Manager

When should fund managers use a fund vs an SPV?

When should fund managers use a fund vs an SPV?

Read more

Fund Manager

10 best practices for first-time fund managers

10 best practices for first-time fund managers

Read more

Analytics

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Bitcoin ETFs and 2 other crypto trends to watch in 2022

Read more

Market Trends

Private market trends: where are fund managers looking in 2022?

Private market trends: where are fund managers looking in 2022?

Read more

Fund Manager

5 female VCs on the rise in 2022

5 female VCs on the rise in 2022

Read more

Analytics

The new competitive edge for VCs and fund managers

The new competitive edge for VCs and fund managers

Read more

Analytics

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

4 trends in M&A to watch in 2022 (Plus 1 more that might surprise you)

Read more

Investor Spotlight

Investor spotlight: Olga Yermolenko

Investor spotlight: Olga Yermolenko

Read more

Analytics

3 stats that show the democratization of VC in 2021

3 stats that show the democratization of VC in 2021

Read more

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc

Allocations secondary market is operated through Allocations Securities, LLC dba AllocationsX, member FINRA/SIPC. To check this firm on BrokerCheck, click on the following link: here. The main FINRA website can be accessed through this link: here. Allocations Securities, LLC is a wholly owned subsidiary of Allocations, Inc.

Copyright © Allocations Inc