What Are Secondary SPVs?

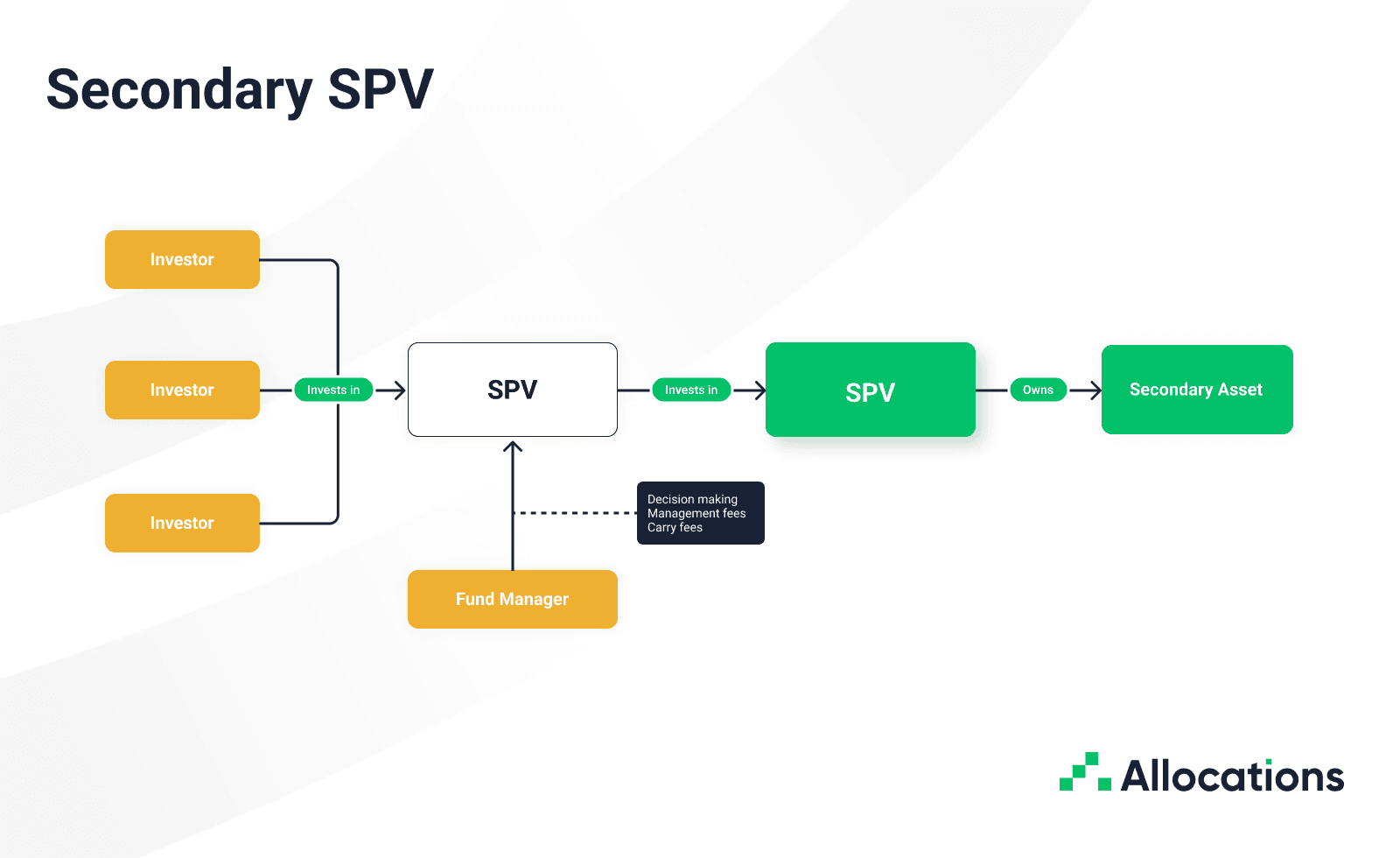

Secondary SPVs are vehicles created to buy existing shares from early shareholders of a private company. Instead of participating in a new primary round, investors pool capital into the SPV, the SPV purchases the shares from the seller, and it takes the place on the cap table.

This gives employees, early investors and founders a way to unlock liquidity without waiting for an IPO or acquisition.

Why Secondary SPVs Matter

The secondary market has expanded significantly, which has made these vehicles more relevant.

Recent data shows:

Global secondary volume crossed 103 billion dollars in the first half of 2025.

US VC direct secondary deals reached more than 60 billion dollars in a single quarter.

Dedicated secondary dry powder now stands above 300 billion dollars.

This rise in activity reflects a broader shift. Large private companies stay private longer, early shareholders seek liquidity earlier and investors want exposure to mature names that are not raising primary rounds.

Secondary SPVs sit at the center of this environment because they offer a practical and structured way to match supply with demand.

Where Secondary SPVs Create Value

Secondary SPVs offer several benefits:

Liquidity for employees and early holders without forcing a financing event.

Simpler access for buyers who want exposure to high quality private companies.

Cleaner cap tables since the SPV appears as a single line item.

Faster execution because the deal does not depend on company fundraising timelines.

More predictable outcomes for both sides when documents, pricing and transfers are handled through one organized entity.

How to Structure a Secondary SPV

A secondary SPV is straightforward in theory but requires careful execution.

Key steps include:

Verify title and transfer rules. Confirm the seller owns the shares, they are vested and transferable, and all agreements allow the sale.

Secure issuer consent. Many companies require board approval or legal review before adding an SPV holder.

Plan taxes and reporting early. Investors should know what tax forms they will receive, when they will receive them and how pass through treatment applies.

Be clear on fees. Outline formation costs, admin charges and banking or reporting expenses. If the structure includes an SPV investing into another SPV, clarify how fees are applied.

Choose experienced administration. A strong platform handles onboarding, money movement, document collection and tax filings in a way that builds trust with investors.

Set realistic investor expectations. Secondary shares remain illiquid until a major event such as an IPO or acquisition. Communicate timelines clearly.

Key Factors That Influence Secondary Deals

Several consistent factors shape how secondary SPVs come together:

The availability of motivated sellers.

Company transfer policies and legal review.

Investor demand for shares in high growth private companies.

Pricing trends that shift with supply and market sentiment.

The speed and quality of administrative support during the close.

These elements can vary across companies and sectors, but they define the timeline and clarity of every secondary transaction.

Conclusion

Secondary SPVs provide a practical means of creating liquidity in private markets. They work well when title checks, issuer consents, tax planning, fee clarity, and investor communication are handled with precision. A well-prepared structure gives sellers certainty and gives investors a clear path into high-quality private companies.

Allocations support this structure at scale. The platform has handled SPV into SPV structures for companies such as SpaceX and is designed to manage the formation, onboarding, wiring, and reporting needed for secondary deals.

SPVs

Read more

SPVs

Read more

Company

Read more

SPVs

Read more

SPVs

Read more

Fund Manager

Read more

Fund Manager

Read more

Analytics

Read more

Analytics

Read more

Fund Manager

Read more

Fund Manager

Read more

Fund Manager

Read more

Company

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

SPVs

Read more

Fund Manager

Read more

Fund Manager

Read more

Investor Spotlight

Read more

SPVs

Read more

Market Trends

Read more

Company

Read more

Analytics

Read more

Market Trends

Read more

Market Trends

Read more

Products

Read more

Fund Manager

Read more

Fund Manager

Read more

Fund Manager

Read more

Analytics

Read more

Market Trends

Read more

Fund Manager

Read more

Analytics

Read more

Analytics

Read more

Investor Spotlight

Read more

Analytics

Read more